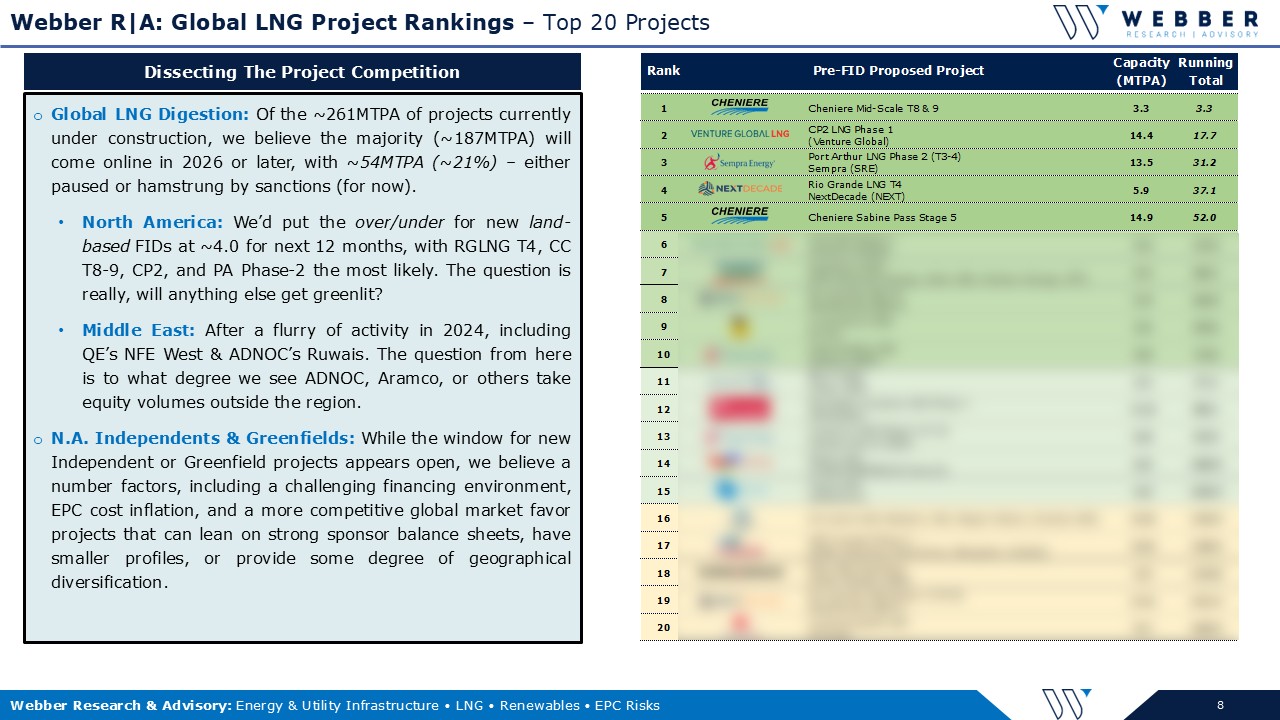

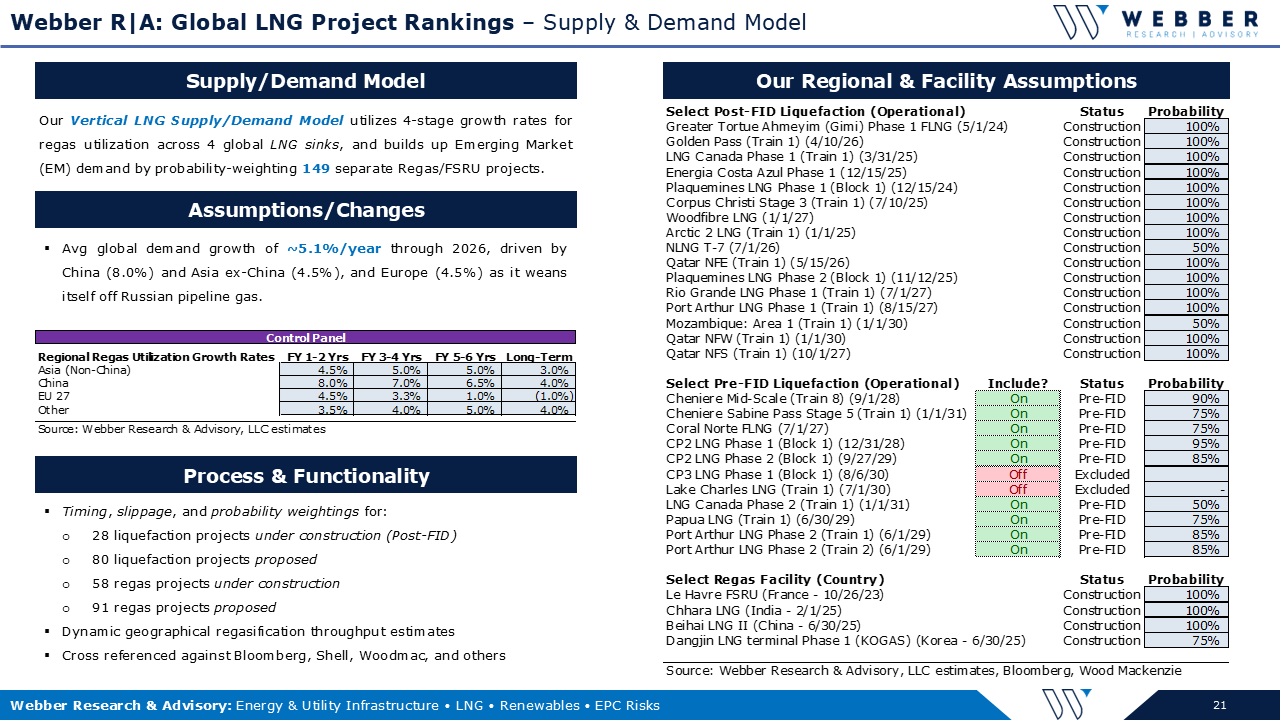

Webber Research: Global LNG Project Tiers, Rankings Outlook, & Balance Model + Trump & LNG: Leveraging The Pizzazz

Venture Global (VG): Initiating Formal Equity Coverage – MP Rating, $16 PT

If you’re already a Webber Research subscriber, you can access this full presentation via our Research Library. For access information, email us at [email protected] or [email protected].

Read More

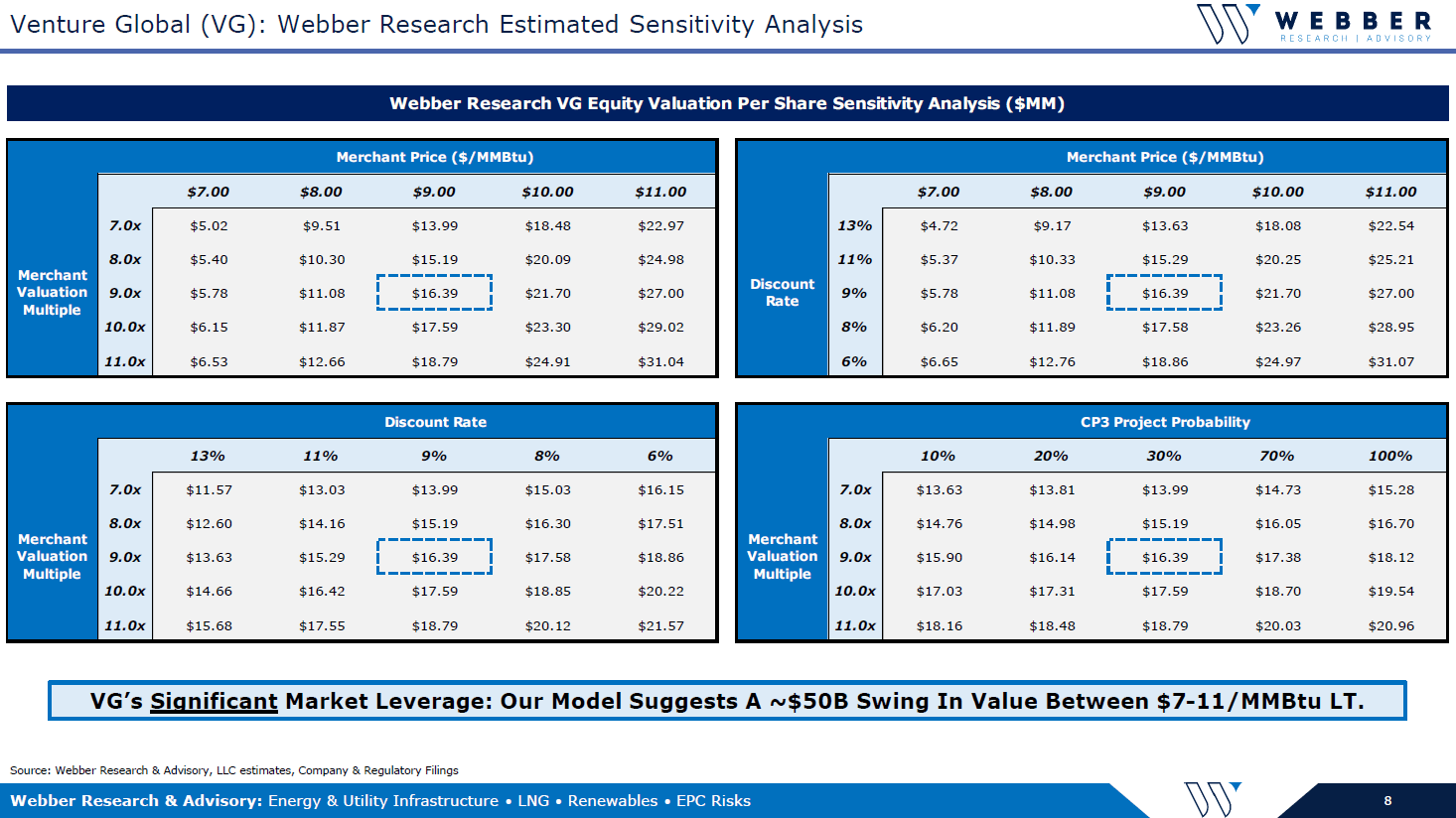

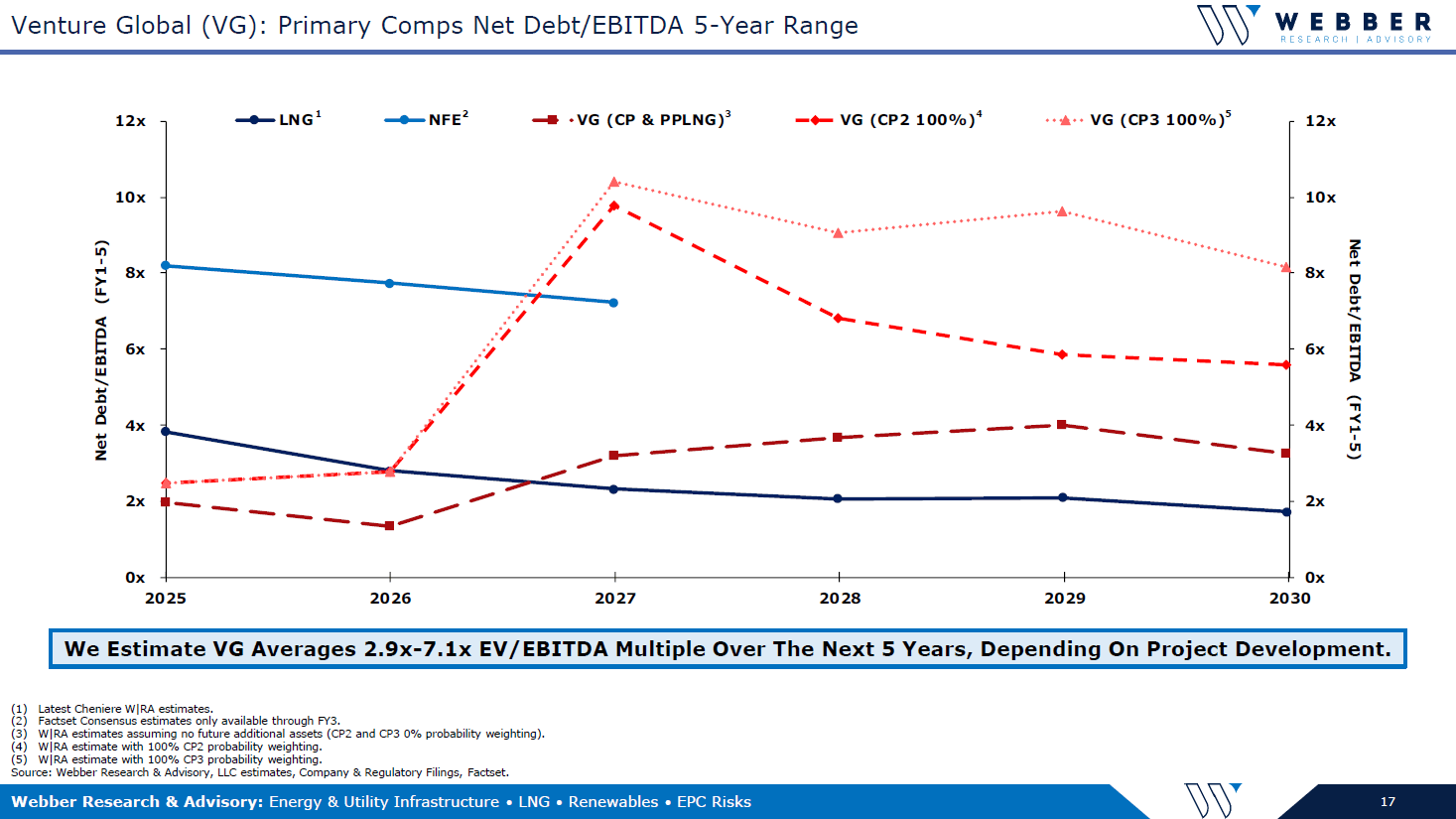

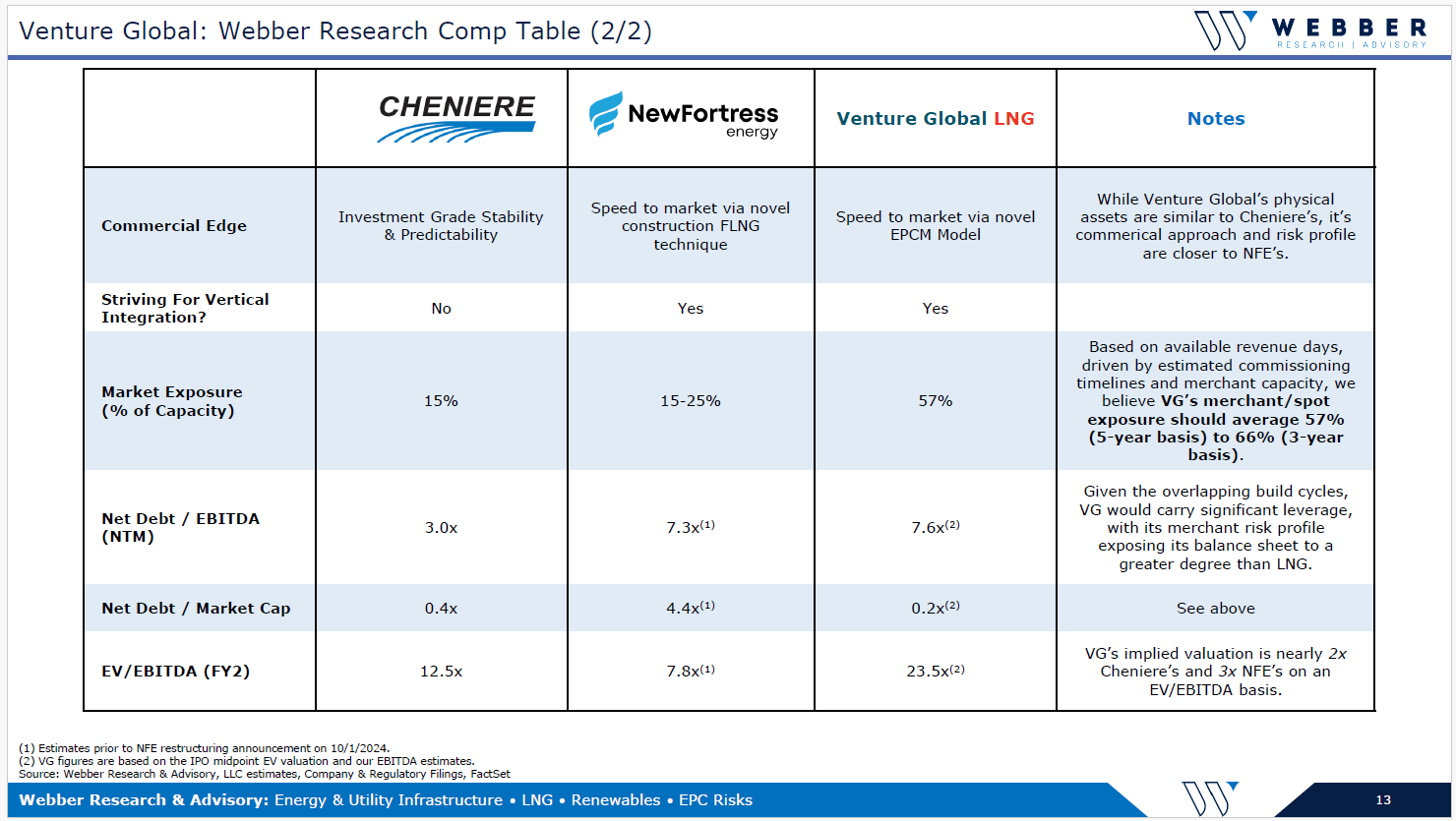

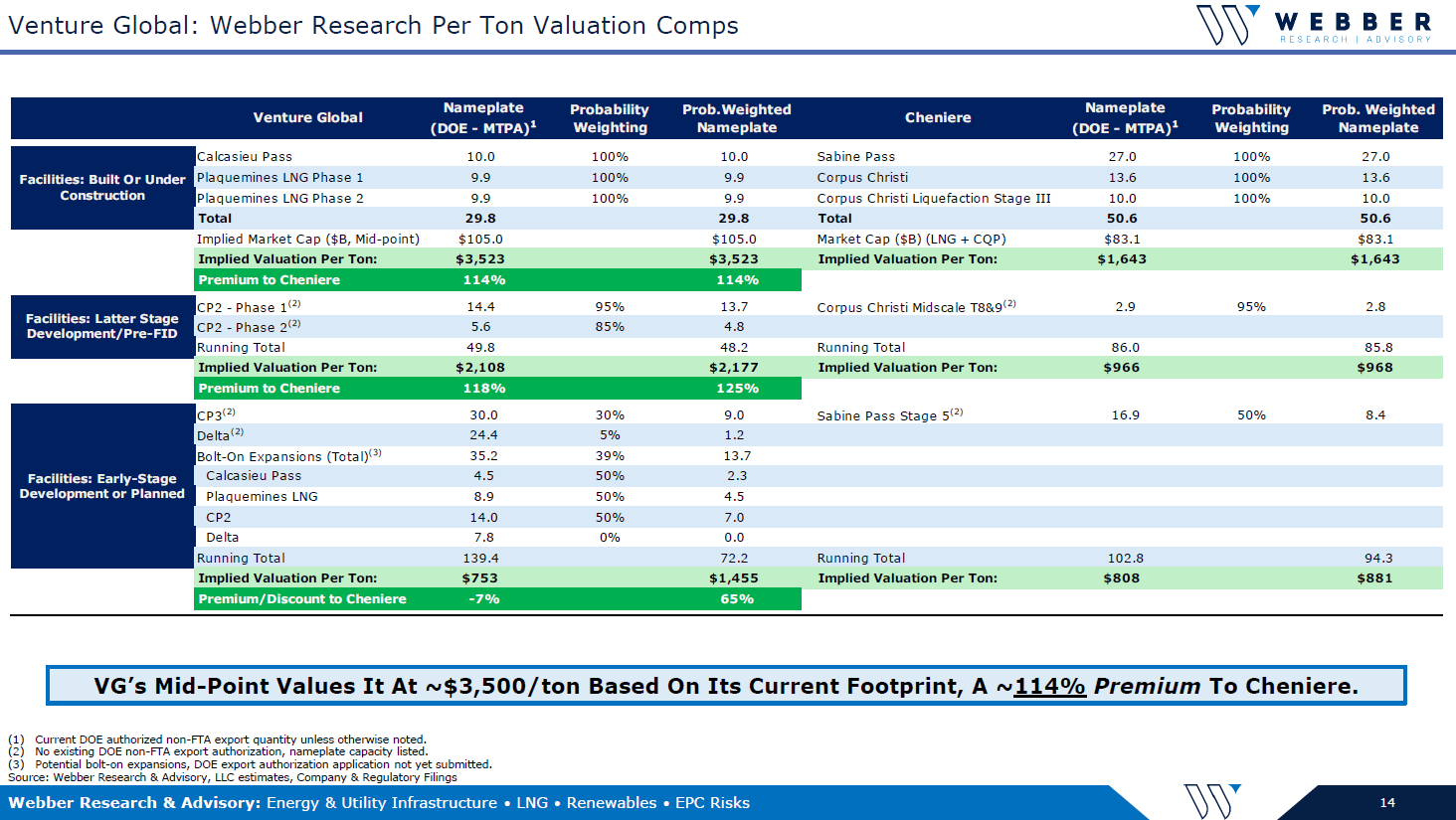

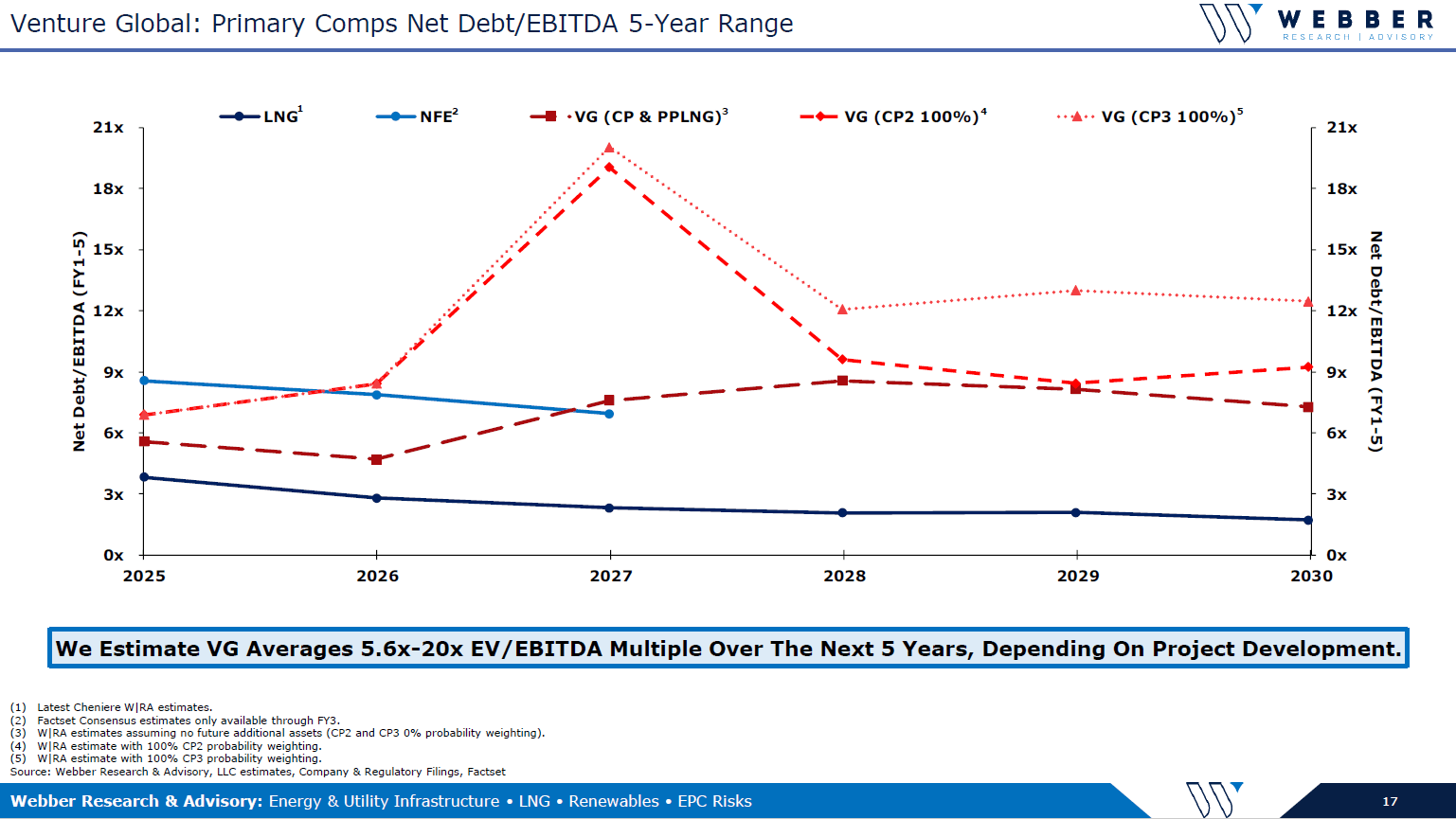

Venture Global IPO: What’s Really Going On Here? Valuation Estimates & Strategy

If you’re already a Webber Research subscriber, you can access this presentation via our Research Library. Otherwise, for the full presentation, please visit our Downloads page. For access and subscription information, email us at [email protected], or at [email protected].

