Southern Company (SO): Vogtle Nuclear Project Q220 Quarterly Monitor

Southern Company (SO) Q2 Vogtle Nuclear Project Monitor - Key Highlights: • Vogtle Expansion: 6-Years Late…And ~$13-$16 Billion Over Budget? (Slides 2-5) • How Much Will SO Be On The Hook For? (Slides 3-6) • Something’s Gotta Give: Key Commissioning Milestones Appear...

Webber R|A Renewables Weekly

Webber Research: Renewable Energy Highlights: Orsted JV To Develop Clean Hydrogen In Copenhagen (page 1) US Extends Safe Harbor Deadlines (page 1) Next Generation EU (page 2) Saudi's Alfanar Rumored To Be Senvion India Buyer (page 2) ENPH Collaboration With University...

Webber R|A Renewables Weekly

Renewable Energy Weekly *REGI (Outperform) – Virtual NDR Weds 5/27 To participate email us directly or at [email protected] Renewables - Weekly Highlights: • GE To Add 193MW Onshore Wind In Turkey – Blades Built In-House (page 1) • SPWR Sells O&M Business,...

W|EPC: Objections To Venture Global’s Storage Tank Design

Venture Global – PHMSA Objects to Calcasieu Pass LNG’s Storage Tank Design A day after Venture Global successfully raised the first LNG storage tank roof (4/27/20) at its Calcasieu Pass LNG facility, PHMSA issued a memo (4/25/20) to FERC objecting to the LNG storage...

Webber Research: Renewable Energy Weekly

ENPH Partners With 5B In Australia GE Renewable Energy Q1 Earnings Sunpower COVID Updates Safe Harbor Deadline Extension Brought To Treasury BNEF Semi-Annual LCOE Update (Page 2, Charts On Page 4) New York Approves Offshore Wind Plans, But Delays Action Due To COVID...

Tanker Stock Could Emerge As COVID-19 Relapse Hedge

https://www.freightwaves.com/news/tanker-stocks-could-emerge-as-covid-19-relapse-hedge/

Tankers: Moving From OPEC Trade, To Global COVID Relapse Hedge

Tanker Q120 Preview & Storage Update Thesis (EURN, DHT, FRO, ASC, etc) .....................Pages 1-2 Floating Storage Scenario Analysis......................Pages 2-5 Tanker Rates Reactions & Implications .................Page 5 Multi-Factor Supply/Demand...

Exxon, Qatar & Golden Pass: Something’s Gotta Give

Analyzing Project Costs & Logistics In The COVID Era (Part 1 of 2 - Satellite Image Analysis Later This Week) Golden Pass: 4 Key Takeaways..........................................Page 2 EPC: Monthly Progress Evolution...................................... Page 3...

TPIC: Shuts Iowa/Juarez Facilities – Withdraws 2020 Guidance

We thought we'd pass along a snippet from our recent note on TPIC (4/23) - highlighting both its 2020 guidance withdraw, as well as the shutdown of its Iowa & Juarez facilities - which, while disclosed in subsequent filings, were not highlighted in the guidance...

Renewable Energy: The Next Generation

Initiating Coverage Of ENPH, TPIC, REGI, & ENS Executive Summary .......................................................Page 5 Industry Overviews........................................................Page 9 Near-Term...

W|EPC: AEP Capital Project Analysis – Q220

Digging Into AEP's Capital Project Backlog AEP Company Overview Page 2 Key Takeaways Page 3 ERCOT Overview ...

W|EPC: Sempra’s Costa Azul – Is ECA Different? A Deep Dive Into SRE’s Mighty Mouse

Sempra LNG’s Costa Azul – Analysis & Risks As Larger Projects Falter Overview Pages 1-3 ECA Phase 1 & 2 Structures Pages 3-4 Supply Dynamics...

Tankers: Floating Storage Scenario Analysis & Utilization Impact

Our 3-Stage Approach To Tankers For the Remainder Of 2020 Our 3-Stage Approach To The Remainder Of 2020 Pages 1-2 Floating Storage Scenario Analysis – Impact On Utilization Pages 2-3 Storage Arbitrage, Inventories, & Rate...

W|EPC: Force Majeure & The LNG Supply Chain: Scenarios For BH, Kiewit, & Venture Global

Reviewing Satellite Images Of Italian Fabrication Yards & Force Majeure Flow Charts • Supply Chain Overview Pages 1-2 • Satellite Images: BH’s Fabrication Yard In Avenza, Italy ...

W|EPC Utilities & Energy – Sempra Deep Dive – Oncor, March 2020

Sempra (SRE) Capital Project Analysis – Oncor March 2020. As part of our W|EPC Utility & Energy Project coverage, we’ve put together a deep dive into a number of large public utilities, including SRE, SO, D, AEP, CNP, ENB, EPD, ET, KMI, XOM, TOT, RDS:A, and...

Southern Company (SO): Vogtle Nuclear Project Q220 Quarterly Monitor

Southern Company (SO) Q2 Vogtle Nuclear Project Monitor - Key Highlights: • Vogtle Expansion: 6-Years Late…And ~$13-$16 Billion Over Budget? (Slides 2-5) • How Much Will SO Be On The Hook For? (Slides 3-6) • Something’s Gotta Give: Key Commissioning Milestones Appear...

