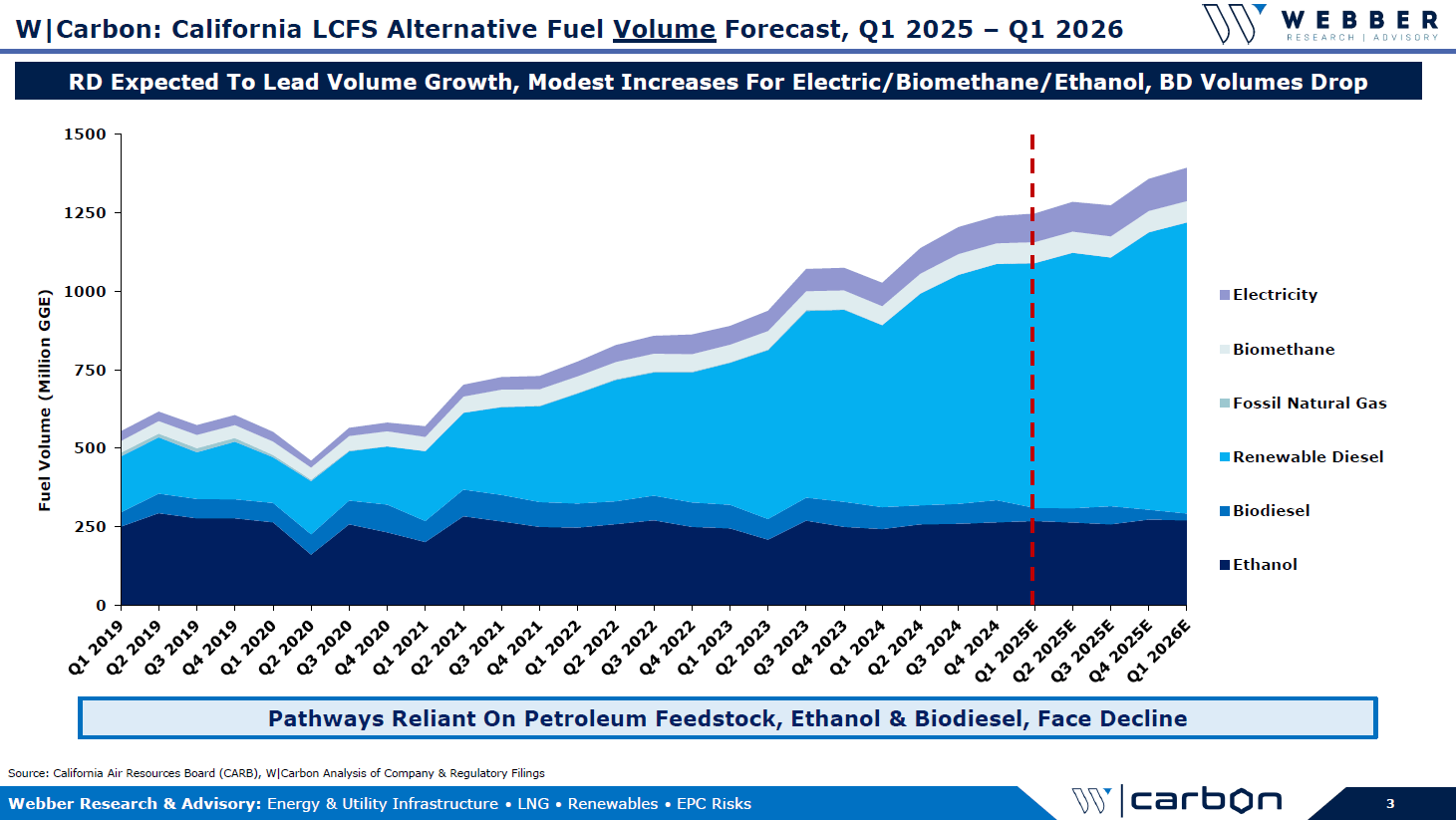

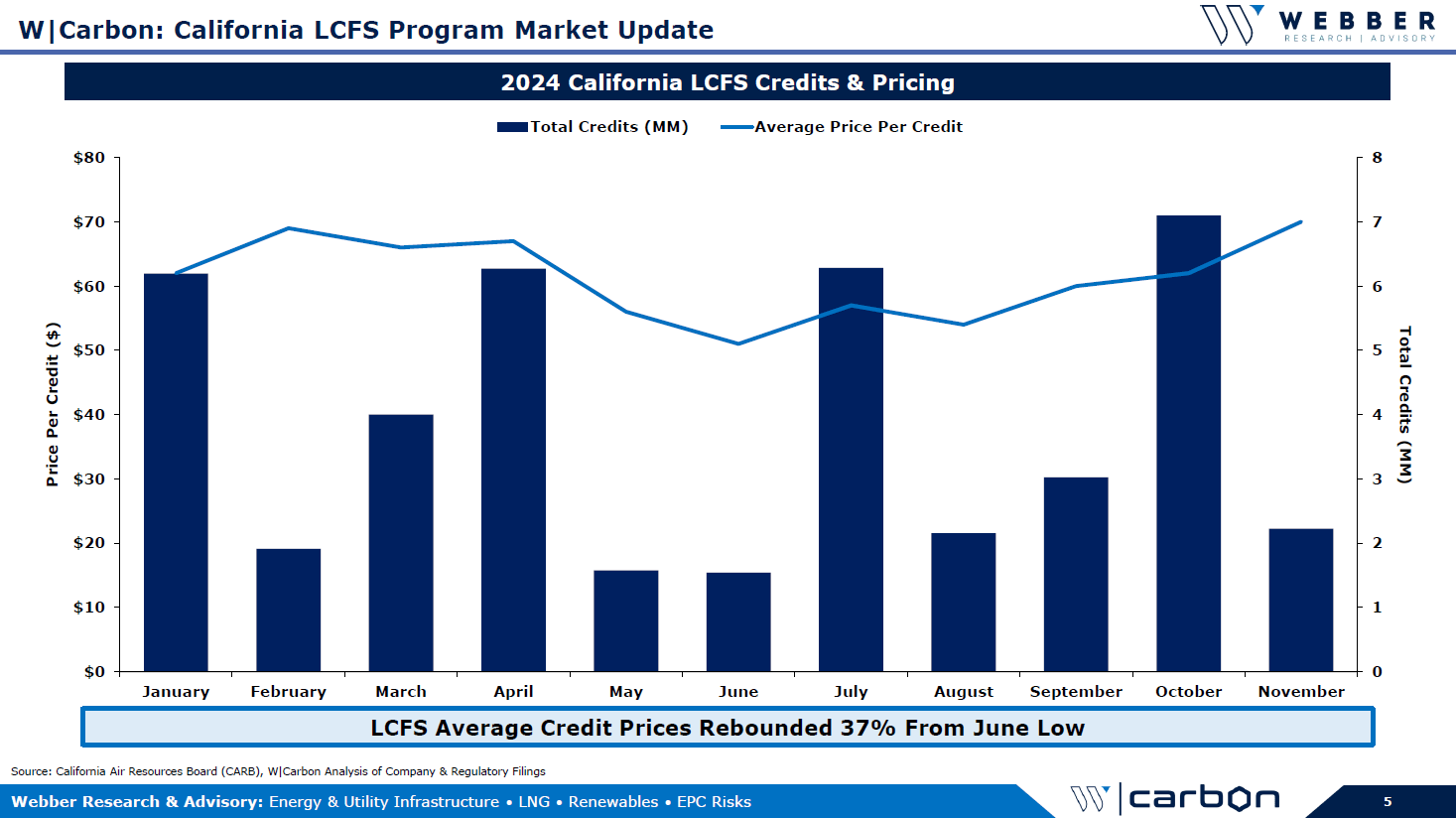

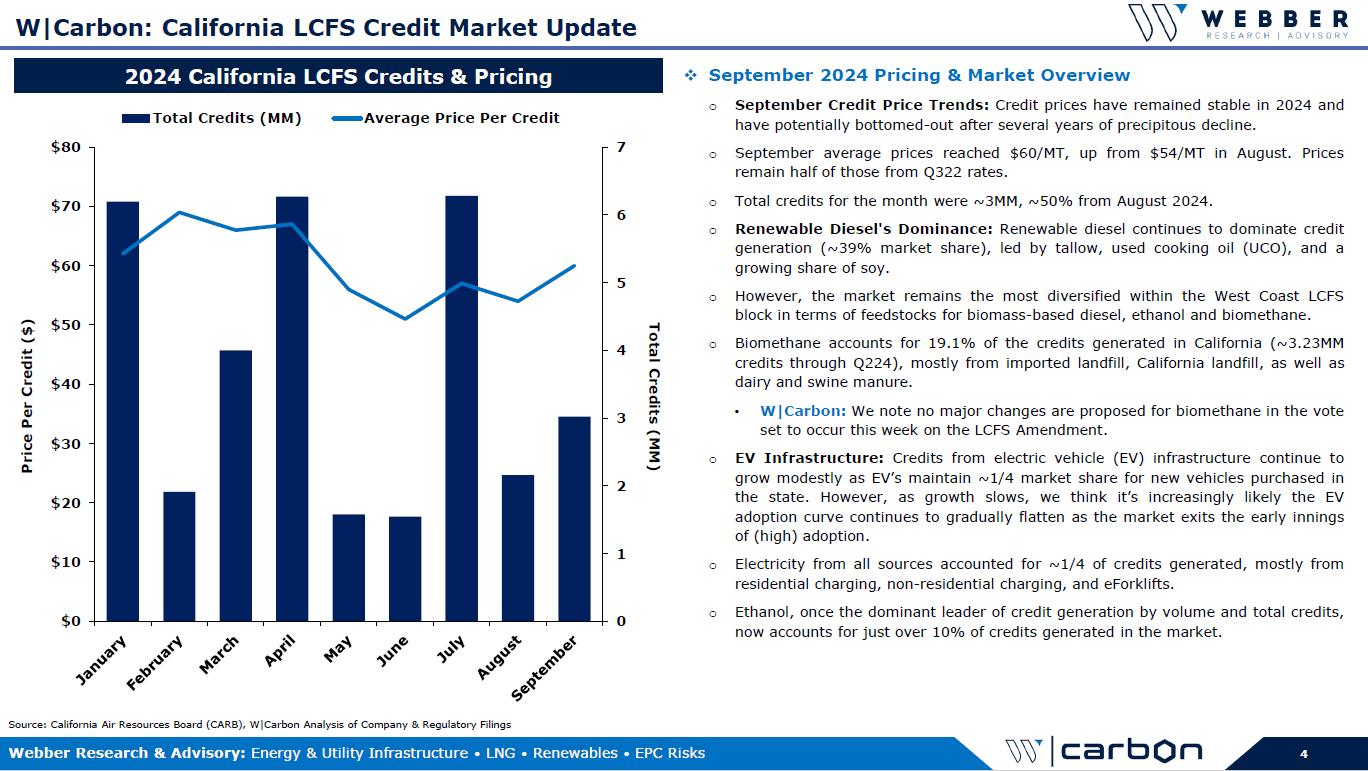

W|Carbon Client Call: California LCFS Price Forecast Through Q1 2026 – Thurs 6/5 @ 11AM ET

Tradewinds: Shipping’s Next Generation of New Makers & Market Movers

Read More

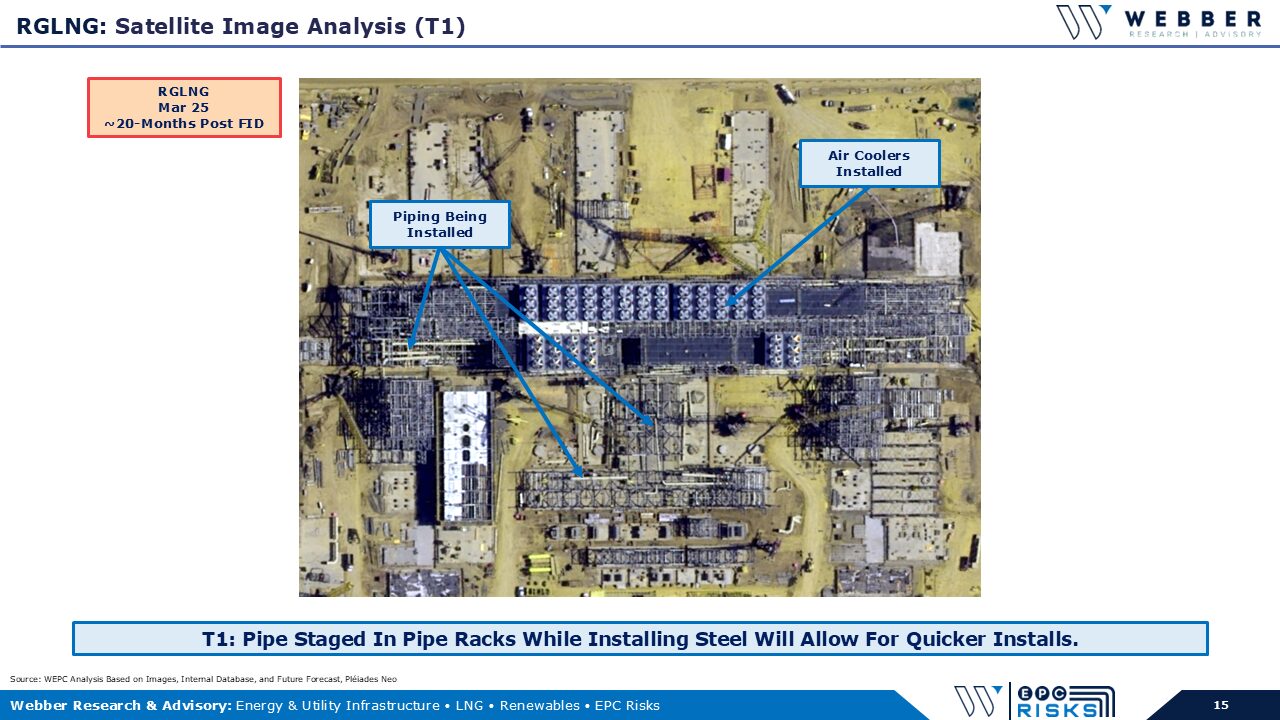

W|EPC: NextDecade (NEXT) – Rio Grande LNG Q225 Project Update & Client Call, Tues 04/22 @11AM EST

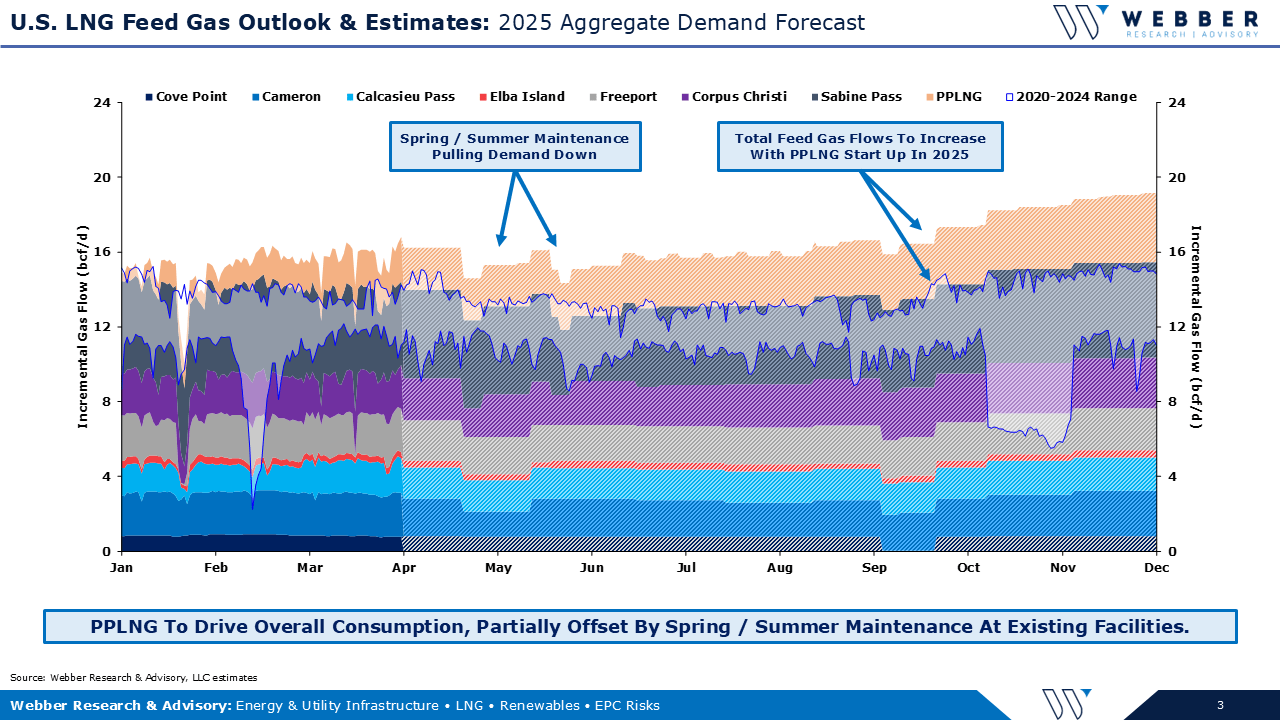

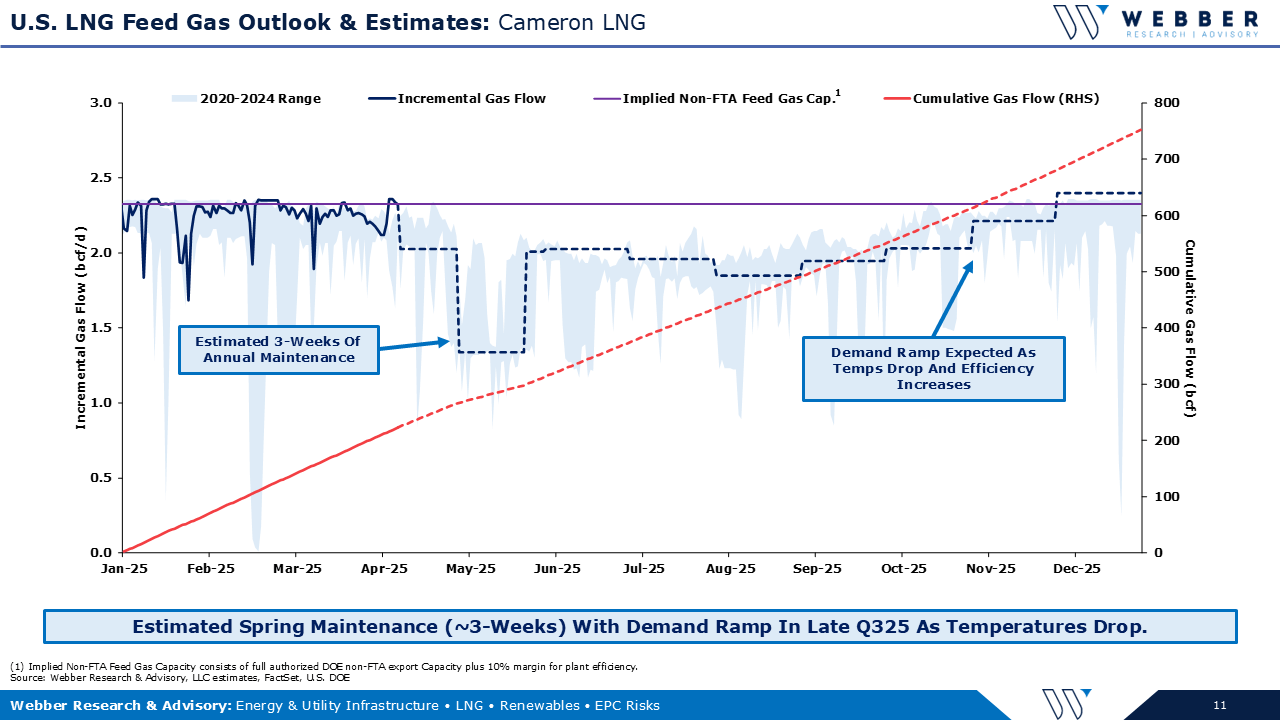

Webber Research: U.S. LNG Feed Gas Outlook & Estimates – Q225

If you’re already a Webber Research subscriber you can access this presentation via our Research Library. For access to the full report, visit our Downloads section, or contact us at [email protected] or [email protected] for subscription information.