W|EPC: Client Call 01/15 @11AM – Venture Global’s Plaquemines Parish – Q125 Project Review

Venture Global IPO Coverage

Read More

Venture Global IPO & Trump 2.0: Assessing The Impact Across 35 LNG Projects

If you’re already a Webber Research client, you can access this 8-page report via our Research Library. For access information please contact us [email protected], or at [email protected].

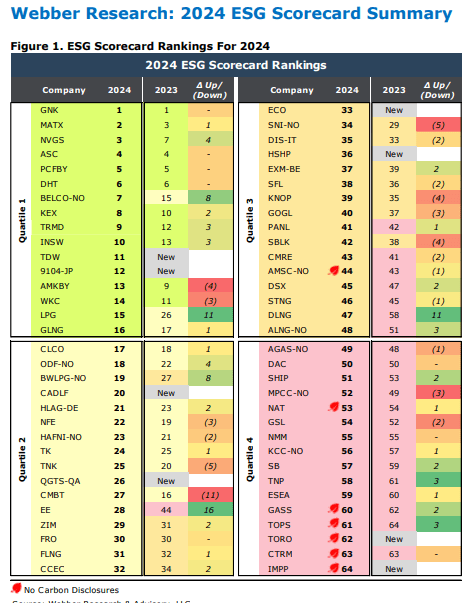

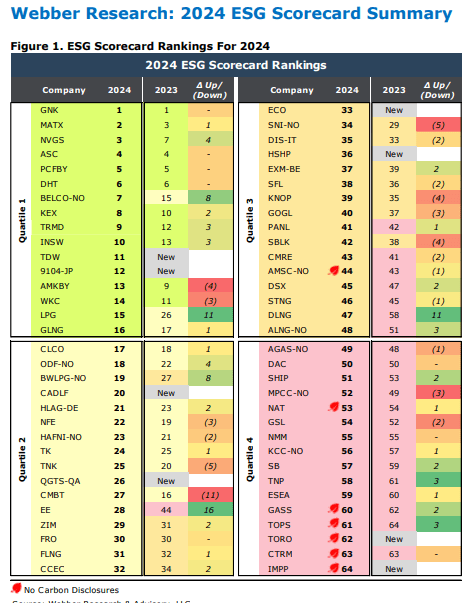

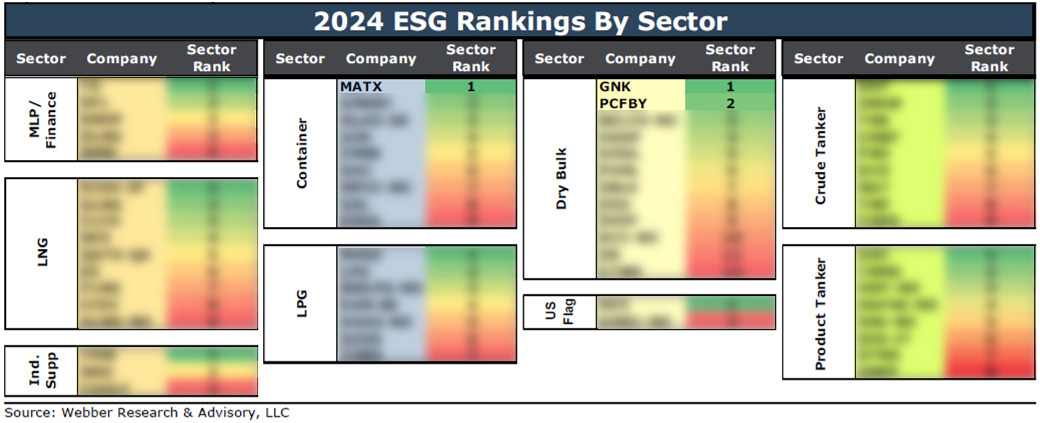

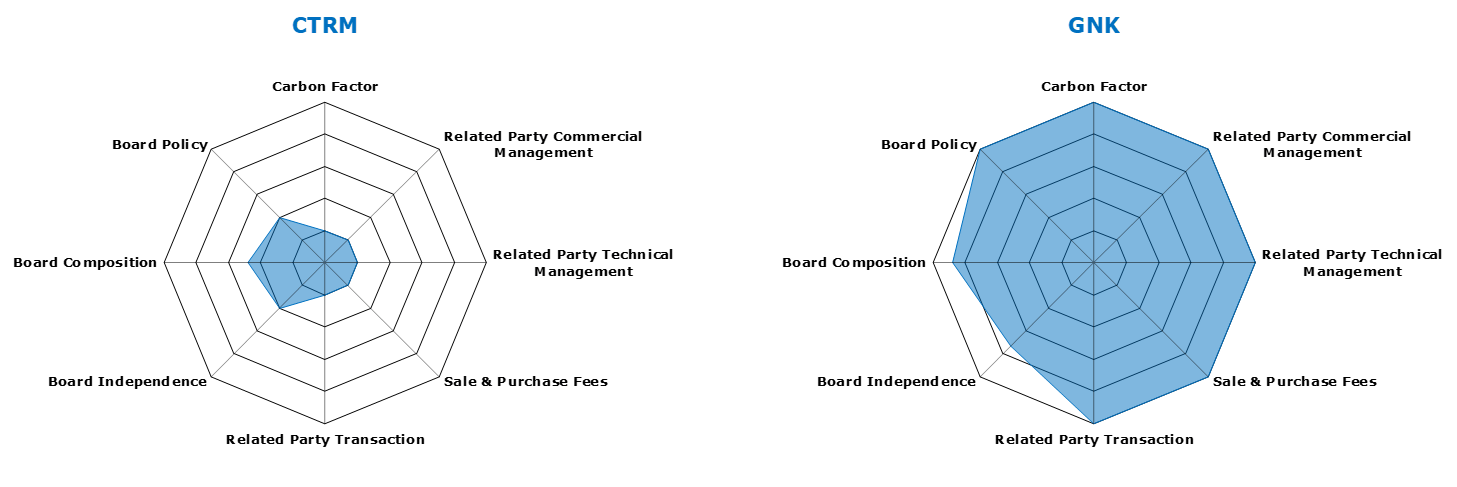

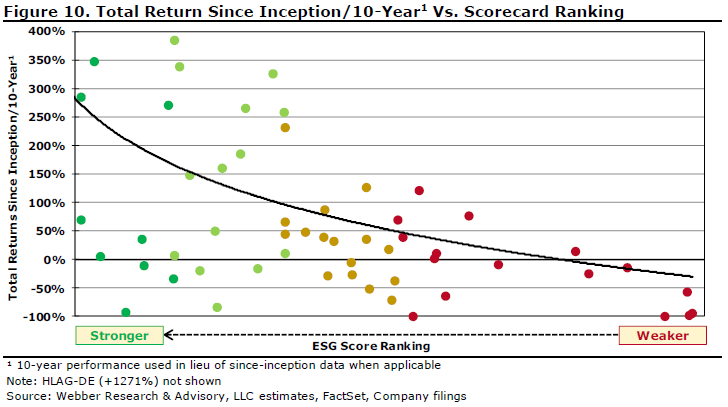

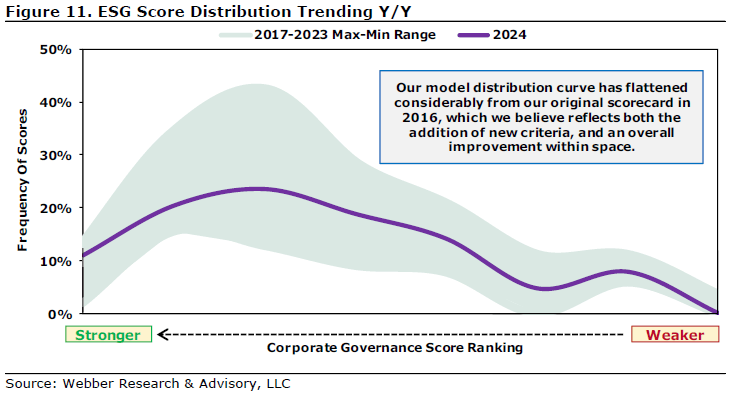

Webber Research: 2024 Shipping ESG Scorecard

To view our full report, visit our Downloads page. If you’re already a Webber Research subscriber, visit our Library. For access information, contact us at [email protected], or at [email protected]

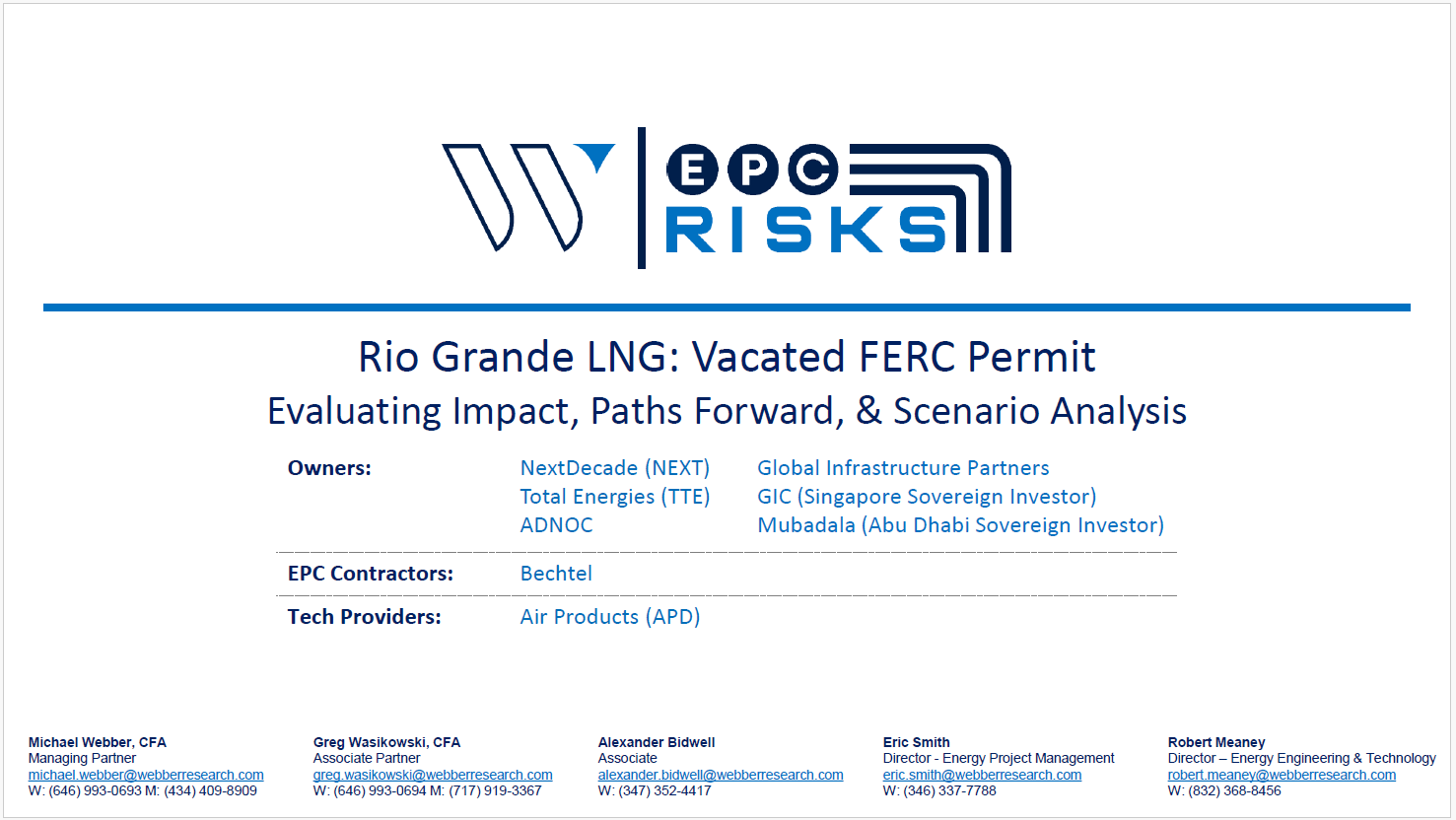

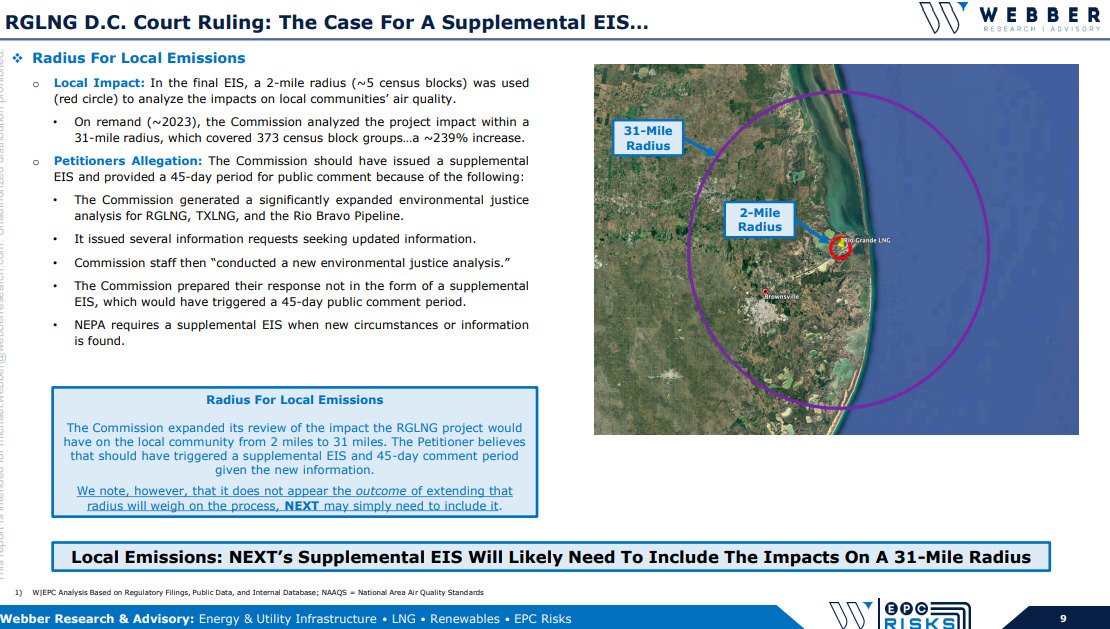

W|EPC: Rio Grande LNG – Vacated FERC Permit Q324 – Analyzing Impact & Scenarios

To access the full presentation, please visit our Downloads page. If you’re an existing Webber Research subscriber, you can access this report via our library. For subscription information, please contact us at [email protected], or at [email protected].

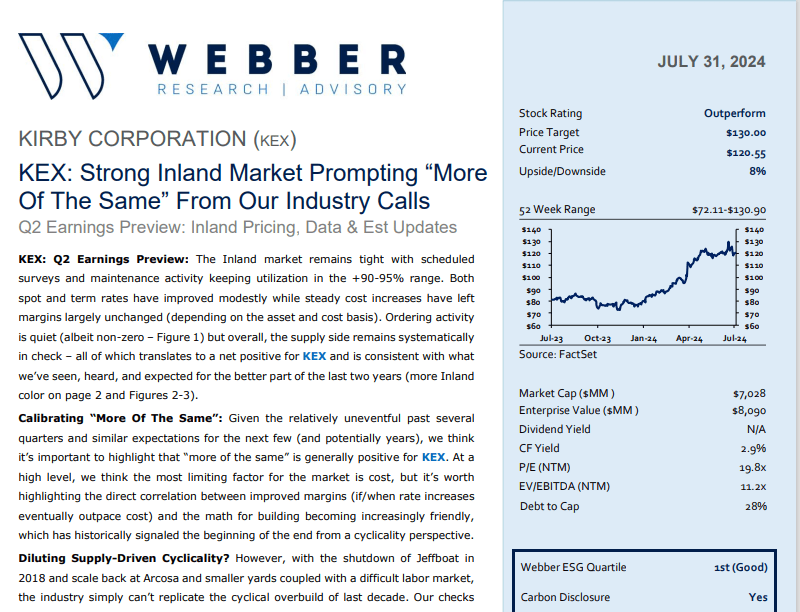

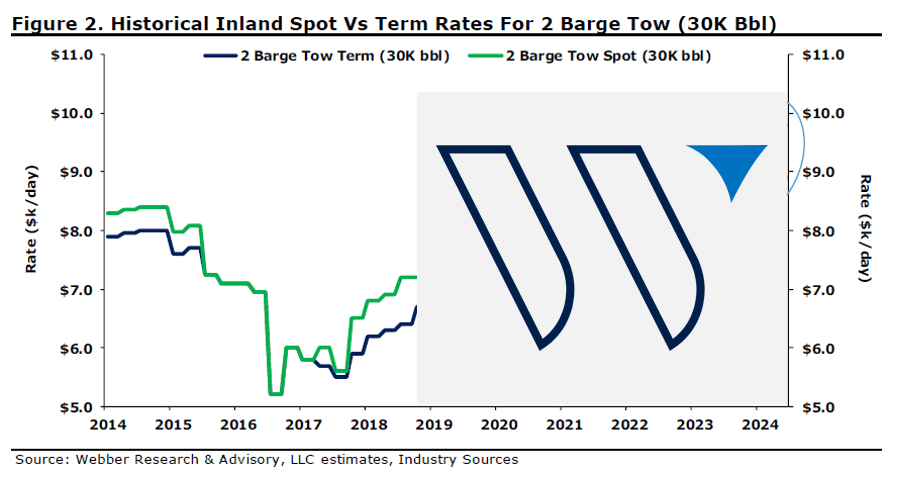

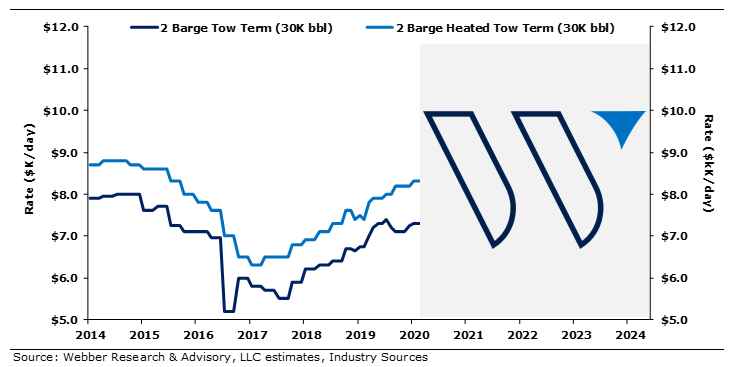

KEX: Q224 Preview – Calibrating Strong Inland Market, Historical Spot & Term Pricing, Orderbook

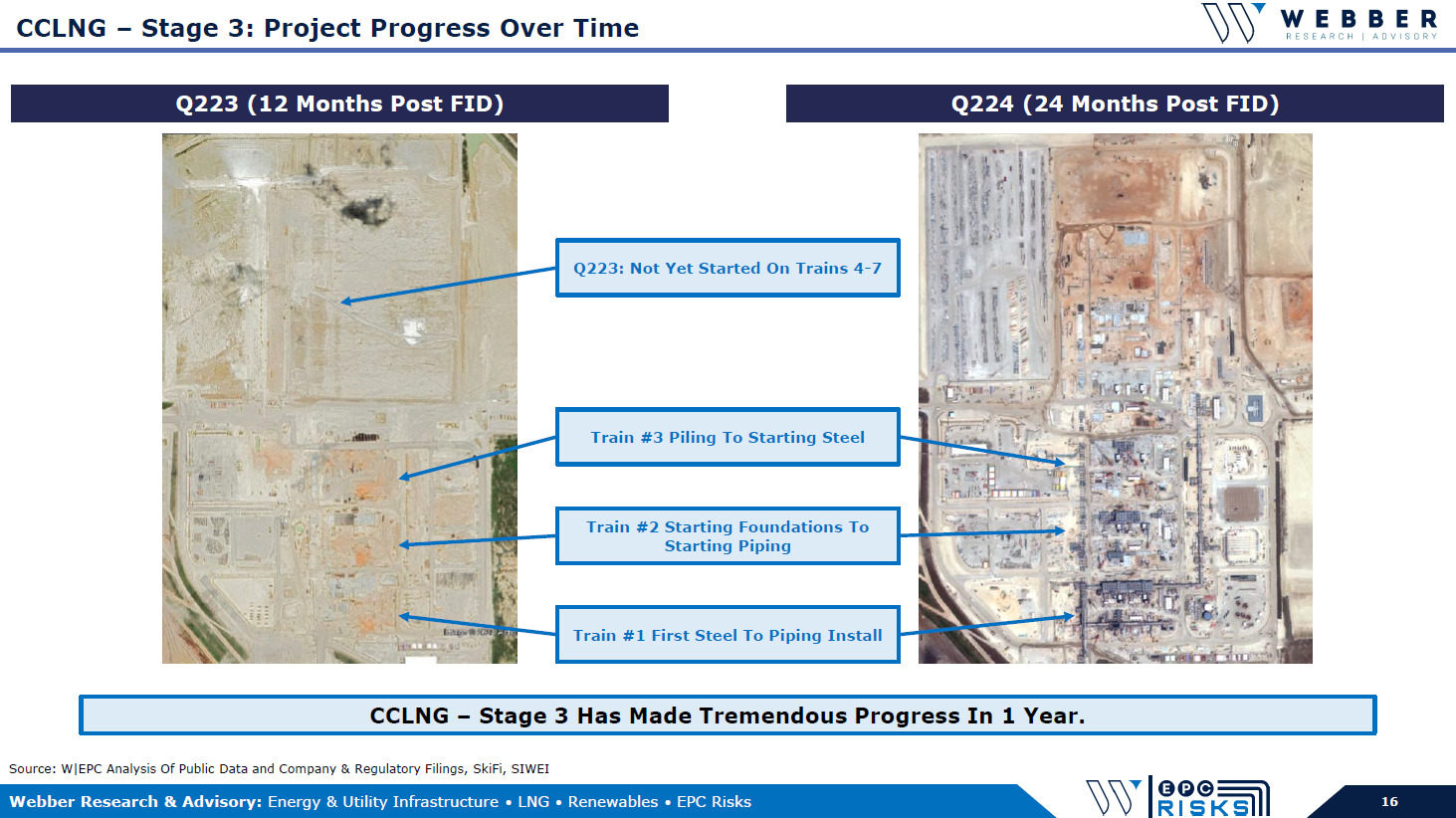

W|EPC: Cheniere’s Corpus Christi LNG – Q224 Project Update

To download this report, click here. If you’re already a Webber Research subscriber, you can access this report via our library. For access information, email us at [email protected] or [email protected].