Webber R|A Renewables Weekly

Webber Research: Renewable Energy Highlights: Orsted JV To Develop Clean Hydrogen In Copenhagen (page 1) US Extends Safe Harbor Deadlines (page 1) Next Generation EU (page 2) Saudi's Alfanar Rumored To Be Senvion India Buyer (page 2) ENPH Collaboration With University...

Webber R|A Renewables Weekly

Renewable Energy Weekly *REGI (Outperform) – Virtual NDR Weds 5/27 To participate email us directly or at [email protected] Renewables - Weekly Highlights: • GE To Add 193MW Onshore Wind In Turkey – Blades Built In-House (page 1) • SPWR Sells O&M Business,...

W|EPC: Objections To Venture Global’s Storage Tank Design

Venture Global – PHMSA Objects to Calcasieu Pass LNG’s Storage Tank Design A day after Venture Global successfully raised the first LNG storage tank roof (4/27/20) at its Calcasieu Pass LNG facility, PHMSA issued a memo (4/25/20) to FERC objecting to the LNG storage...

Webber Research: Renewable Energy Weekly

ENPH Partners With 5B In Australia GE Renewable Energy Q1 Earnings Sunpower COVID Updates Safe Harbor Deadline Extension Brought To Treasury BNEF Semi-Annual LCOE Update (Page 2, Charts On Page 4) New York Approves Offshore Wind Plans, But Delays Action Due To COVID...

Tanker Stock Could Emerge As COVID-19 Relapse Hedge

https://www.freightwaves.com/news/tanker-stocks-could-emerge-as-covid-19-relapse-hedge/

Tankers: Moving From OPEC Trade, To Global COVID Relapse Hedge

Tanker Q120 Preview & Storage Update Thesis (EURN, DHT, FRO, ASC, etc) .....................Pages 1-2 Floating Storage Scenario Analysis......................Pages 2-5 Tanker Rates Reactions & Implications .................Page 5 Multi-Factor Supply/Demand...

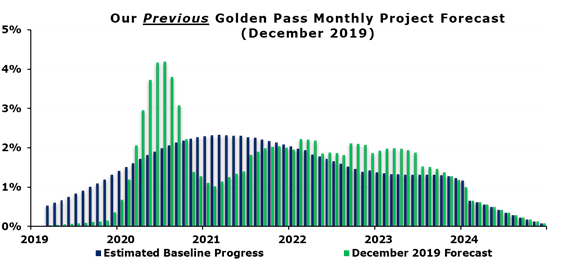

Exxon, Qatar & Golden Pass: Something’s Gotta Give

Analyzing Project Costs & Logistics In The COVID Era (Part 1 of 2 - Satellite Image Analysis Later This Week) Golden Pass: 4 Key Takeaways..........................................Page 2 EPC: Monthly Progress Evolution...................................... Page 3...

TPIC: Shuts Iowa/Juarez Facilities – Withdraws 2020 Guidance

We thought we'd pass along a snippet from our recent note on TPIC (4/23) - highlighting both its 2020 guidance withdraw, as well as the shutdown of its Iowa & Juarez facilities - which, while disclosed in subsequent filings, were not highlighted in the guidance...

Renewable Energy: The Next Generation

Initiating Coverage Of ENPH, TPIC, REGI, & ENS Executive Summary .......................................................Page 5 Industry Overviews........................................................Page 9 Near-Term...

W|EPC: AEP Capital Project Analysis – Q220

Digging Into AEP's Capital Project Backlog AEP Company Overview Page 2 Key Takeaways Page 3 ERCOT Overview ...

W|EPC: Sempra’s Costa Azul – Is ECA Different? A Deep Dive Into SRE’s Mighty Mouse

Sempra LNG’s Costa Azul – Analysis & Risks As Larger Projects Falter Overview Pages 1-3 ECA Phase 1 & 2 Structures Pages 3-4 Supply Dynamics...

Tankers: Floating Storage Scenario Analysis & Utilization Impact

Our 3-Stage Approach To Tankers For the Remainder Of 2020 Our 3-Stage Approach To The Remainder Of 2020 Pages 1-2 Floating Storage Scenario Analysis – Impact On Utilization Pages 2-3 Storage Arbitrage, Inventories, & Rate...

W|EPC: Force Majeure & The LNG Supply Chain: Scenarios For BH, Kiewit, & Venture Global

Reviewing Satellite Images Of Italian Fabrication Yards & Force Majeure Flow Charts • Supply Chain Overview Pages 1-2 • Satellite Images: BH’s Fabrication Yard In Avenza, Italy ...

W|EPC Utilities & Energy – Sempra Deep Dive – Oncor, March 2020

Sempra (SRE) Capital Project Analysis – Oncor March 2020. As part of our W|EPC Utility & Energy Project coverage, we’ve put together a deep dive into a number of large public utilities, including SRE, SO, D, AEP, CNP, ENB, EPD, ET, KMI, XOM, TOT, RDS:A, and...

client log-in

client log-in