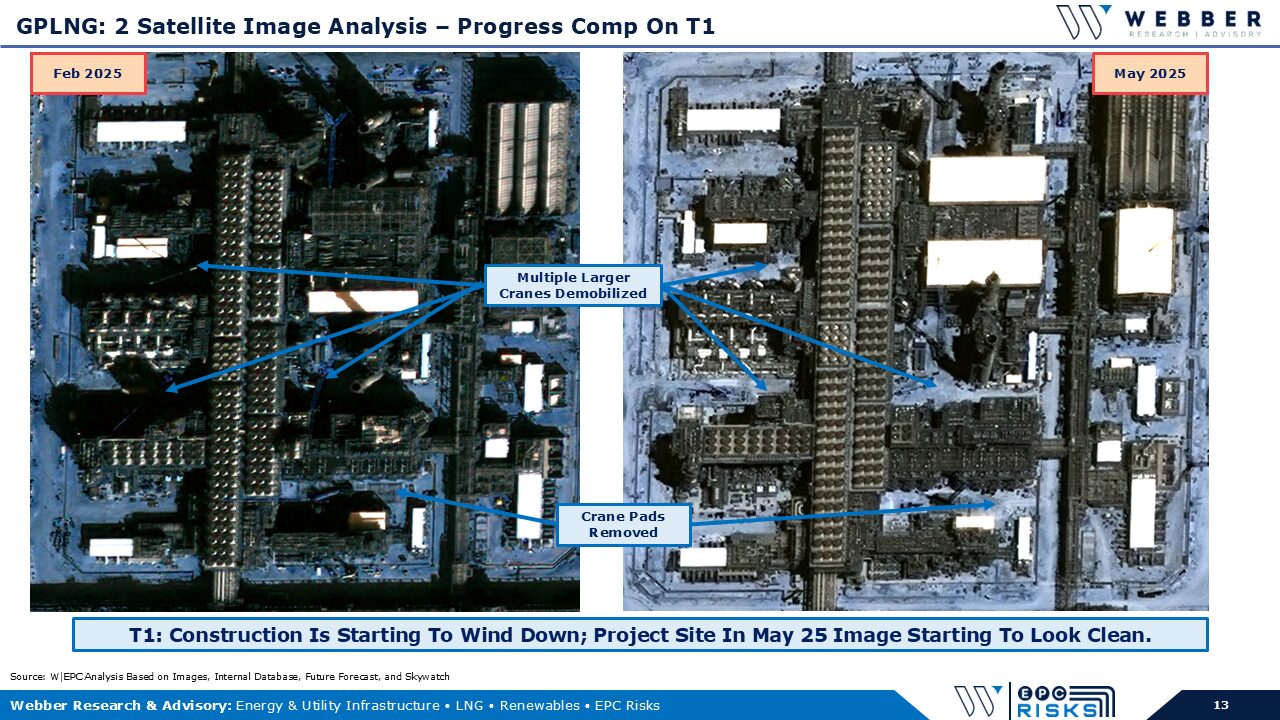

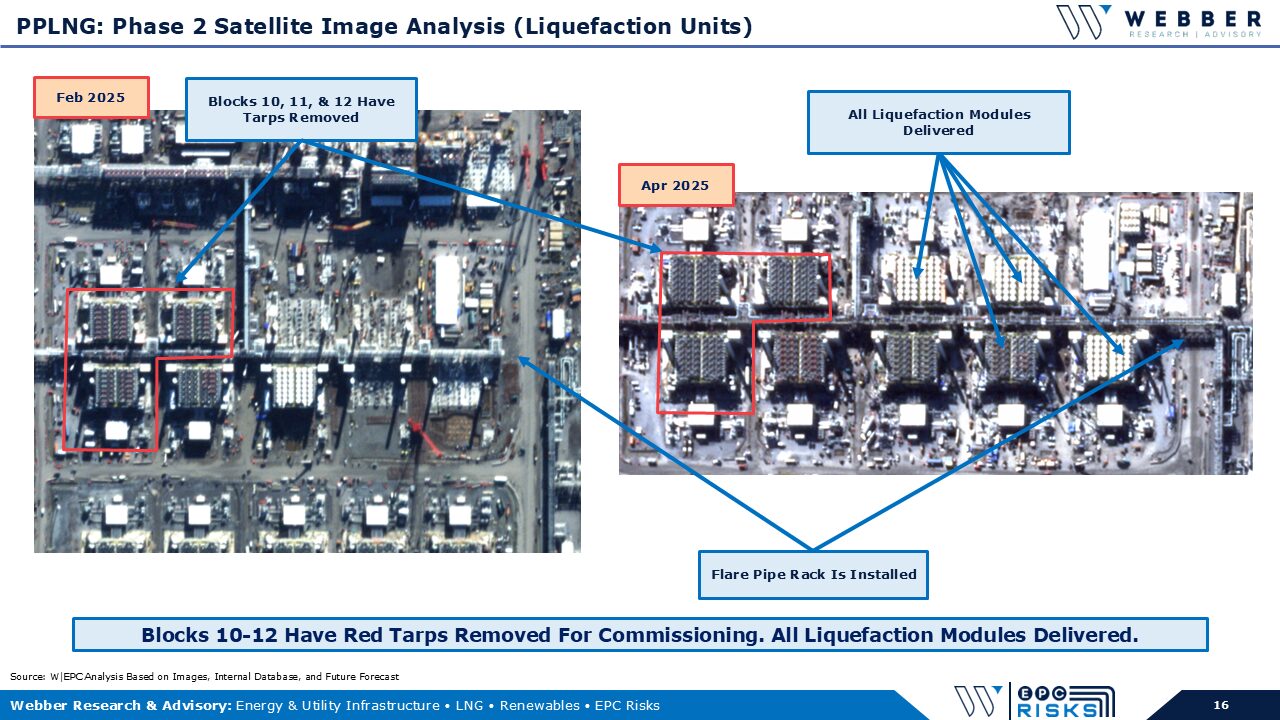

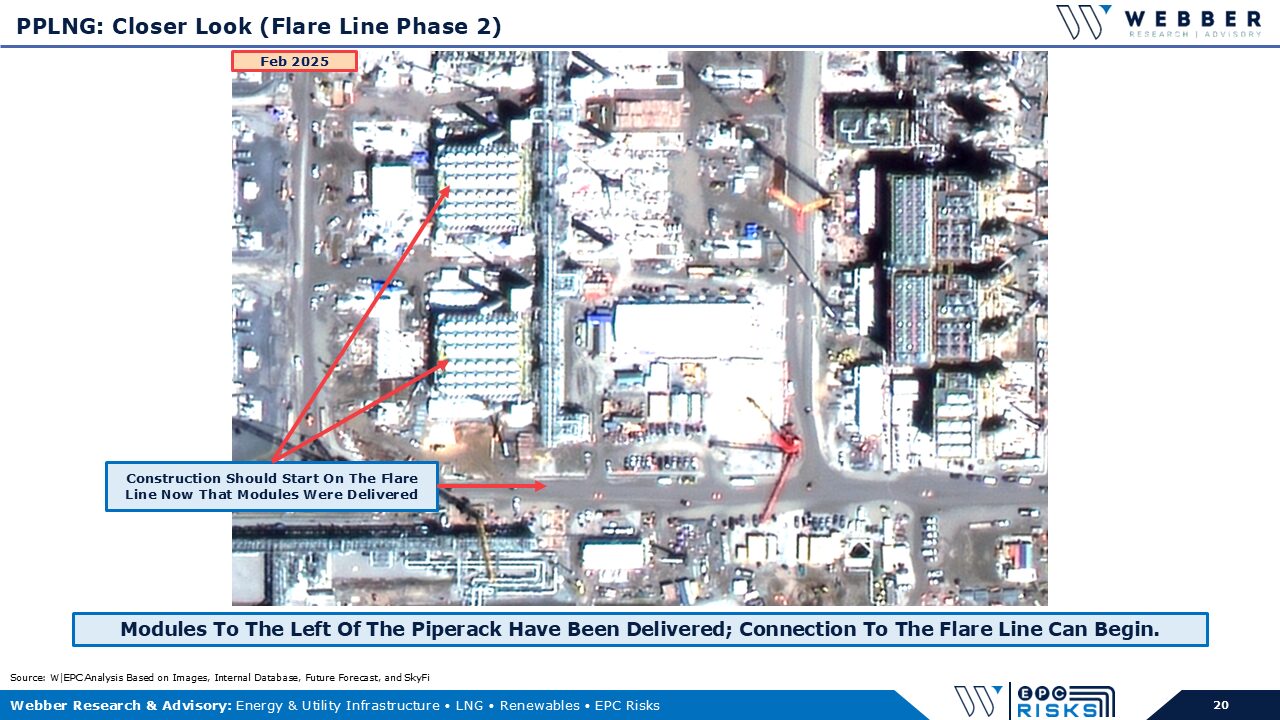

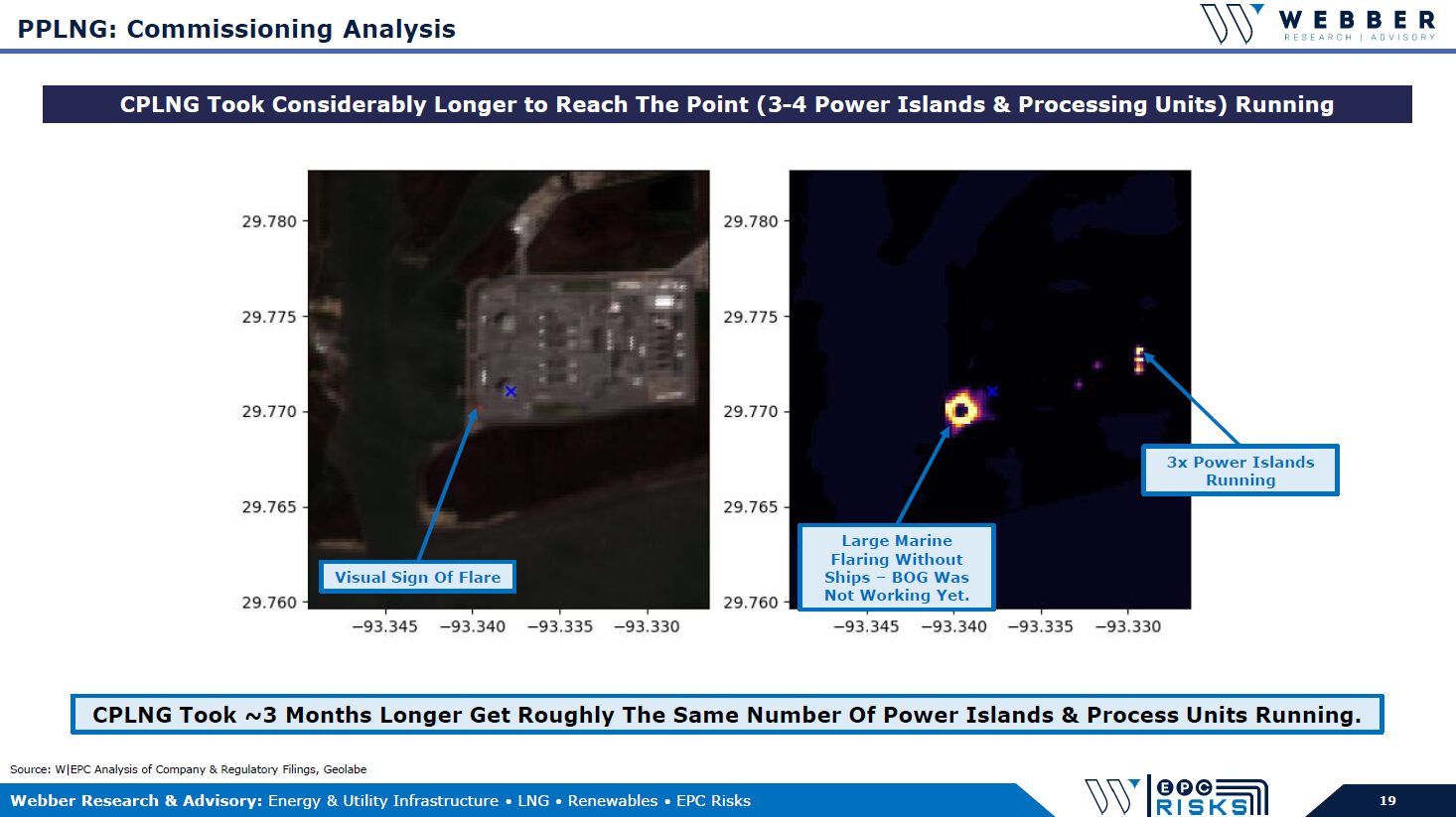

W|EPC: Plaquemines Parish LNG Interim Project Update: Q125

To access the full presentation, please visit our Research Library, or contact us at [email protected] or [email protected].

W|EPC: Golden Pass LNG Project Update – Q125

For the full deck, please visit our Downloads page. If you’re already a Webber Research subscriber, you can access this report via our Research Library. For access information please contact us at [email protected], or [email protected].

Read More

W|EPC: Client Call – Cheniere’s (LNG) Corpus Christi LNG Q125 Update – Thurs 02/27 @11AM EST