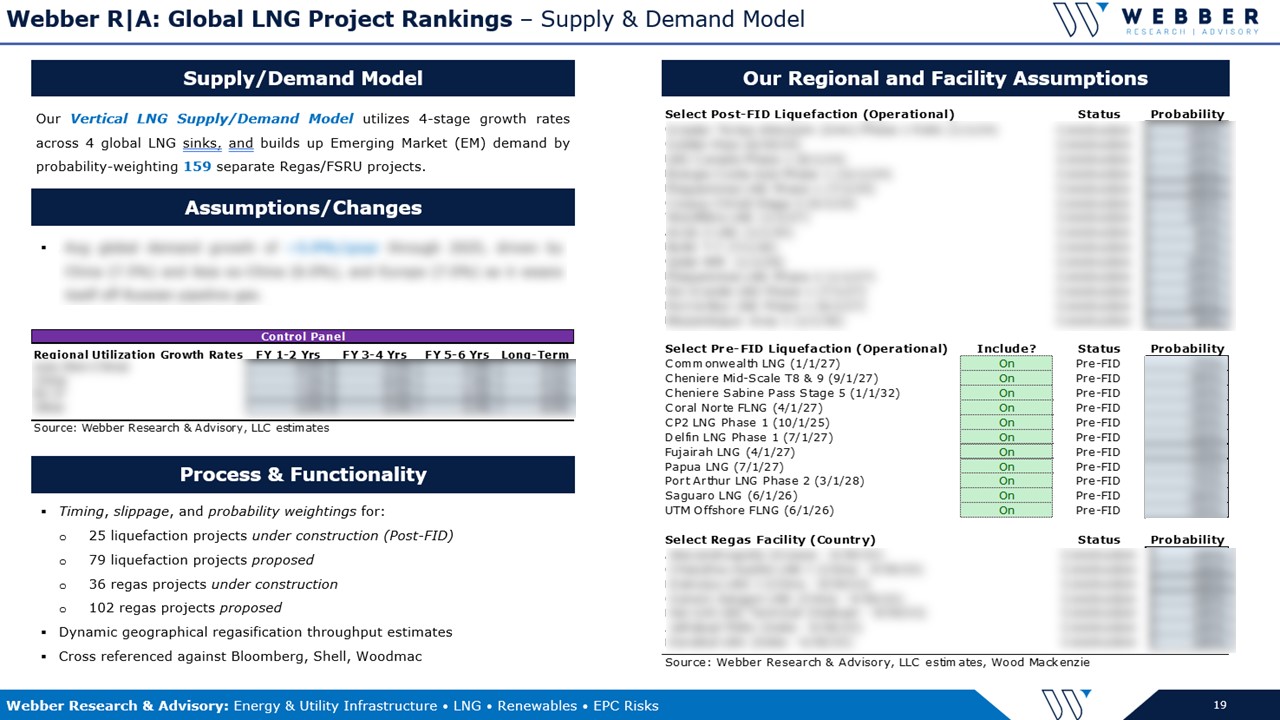

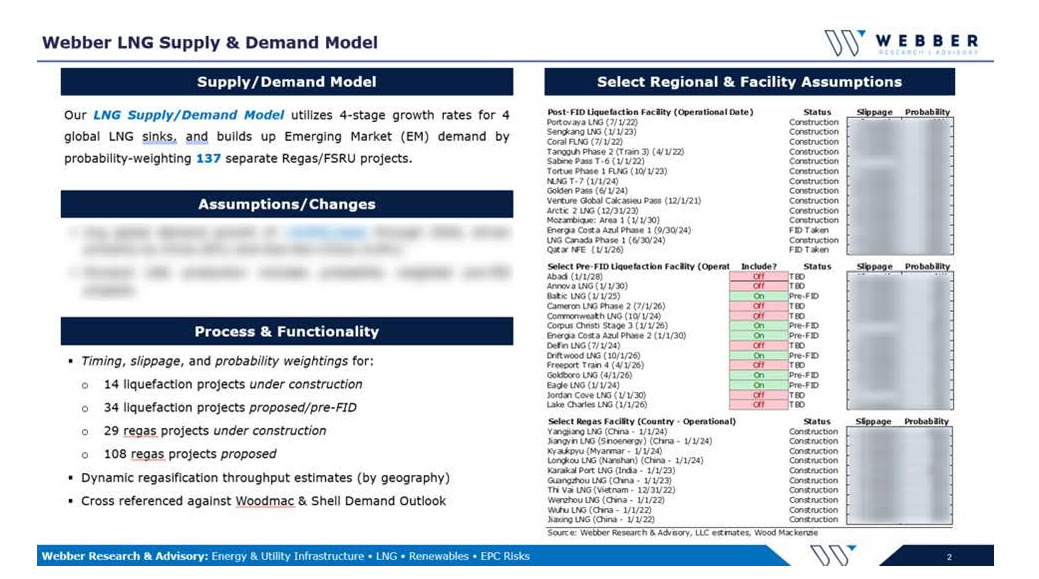

Webber Research: Global LNG Project Rankings & S/D Model Refresh – Q423

If you’re already a Webber Research subscriber, this report is available via our research library. For access information, email us at [email protected]. To download this report, click here.

Read More

Webber Research: Fireside Chat Series – CoolCo LNG CEO Richard Tyrell, Thurs 9/28 @ 11am EST

Webber Research: Fireside Chat Series – NextDecade (NEXT) CEO Matt Schatzman, Tues. 08/08 @11AM EST

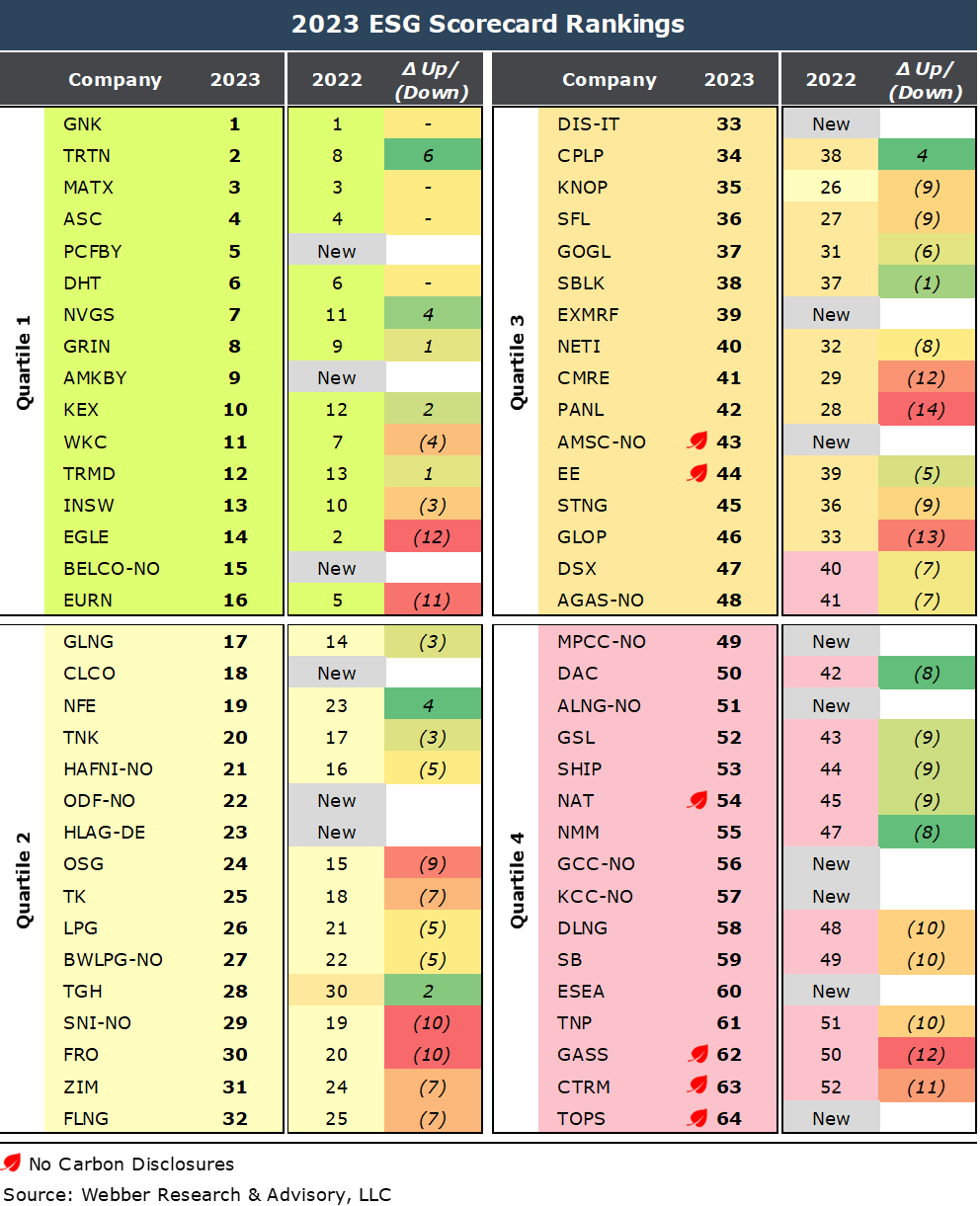

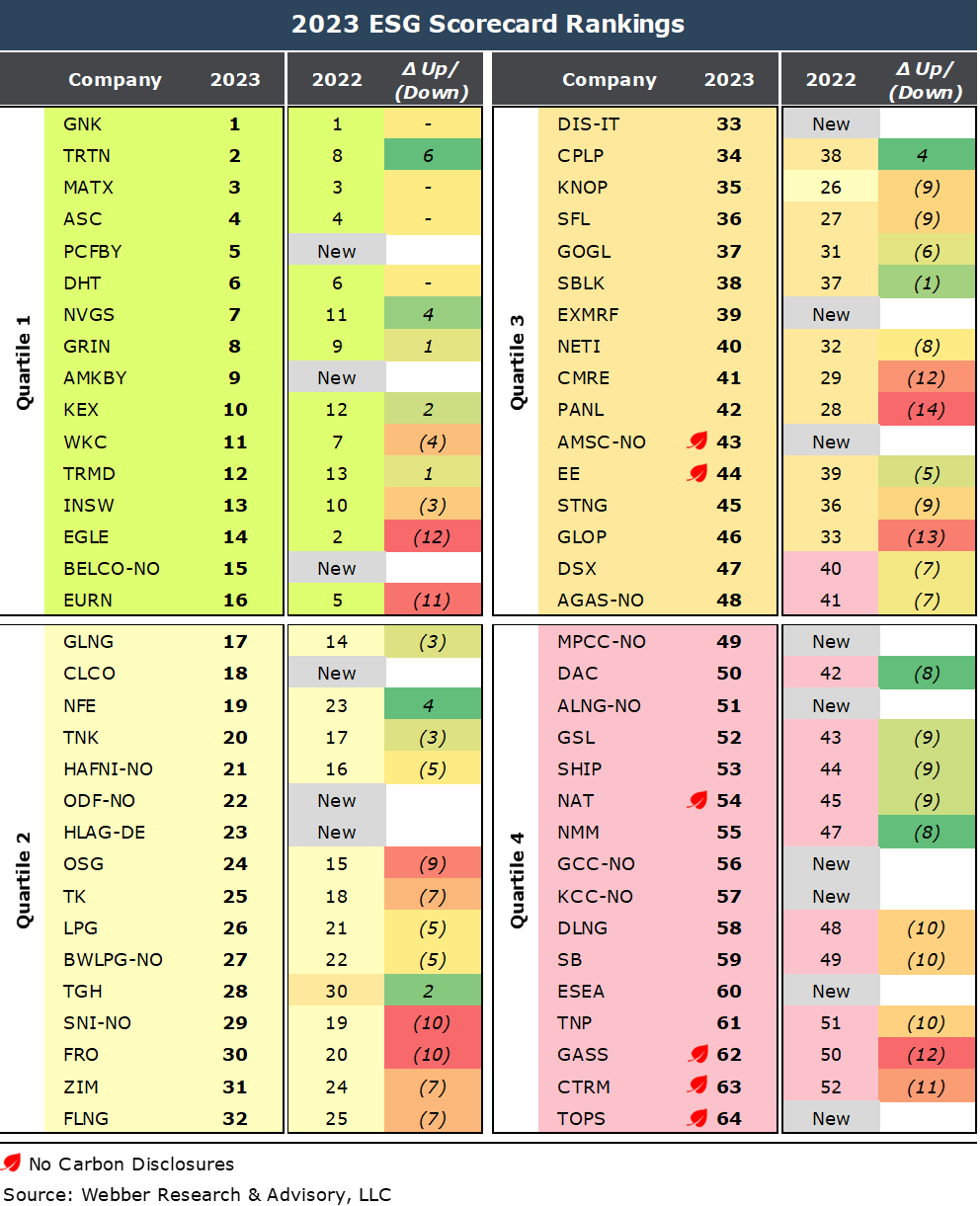

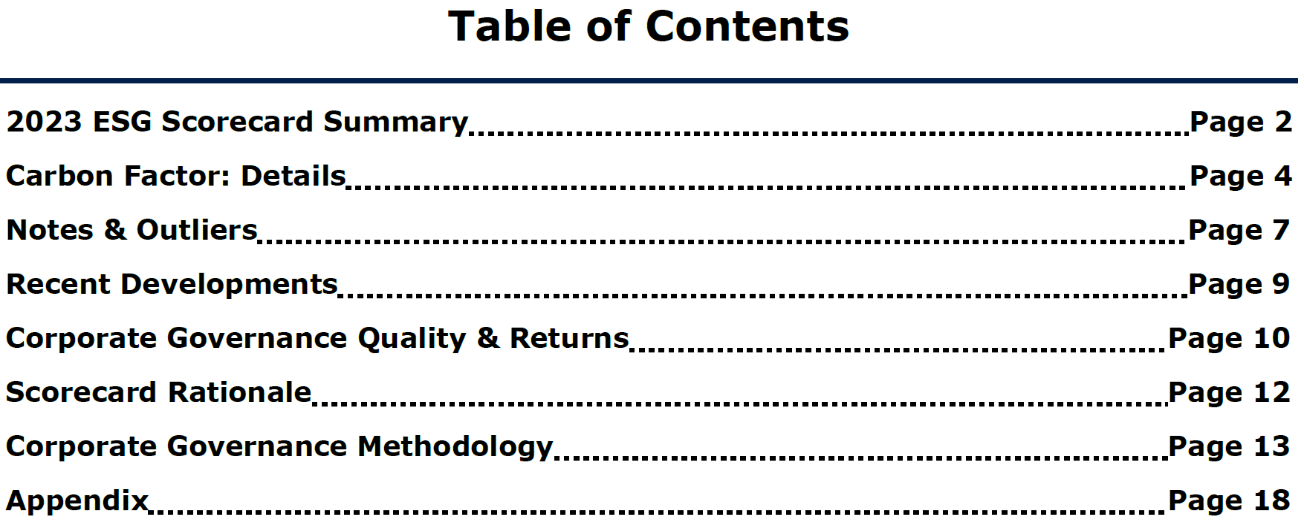

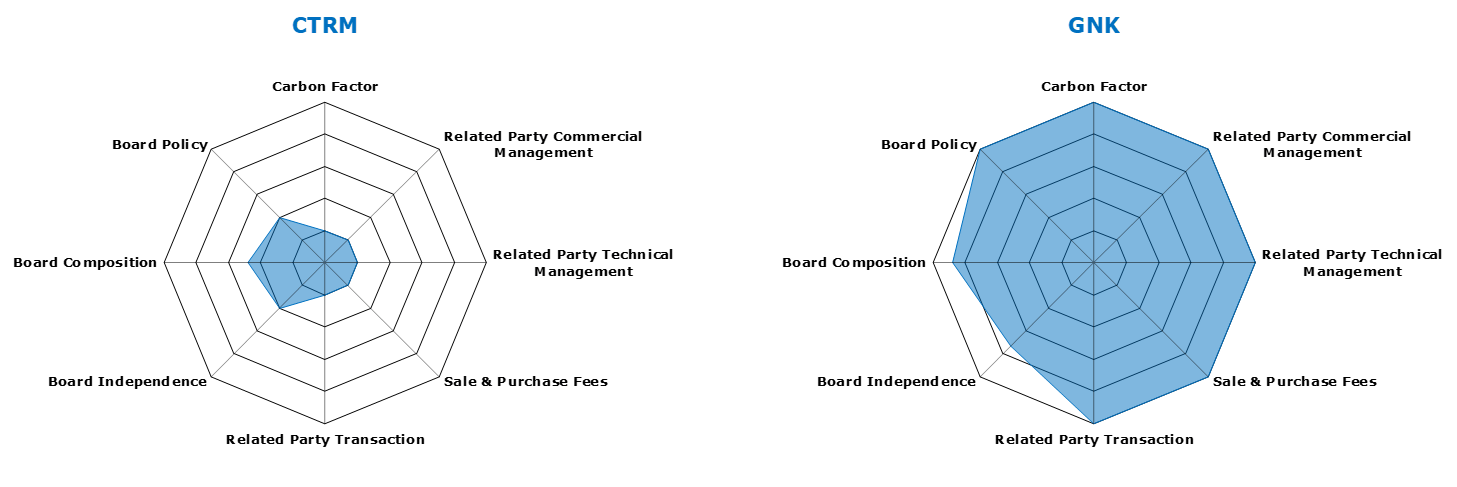

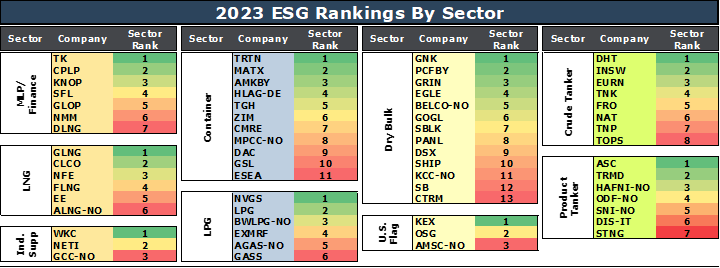

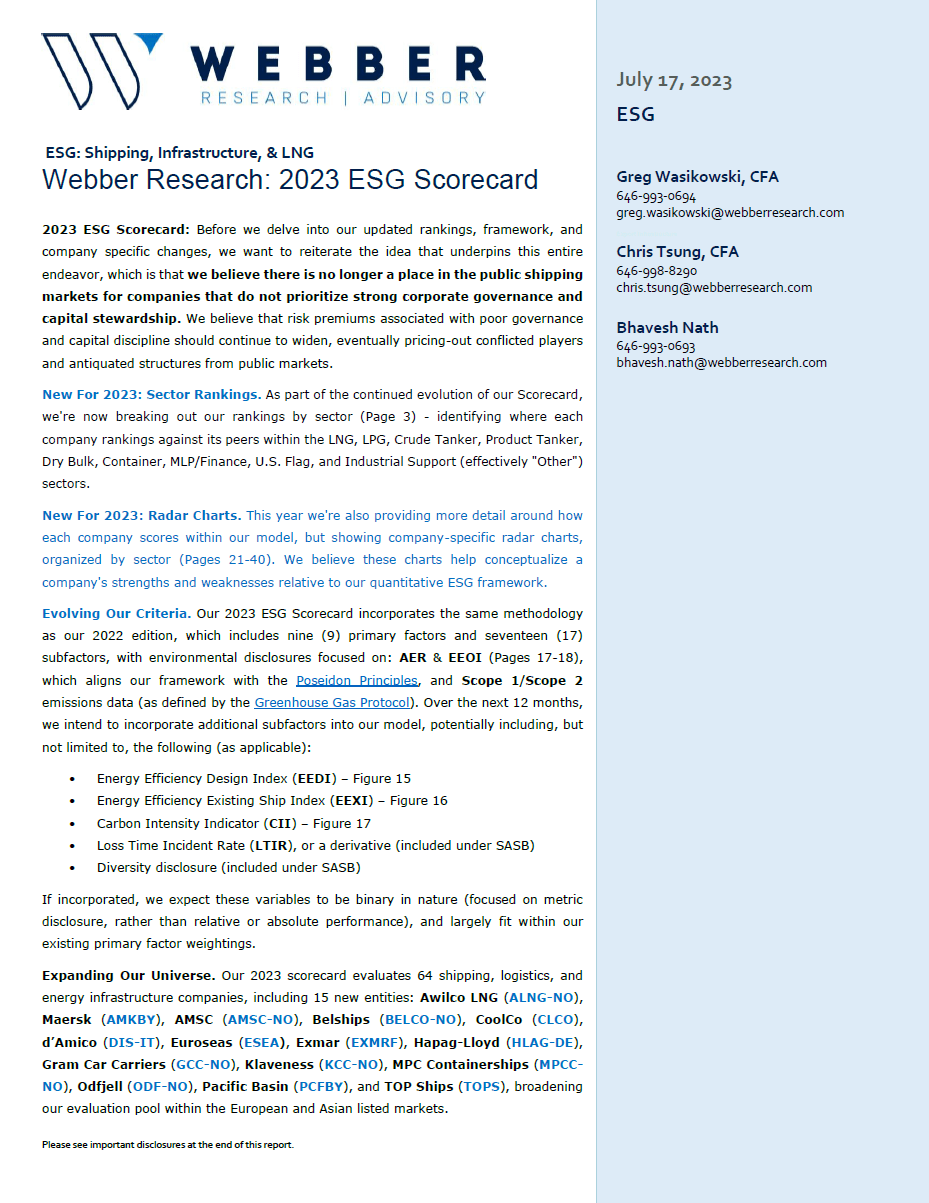

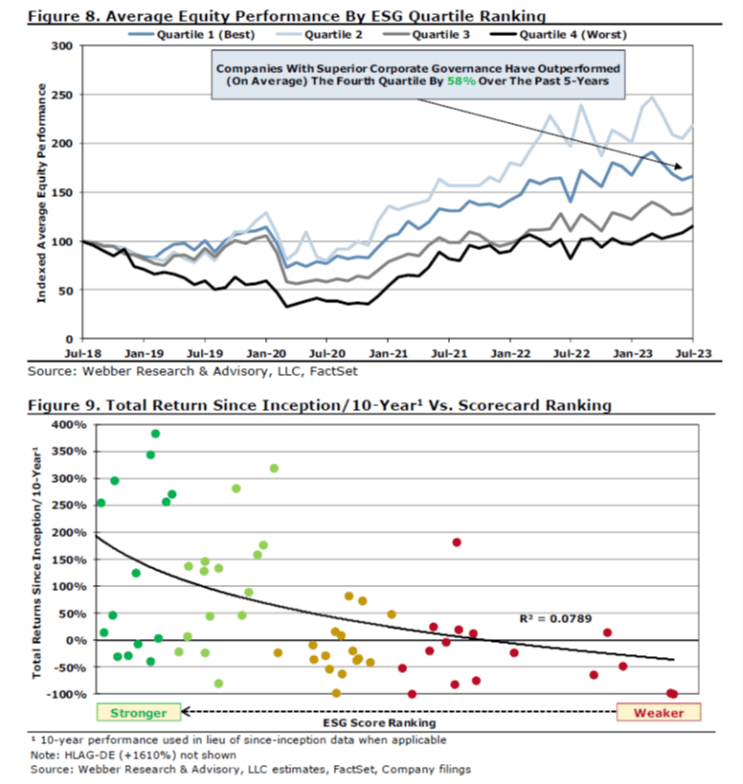

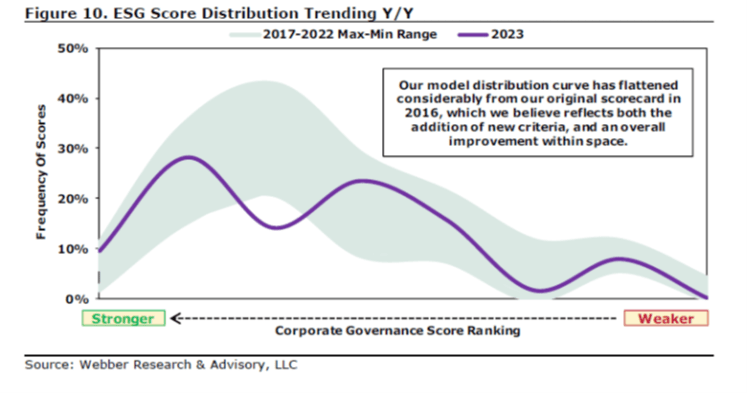

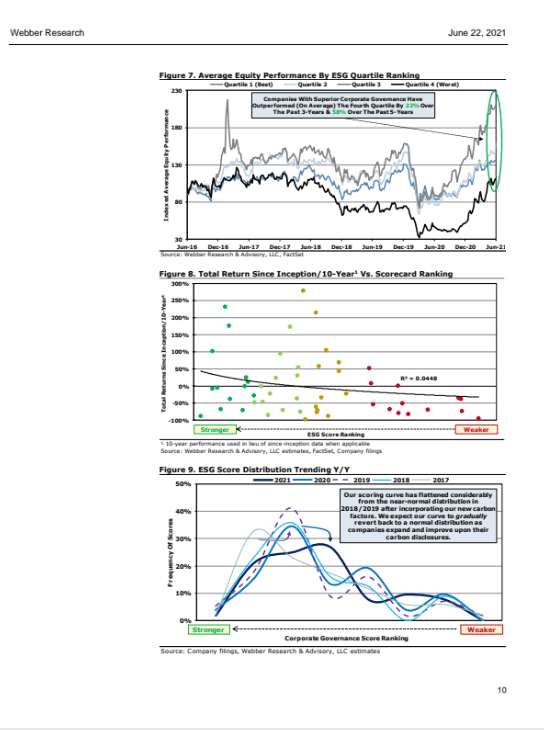

Webber Research: 2023 ESG Scorecard

If you’re a current Webber Research subscriber, you can click here to access this presentation in our library.

