Tankers: Moving From OPEC Trade, To Global COVID Relapse Hedge

Tanker Q120 Preview & Storage Update

- Thesis (EURN, DHT, FRO, ASC, etc) …………………Pages 1-2

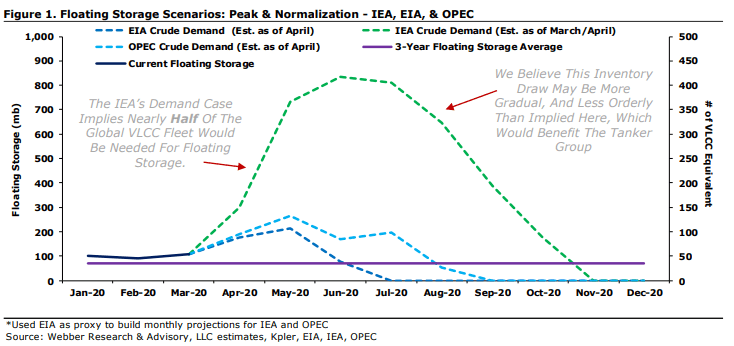

- Floating Storage Scenario Analysis………………….Pages 2-5

- Tanker Rates Reactions & Implications ……………..Page 5

- Multi-Factor Supply/Demand Model……………….. Pages 6-7

- Crude Inventory & Production Cuts………………….Pages 7-9

- Valuations……………………………………………….. Pages 10-11

- Earnings Estimates……………………………………..Page 12

For access information, email us at [email protected]

Contango, COVID, & Floating Storage To Dominate Q1 Earnings: As with our Barge Preview from last week, we expect the majority of this earnings season to revolve around the simultaneous COVID+OPEC supply & demand shocks to global energy markets, which have driven down global oil demand by ~15-30mbd, introduced negative crude pricing for certain landlocked geographies, and reinforced the notion of systemic, structural and economically driven floating storage. The result: our tanker rate charts look more like seismograph readings (page 5) and our tanker group is poised to throw off record cash flow in Q2 & Q3 (and potentially longer). We believe the long tanker trade is gradually transitioning from a shorter-term OPEC trade, into a longer-term COVID-19 global relapse hedge. We believe tanker dynamics from the remainder of 2020 and 2021 will be defined by the depth and duration of the floating storage dynamics – which we believe will be increasingly driven by the shape and pace of a global economic reopening vs any remaining OPEC/policy maneuvers. Now that crisis level production levels are now more defined, we believe tanker rates and equities will have a strong negative correlation to the success of any semi-synchronized economic reopening. Hence, Long Tankers = Long An Extended And Asymmetrical Global Reopening.

client log-in

client log-in