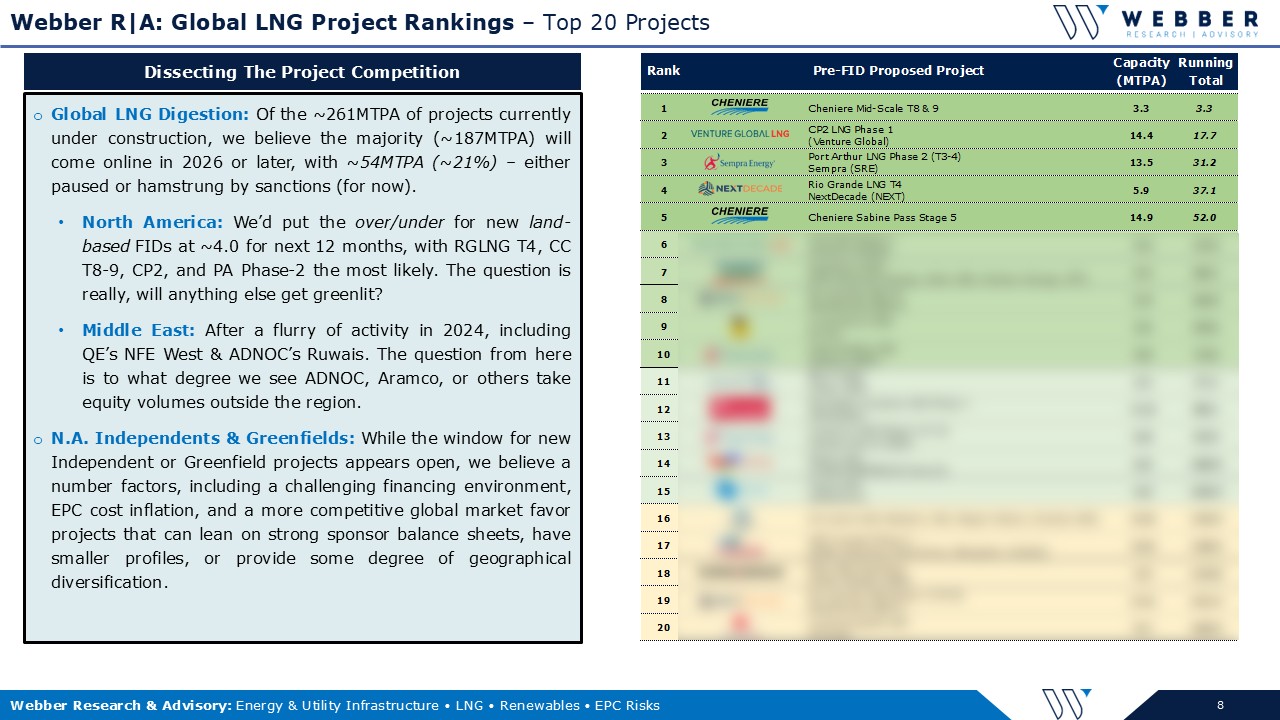

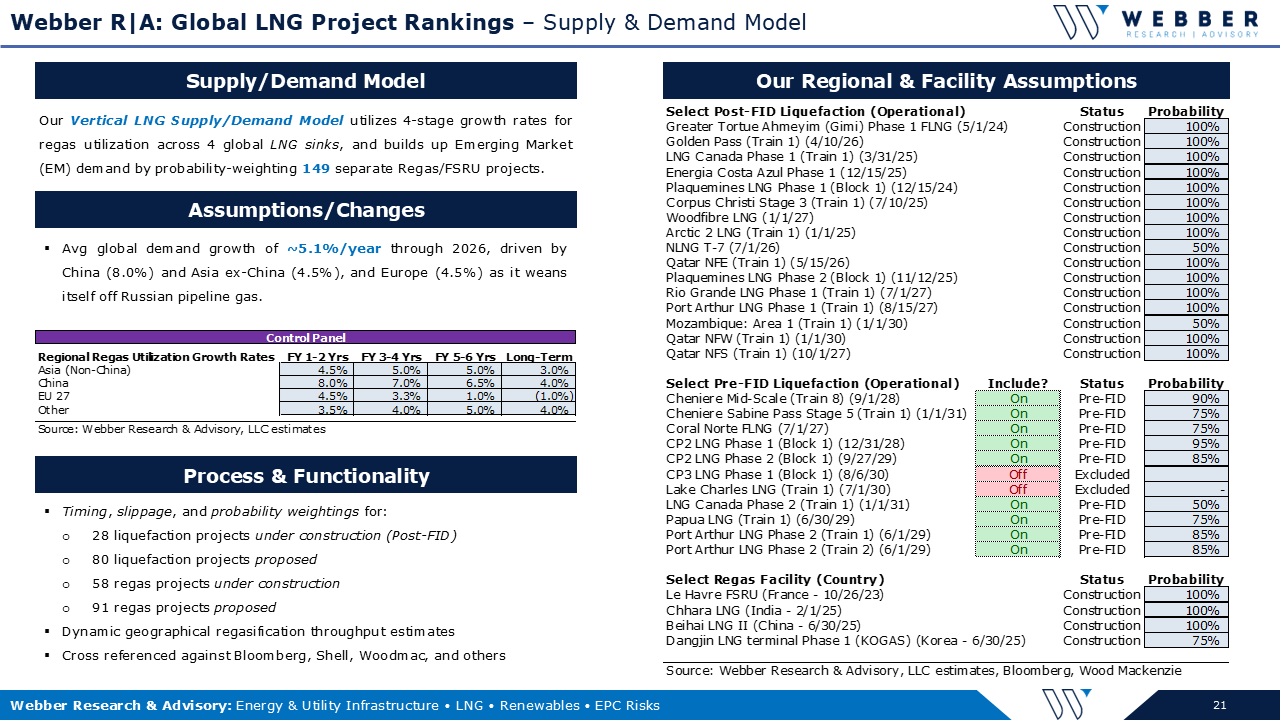

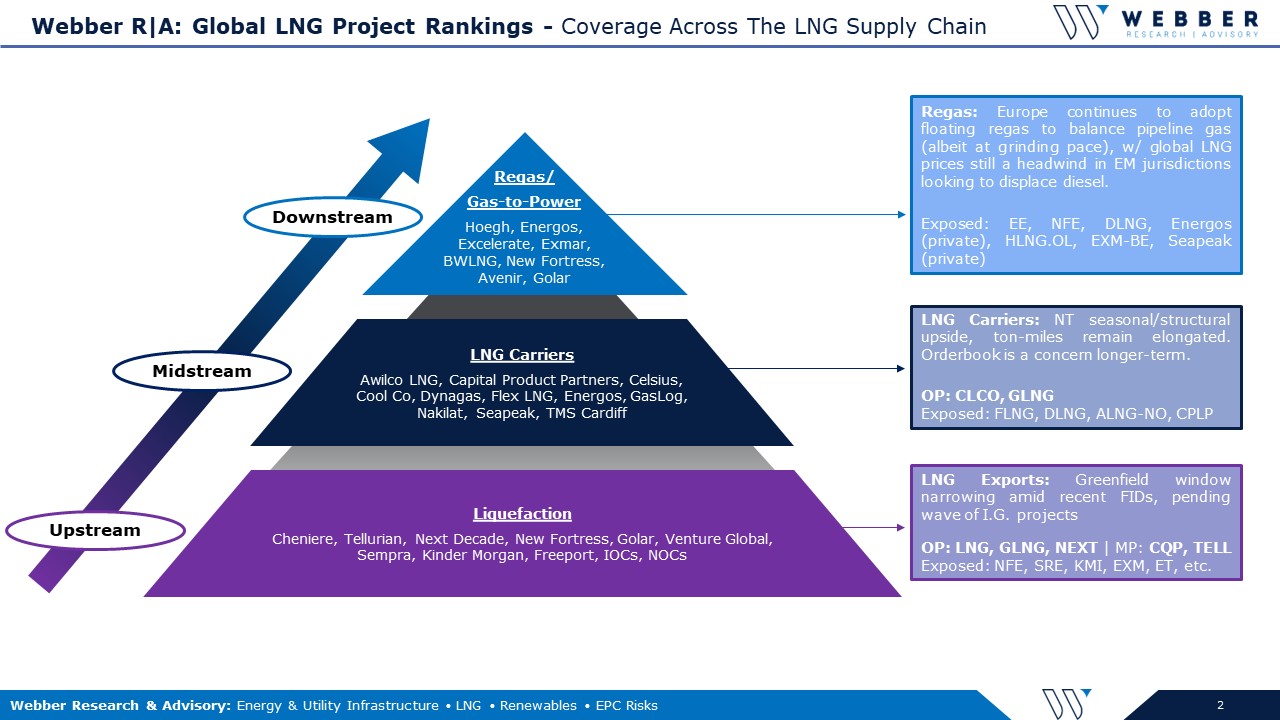

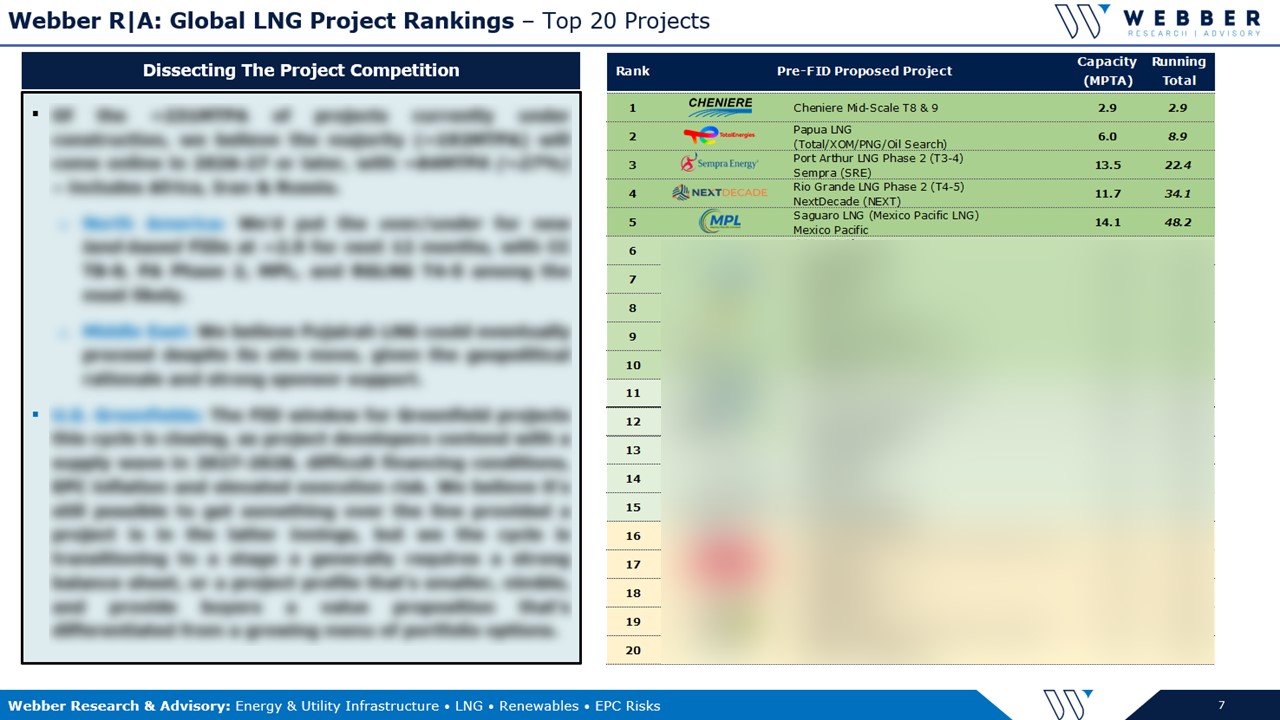

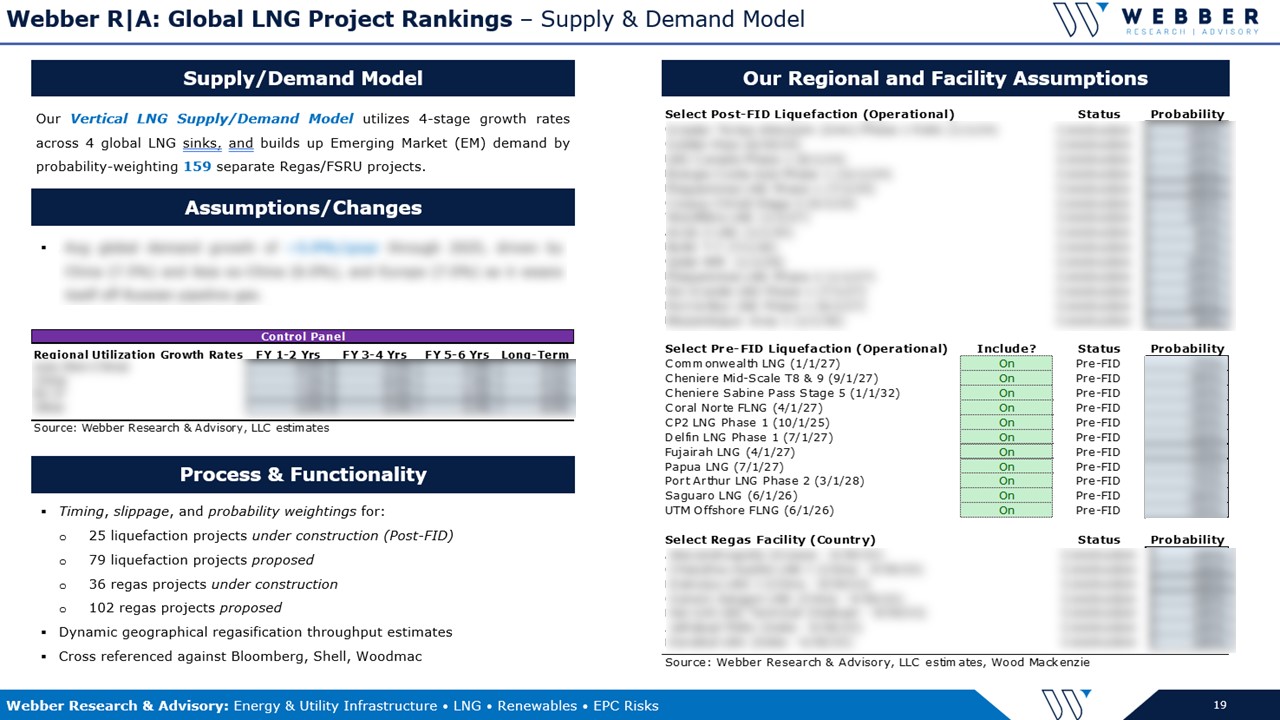

Webber Research: Global LNG Project Tiers, Rankings Outlook, & Balance Model + Trump & LNG: Leveraging The Pizzazz