If you’re not yet a subscriber, please click here to download the full report, or email us at [email protected] for access information.

New for 2023: Company Specific Model Displays

New for 2023: Sector Specific ESG Rankings

Webber Research Fireside Chat Series: Kirby Corp (KEX) CEO David Grzebinski – Weds, May 10th @10am EST

Conference Call Replay: Changes To DOE’s Non-FTA Process: Impact on Global LNG

For replay information, please reach out to [email protected]

Webber Research Recognized by Institutional Investor As Leading Boutique Research Firm – 2022 All America Research Team

Read More

Webber Research: Fireside Chat Series – H2 Funding w/ Edward Rios – Commercialization Executive for the DOE Office of Energy Transitions

For access information, email us at [email protected], or at [email protected]

Read More

Webber Research: Fireside Chat w/ Plug Power (PLUG) CSO Sanjay Shrestha – Weds 01/11 @ 12:30PM EST

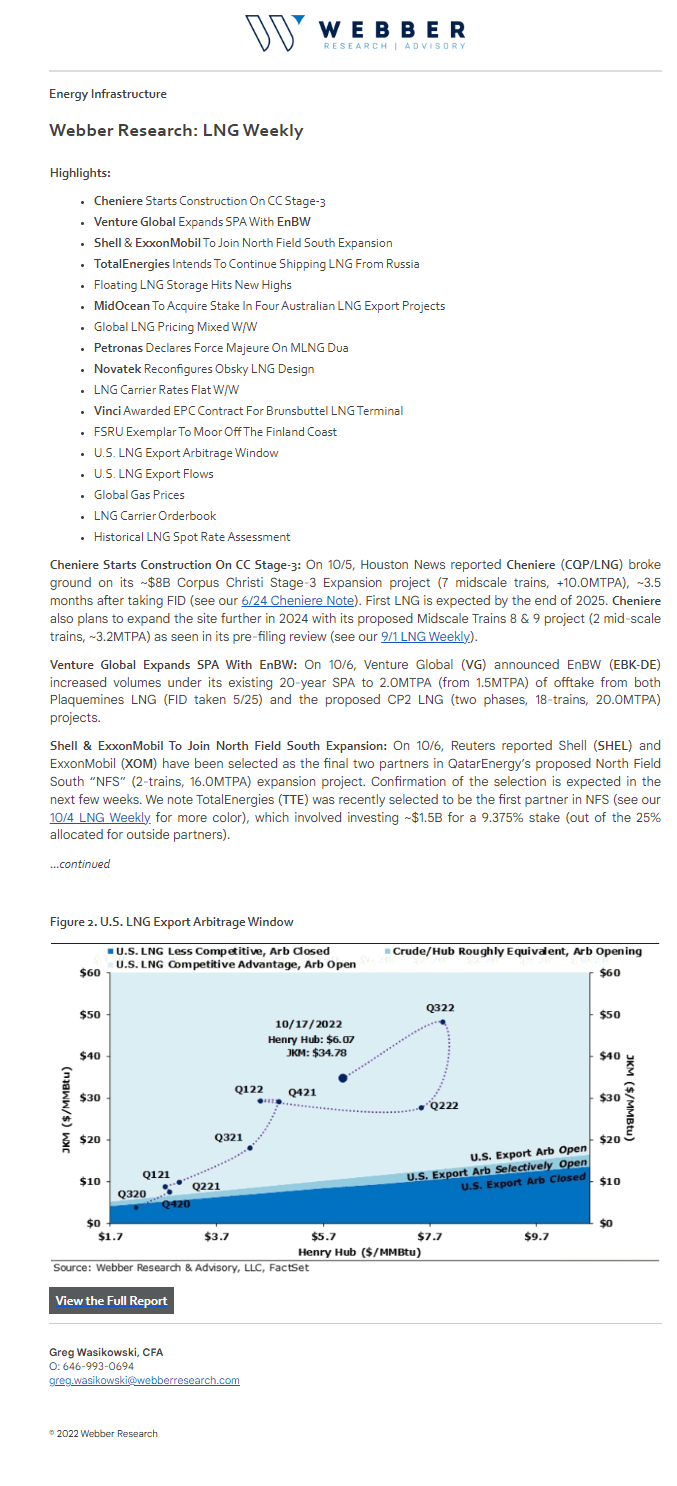

Webber Research: LNG Weekly – VG Expands SPA, CC-Stage 3 Construction, & Tracking The Global Arb

For access information, email us at [email protected], or [email protected]. If you’re already a Webber Research Subscriber, click here.

Webber Research: Fireside Chat – Next Hydrogen (NXH-CA) CEO Raveel Afzaal – Tuesday 10/4 @ 11AM EST

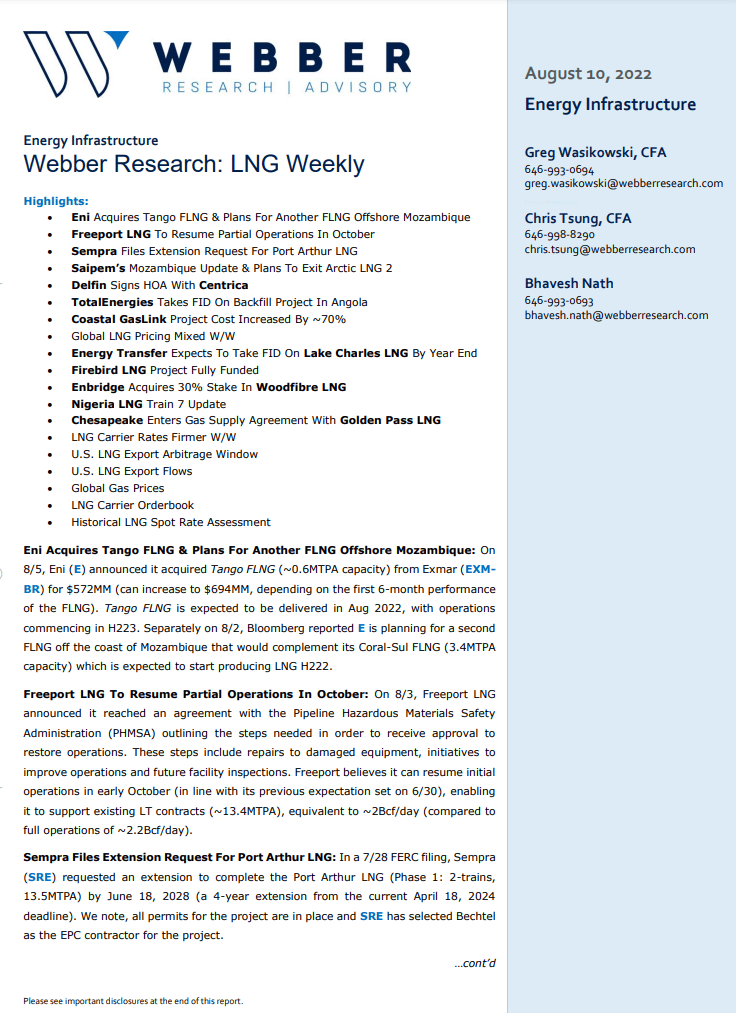

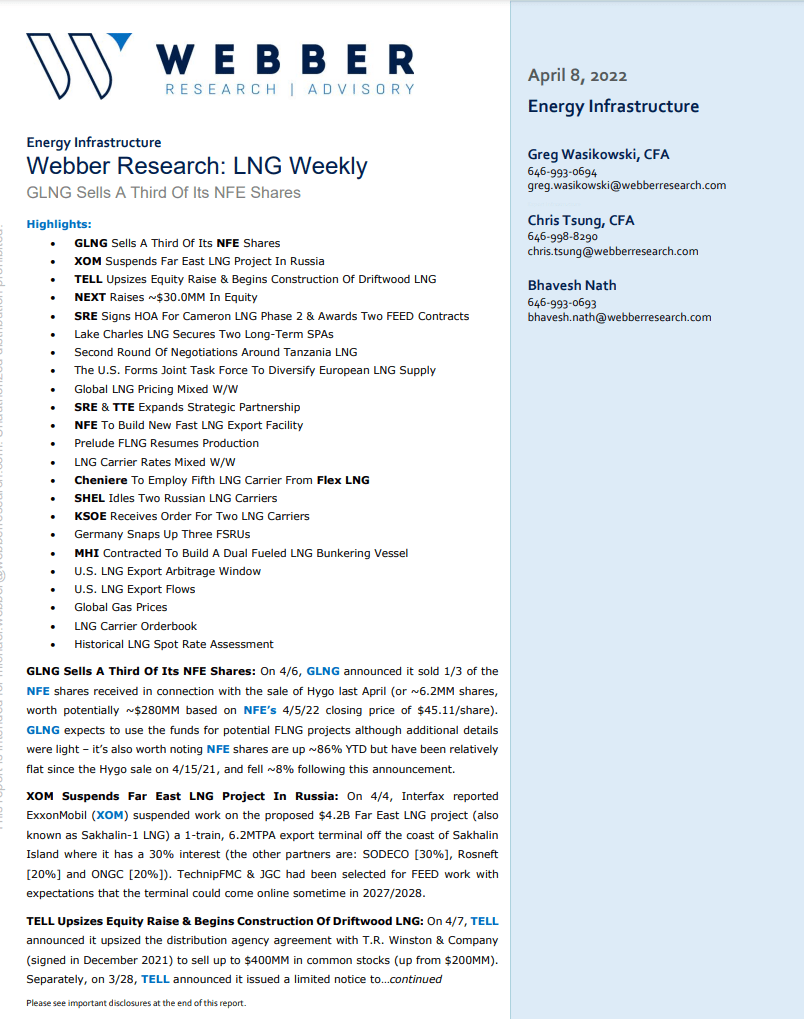

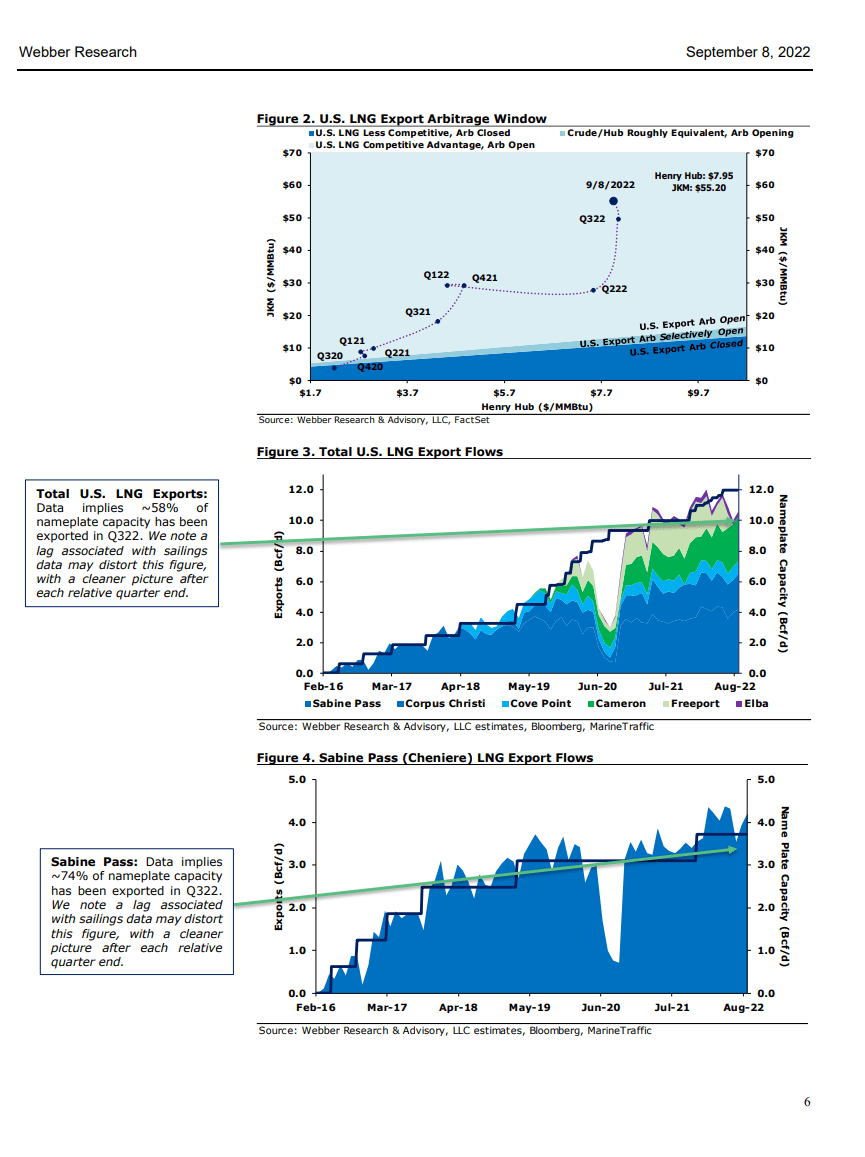

Webber Research: LNG Weekly – Takeaways From Gastech 2022 in Milan

For access information contact [email protected]

For access information contact [email protected]

Read More

Webber Research: LNG Weekly 09.02.2022

For access information please contact us at [email protected]

Read More

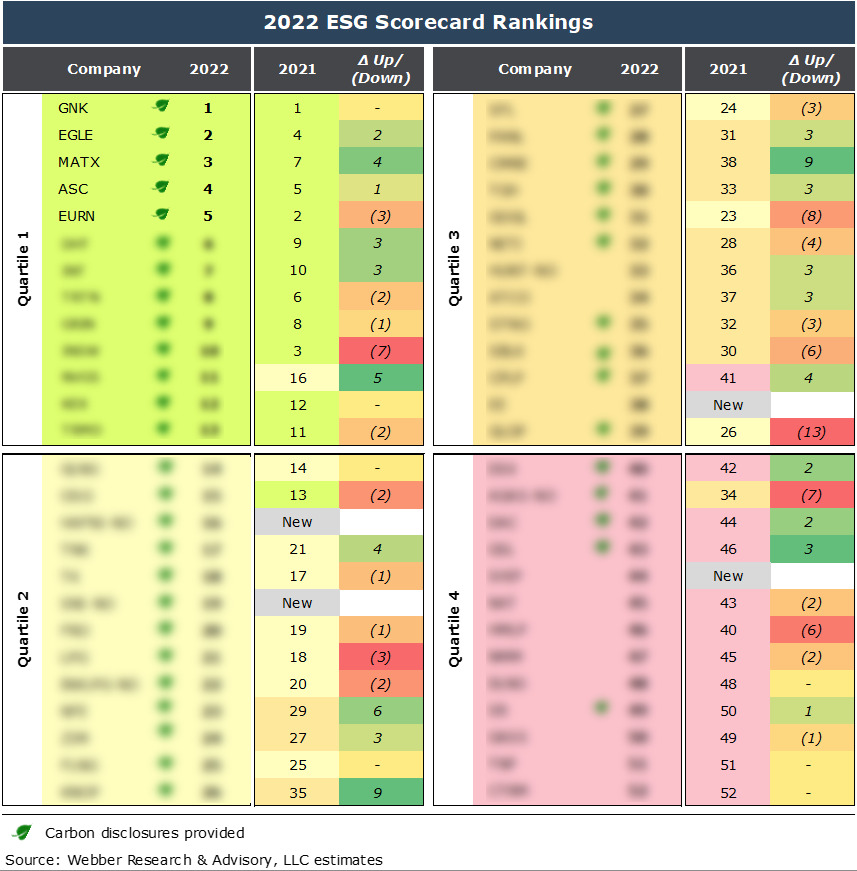

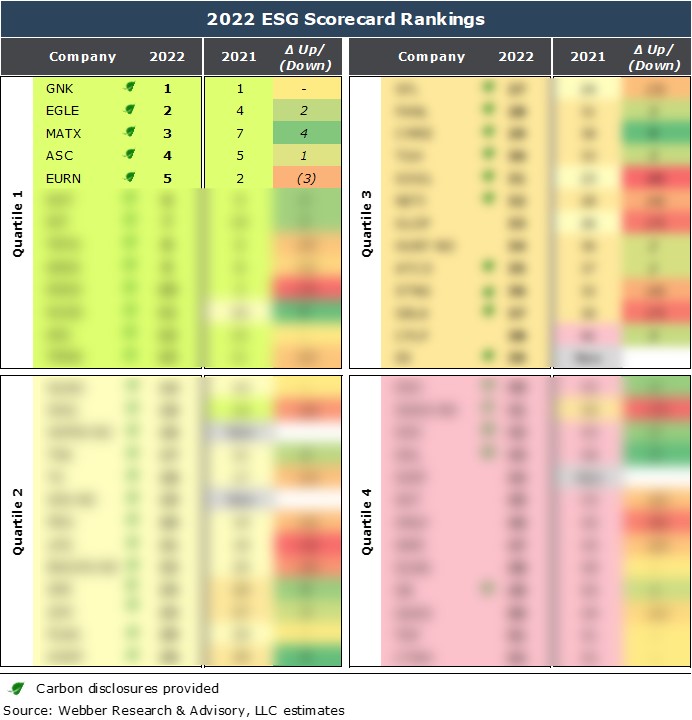

Webber Research: ESG Scorecard 2022

Access Full Report: Webber Research 2022 ESG Scorecard

Read More

Webber Research: Updated LNG Project Rankings & Outlook – Q222

If you’re already a Webber Research subscriber, you can click here to access this presentation in our library. If you’re not yet a subscriber, please contact us at [email protected] for access information.

Webber Research Fireside Chat Series – Kirby Corp (KEX) CEO David Grzebinski & CFO Raj Kumar – Weds, 5/4 @ 11AM EST

Webber Research: Renewables Refresh – 04.20.22

Please reach out to [email protected] for access information.

