Webber Research: Renewable Biofuels – Refinery Conversions, Crack Spreads, & Risks Q420

Renewable Biofuels – Refinery Conversions, Crack Spreads, & Risks Q420

- Key Takeaways (page 2)

- Biofuels – Costs, Risks, & Incentives (page 3)

- Renewable Fuels vs. Traditional Refining Economics (page 4)

- Crack Spread Analysis – Ratios Matter (page 5)

- The California Renewable Fuel Rush (page 6

- Biofuels & Soybean Oil Supply/Demand (page 7

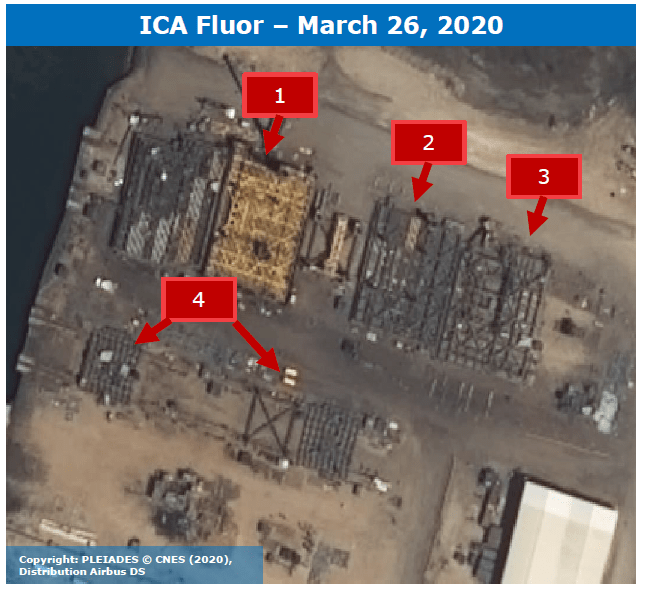

- Biofuels Project Tracker (page 8)

- Hydrogen’s Increased Demand in Biorefining (page 9)

- HVO vs FAME Biofuel (page 10)

- PSX’s Rodeo Refinery Conversion (page 11)

- Rodeo Refinery Conversion Overview (page 12)

- PSX Project Comp – WA vs. CA (page 13)