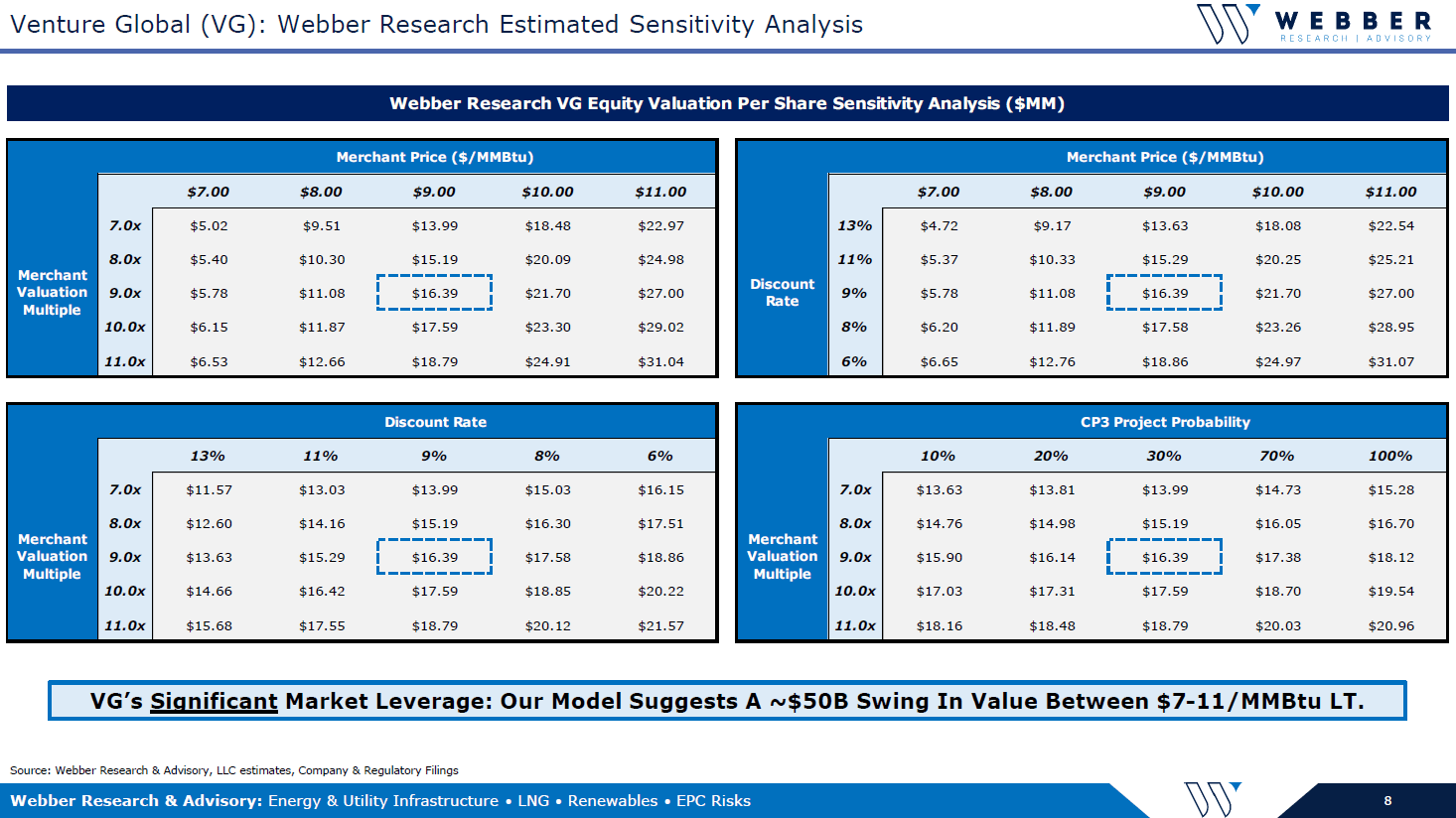

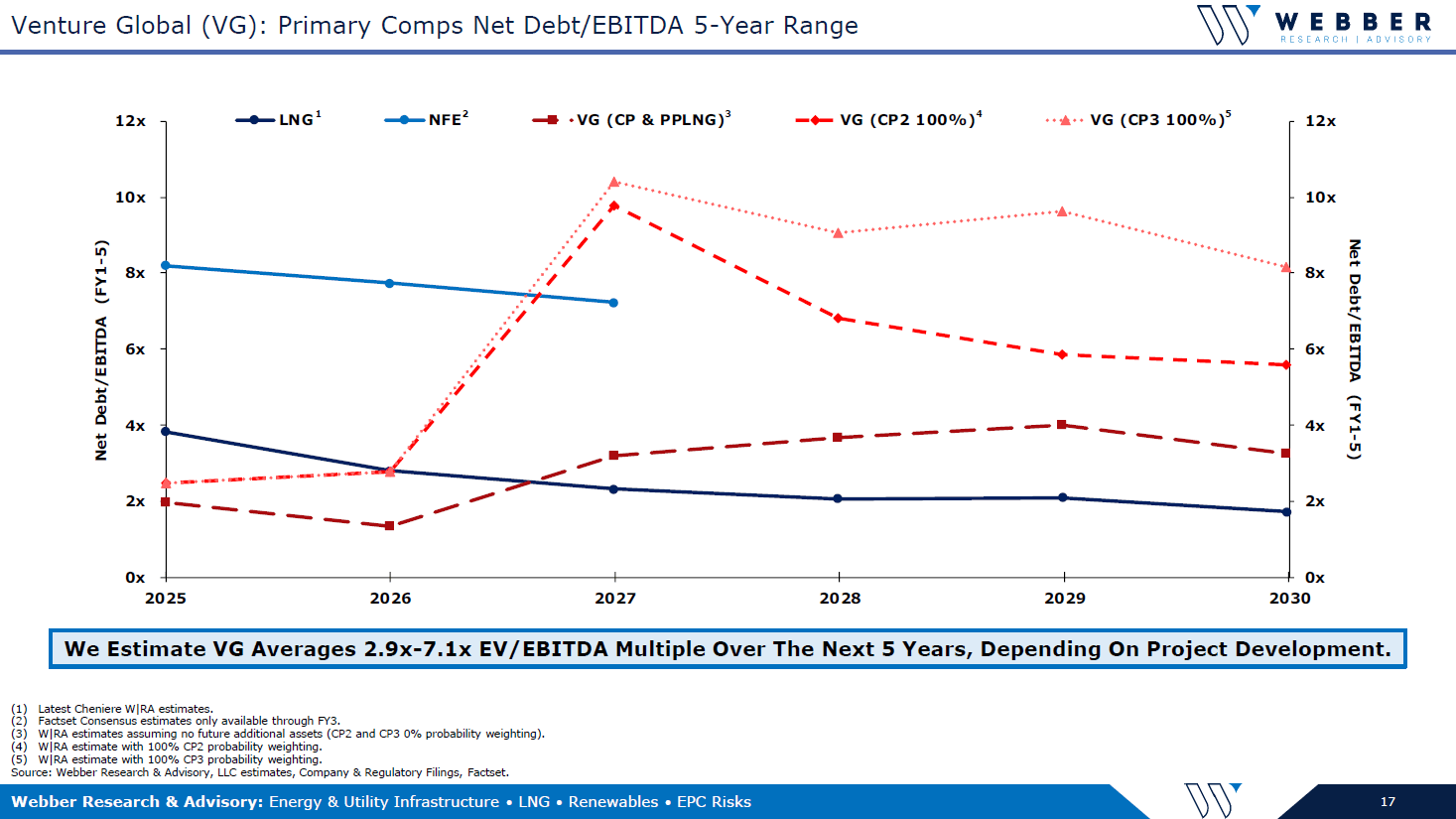

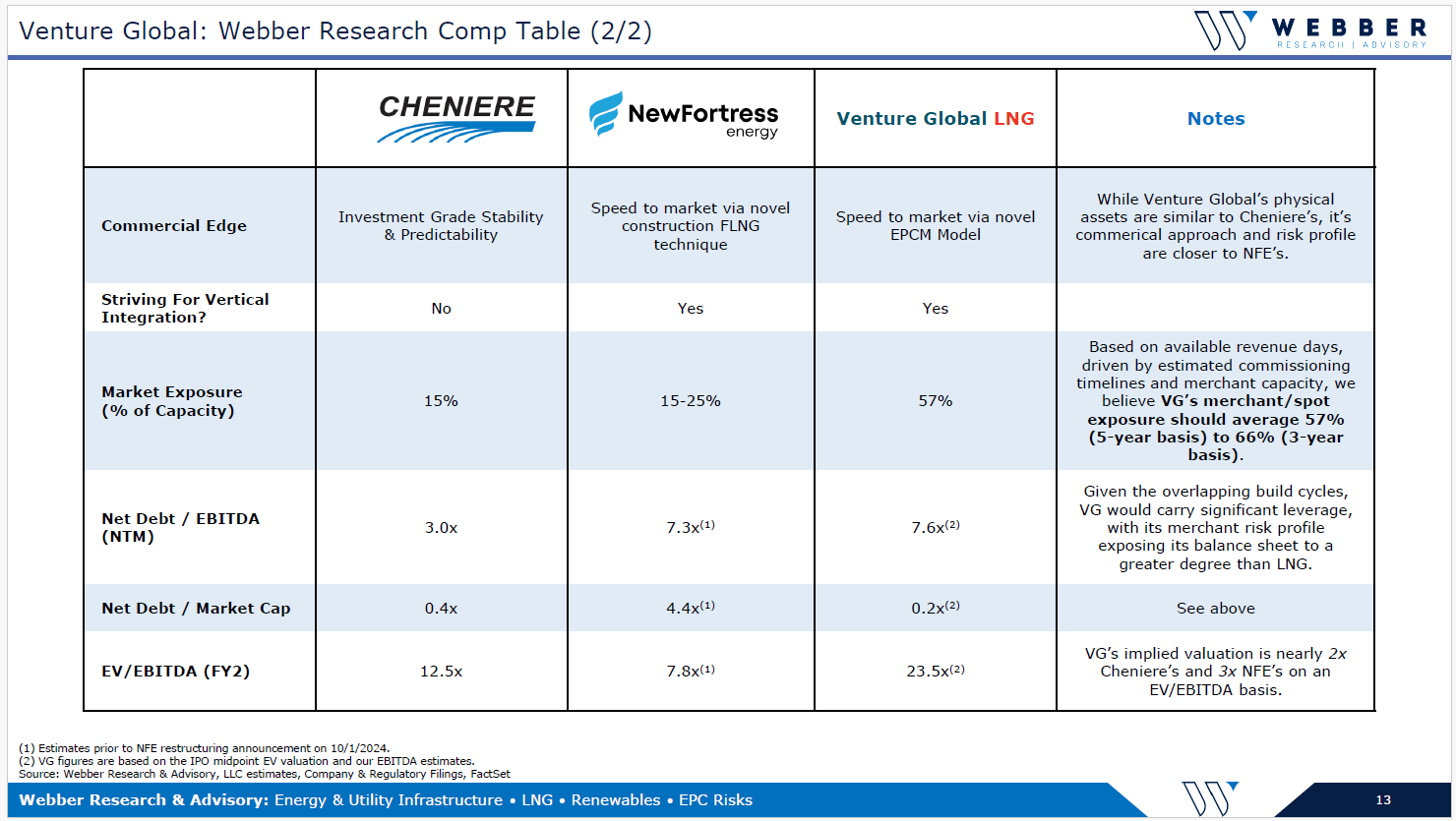

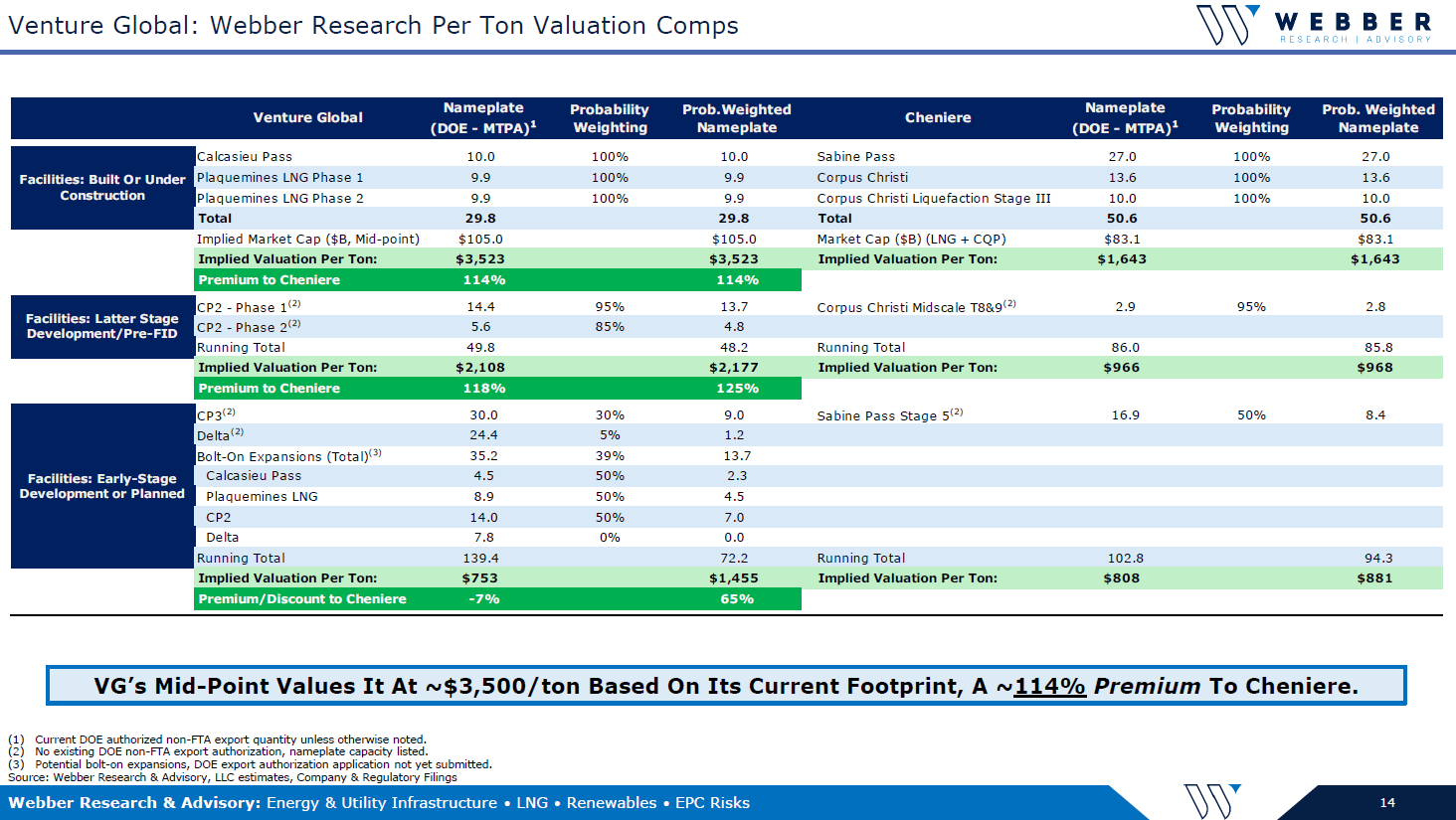

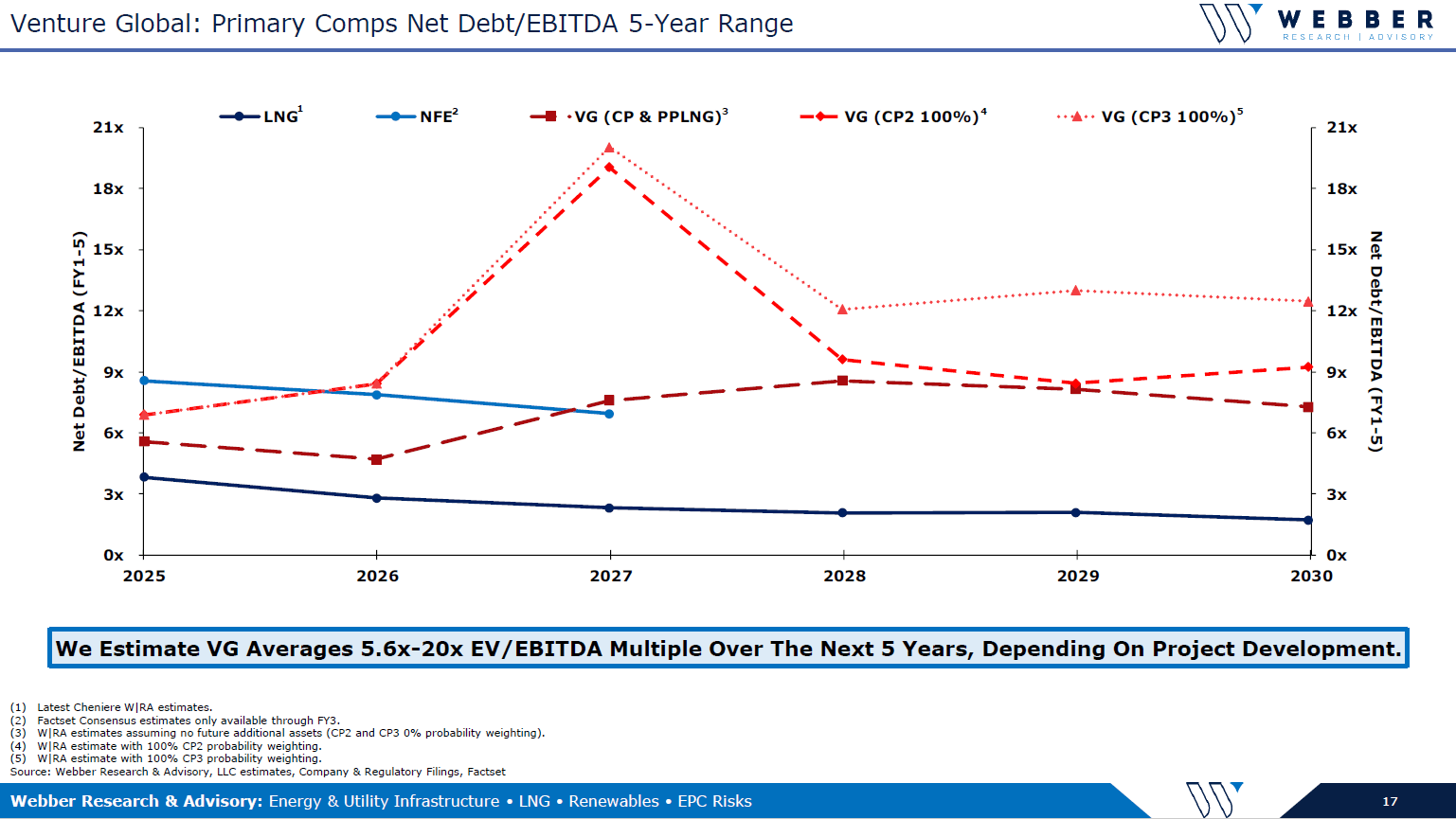

Venture Global (VG): Initiating Formal Equity Coverage – MP Rating, $16 PT

If you’re already a Webber Research subscriber, you can access this full presentation via our Research Library. For access information, email us at [email protected] or [email protected].

Read More

Venture Global IPO: What’s Really Going On Here? Valuation Estimates & Strategy

If you’re already a Webber Research subscriber, you can access this presentation via our Research Library. Otherwise, for the full presentation, please visit our Downloads page. For access and subscription information, email us at [email protected], or at [email protected].

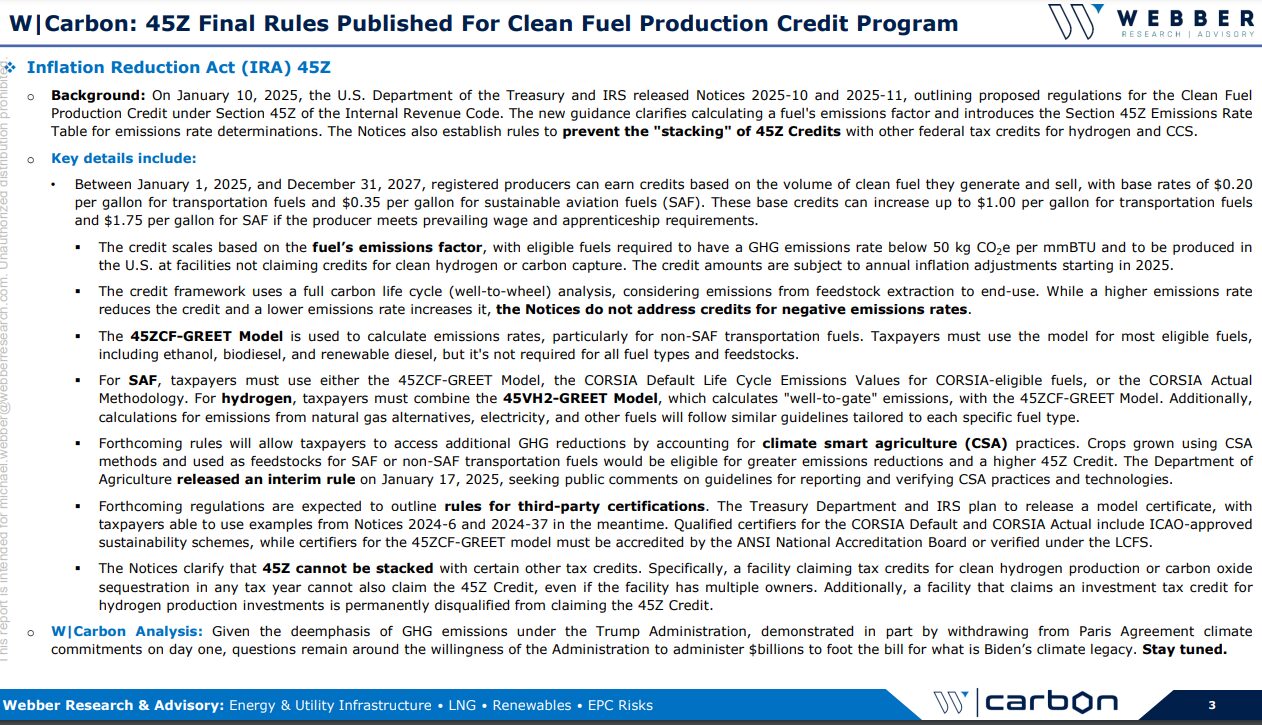

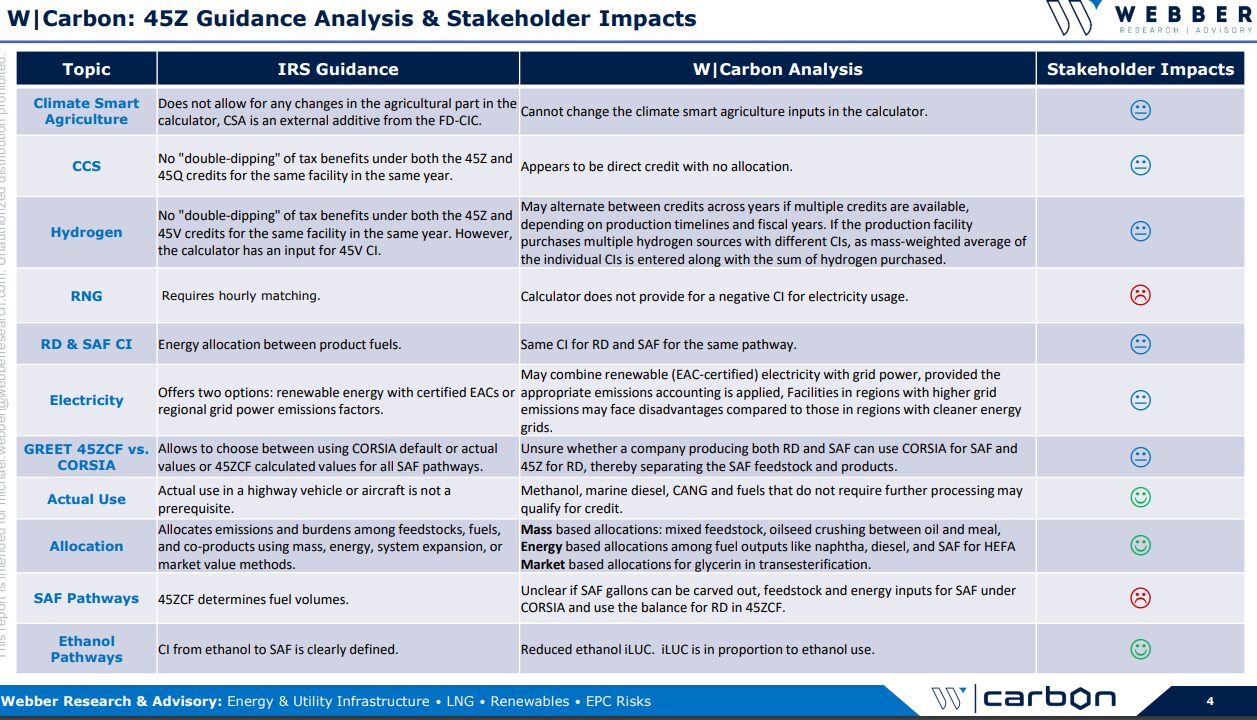

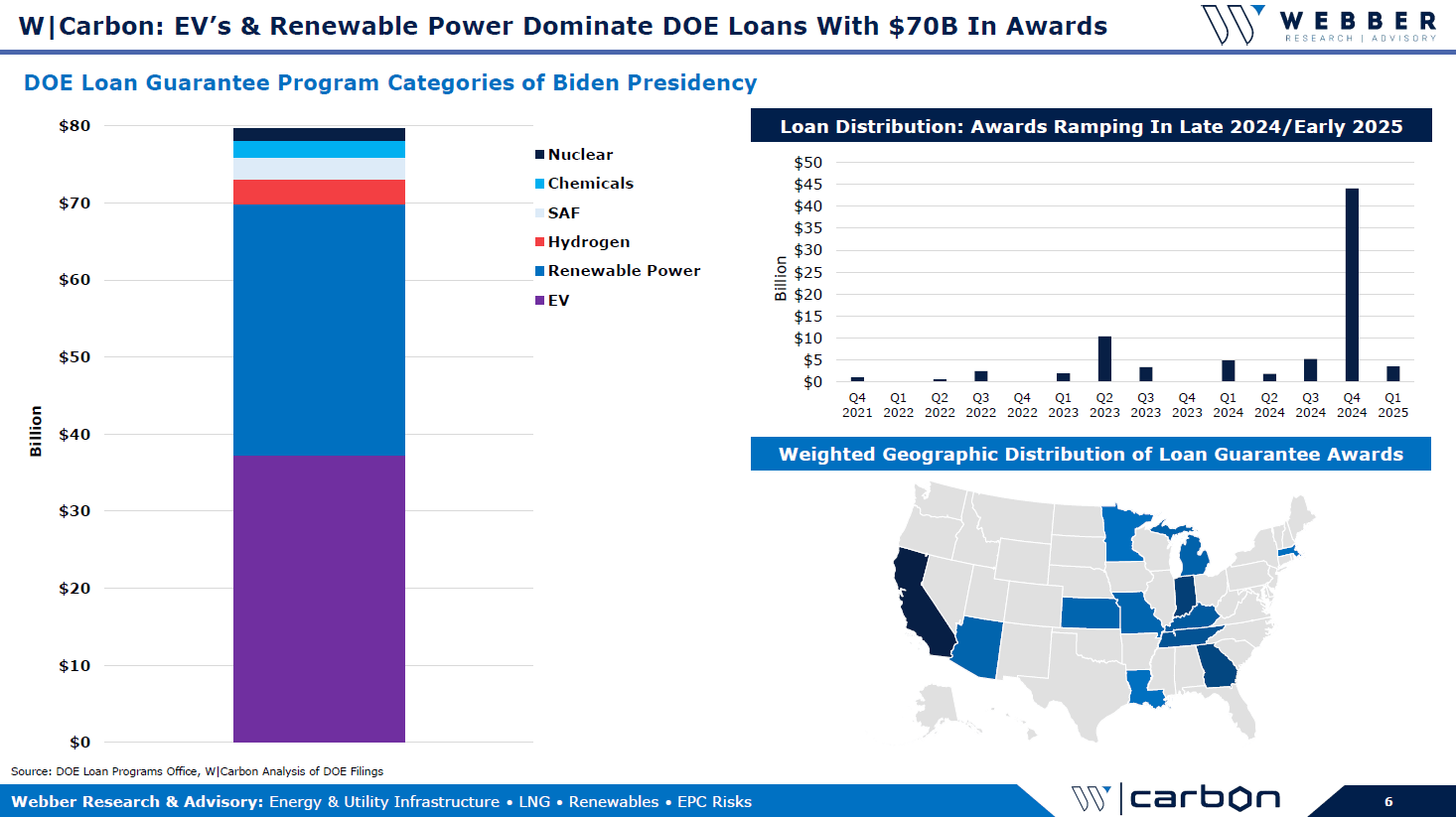

W|Carbon: 45V Guidance Analysis – EVs & Renewable Power Lead DOE Loan Guarantee Awards – January 2025