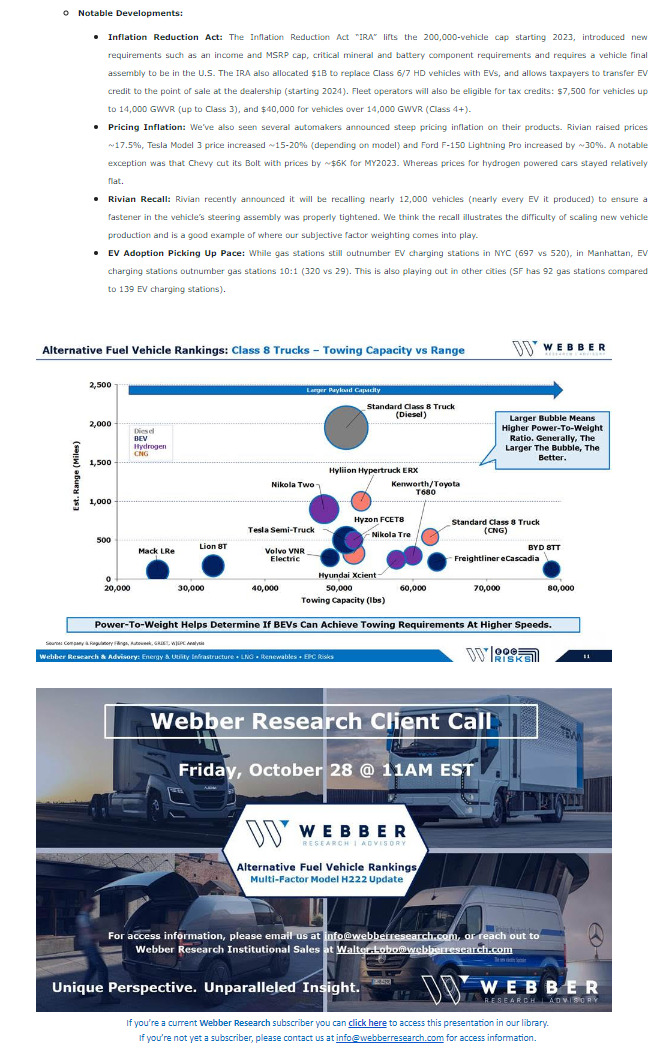

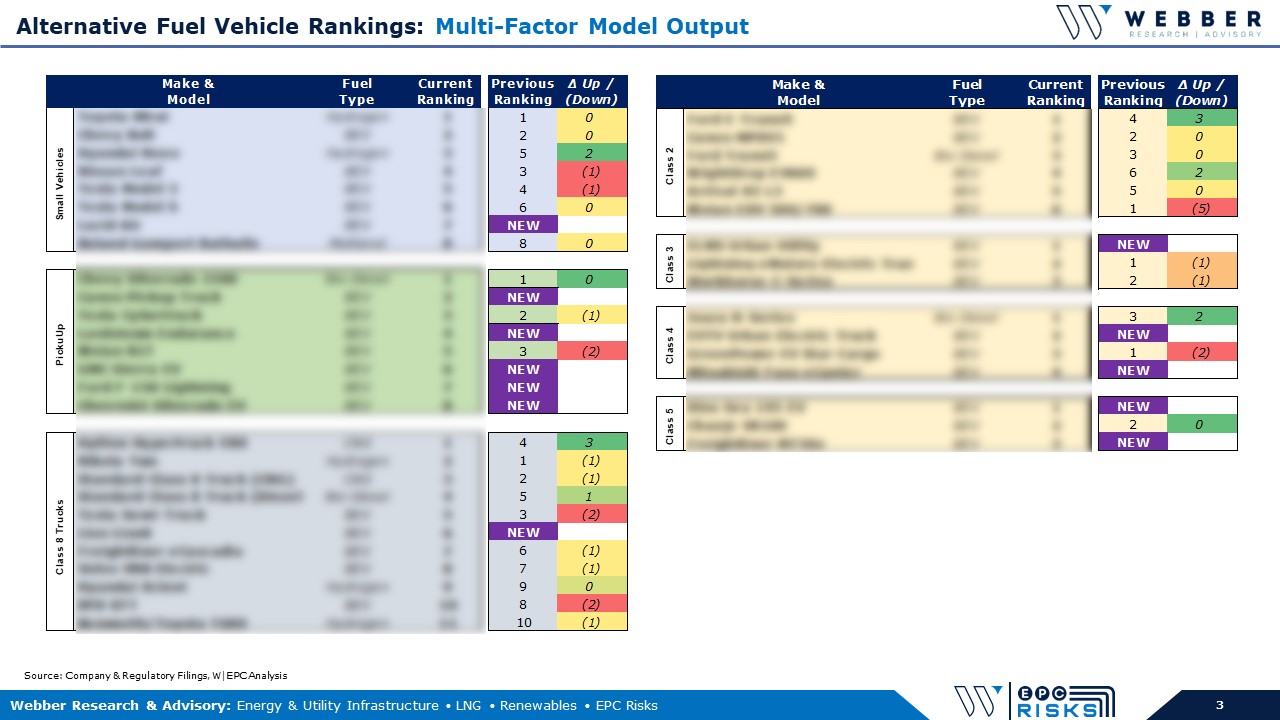

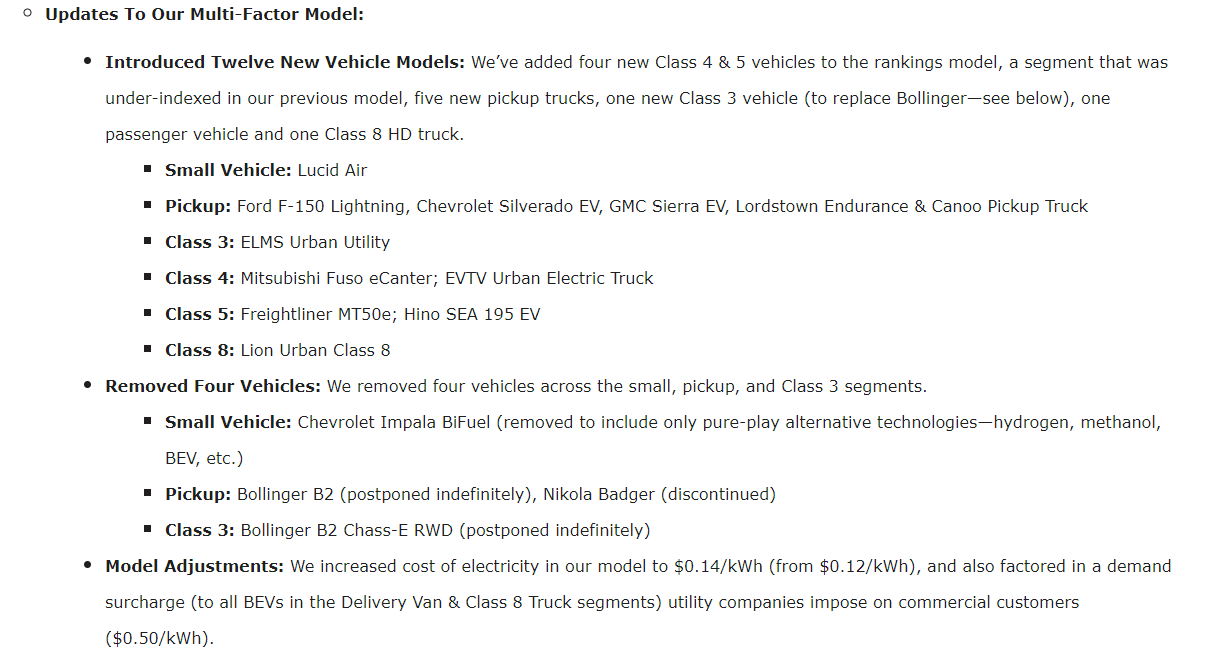

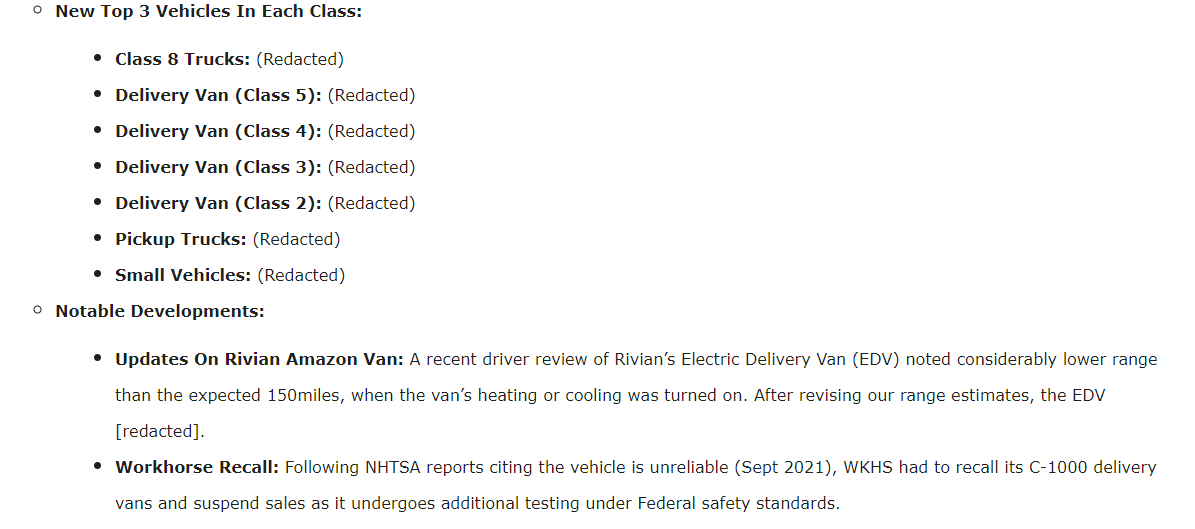

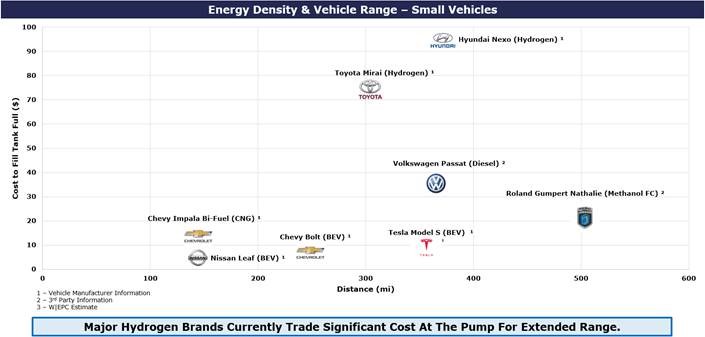

Webber Research: Alternative Fuel Vehicle Rankings – Multi-Factor Model Update H122

If you’re a current Webber Research subscriber you can click here to access this presentation in our library.

If you’re not yet a subscriber, please contact us at [email protected] for access information

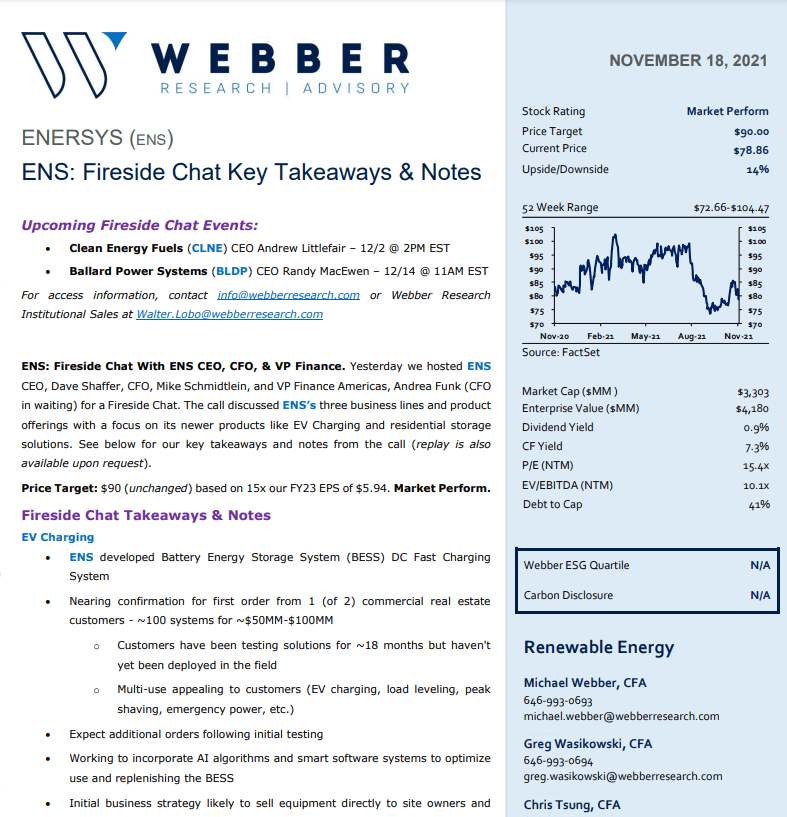

Batteries, Storage, & Charging? Takeaways from our Fireside Chat w/ Enersys (ENS) CEO Dave Shaffer

For access to our full length note, video replay, the rest of the Webber Research fireside chat series, or other parts of our research platform, please contact [email protected].

Read More

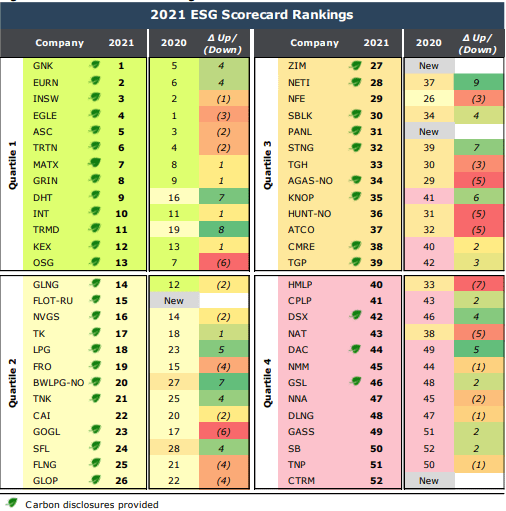

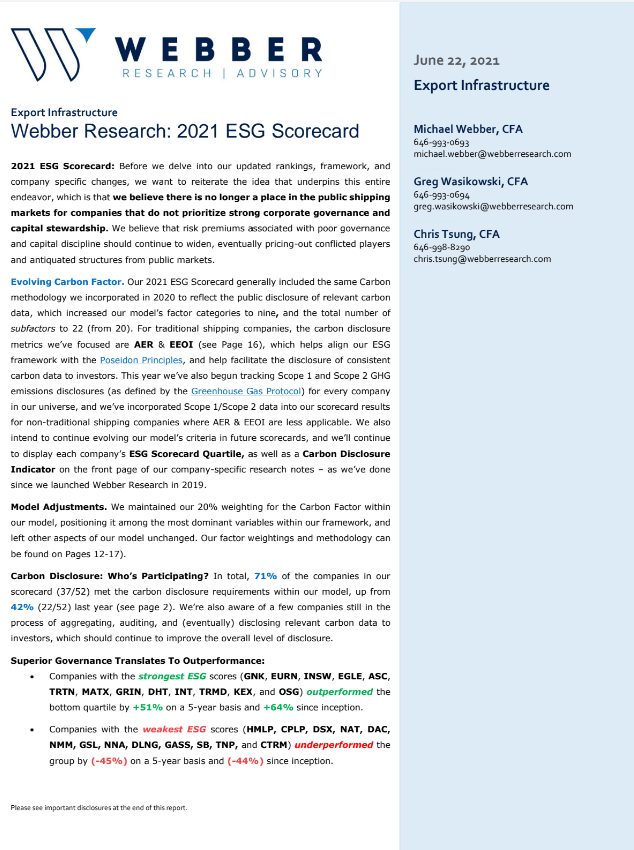

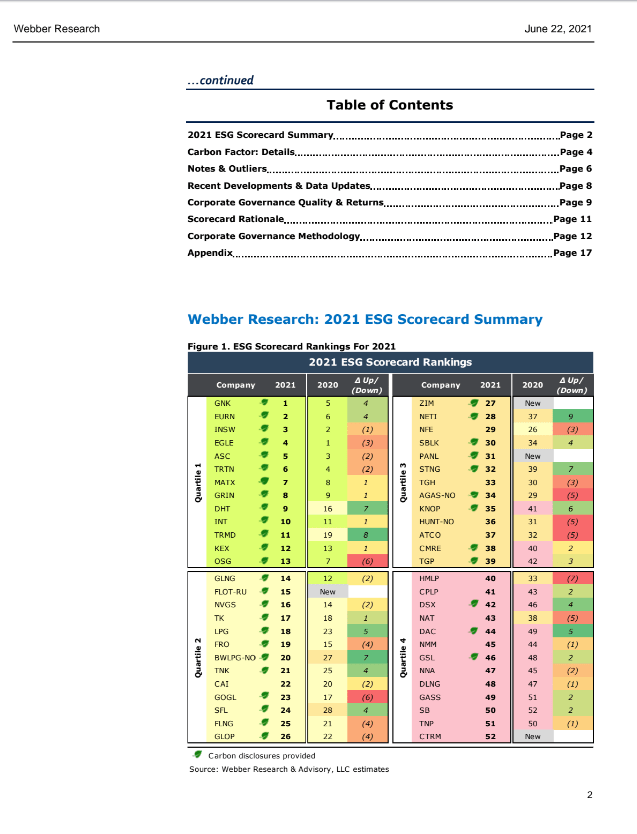

Webber Research: 2021 ESG Scorecard – Marine

Please contact us for a full copy of the report at [email protected]

Fireside Chat: NextDecade LNG (NEXT) CEO Matt Schatzman & CFO Brent Wahl – Thursday, 06/17 @12PM

Client Call: Ranking Alternative Fuel Vehicles – Introducing Our Multi-Factor Model

For access information, please email us at [email protected], or reach out to Webber Research Institutional Sales at [email protected]

Webber Research: Ranking Alternative Fuel Vehicles – Introducing Our Multi-Factor Model

For access information please email us at [email protected], or at [email protected].

Read More

Fireside Chat: Fusion Fuel (HTOO) CFO Fredercio Chaves & CoBD Joao Wahnon – Weds 04/21 @11AM EST

Webber Fireside Chat Series: Renewable Energy Group (REGI) CEO CJ Warner & CFO Todd Robinson – Weds 4/7 @12pm EST

Fireside Chat: Plug Power (PLUG) CSO Sanjay Shrestha – Thursday Feb. 11th @ 11am

For access information, email us at [email protected]

***Conference Call: Alternative Fuels – Emissions, Feedstock, & Gas Stations, Thurs 2/4 @ 2PM EST – Future Of Transport (Part 3)***

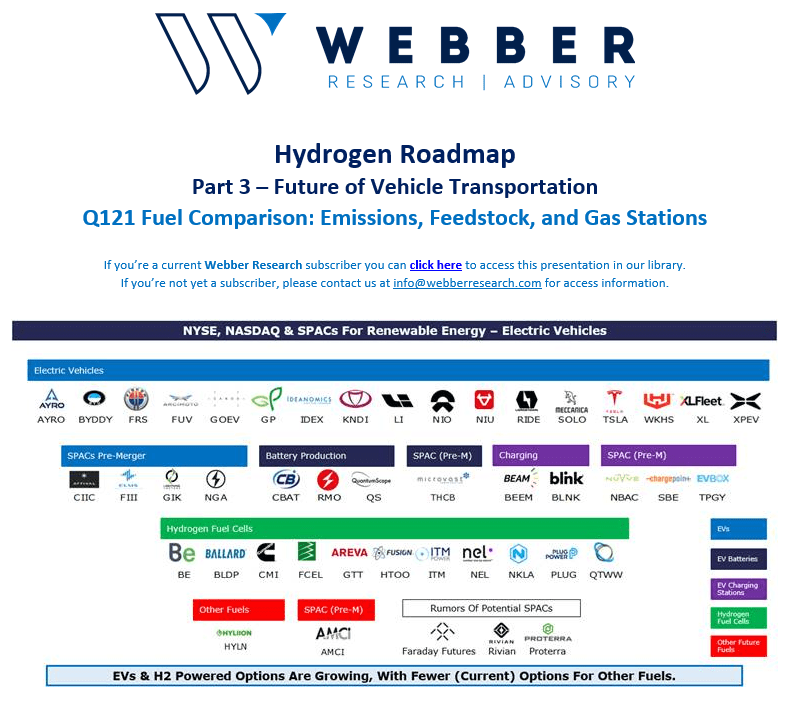

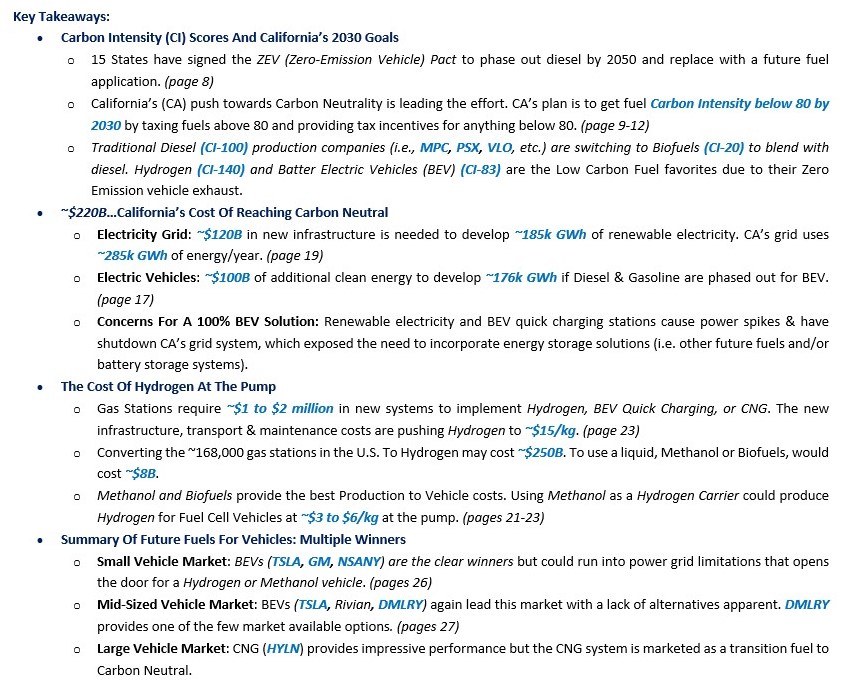

Hydrogen Roadmap – Fuel Comparisons: Emissions, Feedstock, & Gas Stations – Future Of Transportation (Part 3)

For access information, email us at [email protected], or at [email protected]

Read More

Webber Research: Hydrogen Roadmap Part 2 – Future of Vehicle Transportation Alternative Fuels – Efficiency & Safety

For access information, please contact us at [email protected] or at [email protected]

Read More

Conference Call: Future Of Vehicle Transportation – Alternative Fuels Efficiency & Safety w/ Baker Risk, 12/17 @2PM

Client Conference Call: Ranking & Evaluating Alternative Fuels – The Future Of Vehicle Transportation H2 • BEV • Methanol • CNG Hybrid • Ethanol • Ammonia • Biofuels • Diesel

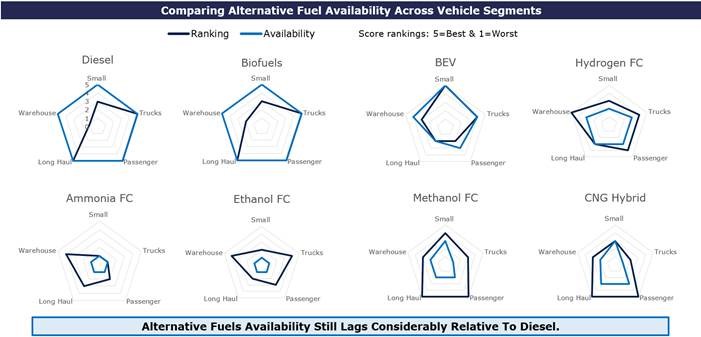

W|EPC: Future Of Transportation – Ranking & Evaluating Alternative Fuels – H2 ∙ BEV ∙ Methanol ∙ CNG Hybrid ∙ Ethanol ∙ Ammonia ∙ Diesel ∙ Biofuels

If you’re a current Webber Research subscriber you access this presentation via our Client Login above. If you’re not yet a subscriber, please contact us at [email protected] for access information.

Alternative Fuel Analysis…Will History Repeat Itself?

In 1992 & 2005, the Department of Energy (DOE) created & amended the Energy Policy Act (EPA) that addressed fuel research and tax benefits for vehicle manufacturing.

Battery Electric Vehicles (BEV), Hydrogen (H2), Hybrids, Biofuels, Ethanol and Methanol were analyzed in 2005, but vehicle manufacturers supported gasoline hybrid vehicles due to technology and production constraints.

Since then, fuel cell technology and global, federal, & state emission guidelines have accelerated innovation and the market is now actively deciding transportation alternatives.

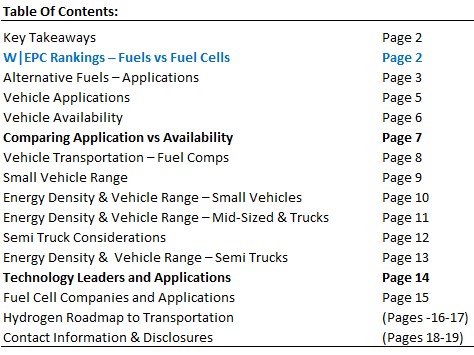

Small Vehicle Applications

BEV have taken a leading role in the small vehicle category with minimal competition from Hydrogen.

Hydrogen’s price, lack of infrastructure, and safety concerns highlight the risk associated with new fuel applications; however, Methanol may have an opportunity to fill this role.

The Roland Gumpert Nathalie markets an impressive range and methanol costs are comparative to BEV, but the $450k price tag limits it’s applications until manufacturing scales up to reduce cost.

Mid-Sized Vehicles and Truck Applications

Mid-Sized Vehicles and Truck Applications

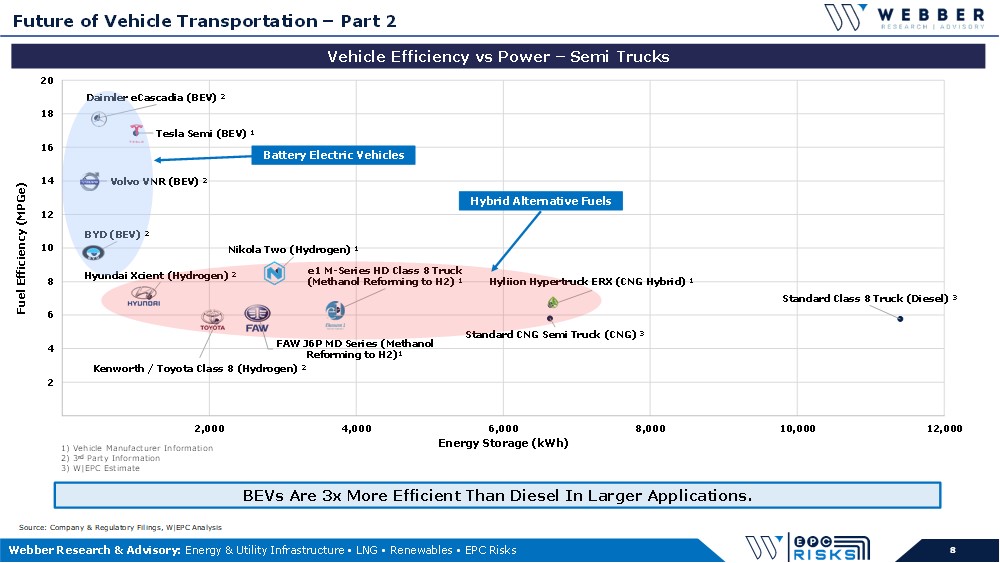

Fuel energy density becomes a larger role as the size of a vehicle increases.

Fuel storage capacity, energy density, and vehicle efficiency play a large role in the range and cost for a vehicle.