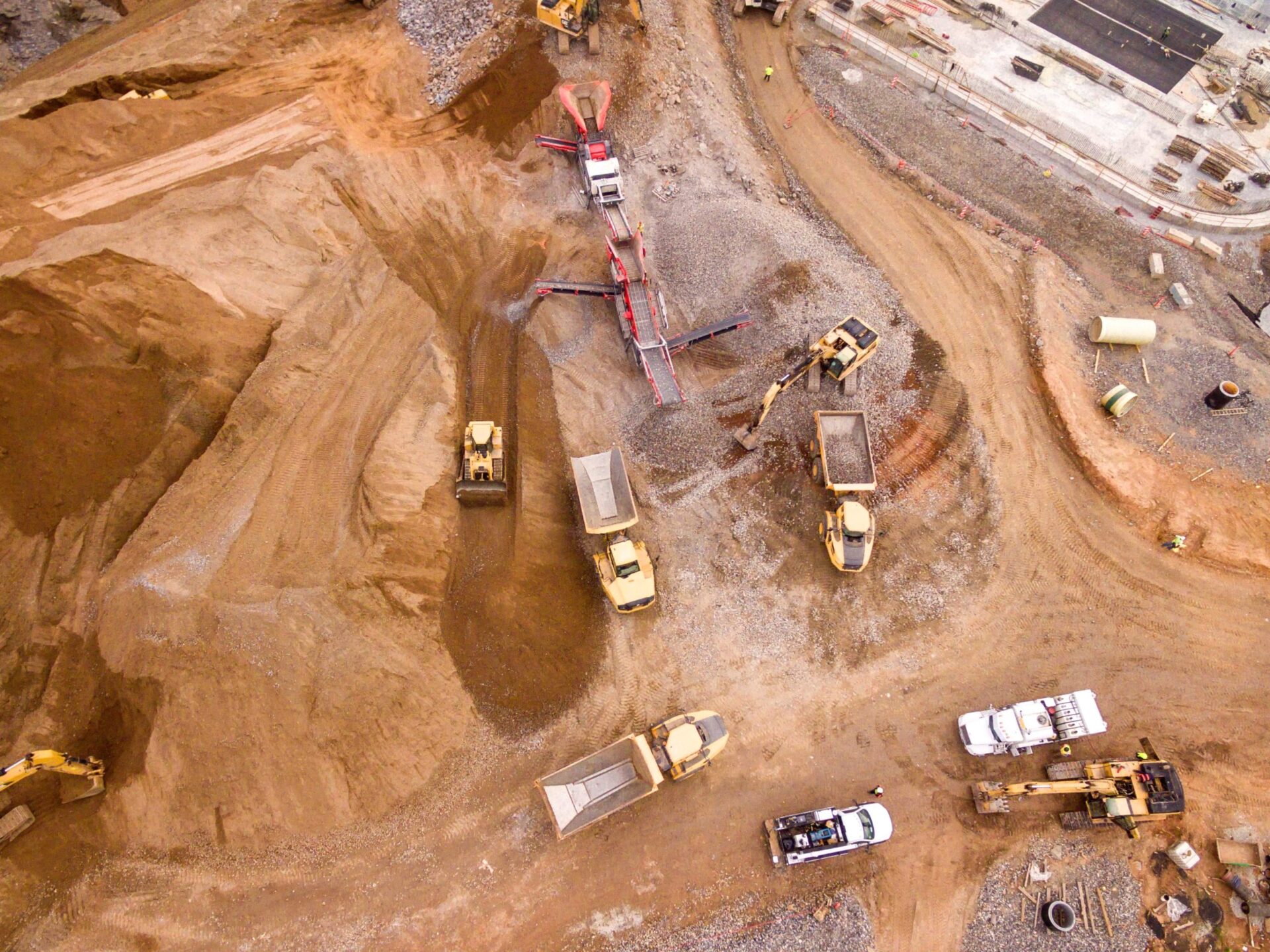

- EPC Dynamics (page 14)

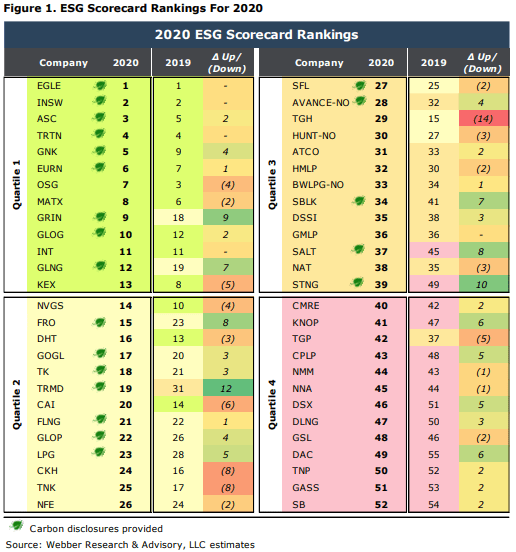

- EPC Contractor Rankings (page 15)

Key Takeaways:

- Renewable Fuel Production… Just in Time or Too Late? (Pages 4 – 8)

- California & Oregon have mandated Carbon Intensity (CI) reductions in transportation fuels, which could increase demand by ~350%, from ~400MM gallons/year to 1,400MM by 2025. Ten other states are evaluating similar LCFS programs, which could potentially push U.S. demand toward 2,400MM gallons/year, up ~600%…

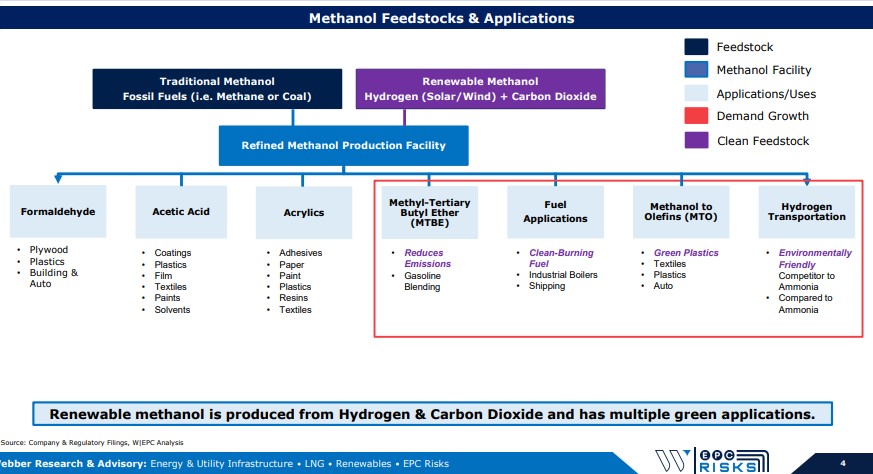

- Refinery Conversions: FAME vs. HVO (Page 10)

- Emerging trend in Biofuels: a transition from Fatty Acid Methyl Ester (FAME) to Hydrotreated Vegetable Oil (HVO), which provides biofuels a longer storage life & can be used in colder climates.

- FAME & HVO biofuels are produced using a refinery’s hydrotreater & isomerization, or a hydrocracking unit with a steady supply of hydrogen. HVO economics are dependent on hydrogen prices & feedstock ratios.

- Hydrogen’s Increased Demand in Biorefining (Page 10)

- As of early 2020, traditional oil refining consumed ~1/3 of the global Hydrogen demand.

- FAME biorefining requires similar Hydrogen consumption relative to traditional refining, but HVO biorefining uses significantly more Hydrogen depending on the process units…

- Speed To Market Matters: Owners, Operators, & Contractors (Pages 12, 13, 15)

- ~10 years ago, companies were chasing another speed to market trend, NGL production and fractionation. Flexible and decisive companies (e.g. EPD, ET, etc.) quickly capitalized on this opportunity and captured market share.

- Large Energy companies (e.g. Exxon, Shell, etc.) are not typically structured to move quickly refining industry (VLO, PSX, MPC) and take on the speed to market risk..

W|EPC: Renewable Biofuel Analysis Refinery Conversions, Crack Spreads, & Risks Q420

For access information, please email us at [email protected] or visit our website at webberresearch.com

Read More client log-in

client log-in