W|Carbon – Full Presentation, January 2025

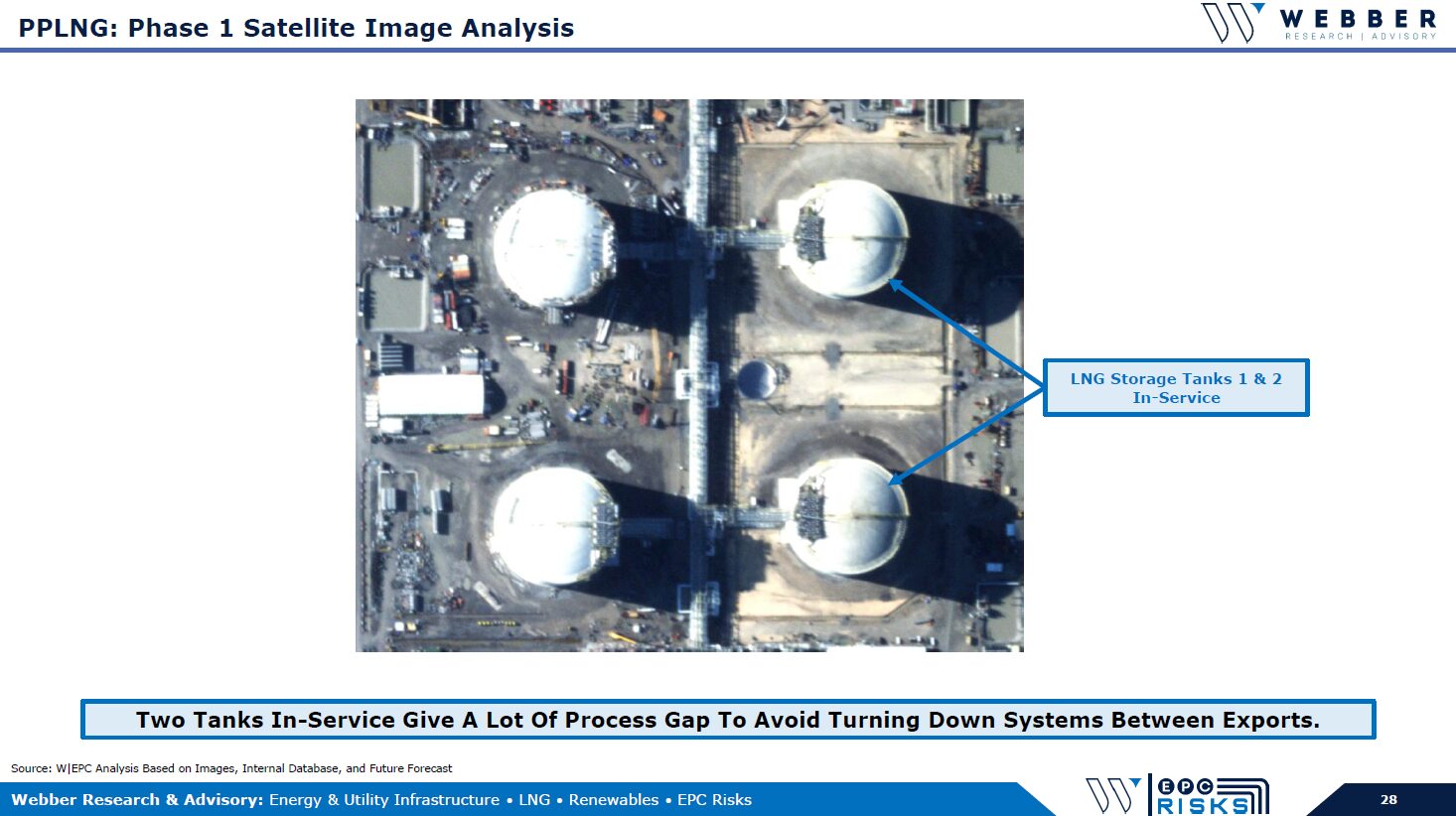

W|EPC: Client Call 01/15 @11AM – Venture Global’s Plaquemines Parish – Q125 Project Review

W|EPC: Venture Global’s Plaquemines Parish LNG – Q125 Project Review

If you’re already a Webber Research client, you can access this via our Library. If you’re not yet a Webber Research client, you can access the full report on our Downloads page, or contact us for access information at [email protected] or [email protected].

Read More

W|Carbon: Trump Administration Energy Policies Sharpen Focus, UCO Imports, & Credit Price/Volume Updates

For access information, email us at [email protected], or at [email protected]

Venture Global IPO Coverage

Read More

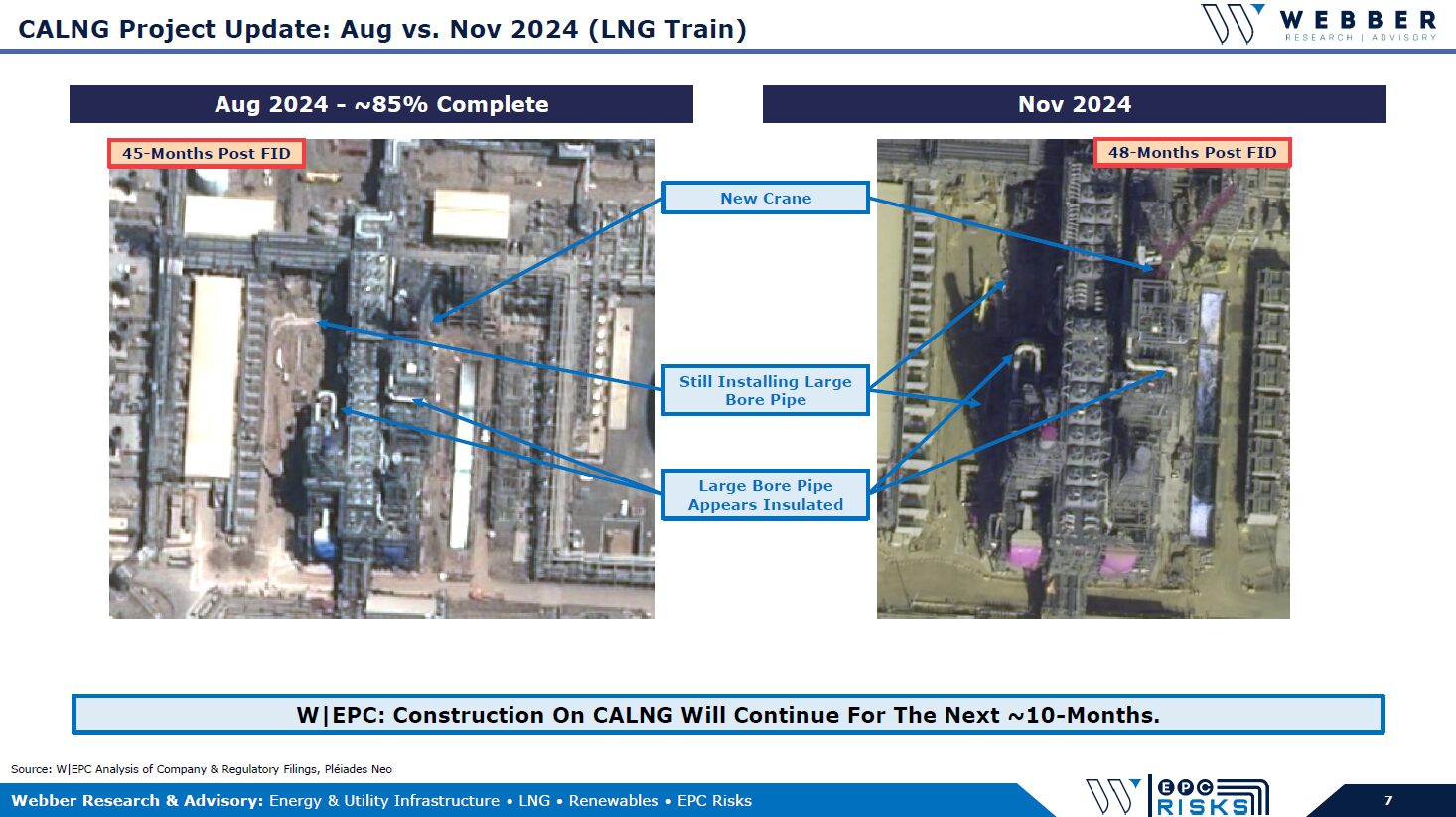

W|EPC: Costa Azul LNG – Q424 Project Review

If you’re already a Webber Research client, you can access this report via our Research Library. For access information, please contact us at [email protected] or [email protected]. For the full report, please visit our Downloads page.

Venture Global IPO & Trump 2.0: Assessing The Impact Across 35 LNG Projects

If you’re already a Webber Research client, you can access this 8-page report via our Research Library. For access information please contact us [email protected], or at [email protected].

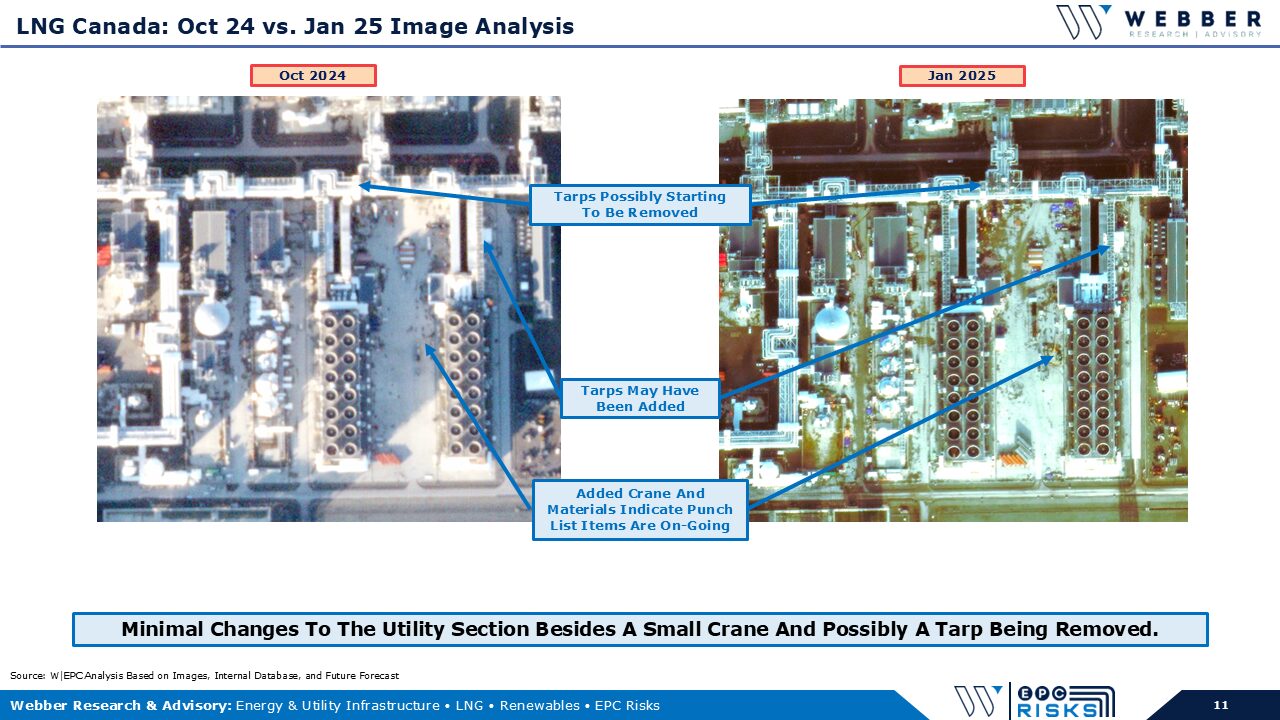

W|EPC: LNG Canada Project Update – Q424

If you’re already a Webber Research client, you can access the full report in our Research Library. If you’re not yet a Webber Research subscriber, please contact us at [email protected] or at [email protected].

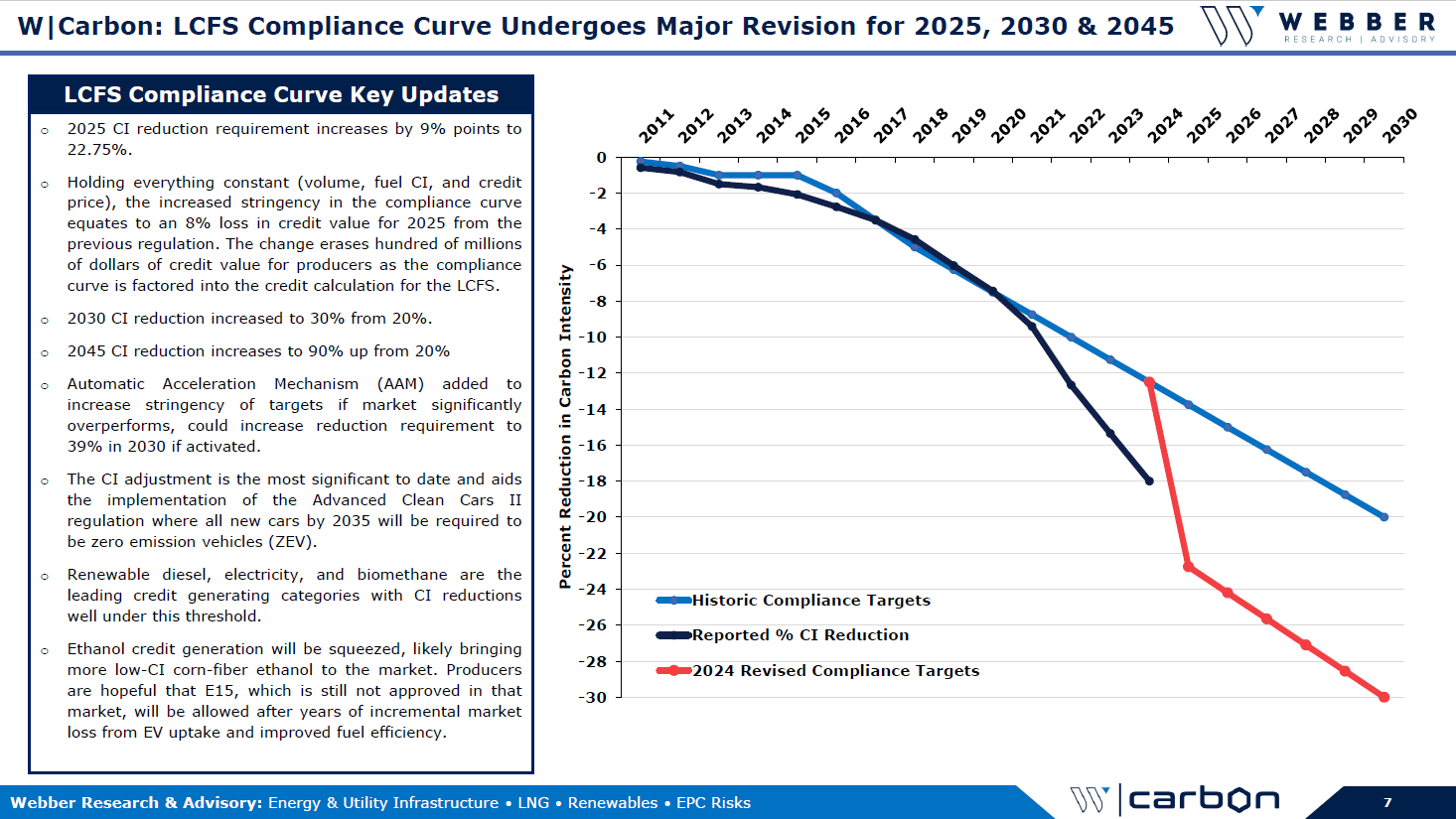

W|Carbon: Trump Impact On Clean Fuels & CARB Approval Of 2024 LCFS Amendments

For access information, please contact us at [email protected] or at [email protected].