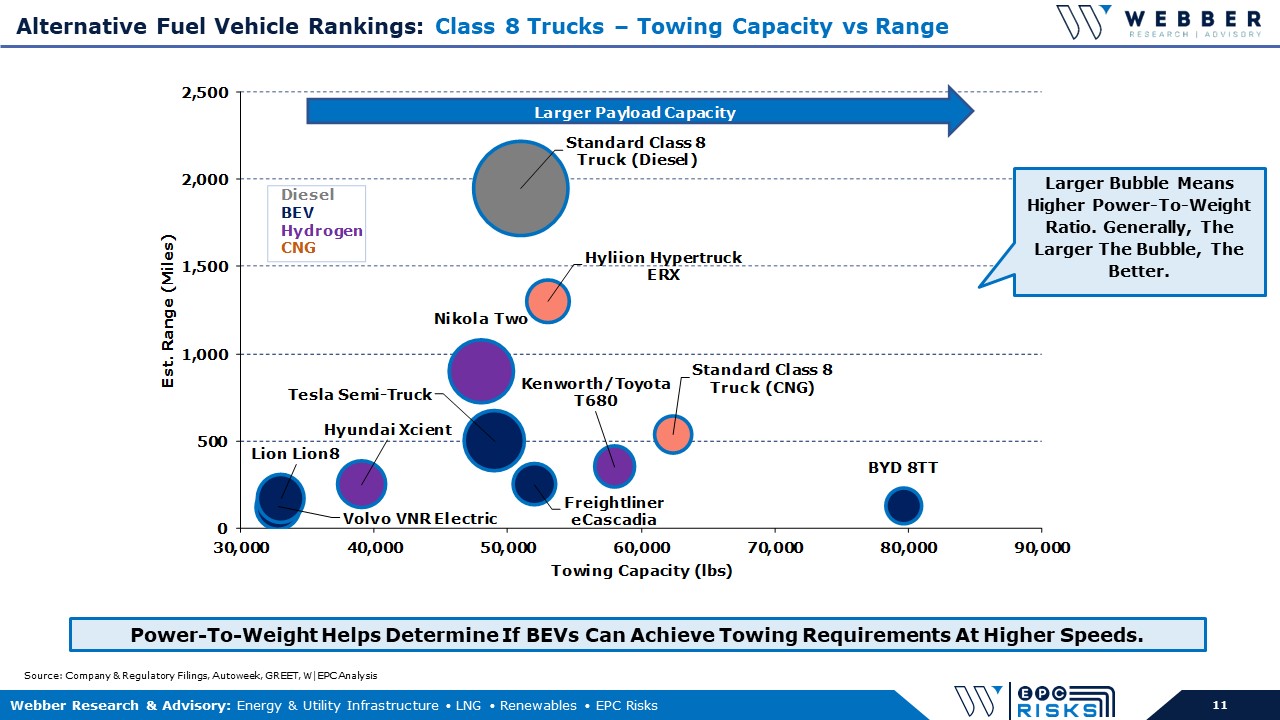

Semi-Truck Range Is A Gating Issue For Future Fuels

New Semi-Truck concepts are ranging from shorter applications (<300 miles) to the long-haul market (>600 mile/day).

Daimler eCascadia seems to make sense for shorter applications and Hyliion’s Compressed Natural Gas (CNG) hybrid semi will likely apply well to long haul trades, if the marketing is as good as advertised.

https://webberresearch.com/downloads/wepc-future-of-transportation-ranking-evaluating-alternative-fuels-h2-%e2%88%99-bev-%e2%88%99-methanol-%e2%88%99-cng-hybrid-%e2%88%99-ethanol-%e2%88%99-ammonia-%e2%88%99-diesel-%e2%88%99-biofu/

Check this: Sex Drive Boosters for Men: Energy, Enthusiasm, and Expertise

Read More

Webber Research: Reviewing California’s Rollout Plans For A Hydrogen Fueling Network

Webber Research: Reviewing California’s Rollout Plans For A Hydrogen Fueling Network Evaluating Safety, Cost, & Implementation Data

For full access information, email us at [email protected], or at [email protected]

In mid-November the California Air Resources Board (CARB) published initial plans detailing the development and implementation of a light-duty hydrogen fueling station networks, including a focus on financial self-sufficiency.

Specifically, CARB’s initial draft highlights:

1. Estimates around required state-support and eventual self-sufficiency

2. A comparison of existing market solutions, ongoing government research, and the latest awards in the Energy Commission’s Grant Funding program.

3. The economic sensitivity around FCEV deployment and the pace of network development.

4. Opportunities for cost reductions

5. Potential price reductions at the pump

6. Regional economic differences

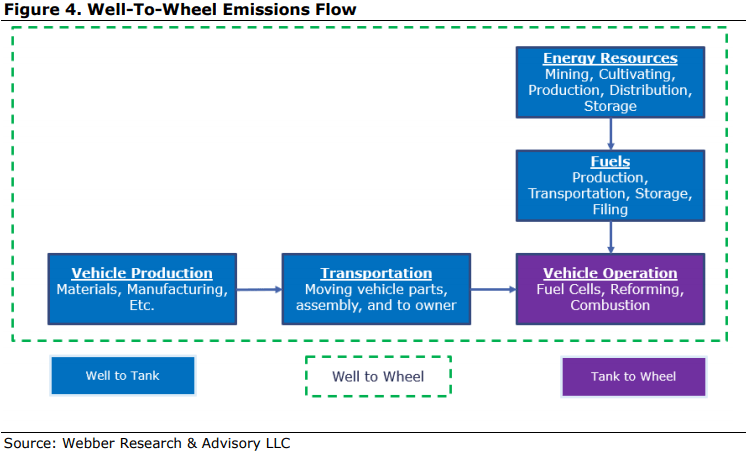

Within the context of CARB’s report, we evaluated the economics and risks for deployment of Hydrogen fueling station options based on the following:

• Public Safety

• Climate Change and Air Quality – Tank to Wheel (TTW) – Well to Wheel (WTW)

• Gas Station Infrastructure Costs

• Hydrogen Costs at Pump for Consumer

W|EPC Takeaway: As highlighted below, if the primary goal of CARB is to reduce tailpipe emissions, we believe electric vehicles and hydrogen vehicles are the most viable options today. However, if the goal is to reduce total emissions and to implement hydrogen fueling as quickly, safely, and cost-effectively as possible, it opens the door for a mix of other fuel considerations – including biofuels, e-fuels, and other energy mediums to expedite the Hydrogen Economy. We believe how California ultimately balances those priorities will determine what it’s future fueling network looks like.

Climate Change & Air Quality

Air quality and the need for sustainable future fuels to reduce GHG emissions is driving alternative fuel technology development. CARB’s Low Carbon Fuel Credits (LCFC) are based on Well to Wheel Carbon Intensity Scores (CI) that identify upstream pollution caused by fuels.

Gas Station Infrastructure Costs

Future fuels (i.e. H2, Ammonia, Methanol) will require new infrastructure in almost all cases to meet federal and state emission guidelines. The Implementation cost of these can vary from storage retrofitting, to +$1 million infrastructure upgrades. The costs could further increase based on the engineering design and blast radius study results.

Hydrogen gas station equipment could include:

• Compressors – 350 bar pressure

• Above Ground Storage

250 bar pressure

250 kg storage

• H2 Dispenser Larger corporate gas stations may have the financial means to implement the costly infrastructure upgrades especially if supported by fuel tax credits. However, smaller gas stations may face challenges investing in the capital costs & the ~$2K/month electricity bill to own & operate the equipment.

Cost comparisons vs the low-cost alternative for Methanol:

• Hydrogen – See Figure 6. Multiple scenarios based on CARB capital cost estimates

• Methanol to Hydrogen in Vehicle – ~$50,000 per gas station to upgrade storage

• Methanol to Hydrogen at Pump – ~$1 million per gas station (250kg H2 storage)

Hydrogen Costs at Pump for Consumer: ~$16/kg and by 2030 as Low as $8/kg?

At the pump, the H2 price begins to stack up due to CAPEX, maintenance, safety, and production costs. We have provided a few options that have been considered for comparisons sake below that could further drive down the cost of hydrogen.

• Centralized Electrolysis: ~$8/kg

• Centralized Reformer (No Carbon Capture): ~$2.50/kg

• Methanol Reforming at Pump: ~$5/kg

Includes 250kg hydrogen storage and compression

• Methanol Reforming in Vehicle: ~$3.50/kg

Gas Station infrastructure cost are relatively minimal

For a methanol reforming at pump scenario, storage-related infrastructure costs could be lighter as Methanol is a potential mid-stream solution for hydrogen, and is generally easier to store in large quantities – potentially pushing the hydrogen cost at the pump level below $10/kg in a shorter timeframe.

For full access information, email us at [email protected], or at [email protected]

Read More

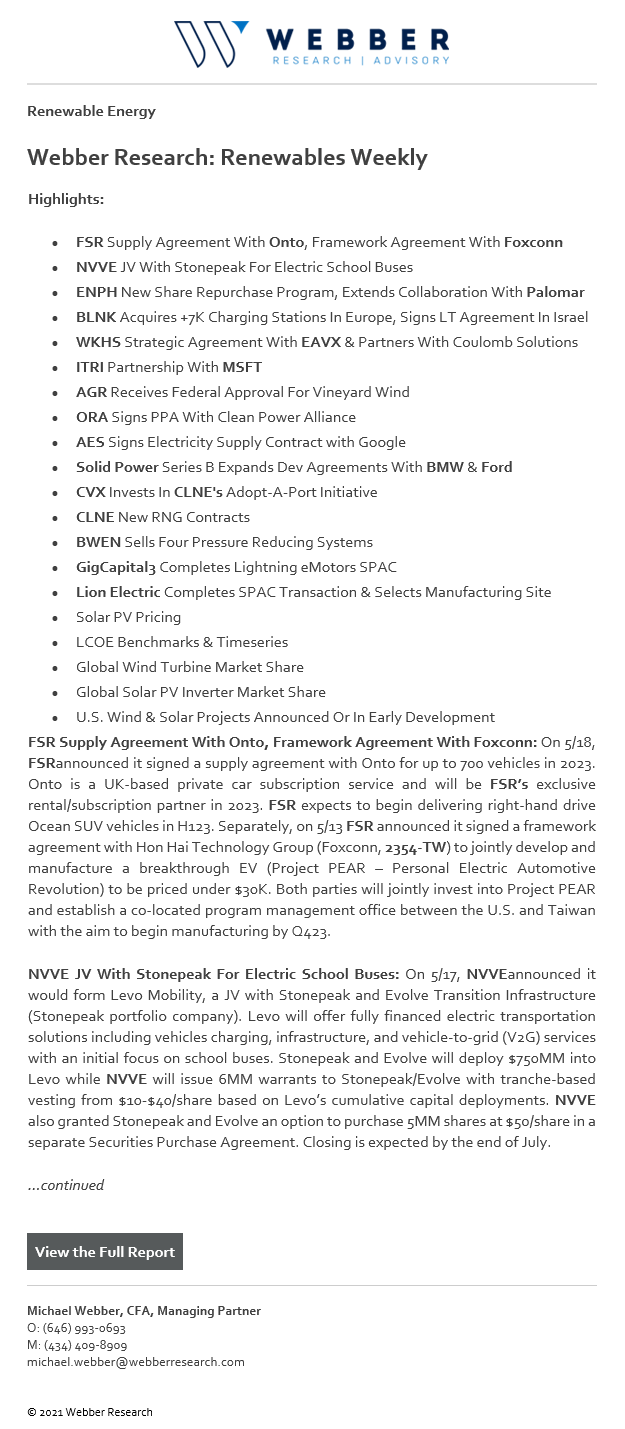

Webber Research: Renewables Weekly

Webber Research: Renewables Weekly 11/18/2020

- Highlights:

• PLUG – $846MM Public Offering

• ENPH ACM Partnership & Dist Agreement In The Philippines

• BLNK Cable Management Solution

• AMRC Completes Two Projects

• FLR Collaboration With Sargent & Lundy On Modular Nuclear Plant

• RIDE Business Updates

• Vestas Orders In Poland & UK

• SGRE Introduces Low-Wind Turbine

• Nordex 302MW Order In Texas

• DNV GL Certifies GE’s Haliade-X Prototype

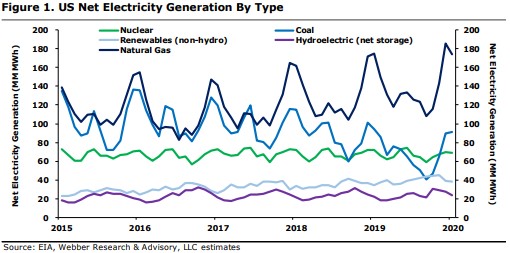

• US Net Electricity Generation

• Solar PV Pricing

• LCOE Benchmarks & Timeseries

• Global Wind Turbine Market Share

• Global Solar PV Inverter Market Share

• US Wind & Solar Projects Announced Or In Early Development - PLUG $846MM Public Offering: On 11/16 PLUG announced it would offer 38MM shares at $22.25 (11% discount to its previous close) for total proceeds of ~$846MM (upsized from $750MM). We note this is PLUG’s third public offering in the past year and adds to its $200MM convertible notes from May. PLUG ended Q3 with ~$450MM in unrestricted cash (+$700MM including restricted cash) which, even with significant Capex going to construction of the Gigafactory, we think was enough runway to 2023-2024 when PLUG is expected to start generating positive cash flow. The offering would bring PLUG’s pro forma cash balance to over $1.5B, which we think has less to do with added conservatism (after reporting positive Q3 EBITDA and raising its 2021 gross billings guidance last week) and more to do with accelerating its green hydrogen strategy, potential M&A, and/or other unannounced growth opportunities (partnerships in the US with a major software player or in the EU with an auto OEM). We’ll see…

- ENPH ACM Partnership & Distribution Agreement In The Philippines: On 11/16 ENPH announced an agreement with MSpectrum to distribute ENPH products to residential and commercial installers across the Philippines. IQ 7 products will be available in Q121. ENPH also announced a strategic partnership with DMEGC Solar Energy to develop a high-efficiency Enphase Energized AC Module (ACM) for the European solar market. The Mono PERC Black Enphase Energized ACM features IQ 7 microinverters and is currently available in France and the Netherlands.

- BLNK Cable Management Solution: On 11/16, BLNK introduced its new Cable Management Solution for new and existing EV Charger locations. The new system is compatible with rectangular and triangular pedestal charging stations as well as wall or pedestal mounted chargers. It also features a retraction mechanism similar to most gas pump designs for customer familiarity.

…continued

For access information, email us at [email protected], or go to webberresearch.com/downloads

Read More

Webber Research: Renewables Weekly

Webber Research: Renewables Weekly 11/05/2020

- Baker Hughes (BKR) Buys Carbon Capture Platform

- Dominion (D )Proposes 9 New Solar Facilities For ~500MW

- AMRC – 2 New Contracts In Oregon

- Neste Acquires Neighboring Refinery Plant

- ITRI Deploys AMI In Canada

- AGR Investor Day & PNM Merger

- Vestas Buys Out MHI Stake In MHI Vestas JV

- AEP PPAs In Ohio

- Diamond Green Diesel Receives Air Permit From TCEQ

- US Net Electricity Generation

- Solar PV Pricing

- LCOE Benchmarks & Timeseries

- Global Wind Turbine Market Share

- Global Solar PV Inverter Market Share

- US Wind & Solar Projects Announced Or In Early Development

BKR Buys Carbon Capture Platform: On 11/3 BKR announced it acquired Compact Carbon Capture (3C) for an undisclosed amount. BKR plans to accelerate development and commercialization of 3C’s carbon capture solution, which adds to its existing portfolio of carbon capture technology including turbomachinery, solvent-based capture processes, well construction, CO2 storage management, and digital monitoring solutions…

Dominion Proposes 9 New Solar Facilities For ~500MW: On 11/2, Dominion Energy (D) proposed a slate of 9 new solar projects with output of 498MW. Six of the facilities (416MW) are through PPAs, helping to fulfill the Virginia Clean Economy Act (VCEA) requirement of having 1/3 of new solar and onshore wind be procured through PPAs through 2035….

AMRC 2 New Contracts In Oregon: On 10/26 and 10/27 AMRC…..

For access information, email us at [email protected], or go to webberresearch.com/downloads

Read More

Webber Research: Renewables Weekly

Webber Research: Renewables Weekly 10.20.20

Highlights:

• CEC Releases Clean Transportation Plan (page 1)

• New York Set 70% Renewable Energy Mandate By 2030 (page 1)

• ENPH Partners With Natura Living In Thailand (page 1)

• ENS Partners With alpha-Encorp (page 2)

• Bifacial Tariff Exemptions Blocked (page 2)

• JKS Signs Module Supply Agreement (page 2)

• CSIQ Adding Storage To GS Solar Farm (page 2)

• Enel Begins Construction Of Azure Sky Solar Project (page 2)

• Siemens Sub Acquires AMS (page 2)

• Proterra Raises $200MM (page 2)

• GE Wins 327MW Wind Order In India (page 2)

• SGRE Edges Out Vestas In Q2 (page 3)

• NOVA Expands Solar + Storage Offering (page 3)

• Arrival Raises $118MM From BlackRock Investment (page 3)

• PNM Plans To Replace Coal Plant With 1GW Solar + Storage (page 3)

• US Net Electricity Generation (pages 4-5)

• Solar PV Pricing (page 5)

• LCOE Benchmarks & Timeseries (page 6)

• Global Wind Turbine Market Share (Page 7)

• Global Solar PV Inverter Market Share (page 7)

• US Wind & Solar Projects Announced Or In Early Development (page 8)

CEC Releases Clean Transportation Plan: Last week, the California Energy Commission (CEC) released its clean transportation plan with ~$384MM of investments scheduled over the next 3 years for electric vehicle (EV) and zero-emission vehicle (ZEV) infrastructure. The spending includes ~$133MM for light-duty EV charging systems, ~$130MM for medium- and heavy-duty ZEV infrastructure, and ~$70MM for hydrogen refueling infrastructure. California currently has ~26MM automobiles and ~6MM trucks registered in the state – ~726k of which are ZEVs (vs its goal of 1.5MM by 2025 and 3MM by 2030). It also currently has 57k Level 2 chargers and 4.9k DC fast chargers vs its 2025 goal of 240k Level 2 and 10k fast chargers.

New York Set 70% Renewable Energy Mandate By 2030: On 10/15 New York’s Public Service Commission (PSC) announced it would formally adopt a 70% renewable energy initiative by 2030 as part of its Clean Energy Standard. The announcement includes a directive for NYSERDA to enter into annual contracts for 4,500MWh for upstate renewables and 700-1,000MW of offshore wind.

ENPH Partners With Natura Living In Thailand: On 10/12 ENPH announced it partnered with Natura Living to develop commercial solar projects in Thailand for PepsiCo (PEP). Natura installed a 60kW solar array on PEP’s snack division building using ENPH’s IQ 7+ microinverters and is currently installing another 60kW array on PEP’s agronomy division building (expected completion in Q420).

For access information, email us at [email protected], or go to webberresearch.com/downloads

Read More

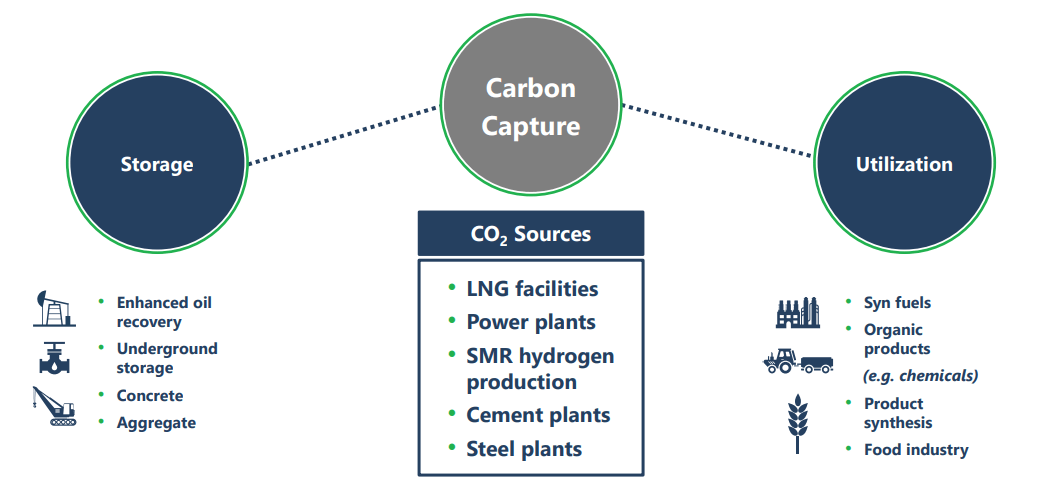

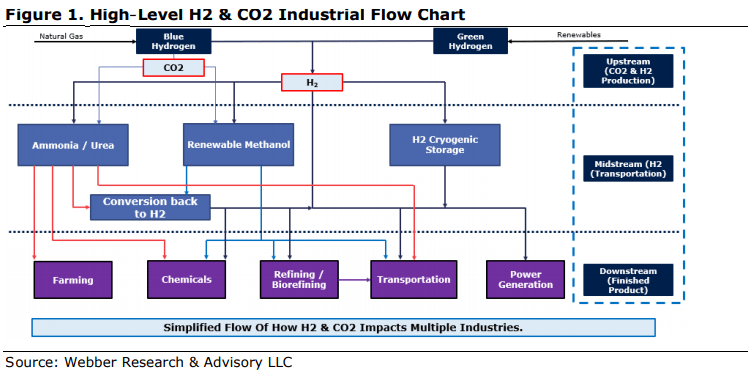

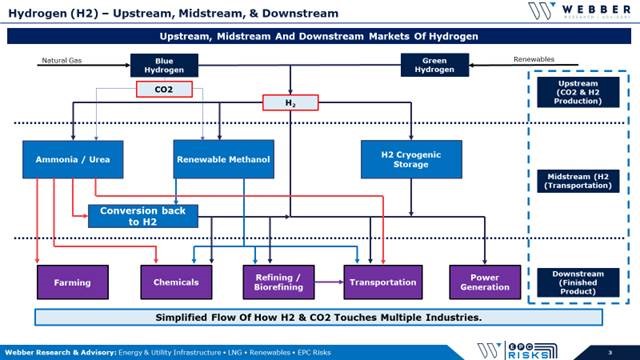

Hydrogen (H2) – The Production Process Roadmap – Upstream, Midstream, & Downstream – Q420

Hydrogen ∙ Ammonia ∙ Methanol

Table Of Contents:

- Key Takeaways And Flow Of H2 & CO2………………………………………Page 2

- Hydrogen’s Upstream

- Electrolysis Technologies & Market Leaders…………………….…..…Page 6

- Blue Hydrogen CO2 Issue………………………………………….…….Page 7

- Hydrogen Is Getting Cheaper………………………………………….…Page 8

- Carbon Capture Systems & CO2’s Critical Role…………..………..…Page 9

- Hydrogen’s Midstream – Transportation

- Ammonia Transportation – Green Hydrogen………………..….…….Page 12

- Methanol Transportation – Blue & Green Hydrogen……………..….Page 14

- Cryogenic Hydrogen Energy Loss Concern…………………….……Page 16

- Closer Look – Ammonia vs Methanol

- Hydrogen Comparison…………………………………………………Page 18

- Example Product Comparison…………………………………………Page 19

- Converting Back To H2…………………………………………………Page 20

- Ammonia & Methanol Co-Production Facilities………..….………..Page 21

- Marine and Fuel Cell Comps

- Industry Impact – H2 Transportation…………………………………Page 23

- IMO Driving LNG, Ammonia Or Methanol Fuel For Ships….……..Page 24

- Carbon Neutral Marine Fuels – IMO 2050………………………….Page 25

- Ammonia & Methanol Co-Production Facilities…………………….Page 26

- Technology Leaders and Applications

- H2 – Industry Technology Leaders………………………………….Page 28

- Applying Technology In The EPC Process…………….………..…Page 29

- Technology Packaging & Trends…………………………….….….Page 30

Key Takeaways:

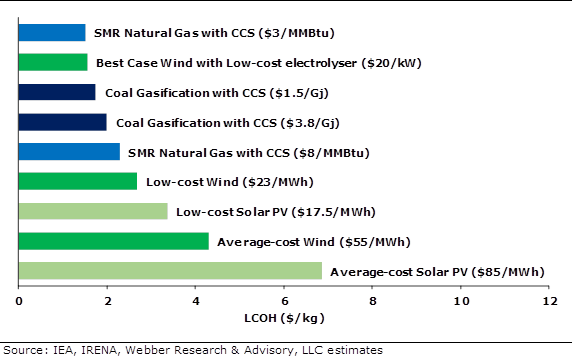

Upstream Sources Of Hydrogen – Blue & Green (Pages 4 – 9)

>95% of Hydrogen (H2) is produced using Steam Methane Reformer (SMR) technology that produces 7 units of CO2/unit of H2 (on average)

SMR w/ a carbon capture system (Blue H2) is the preferred option to environmentally manage excess CO2. (page 7)

Green H2 provides minimal CO2 but current technology limits Green H2’s cost competitiveness. (Page 6)

H2’s Sprint To Market Share… Current Leaders (Pages 17 – 21, 27 – 30)

We analyzed 13 Technology Companies spanning 12 Process industries, including ThyssenKrupp, Air Products, Air Liquide, & KBR/Johnson Matthey…the clear technology leaders include…

Frozen Industries – Marine, Automotive, & H2 Transport (Pages 22 – 26)

Outside factors (i.e. carbon neutral fuels, fuel cells, regulations, safety, & other downstream applications) will play a large role in selecting the midstream transportation choice for H2.

International Maritime Organization’s (IMO) mandates for reduced emissions has many ship builders looking at LNG, Ammonia, and/or Methanol; without a clear long-term winner (yet), many shipbuilders are frozen.

Fuel pumps (gas stations) must receive H2 from high-pressure storage vehicles, pipelines, or by converting Methanol or Ammonia to H2 at the fuel pump, with a number of implications.…(page 20)

Midstream For Hydrogen – H2 Transportation Options (Pages 10 – 16)

Ammonia, Methanol, and Cryogenic H2 are used to transport H2 long-distances.

Ammonia is the clear favorite to…

Methanol is the best option for…

Cryogenic H2 technology/costs…

For access information, please email us at [email protected], or our institutional sales at [email protected]

Read More

Renewable Energy: Expanding Our Hydrogen & Solar Coverage

Initiating Coverage Of PLUG, BLDP, & SEDG

Plug Power (PLUG)

Company Overview – Page 5

Plug Symposium (Raw Notes) – Page 10

Investment Rationale / Key Points – Page 12

Primary Risks – Page 14

Valuation – Page 15

Ballard Power Systems (BLDP)

Company Overview – Page 22

Analyst Day (Raw Notes) – Page 28

Investment Rationale / Key Points – Page 35

Primary Risks – Page 36

Valuation – Page 37

SolarEdge Technologies (SEDG)

Company Overview – Page 45

Investment Rationale / Key Points – Page 48

Primary Risks – Page 49

Valuation – Page 50

Industry Overviews

Hydrogen & Fuel Cells – Page 55

Solar / Inverters – Page 67

Expanding Our Hydrogen & Inverter Coverage. We are initiating coverage of PLUG (Outperform, PT: $19), BLDP (Outperform, PT: $26), and SEDG (Market Perform, PT: $200). Since launching our first wave of coverage in April (REGI – OP, ENPH – MP, TPIC – MP, and ENS – MP) renewables have continued to aggressively take both mind-share and market-share – positioning the sector for unprecedented investment as governments, counterparties, and end-users move toward carbon neutrality over the next 15-40 years. Benchmark renewable levelized cost of energy (LCOE) figures have declined nearly 75% over the past-10 years, increasing the viability of alternative energy sources. We believe the extension of that process toward low- and zero-carbon hydrogen could create a generational growth engine across Energy, Industrials, and Technology over the next several decades.

The Push For Hydrogen: Major markets worldwide continue to adopt integrated hydrogen strategies and roadmaps, with Europe and China at the forefront. The EU is expected to invest €183-€490B by 2050 to effectively develop a continental hydrogen economy, with green hydrogen (i.e. hydrogen created using renewable sources) at its center. China recently announced its National Hydrogen Fuel Cell Strategy and pledged to reach carbon neutrality by 2060 despite currently deriving two-thirds of its power from coal. We think the increasingly widespread support for carbon-reducing policy creates a deliberate and sturdy foundation for renewables, and particularly hydrogen.

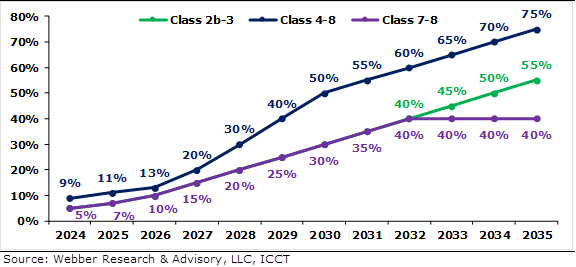

Figure 58. California Advanced Clean Truck Regulations

Figure 50. Hydrogen Production Costs From Renewables & Fossil Fuels

For access information, please email us at [email protected]

Read More

Webber Research: Renewable Biofuels – Refinery Conversions, Crack Spreads, & Risks Q420

Renewable Biofuels – Refinery Conversions, Crack Spreads, & Risks Q420

- Key Takeaways (page 2)

- Biofuels – Costs, Risks, & Incentives (page 3)

- Renewable Fuels vs. Traditional Refining Economics (page 4)

- Crack Spread Analysis – Ratios Matter (page 5)

- The California Renewable Fuel Rush (page 6

- Biofuels & Soybean Oil Supply/Demand (page 7

- Biofuels Project Tracker (page 8)

- Hydrogen’s Increased Demand in Biorefining (page 9)

- HVO vs FAME Biofuel (page 10)

- PSX’s Rodeo Refinery Conversion (page 11)

- Rodeo Refinery Conversion Overview (page 12)

- PSX Project Comp – WA vs. CA (page 13)

- EPC Dynamics (page 14)

- EPC Contractor Rankings (page 15)

Key Takeaways:

- Renewable Fuel Production… Just in Time or Too Late? (Pages 4 – 8)

- California & Oregon have mandated Carbon Intensity (CI) reductions in transportation fuels, which could increase demand by ~350%, from ~400MM gallons/year to 1,400MM by 2025. Ten other states are evaluating similar LCFS programs, which could potentially push U.S. demand toward 2,400MM gallons/year, up ~600%…

- Refinery Conversions: FAME vs. HVO (Page 10)

- Emerging trend in Biofuels: a transition from Fatty Acid Methyl Ester (FAME) to Hydrotreated Vegetable Oil (HVO), which provides biofuels a longer storage life & can be used in colder climates.

- FAME & HVO biofuels are produced using a refinery’s hydrotreater & isomerization, or a hydrocracking unit with a steady supply of hydrogen. HVO economics are dependent on hydrogen prices & feedstock ratios.

- Hydrogen’s Increased Demand in Biorefining (Page 10)

- As of early 2020, traditional oil refining consumed ~1/3 of the global Hydrogen demand.

- FAME biorefining requires similar Hydrogen consumption relative to traditional refining, but HVO biorefining uses significantly more Hydrogen depending on the process units…

- Speed To Market Matters: Owners, Operators, & Contractors (Pages 12, 13, 15)

- ~10 years ago, companies were chasing another speed to market trend, NGL production and fractionation. Flexible and decisive companies (e.g. EPD, ET, etc.) quickly capitalized on this opportunity and captured market share.

- Large Energy companies (e.g. Exxon, Shell, etc.) are not typically structured to move quickly refining industry (VLO, PSX, MPC) and take on the speed to market risk..

W|EPC: Renewable Biofuel Analysis Refinery Conversions, Crack Spreads, & Risks Q420

For access information, please email us at [email protected] or visit our website at webberresearch.com

Read More

Webber Research: Hydrogen Tracker

Webber Research: Hydrogen Tracker 09/09/2020

Recent News (page 1)

M&A Tracker (page 3)

Valuation Summaries (page 3)

Hydrogen Production Costs (page 4)

Industry/Background (page 6)

LH2 Carrier Progress (page 7)

• GM Forms Strategic Alliance With Nikola: On 9/8, GM announced it took an 11% ownership stake in Nikola (NKLA) worth ~$2B as well as the right to elect one director to NKLA’s Board, in exchange for in-kind services. GM will engineer and manufacture the Nikola Badger (both the BCEV and FCEV models), and will be the exclusive supplier of fuel cells globally (except in Europe) for NKLA’s Class 7/8 trucks (heavy-duty trucks, including the Nikola Badger, Nikola Tre, Nikola One, Nikola Two and the NZT), utilizing its Ultium battery system and Hydrotec fuel cell technology. NKLA said it expects to save more than $4B in battery and powertrain costs over 10 years and $1B+ in engineering and validation costs, while GM expects to receive in excess of $4B of benefits from the equity value of NKLA shares, contract manufacturing of the Badger, supply contracts for batteries and fuel cells, and EV credits retained over the life of the contract. GM will be subject to a staged lock-up period (beginning in 1 year and ends in June 2025). The Badger will make its public debut 12/3-12/5 at Nikola World 2020

• Ballard Markets First Fuel Cell Designed For Marine Vessel Propulsion

• Siemens Announces Green Hydrogen Systems As Electrolysis Partner

• California Regulators Funds 36 More Hydrogen Stations

• Australia’s First Green Hydrogen Plant

• Germany Eyes Hydrogen Project In Democratic Republic Of Congo

• Freudenberg Sealing Technologies To Develop Special Fuel Cell System For HeavyDuty Trucks

• SunHydrogen Expands Partnership With University Of Iowa

• Wystrach Reveals Its Mobile Hydrogen Refueling Station

M&A Tracker

• 6/23/20 PLUG Acquires United Hydrogen & Giner ELX:

• Total consideration of ~$123MM (~$65MM for United Hydrogen and ~$58MM for Giner ELX).

• United Hydrogen is a merchant hydrogen producer in North America with production capacity of 6.4t/d with plans to expand to 10t/d.

• PLUG previously announced it held a convertible bond in United Hydrogen which could represent over 30% equity ownership on a converted basis.

• Giner ELX provides PEM hydrogen generators, grid-level renewable energy storage solutions, and onsite generation systems for fuel cell vehicle refueling stations.

• PLUG increased its 2024 financial targets to $1.2B in revenue (from $1.0B), $210MM in operating income (from $170MM), and $250MM in adjusted EBITDA (from $200MM).

For access information, email us at [email protected], or go to webberresearch.com/downloads

Read More

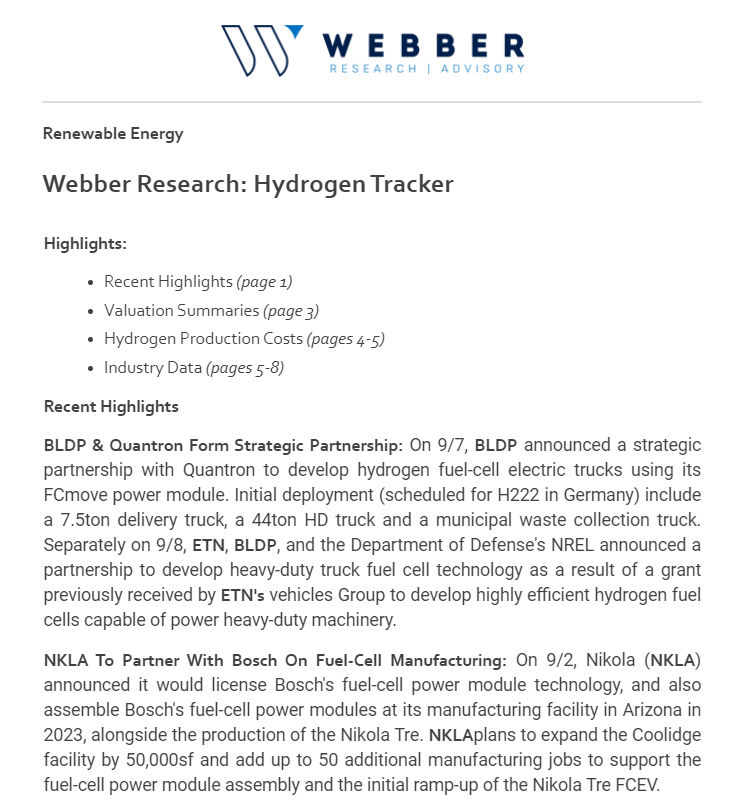

Webber Research: Hydrogen Tracker Highlights:

- Recent Highlights (page 1)

- LH2 Carrier Progress (page 3)

- M&A Tracker (page 4)

- Valuation Summaries (page 5)

- Hydrogen Production Costs From Fossil Fuels (page 6)

- Hydrogen Production Costs From Renewables (page 7)

- Hydrogen Projects & Electrolyzer Tech (page 8)

- Fuel Cell Technology Comparisons (page 9)

Recent Highlights

NKLA Breaks Ground On Coolidge Facility: On 7/23 NKLA announced it began construction on its 1MM sqft……

NEE Eases Into Hydrogen: On 7/24 NEE proposed a $65MM pilot green hydrogen plant with a 20MW electrolyzer in Florida….

MSFT To Replace Diesel Backup Power With Hydrogen: On 7/27 MSFT announced it successfully powered a row of data center servers for 48 consecutive hours with a 150kw hydrogen fuel cell system….

Linde To Build Refueling Station For World’s First Hydrogen Passenger Train: LIN will build and operate the station and is expected to begin construction in… BKR & Snam Complete Testing On Hybrid Hydrogen Turbine: On 7/20 BKR and Snam announced the successful testing of the hybrid hydrogen-powered NovaLT12 turbine

Read More

Webber Research: Hydrogen Tracker

For access information, email us at [email protected]

Highlights:

• Recent News (page 1)

• LH2 Carrier Progress (page 3)

• M&A Tracker (page 4)

• Valuation Summaries (page 5)

• Hydrogen Production Costs (page 7)

• Industry Dynamics (page 9)

- PLUG Launches GenSure HP Platform

- Linde Signs MOU For Hydrogen Mobility At 2022 Winter Olympics

- Hyperion Set To Unveil XP-1 In August

- US DOE Announces $11.5MM In Funding For CCS

- Air Liquide Opens Hydrogen Fueling Station In Japan

- McPhy Selected For Unnamed Fueling Station Project

- Keeping Tabs On The World’s First Liquefied Hydrogen (LH2) Carrier:

- Future Supply Chain Dynamics

Webber Research Hydrogen Tracker

Introducing the Webber Research Hydrogen Tracker

Yesterday we launched our Hydrogen Tracker – a weekly research product dedicated to the build out of Hydrogen production, technologies, and associated markets. For information about access to our Hydrogen Research, Renewables, or our Utility, Energy, & LNG Infrastructure Project coverage, please email us at [email protected]

Highlights:

• Recent News (page 1)

• LH2 Carrier Progress (page 3)

• M&A Tracker (page 4)

• Valuation Details (page 4)

• Hydrogen Production Costs (page 5)

• Demand Trends (Page 7)

• Electrolyzer Market Share & Technology Growth (page 8)

- Data & Updates:

- EU Hydrogen Strategy: On 7/8 the European Commission provided additional details on its broader energy transition including its hydrogen strategy…

- APD, ACWA Power, & NEOM Form JV For $7B Green Hydrogen Facility In Saudi Arabia: On 7/7 APD announced, in conjunction with equal JV partners, ACWA Power and NEOM, the signing of a $5B agreement for a global-scale green hydrogen-based ammonia production facility…

- Air Liquide & Port of Rotterdam Joint Initiative For Hydrogen Trucking: On 7/6 Air Liquide (AI-FR) and the Port of Rotterdam Authority announced a joint initiative to adopt and build the infrastructure for 1,000 hydrogen-powered zero-emission trucks by 2025…

- CARB Passes Zero-Emission Truck Regulations: On 6/25 the California Air Resources Board (CARB) passed the Advanced Clean Trucks (ACT) Regulation which accelerates the large-scale transition of zero-emission medium and heavy duty vehicles in California. Beginning in 2024, 9% of all on-road Class 4-8 trucks sales…

- NEL +NOK 150MM Purchase Order: On 6/30 NEL announced a +NOK 150MM purchase order for multiple H2Station units from…

- BLDP $7.7MM Purchase Order From JV: On 7/2 BLDP announced it received a $7.7MM purchase order of membrane electrode assemblies (MEAs) for use in…

- NKLA Starts Preorders: On 6/29 NKLA opened preorders for its Badger pickup truck, NZT off-highway vehicle (OHV), and WAV jet ski…

- FCEL Terminates Exclusivity Agreements With POSCO, Seeks +$200MM In Compensation: On 6/28 FCEL officially notified POSCO Energy and…

…continued

For access information, please email us at [email protected]

Read More

Webber Research: Renewables Weekly

Renewable Energy Highlights:

For access information email us at [email protected]

- Wild Week For ENPH (page 1)

- PLUG Acquires United Hydrogen & Giner ELX (page 2)

- BLDP Follow-On Order From Wrightbus (page 2)

- JinkoSolar To Supply Bifacial Modules In Chile (page 2)

- RUN To Launch 2 Virtual Power Plants (page 2)

- FCEL Restarts Operations At Torrington, CT Facility (page 2)

- NOVA Closes Solar Backed Notes (page 2)

- NEL +$3MM Purchase Order (page 2)

- GE Nearly Doubling Headcount At LM Wind Facility (page 2)

- SGRE SG 14-222 DD Turbine Backlog Up To 4.3GW (page 2)

- MHI Vestas Supplier Begins Taiwanese Blade Facility Construction (page 3)

- Vestas Recent Order Summary (page 3)

- Denmark To Develop First Offshore Wind Energy Islands (page 3)

- Germany’s National Hydrogen Strategy (page 4)

- New Jersey Plans Offshore Wind Port (page 4)

- EPA Receives 52 New SREs For 2011-2018 (page 4)

- Australian Storage Capacity To More Than Double In 2020 (page 4)

- US Net Electricity Generation (pages 5-6)

- Solar PV Pricing (page 6)

- LCOE Benchmarks & Timeseries (page 7)

- Global Wind Turbine Market Share (Page 8)

- Solar PV Inverter Market Share (page 9)

- US Wind & Solar Projects Announced Or In Early Development (page 10)

Wild Week For ENPH: Last week ENPH traded down 26% on the back of a short report alleging various accounting violations and more serious fraudulent activity, before recovering most of the lost ground in the days that immediately followed (-4% on the week). From our perspective, the report highlights a number of red flags, however…..

For access information email us at [email protected]

Read More

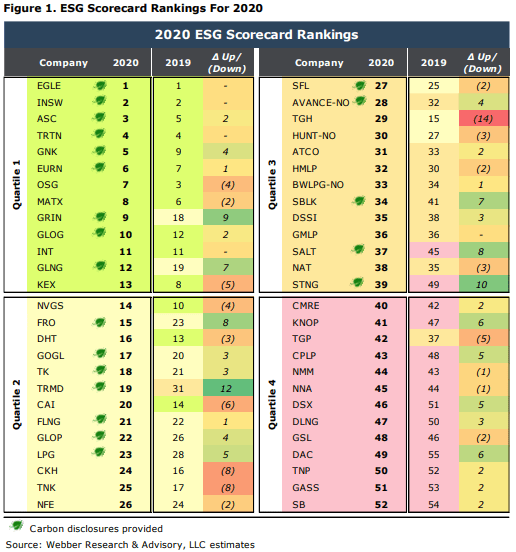

Webber Research ESG Scorecard: 2020

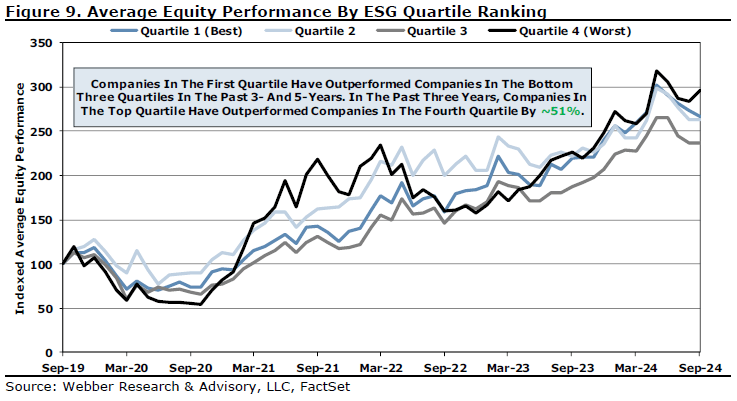

2020 ESG Scorecard – Updated Model, Same Idea. Before we delve into our updated rankings, framework, and company specific changes, we want to reiterate the idea that underpins this entire endeavor, which is that we believe there is no longer a place in the public shipping markets for companies that do not prioritize strong corporate governance and capital stewardship. We believe that risk premiums associated with poor governance and capital discipline should continue to widen, eventually pricing-out conflicted players and antiquated structures from public markets.

New Carbon Factor. Our 2020 ESG Scorecard includes a broadened methodology that incorporates the public disclosure of relevant of carbon data, which becomes the 9th factor within our proprietary multi-factor ESG model and increases the total number of subfactors to 20 (from 18). The carbon disclosure metrics we’ve chosen to initially include (AER & EEOI – see Page 15) are aimed at aligning our ESG framework with the Poseidon Principles, and intended to help facilitate the consistency and disclosure of carbon data to investors. We will also continue to display each company’s ESG Scorecard Quartile, as well as a Carbon Disclosure Indicator on the front page of our company-specific research notes – as we’ve done since we launched Webber Research in Q419.

Model Adjustments. We’ve given our new Carbon Factor a 20% weighting within our model, positioning it among the most dominant variables within our framework, while re-weighting other aspects of our model in order to accommodate the addition. Our revised factor weightings and methodology can be found on Pages 10-15. We also narrowed our 2020 ESG Scorecard universe to 52 companies from 56 (Page 5).

Carbon Disclosure: Who’s Participating? We’ve included a summary of our work around carbon disclosures on Pages 2-3. In total, 42% of the companies in our scorecard (22/52) met carbon disclosure requirements within our model. While we’re encouraged by the level of initial participation, there’s clearly room improvement. To that point, we’re aware of several companies still the process of aggregating, auditing, and (eventually) disclosing relevant carbon data to investors, which should continue to improve the participation level in subsequent scorecards.

Superior Governance Translates To Outperformance:

• Companies with the strongest ESG scores (EGLE, INSW, ASC, TRTN, GNK, EURN, OSG, MATX, GRIN, GLOG, INT, GLNG, and KEX) outperformed the group by 16% on a 5-year basis and 41% since inception.

• Companies with the weakest ESG scores (CMRE, KNOP, TGP, CPLP, NMM, NNA, DSX, DLNG, GSL, DAC, TNP, GASS, and SB) underperformed the group by (24%) on a 3-year basis and (25%) since inception.

Read More

Webber R|A Renewables Weekly

Webber Research: Renewable Energy

Highlights:

- Orsted JV To Develop Clean Hydrogen In Copenhagen (page 1)

- US Extends Safe Harbor Deadlines (page 1)

- Next Generation EU (page 2)

- Saudi’s Alfanar Rumored To Be Senvion India Buyer (page 2)

- ENPH Collaboration With University of Washington (page 2)

- RUN Introduces Brightbox In Nevada & Colorado (page 2)

- ENS Board Changes & Dividend Declaration (page 2)

- SGRE SG 14-222 DD Backlog Updates (page 2)

- Vestas Expands 2020 Vietnam Intake To Over 300MW (page 3)

- Aerodyn To Develop 111-Meter TC1B Rotor Blade (page 3)

- US Net Electricity Generation (pages 3-4)

- Solar PV Pricing (page 4)

- LCOE Benchmarks & Timeseries (page 5)

- Global Wind Turbine Market Share (page 6)

- Solar PV Inverter Market Share (page 6)

- US Wind & Solar Projects Announced Or In Early Development (page 7)

Orsted JV To Develop Large-Scale Clean Hydrogen In Copenhagen: On 5/26 Orsted announced it entered into a JV with Copenhagen Airports, Maersk (marine), DSV Panalpina (logistics), DFDS (ferry), and SAS (aviation) to develop a hydrogen and e-fuel production facility. The project will be developed in three phases with the ultimate goal of providing renewable fuel sources for multiple transportation methods in the Greater Copenhagen Area. Phase 1 includes a 10MW electrolyser to generate renewable hydrogen fuel for buses and trucks – potentially operational as early as 2023. Phase 2 considers a 250MW electrolyser which would have the capacity to produce renewable methanol for maritime transport and renewable jet fuel for aviation – potentially operational by 2027 when the first offshore wind power is available from Ronne Banke off the island of Bornholm. Phase 3 would upgrade the electrolyser capacity to 1.3GW with the potential to displace 30% of fossil fuels used at Copenhagen Airports by 2030. Orsted said the project could reach FID as early as 2021 after receiving required regulatory approvals as well as a full feasibility study.