Read More

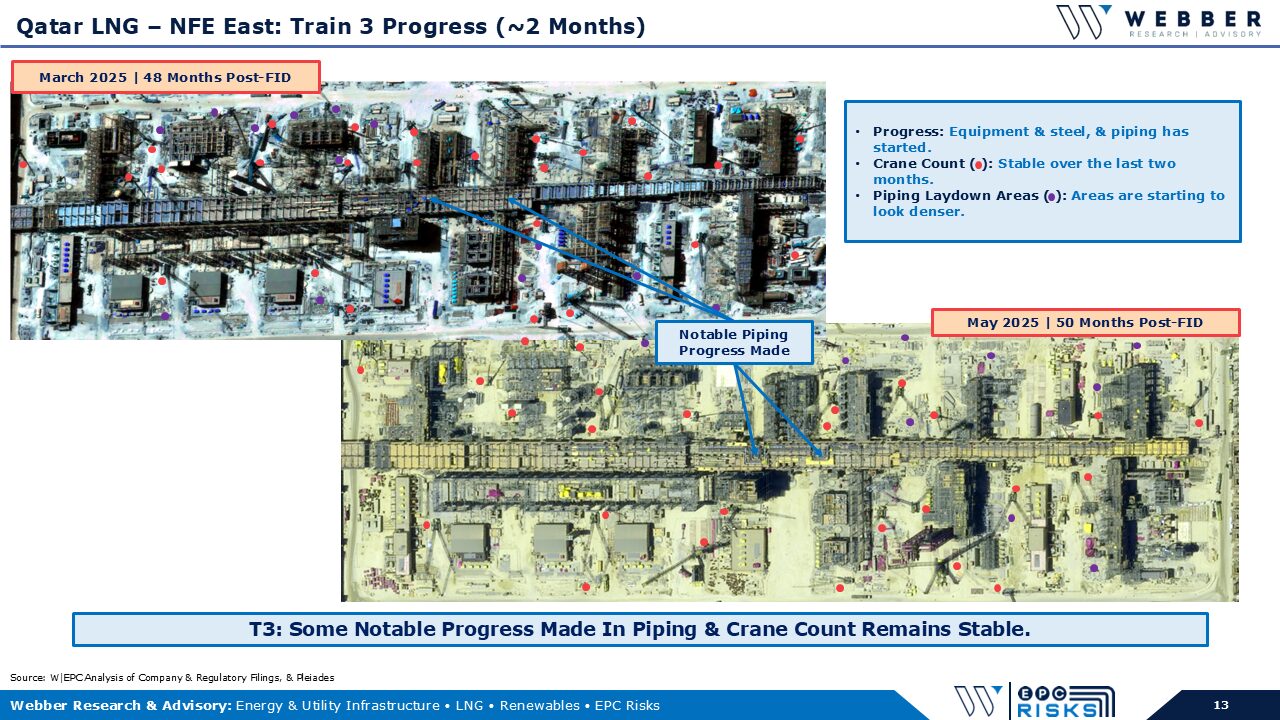

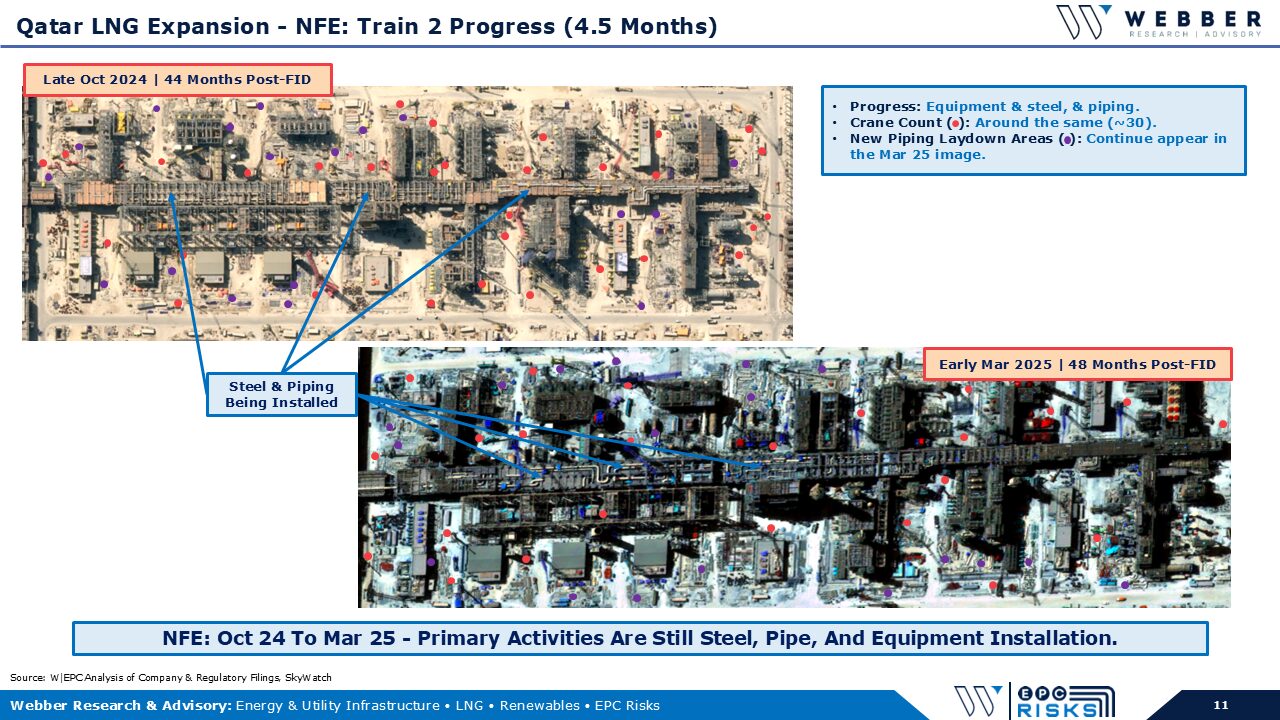

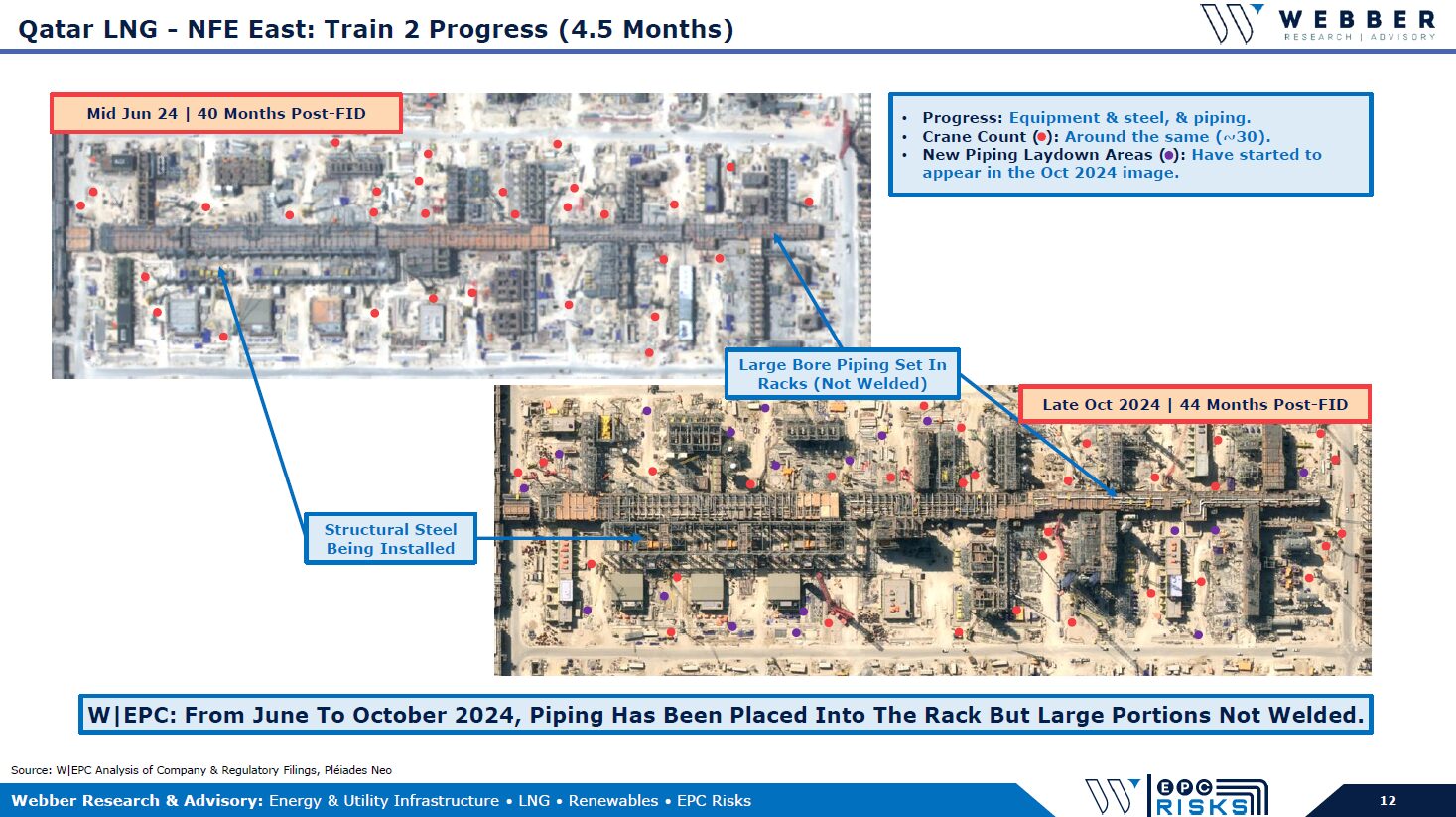

W|EPC: Qatar LNG North Field Expansion (NFE) East – Q424 Project Update

If you’re already a Webber Research client, you can access this report via our Research Library. For access information, email us at [email protected], or at [email protected].

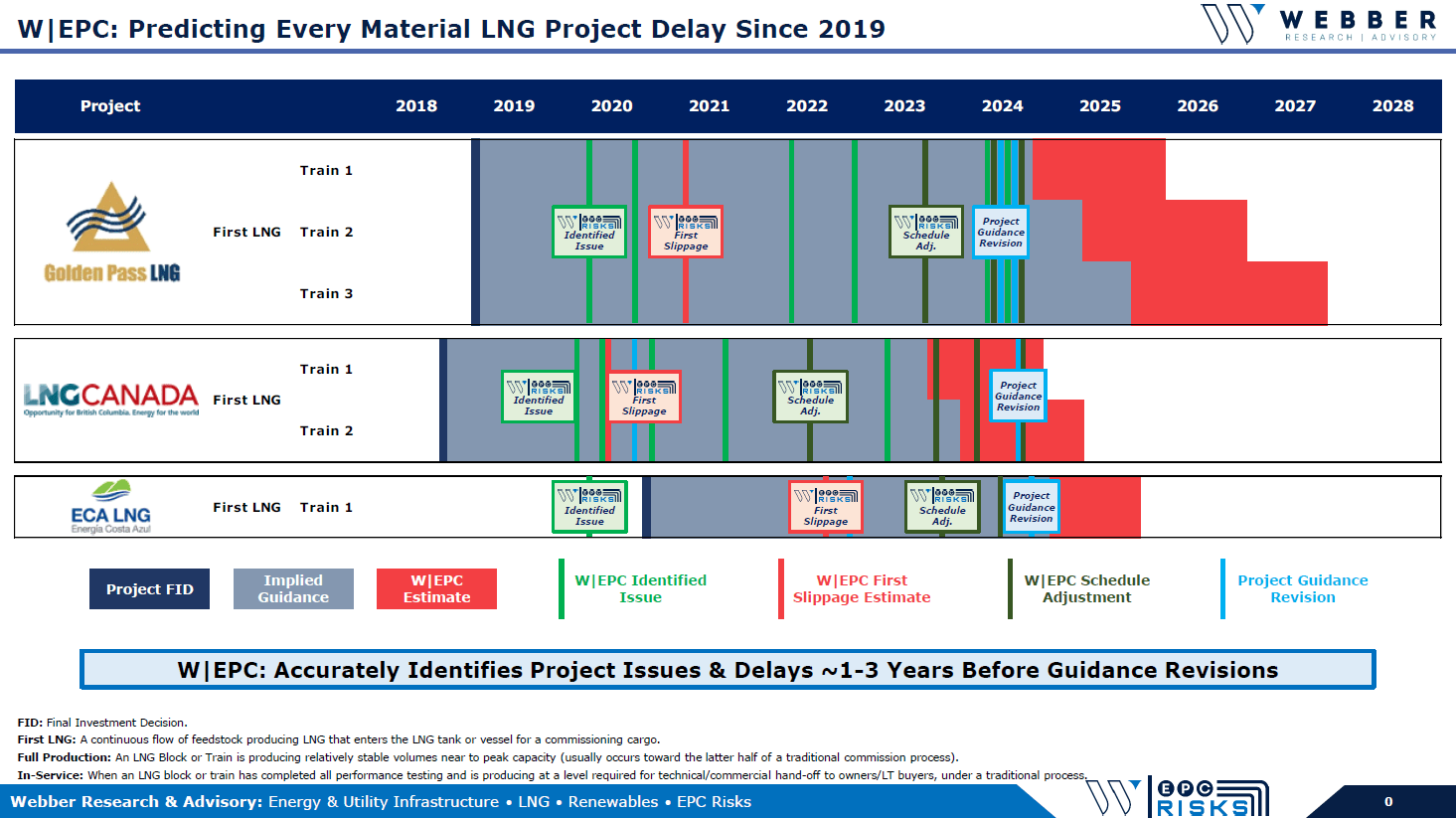

W|EPC: Predicting Every Material LNG Project Delay Since 2019

For access information please contact us at [email protected] or [email protected].

Read More

W|Carbon: Clean Fuels & Carbon Market Research – CARB LCFS Amendments Votes

If you’re already a Webber Research subscriber, you can access this report via our Research Library. To access the full report, please visit our Downloads page, or contact us at [email protected] or [email protected].