US Extends Safe Harbor Deadlines: continued…

For access information email us at [email protected]

Read More

Webber R|A Renewables Weekly

Renewable Energy Weekly

*REGI (Outperform) – Virtual NDR Weds 5/27 To participate email us directly or at [email protected]

Renewables – Weekly Highlights:

• GE To Add 193MW Onshore Wind In Turkey – Blades Built In-House (page 1)

• SPWR Sells O&M Business, Clears Maxeon Regulatory Hurdle (page 1)

• ENPH Expands Commercial Presence (page 1)

• IEA Updates Renewable Energy 2020 & 2021 Outlook (page 2)

• BNEF EV Outlook (page 2)

• AMRC Begins Commercial Operations In Ireland (page 2)

• SGRE Launches 14MW Direct Drive Offshore Turbine (page 2)

• Ginlong Solis To Double Manufacturing Capacity (page 3)

• Jinko & LONGi Launch New Modules (page 3)

• Sungrow To Provide Inverters For Ibri II Project In Oman (page 3)

• Suzlon Restructuring Update (page 3)

• PLUG Prices 2025 Convertible Notes (page 3)

• NJ Clean Energy Equity Act (page 3)

• US Net Electricity Generation (pages 4-5)

• Solar PV Pricing Dynamics (page 5)

• LCOE Benchmarks & Timeseries (page 6)

• Global Wind Turbine Market Share (page 7)

• Solar PV Inverter Market Share (page 7)

…continued

For more information on access and pricing, please email [email protected]

Read More

Webber Research: Renewable Energy Weekly

- ENPH Partners With 5B In Australia

- GE Renewable Energy Q1 Earnings

- Sunpower COVID Updates

- Safe Harbor Deadline Extension Brought To Treasury

- BNEF Semi-Annual LCOE Update (Page 2, Charts On Page 4)

- New York Approves Offshore Wind Plans, But Delays Action Due To COVID

- Orsted’s 120GW Skipjack Offshore Wind Farm Delayed 1 Year

- Q Cells Tops US Market Share

- Sunrun Hires New CFO

- Houston’s First Climate Action Plan

- California Confirms PV & Storage Installers Are Essential Workers

- Chicago Supporting EV Adoption

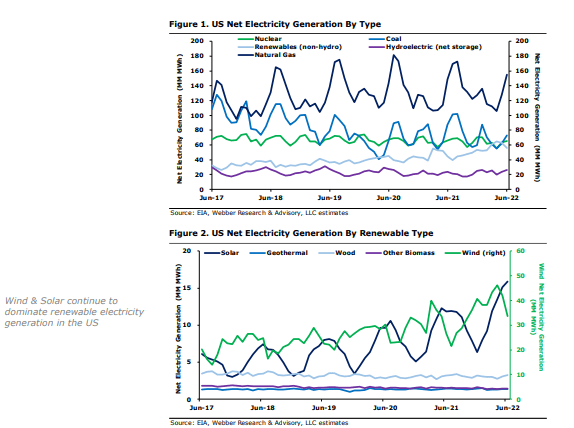

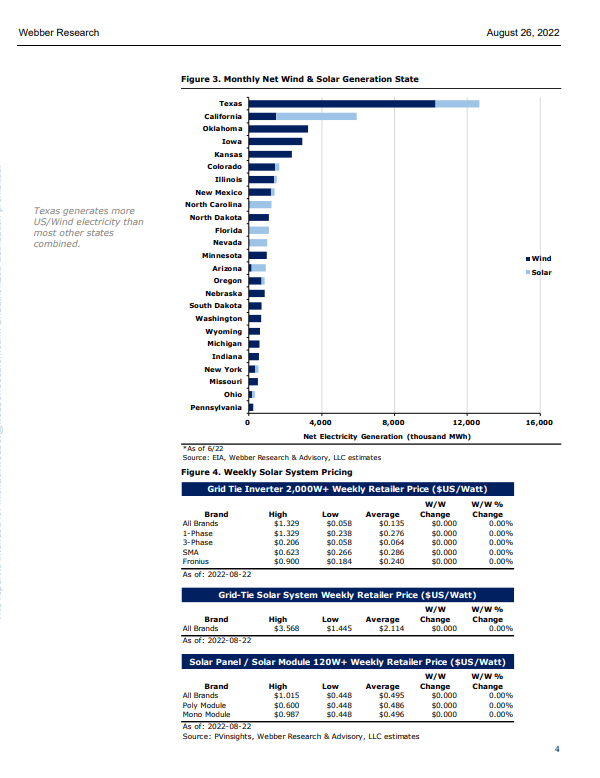

- Figures:

- US Net Electricity Generation By Type

- US Net Electricity Generation By Renewable Type

- Monthly Net Wind & Solar Generation State

- Weekly Solar System Pricing

- Grid-Tie Solar System Weekly Retailer Price ($US/Watt)

- Solar Panel / Solar Module 120W+ Weekly Retailer Price ($US/Watt)

For access information, email us at [email protected]

ENPH Partners With 5B In Australia: On 4/22 ENPH announced it would collaborate with Australian solar innovator, 5B in its role in the Resilient Energy Collective (REC) – aimed at providing solar power solutions to Australians disconnected by bushfires and floods. 5B selected ENPH’s IQ 7+ microinverters to pair with its portable Maverick solar array systems, which will also be outfitted with Enphase Envoy with (communication gateway) which connects the system to Enphase Enlighten for easy monitoring & maintenance. ENPH also announced a partnership with Sunlogics in Belgium on 4/29 as its exclusive microinverter supplier using IQ 7 and 7+ microinverters (also outfitted with Envoy). Separately, after the close on 4/27 ENPH was announced to replace Core Laboratories (CLB) in the S&P MidCap 400 index effective before the market open on 5/1. ENPH traded up 16% on 4/28 as a result.

GE Renewable Energy Q1 Earnings: On 4/29 GE reported a $302MM Q1 loss in its Renewable Energy segment, down from a $187MM loss in Q119. Orders declined 13% y/y to $3.1B, which GE attributed mostly to poor execution and only partly to COVIDrelated supply chain disruptions and delays. GE highlighted LM Wind’s sites closures in India and the US and capacity reductions at 3 other sites in its Onshore Wind business (previously disclosed). In its Offshore Wind business, GE remains on track for certification of its Haliade-X turbine and plans to start production after delivering its 80- unit 6MW commitments to EDF (expected completion 2021). In Grid & Hydro, GE is operating 15 factories at full utilization, 10 factories at less than 80% utilization, and 8 factories at less than 50% utilization. Its facilities located in China are operating at preCOVID levels, including Wuhan which was shut down for 6 weeks. Overall GE said COVID-19 has had a limited effect on its Renewables business but that it’s monitoring supply chain constraints and implementing cost-out and restructuring initiatives.

Sunpower COVID Updates: On 4/20 SPWR announced further actions to address the financial and operational impacts of the COVID-19 pandemic including reducing base salaries of executive management another 35-50% (after cutting 25-30% and withdrawing 2020 financial guidance a month earlier), idling factories in France, Malaysia, Mexico, the Philippines, and the US (with expectations to bring them back online in the coming few weeks), and temporarily transitioning a portion of its employees to 4-day work weeks in response to reduced demand and workload (affecting ~3,000 workers according to GTM), but it said it’s still on track to spin-off its manufacturing arm, Maxeon Solar Technologies by the end of Q2.

Safe Harbor Deadline Extension Brought To Treasury: Last week senators from the Energy and Natural Resources Committee wrote a letter to the Department of Treasury advocating a 1yr deadline extensions for the Investment Tax Credit (ITC) and Production Tax Credit (PTC) due to setbacks related to the COVID-19 outbreak. …continued

For access information, email us at [email protected]

Read More

Tankers: Moving From OPEC Trade, To Global COVID Relapse Hedge

Tanker Q120 Preview & Storage Update

- Thesis (EURN, DHT, FRO, ASC, etc) …………………Pages 1-2

- Floating Storage Scenario Analysis………………….Pages 2-5

- Tanker Rates Reactions & Implications ……………..Page 5

- Multi-Factor Supply/Demand Model……………….. Pages 6-7

- Crude Inventory & Production Cuts………………….Pages 7-9

- Valuations……………………………………………….. Pages 10-11

- Earnings Estimates……………………………………..Page 12

For access information, email us at [email protected]

Contango, COVID, & Floating Storage To Dominate Q1 Earnings: As with our Barge Preview from last week, we expect the majority of this earnings season to revolve around the simultaneous COVID+OPEC supply & demand shocks to global energy markets, which have driven down global oil demand by ~15-30mbd, introduced negative crude pricing for certain landlocked geographies, and reinforced the notion of systemic, structural and economically driven floating storage. The result: our tanker rate charts look more like seismograph readings (page 5) and our tanker group is poised to throw off record cash flow in Q2 & Q3 (and potentially longer). We believe the long tanker trade is gradually transitioning from a shorter-term OPEC trade, into a longer-term COVID-19 global relapse hedge. We believe tanker dynamics from the remainder of 2020 and 2021 will be defined by the depth and duration of the floating storage dynamics – which we believe will be increasingly driven by the shape and pace of a global economic reopening vs any remaining OPEC/policy maneuvers. Now that crisis level production levels are now more defined, we believe tanker rates and equities will have a strong negative correlation to the success of any semi-synchronized economic reopening. Hence, Long Tankers = Long An Extended And Asymmetrical Global Reopening.

TPIC: Shuts Iowa/Juarez Facilities – Withdraws 2020 Guidance

We thought we’d pass along a snippet from our recent note on TPIC (4/23) – highlighting both its 2020 guidance withdraw, as well as the shutdown of its Iowa & Juarez facilities – which, while disclosed in subsequent filings, were not highlighted in the guidance suspension press release. For access information email us at [email protected]

TPIC: Newton Iowa Facility Latest To Be Affected By COVID-19. Earlier today TPIC announced it would pause production at its manufacturing facility in Newton, Iowa after 28 associates tested positive for COVID-19 last week. The Newton facility is set to be shut for roughly 1 week for deep cleaning and development of more advanced testing procedures for associates. Additional Updates: Not included in the press release was a series of updates to its other manufacturing facilities:

- Juarez, Mexico: 1 facility (of 3) temporarily closed due to an order from a division of the Mexico Secretary of Labor. TPIC said it plans to administratively challenge the order but that if it’s not reversed, the facility would be closed through 5/31.

- Matamoros, Mexico: Reduced capacity timeline extended from 4/30 to 5/31 due to the extension of Mexico’s sanitary emergency order and demands from its labor union.

- Chennai, India: Resumed limited production with additional personnel on 4/21 (previously targeted 4/15). Other facilities operating at normal capacity, including its 2 facilities in Izmir, Turkey which had been operating at 50% capacity for the first half of April.

- Guidance Suspension Not Surprising: As a result of the additional facility closures and the general unpredictability of the magnitude and duration of the pandemic, TPIC also announced it was withdrawing its 2020 guidance (Figure 1). The majority of TPIC’s Wind OEM peers and customers have already suspended guidance – making TPIC’s announcement seem largely inevitable – particularly after it had already tempered EBITDA expectations earlier this month (below). TPIC said it would provide an update on its Q120 earnings call (5/7) but we don’t expect a confident reset 2 weeks from now.

- That said, we do expect the revised guidance to be substantially lower – as we’ve already been modeling 2020 EBITDA 21% lower than the mid-point of….continued

For access information email us at [email protected]

Read More

Renewable Energy: The Next Generation

Initiating Coverage Of ENPH, TPIC, REGI, & ENS

Executive Summary ……………………………………………….Page 5

Industry Overviews………………………………………………..Page 9

Near-Term Drivers.…………………………………………………Page 11

Solar …………………………………………………………………Page 14

Wind …………………………………………………………………Page 20

Biofuels ……………………………………………………………..Page 25

Energy Storage …………………………………………………….Page 30

Enphase Energy, Inc. (ENPH) …………………………………….Page 33

TPI Composites, Inc. (TPIC) ………………………………………Page 47

Renewable Energy Group, Inc. (REGI) ………………………….Page 59

Enersys (ENS) ………………………………………………………Page 70

Disclosures ………………………………………………………….Page 81

Rolling Out Our First Wave Of Renewable Energy Coverage: We are initiating coverage of REGI (Outperform, PT: $36), ENPH (Market Perform, PT: $33), TPIC (Market Perform, PT: $17), and ENS (Market Perform, PT: $55). As our historical energy infrastructure coverage has evolved, we’ve watched renewables consistently gain market share and play an increasingly competitive role in energy trade dynamics – particularly in the emerging markets, where we’ve seen prices come down, viability rise, and competitive flash points between traditional fuels, LNG, and renewables. Rather than focus solely on incumbent fuels and infrastructure, or solely on a potential bridge like LNG, we think it’s more prudent to cover energy transitions from every angle – hence our expansion into renewables.

Why These Names? We’re establishing a footprint in several renewable verticals: solar, wind, biofuels, and energy storage, creating a well-rounded platform that we can continue to expand. Within those verticals, ENPH, TPIC, REGI, and ENS were among the stocks most commonly highlighted by our clients as either underfollowed, misunderstood, or both. Although oil and gas (which remains the focal point of our legacy

coverage) still dominate global energy markets, it’s increasingly clear the future of energy is here – and it’s decarbonizing, innovating, and quickly becoming price competitive. We also think the group dovetails nicely with our skill-sets: analyzing SMID energy and infrastructure names with asymmetric risk/return profiles.

How Are We Tackling Renewables? There’s a reason why we were both drawn to and pushed toward this space – each company has a strong core business, at least one (or several) growth drivers, and the kind of significant shifting dynamics that can create particularly compelling risk/reward profiles.

COVID-19 Disclaimer: We continue to highlight our gratitude for health care providers and first responders during this time, and while our primary focus continues to be with the safety and well-being of our families, associates, and employees, the pandemic has certainly complicated our plans for initiation, however we think it’s important to have coverage through this period of uncertainty – rather than simply waiting for smoother seas. Each of our names have been and will continue to be greatly affected by the outbreak and associated economic downturn. Countries around the world have delayed energy auctions while agencies and data service providers have all begun to cut global supply and demand forecasts across all energy verticals. That said, it’s still too early to fully assess the potential impact on our industry- and company-level coverage. As a result, we are generally exercising caution with our ratings, price targets, and estimates until we get a broader view of the long-term disruption.

Investment Theses (Abridged)

Enphase Energy (ENPH) – Market Perform, PT: $33….continued

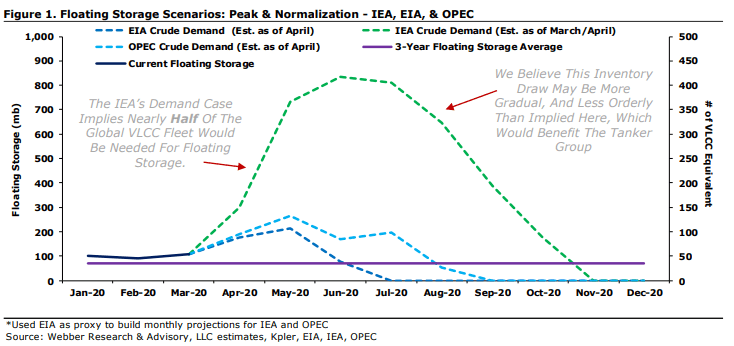

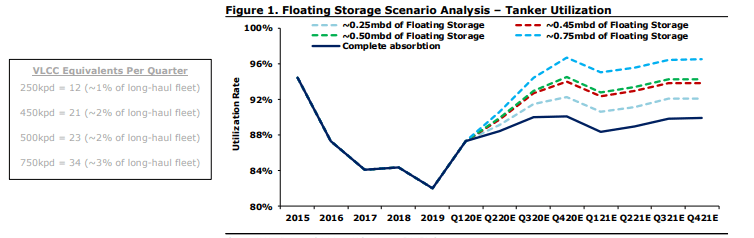

Tankers: Floating Storage Scenario Analysis & Utilization Impact

Our 3-Stage Approach To Tankers For the Remainder Of 2020

- Our 3-Stage Approach To The Remainder Of 2020 Pages 1-2

- Floating Storage Scenario Analysis – Impact On Utilization Pages 2-3

- Storage Arbitrage, Inventories, & Rate Reactions Pages 4-7

- Multi-Factor Crude Tanker Utilization Model Pages 8-9

- Updated Tanker NAVs, Valuation Metrics, & Estimates Pages 9-10

For access information, please email us at [email protected]

Depth Of Floating Storage Build Key For Tanker Equities In Q220. Amid the double black swan start to the year (OPEC supply shock/pricing war coupled with demand destruction from the COVID-19 response), tanker equities have (generally) acted as a hedge against the rest of the energy tape, as the prospect of significant structural and arb-driven floating storage has supported tanker earnings well above seasonal trends (page 4). While increasing OPEC & Russian crude production battle to replace US exports (the degree to which remains in question) – the market mechanism for finding that new global production balance should ultimately result in saturated land based storage and a ramp in floating storage (already ~100mb), and narrower tanker capacity, providing a significant tailwind for tanker cash flows. From an equity perspective, we think about Tanker stocks (FRO, EURN, DHT, ASC, etc.) in 3 stages….(Pages 1-2)

What Would Robust Floating Storage Mean For Tanker Rates & Utilization In Q2/Q3? We ran a multi-factor scenario analysis based on our updated crude tanker utilization model, flexed for different levels of incremental daily crude production moving into floating storage over the next 2-3 quarters. At the low end of the range…(Pages 2-8)

For access information, please email us at [email protected]

Read More

Tankers Reset As OPEC War Changes Economics

- Market Updates & Thoughts………………..Pages 1-3

- Tanker Trade Dynamics………………………Page 4

- Fuel Spreads, Economics……………………Page 5

- Crude/Product/LPG Rate Changes…………Pages 6-9

- LNG Arb, Freight Dynamics…………………Pages 10-11

- Container Fundamentals……………………Page 12

- Relative Valuations…………………………..Pages 13-19

Tanker Spot Rates Soften Off Of Peak Levels As Saudi Reign In Freight Rebates: Spot rates weakened on slow fixture activity, crude prices bounding from under $25/barrel to ~$30/barrel (Brent), and Saudi Arabia announced limiting freight compensation to 10% of crude’s official selling price. According to TradeWinds, at least 10 VLCC & Suezmax spot fixtures loading Saudi crude had failed last week. VLCC spot rates (TCEs) led the decline with rates falling to $135.3K/day (-52% w/w and +408% m/m), Suezmax TCEs at $70.0K/day (-42% w/w and +166% m/m), and Aframax TCEs firming to $59.5K/day (+39% w/w and +120% m/m). We note rates remain well above consensus.

Roughly Half Of Bahri’s VLCC On Subject Destined For USG: Last week, Saudi Arabia’s Bahri put 25 VLCCs on subject after their announcement to flood the oil market (by increasing its production and lowering its oil price) in response to OPEC+ disbandment (see our OPEC+ Fallout note). VLCC rates had spiked as Saudi Arabia was said to provide freight rebates to some customers for crude transports between Saudi Arabia and Egypt. Bahri owns 41 VLCCs and rarely enters the spot market to charter third party tonnage. In addition to the large number of subjects, the intended destination for these vessels are telling of Saudi’s intent: 10 of the 25 VLCCs are destinated for the U.S. Gulf, 4 are likely going to Europe, 10 are fixed to discharge at the entry point of the Sumed pipeline (Ain Sokhna) which transports crude oil through Egypt to the Mediterranean (likely to end up in Europe). None of the spot VLCCs are fixed to Eastern destinations.

Scrubber Payback Period Upended Following Crash In Crude Prices: The spread between HSFO and LSFO has narrowed to $87/mt in Singapore and $47/mt in Rotterdam (Figures 2 & 3), extending the payback period to ~4 years. A VLCC fitted with a scrubber is able to command a spot earnings premium of ~$4.5K/day, down from nearly $20K/day at the start of the year.

For access information please email us at [email protected]

Read More

OPEC+ Fallout: Contagion Everywhere From Looming Price War…

***From Sunday 3/8***

For access information please email us at [email protected]

Tankers Among Few Eventual Beneficiaries

- Impact On Tankers: Page 1, 3-5

- The 2015 Tanker Comp, Similarities, Implied Upside Pages 3-4

- Impact On LNG Developers (LNG, TELL, NEXT, GLNG, NFE) Pages 2-3

- Historical & Implied Equity Correlations To Crude Vol Page 3

- NAVs: Current, Mid-Cycle to Trough Range Page 3

- OPEC+ Background Page 3, 6

This Is Going To Hurt: On Friday (3/6) talks between OPEC and its OPEC+ allies (Russia) over a corona-related production cut collapsed, sending oil prices down with it (Brent and WTI down 9% and 10%, respectively on Friday). While the lack of OPEC+ support for crude prices was enough to rattle markets, what’s transpired since – the relationship between the Saudis and the Russians rapidly devolving into what looks like an all-out pricing war – has the potential to reshape energy markets for years to come, and will likely take the mantle as the most value-destructive policy shift in decades.

Exogenous Demand Shock, Meet Exogenous Supply Shock. As noted below, Aramco has already come out with discounted crude prices (OSPs) on the back of the meeting, and is reportedly speaking to a potential production ramp from its current 9.7mbd, to well above 10mbd, and could even reach a record of 12mbd. Again – that would be additional supply into a market that’s already oversupplied amid global efforts to contain the Coronavirus (nCoV) weighing on demand. While the Russians have less available swing production, what they do have will be moving in the wrong direction as well, as they look to grab share from U.S. Shale producers.

How Does This Impact Our Universe:

Tankers: We’ll Call It Mixed… (And That’s One Of The Few Bright Spots). Once the dust settles the tanker group, including FRO, DHT, EURN, ASC, etc, should be one of the few actual overproduction beneficiaries as: 1) tanker activity and rates are generally positively levered to production volumes (including overproduction), and 2) we expect to see floating storage, both economic (as the front end of the crude forward curve collapses (already in progress) and…….continued on Pages 3-5

Most Relevant Tanker Comp: 2015, after OPEC failed to respond to falling crude prices. While overcapacity and falling crude prices ravaged the rest of the energy markets, Crude Tanker rates (VLCCs) averaged $65K/day (Figure 4) – a level not reached since 2008, up 116% y/y and the firmest level in nearly a decade. What would 2015 day rates mean for current tanker stocks? If we replaced our current 2020 rate decks with the 2015 average rates….continued on page Pages 2-3

Everything Stops. If nCoV brought the near-term prospects of new LNG business to a particularly slow crawl, we believe the OPEC+ blow up will bring it to a full stop, at least until the dust settles. For companies in the process of restructuring (like TELL).….continued on Pages 2-3

For access please email us at [email protected]

Read More

Tellurian tightens belt amid dim short-term outlook for LNG industry

Read More

LNG’s Black Friday

LNG’s Black Friday: Endgame For TELL,

Magnolia (LNG-ASX) Gets Taken Out

For access please email us at [email protected]

The Walls Close In Around TELL – Stock Down 72% This Week As Liquidity & Commercial Realities Finally Overlap. TELL has traded down 52% today, as continued commercial slippage, mounting liquidity concerns, and the broader market de-risking have combined to price-in the new economic reality for Tellurian: It’s not going to make it. The week started off with proponents of TELL/Driftwood wondering whether another presidential photo-op and some interim Petronet commercial progress could be stretched into an event meaningful enough to support a TELL capital raise and runway extension. It was a thin premise to begin with, and the list of plausible alternatives was already getting shorter. We believe what followed – first silence, then Petronet seemingly downsizing to a 1.0mtpa competitive tender, then an extension of the original Petronet MOU which brought TELL’s next maturity into play – was effectively the latest in a string of “the emperor has no clothes” moments for the remaining TELL bull thesis. It just happened to coincide with one of the steepest market corrections in recent history. See Pages 2-4 for more detail.

LNG Ltd. (Magnolia LNG) Magnolia LNG Developer Likely Going Private In $75MM Takeover Deal: We’ve suspended our coverage and estimates for LNG Ltd. On 2/28, Liquefied Natural Gas

Limited (ASX: LNG, US ADR: LNGLY) halted trading as it entered into a bid implementation agreement (BIA – Figure 2) with LNG9 PTE Ltd. Under Australian law, the bidder (LNG9) needs to get to 90% to force full consolidation, with options to get there if it doesn’t initially hit that hurdle. LNG9 will make an off-market takeover bid to acquire all issued ordinary shares of LNGL and take the company private (offer to shareholders to commence on April 2 and close on May 3). According to management the deal comes after a very thorough vetting of the market. Stonepeak also seems…See Pages 4-6 for more detail.

client log-in

client log-in