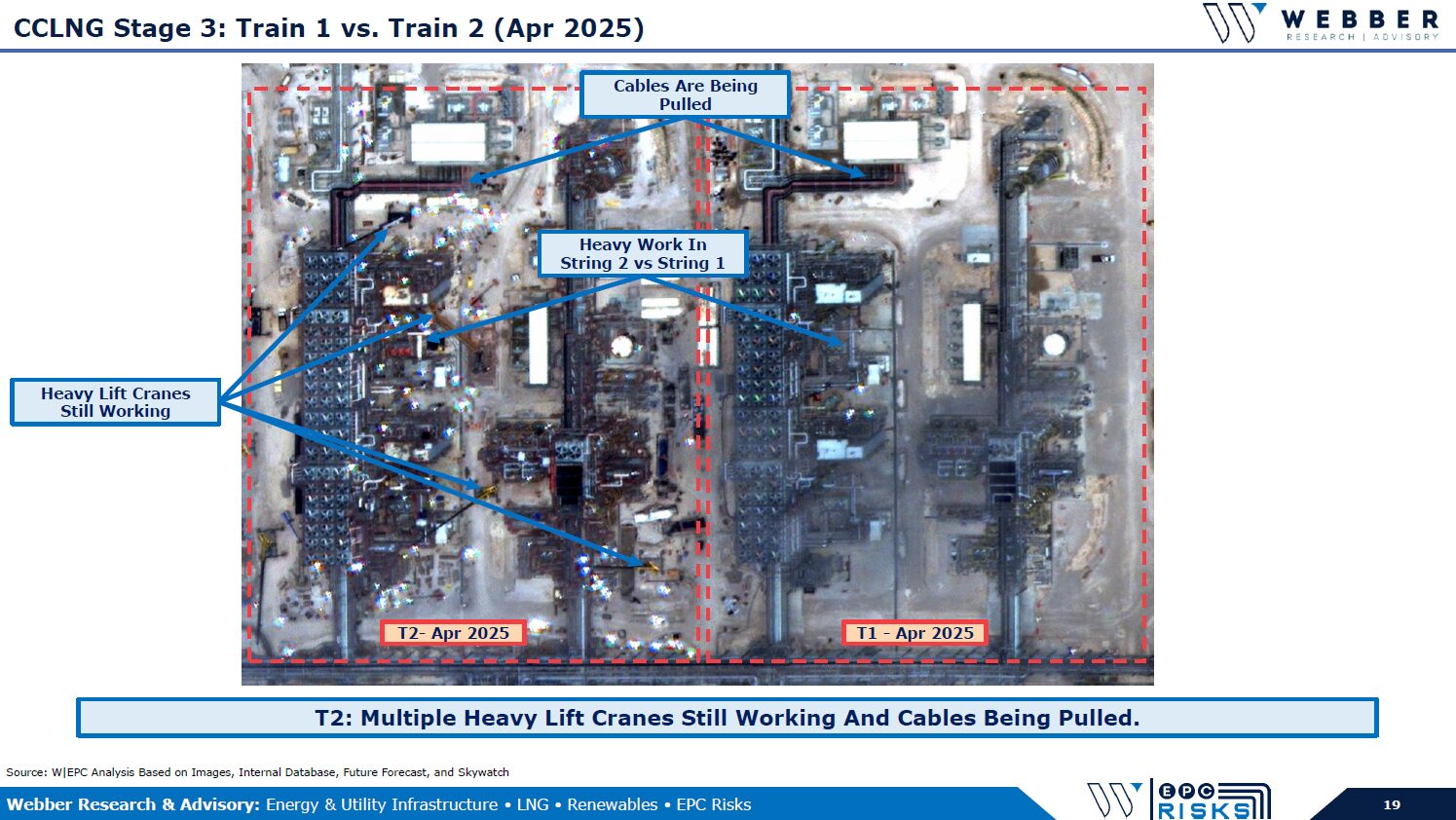

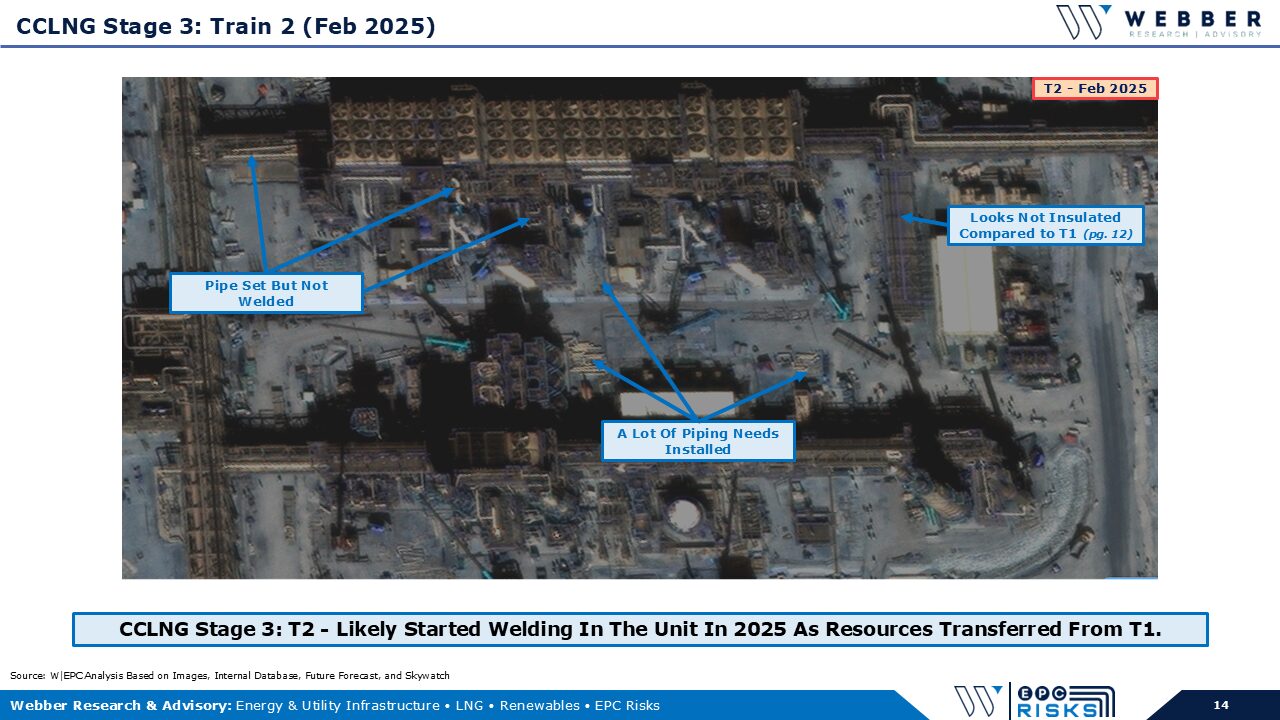

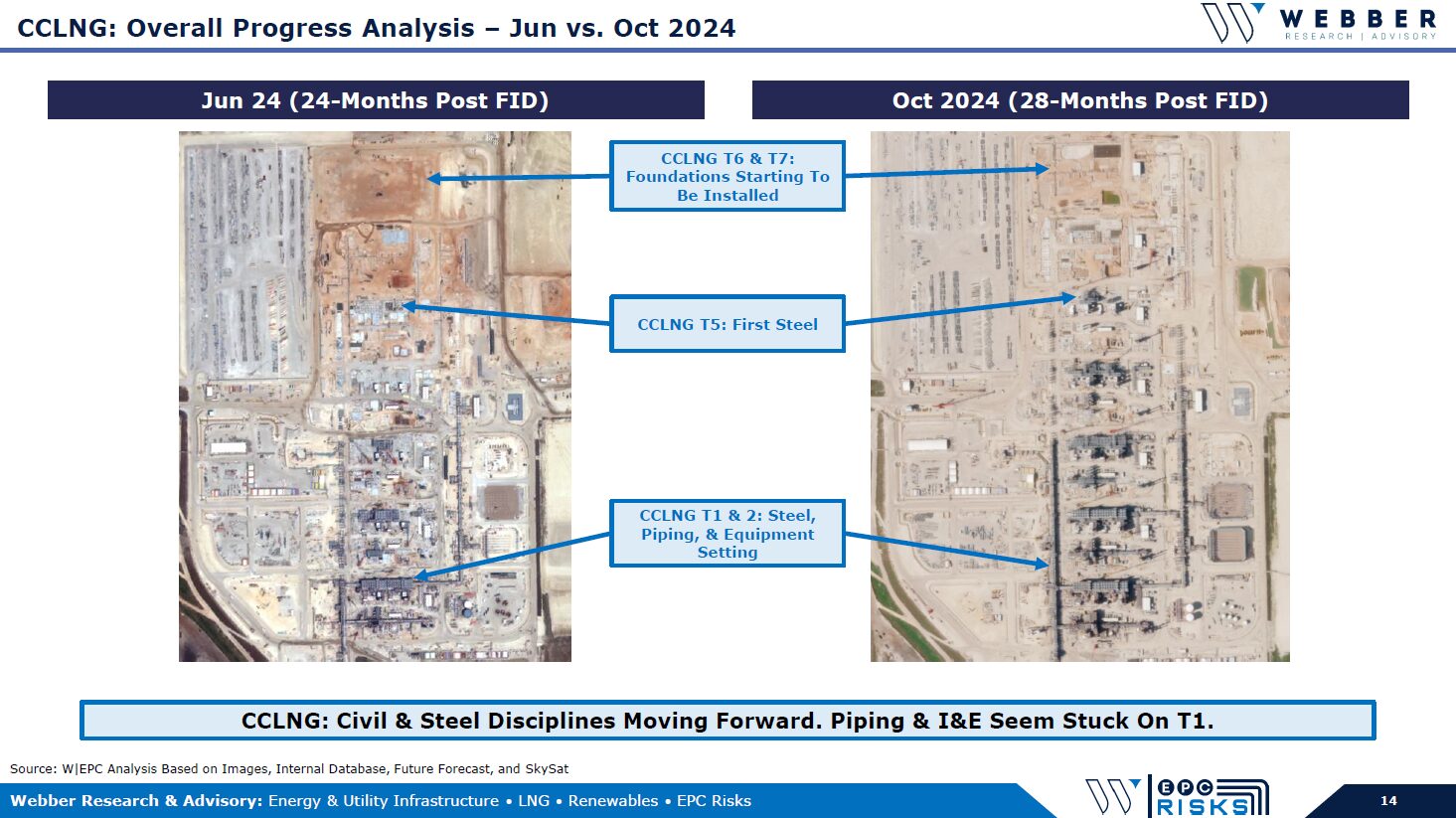

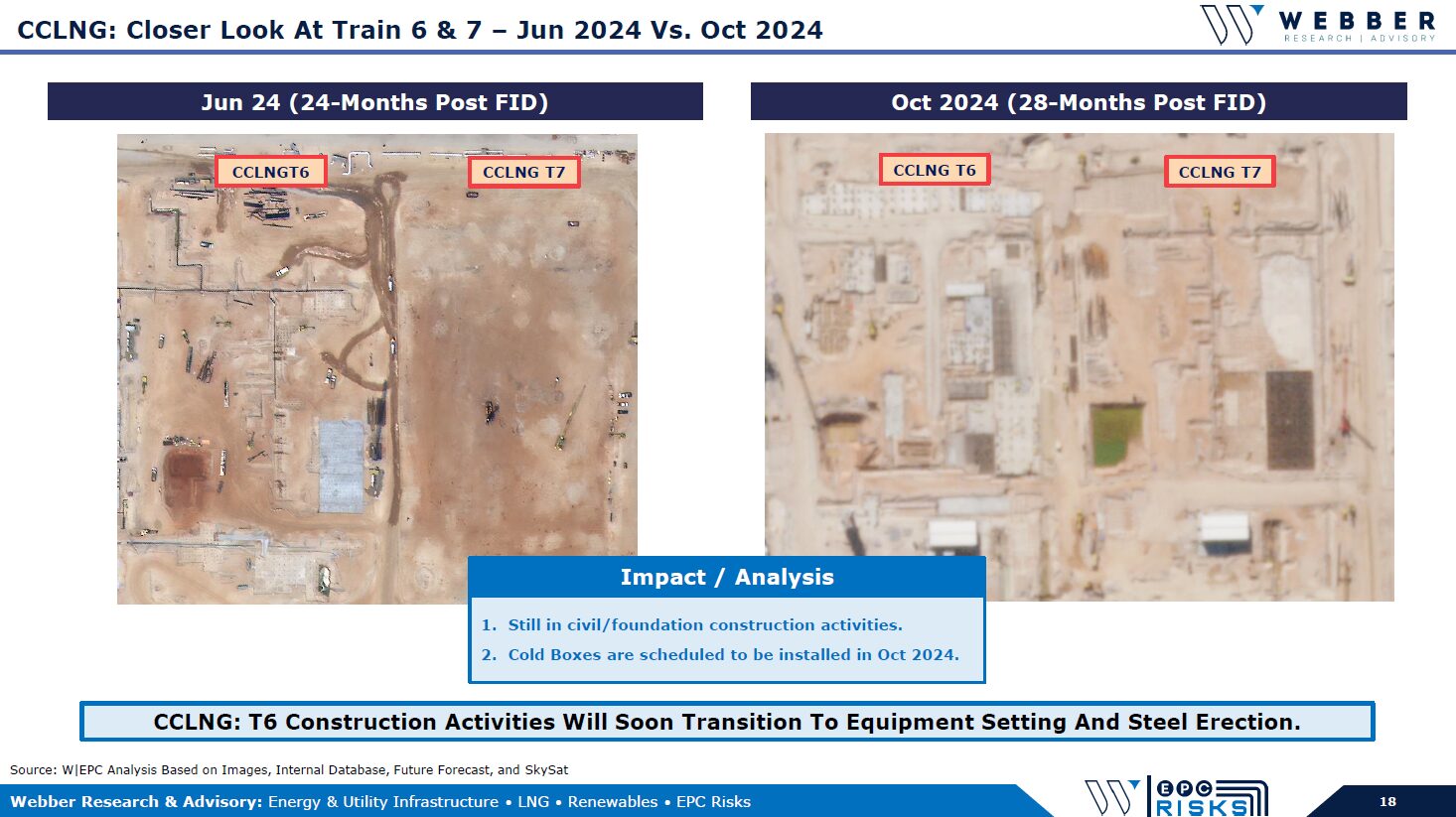

W|EPC: Corpus Christi LNG Project Update – Q424

If you’re already a Webber Research subscriber, you can access this report via our Research Library. To access the full report, please visit our Downloads page, or contact us at [email protected] or [email protected].

Read More

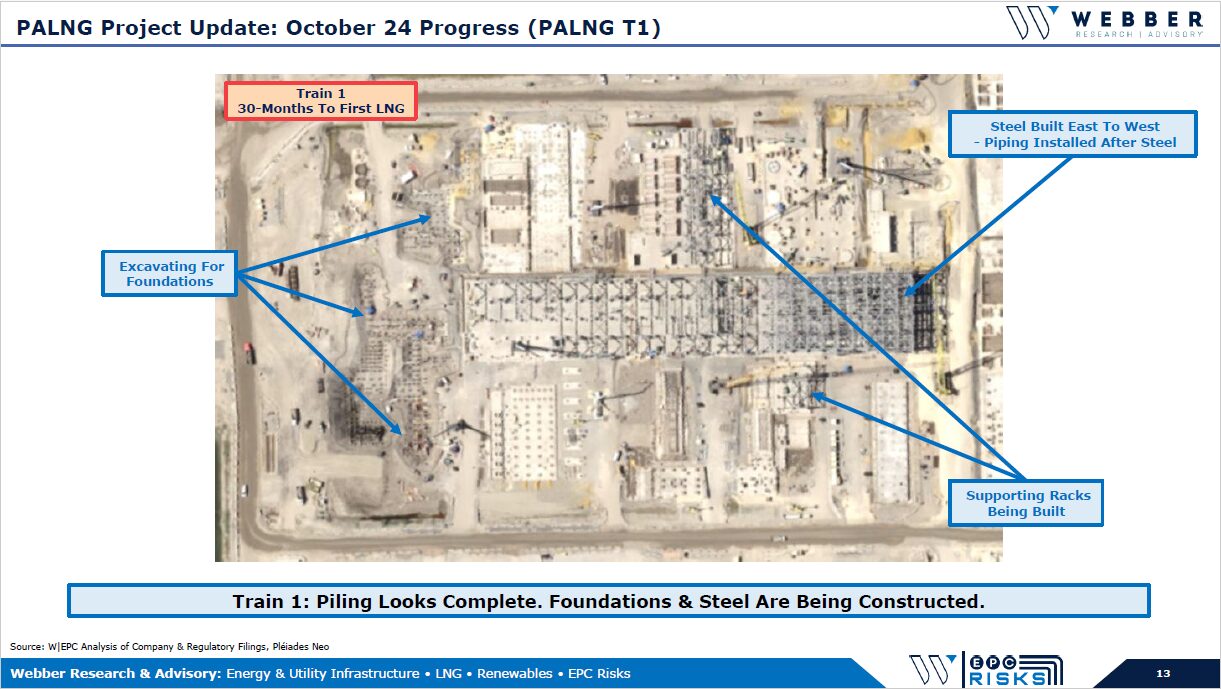

W|EPC: Port Arthur LNG Quarterly Project Update – Q4234

For access information, please contact us at [email protected] or [email protected]

Lloyds List: Shipping & LNG – The Good, The Bad, & The Ugly

https://www.lloydslist.com/LL1151122/Shipping-corporate-governance-the-good-the-bad-and-the-ugly

Read More

Webber Research: Renewables Weekly – 04.06.21

Read More

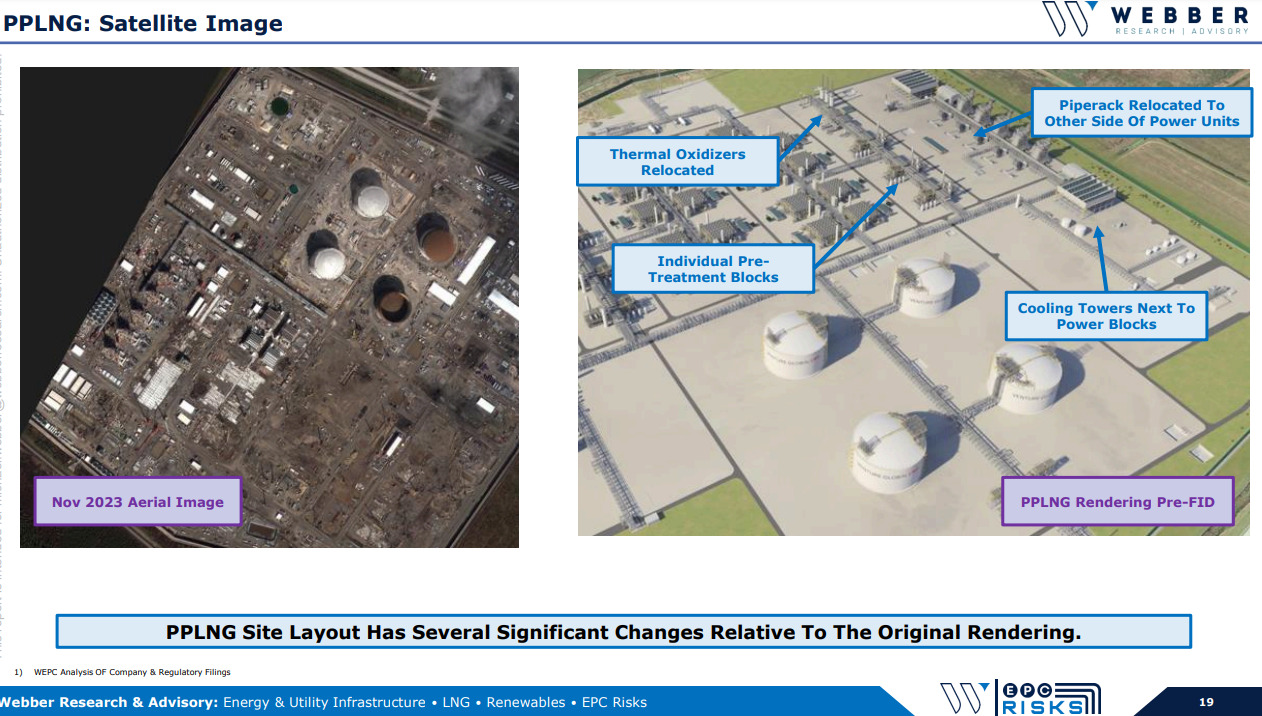

W|EPC: Plaqumines Parish LNG Project Update – Q123

Read More

Kicking around ESG: Why analyst Mike Webber prefers goalposts that don’t move

Read More

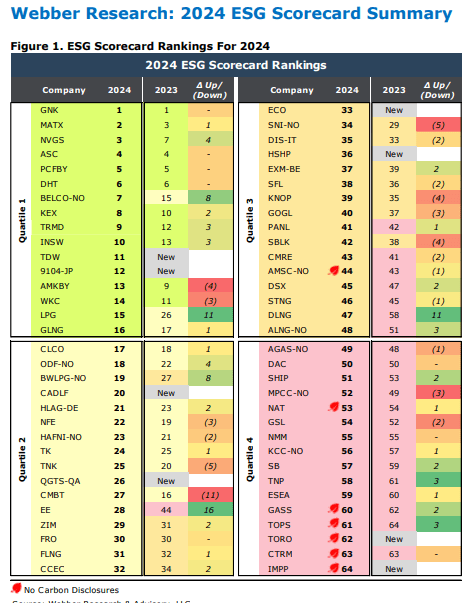

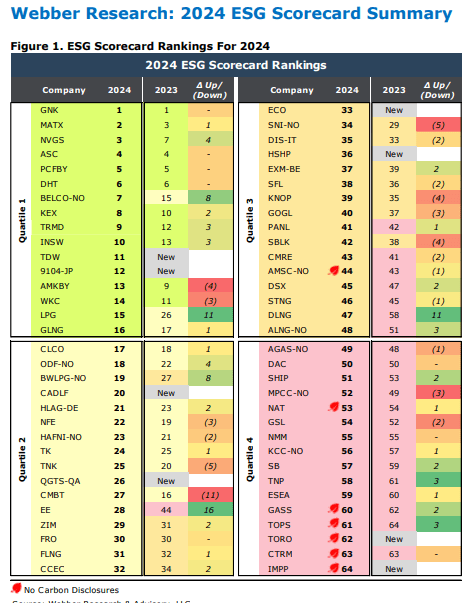

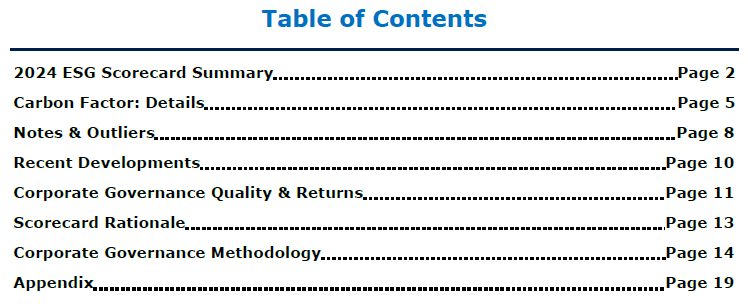

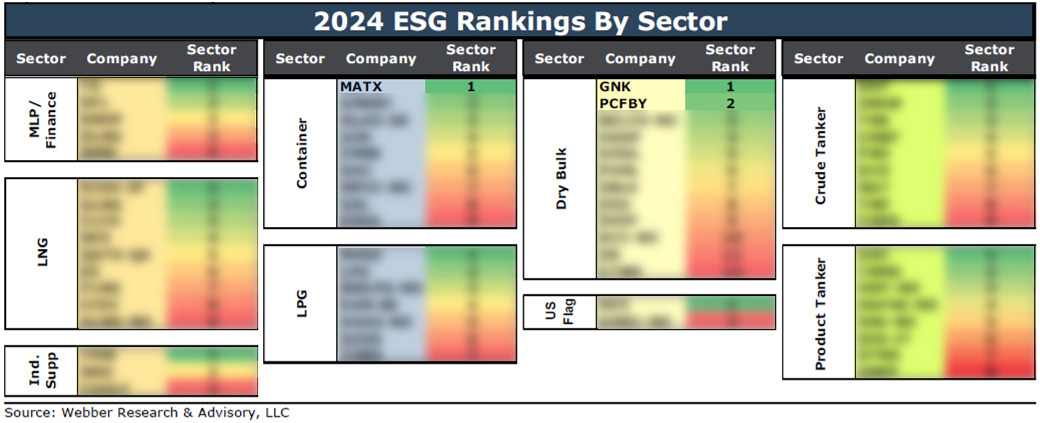

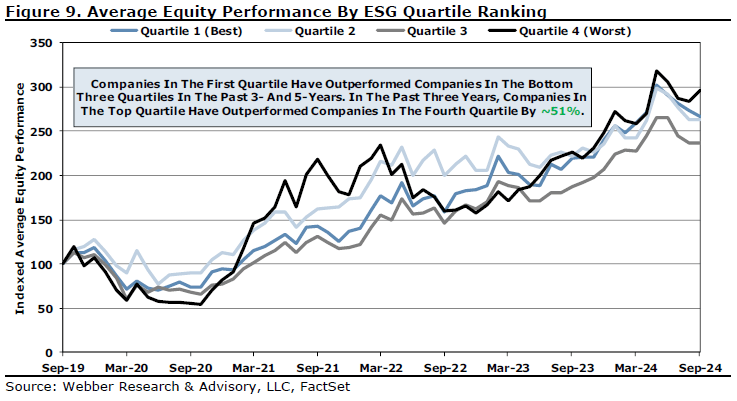

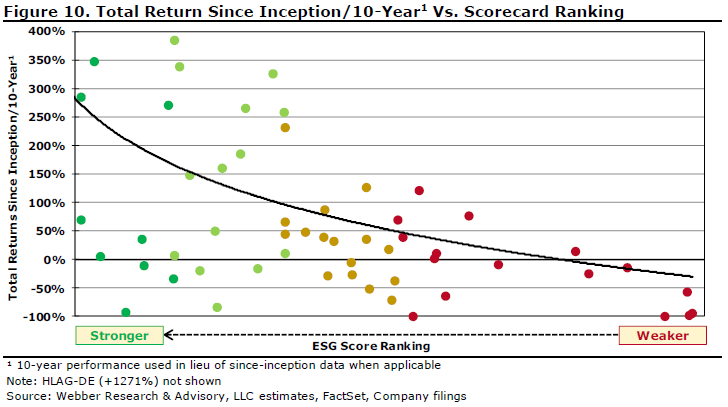

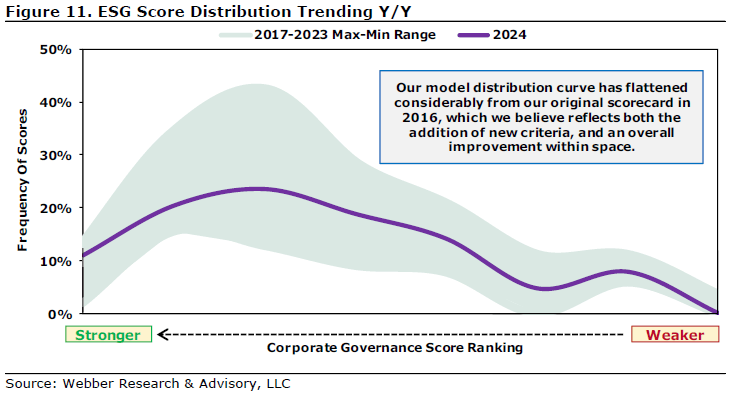

Webber Research: 2024 Shipping ESG Scorecard

To view our full report, visit our Downloads page. If you’re already a Webber Research subscriber, visit our Library. For access information, contact us at [email protected], or at [email protected]

Tradewinds: Webber Research’s 2024 ESG Scorecard – Genco reigns, CMB.Tech tumbles and Imperial Petroleum lags

Read More

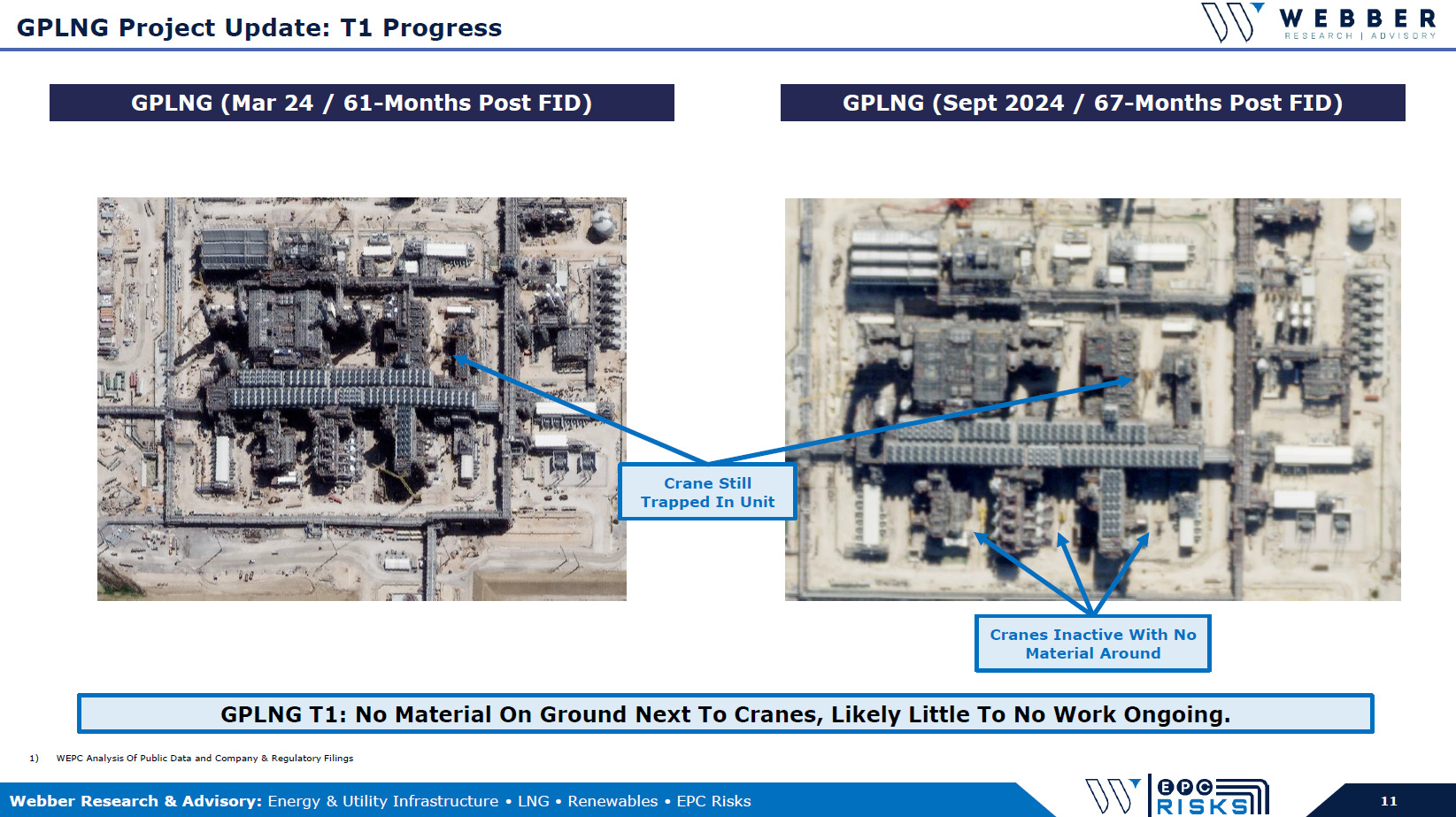

W|EPC: Golden Pass LNG Q324 Project Review – Client Call Weds 09/25 @11AM EST

For our full Q324 Project Review, please visit our Downloads section. If you’re already a Webber Research subscriber, you can access this report via our Research Library. For access information, please contact us at [email protected], or at [email protected].

W|EPC: Plaquemines Parish LNG Project Update – Q324

For our full report, please visit our download page. If you’re already a Webber Research subscriber, you can access this report via our library. For access information, email us at [email protected] or at [email protected]

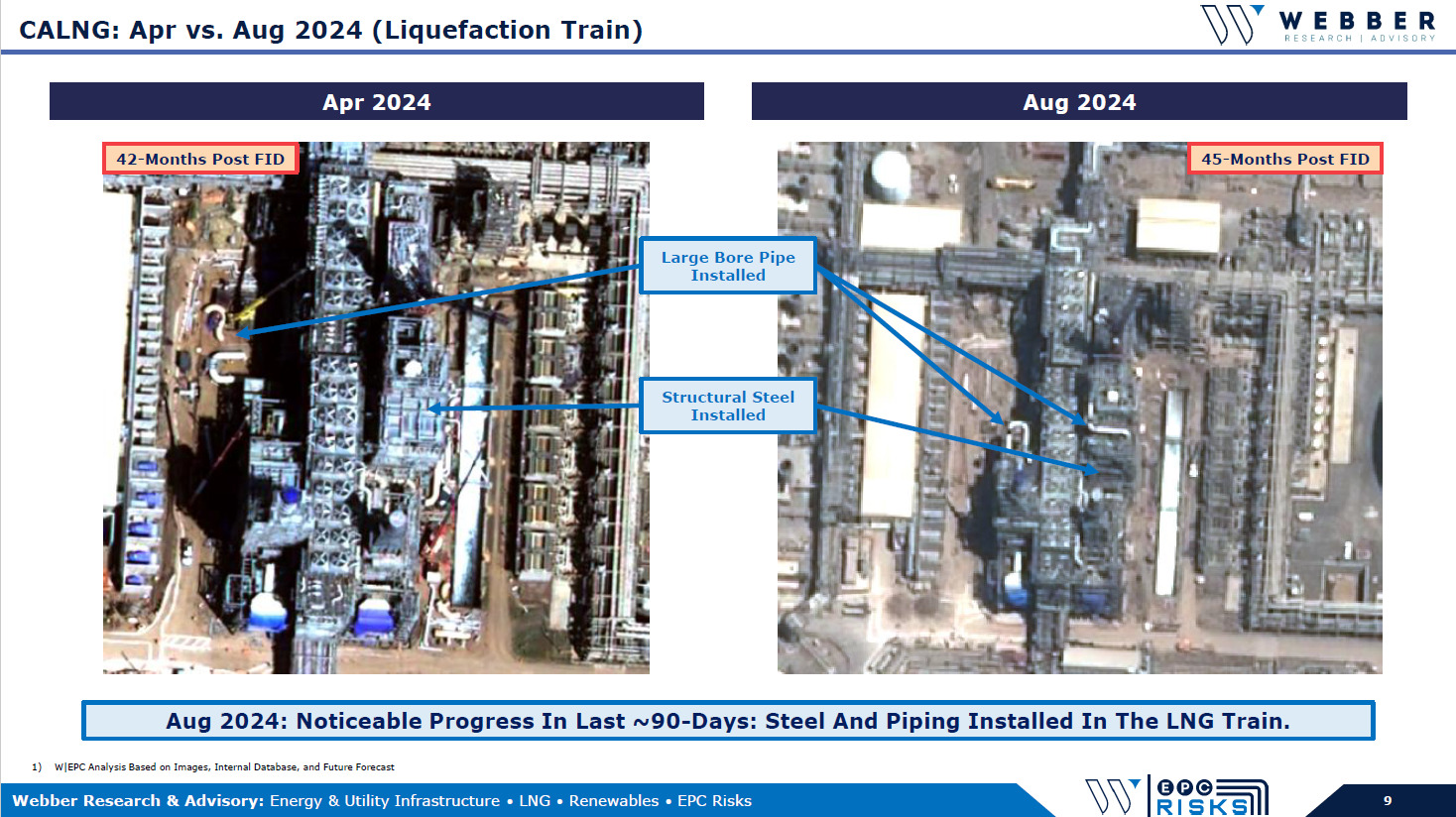

W|EPC: Costa Azul LNG – Project Update Q324

For our full report, please visit our download page. If you’re already a Webber Research subscriber, you can access this report via our library. For access information, email us at [email protected] or at [email protected]

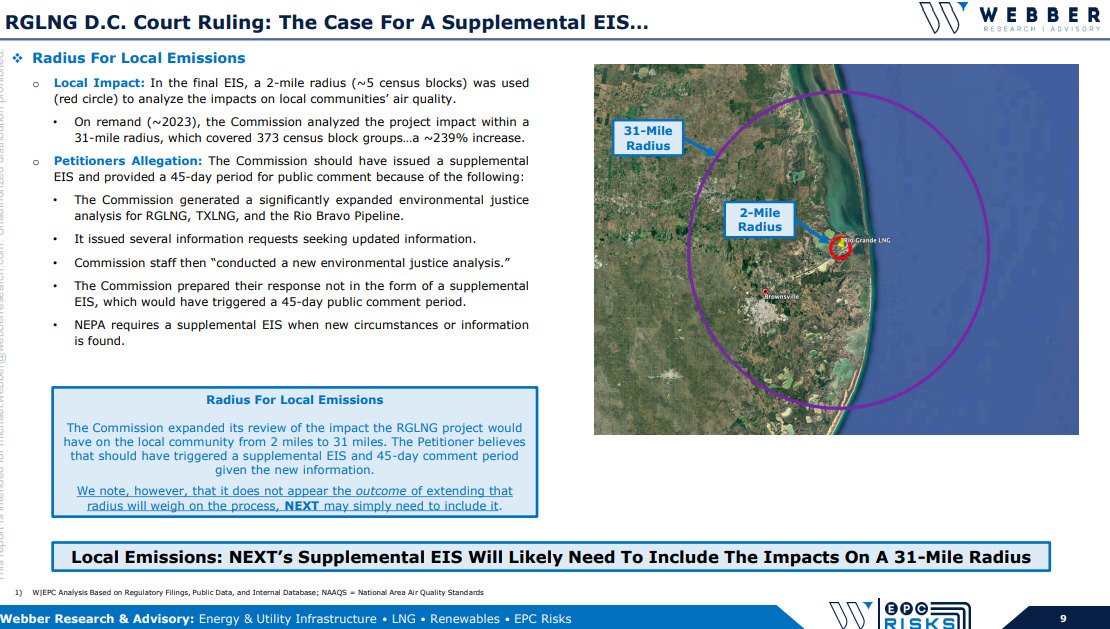

W|EPC: Rio Grande LNG – Vacated FERC Permit Q324 – Analyzing Impact & Scenarios

To access the full presentation, please visit our Downloads page. If you’re an existing Webber Research subscriber, you can access this report via our library. For subscription information, please contact us at [email protected], or at [email protected].

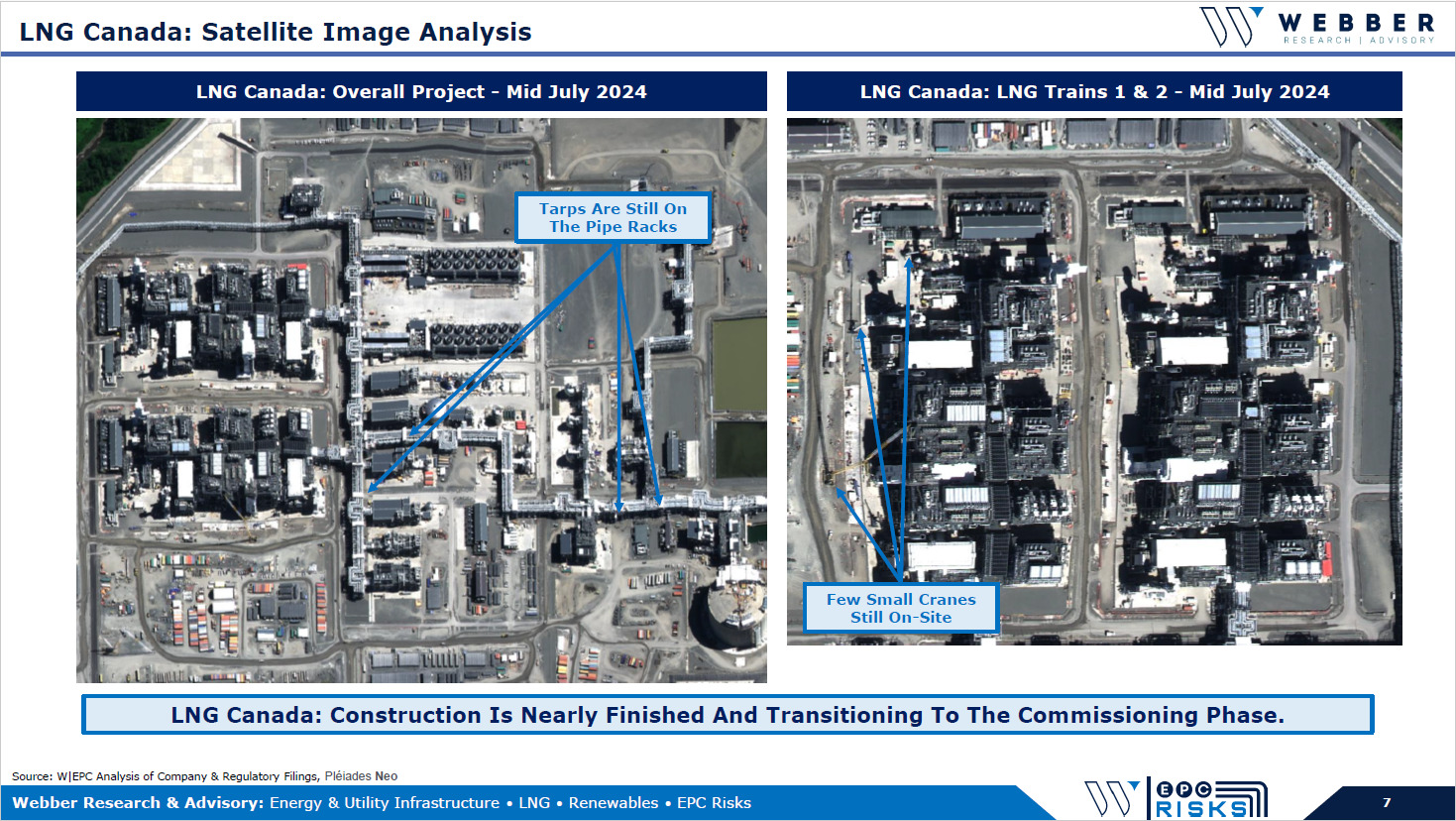

W|EPC: LNG Canada Q324 Project Update – Updated Timeline Ests, Satellite Image Review, & Analysis

To access the full report, please visit our downloads page. If you’re already a Webber Research client, you can access this report via our library. For subscription information, contact us at [email protected] or at [email protected]

Read More

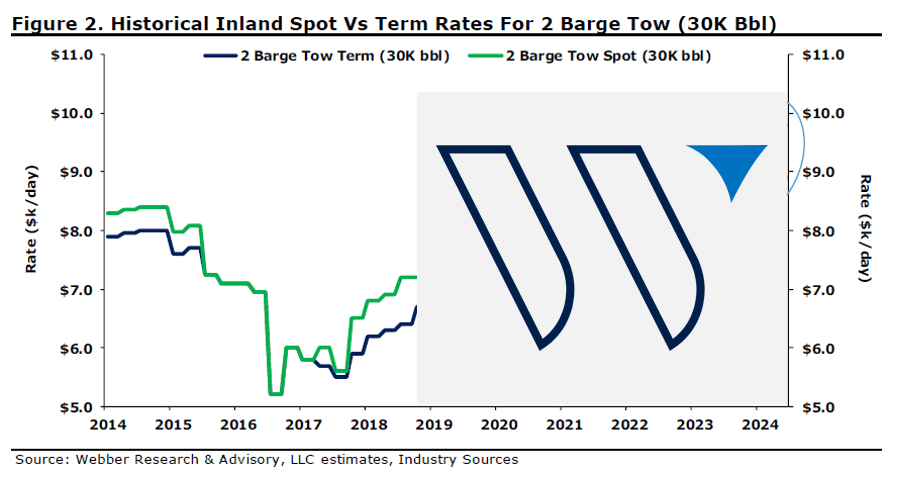

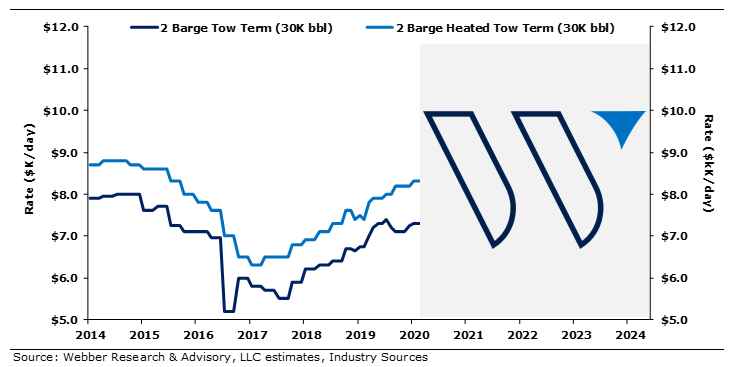

KEX: Q224 Preview – Calibrating Strong Inland Market, Historical Spot & Term Pricing, Orderbook

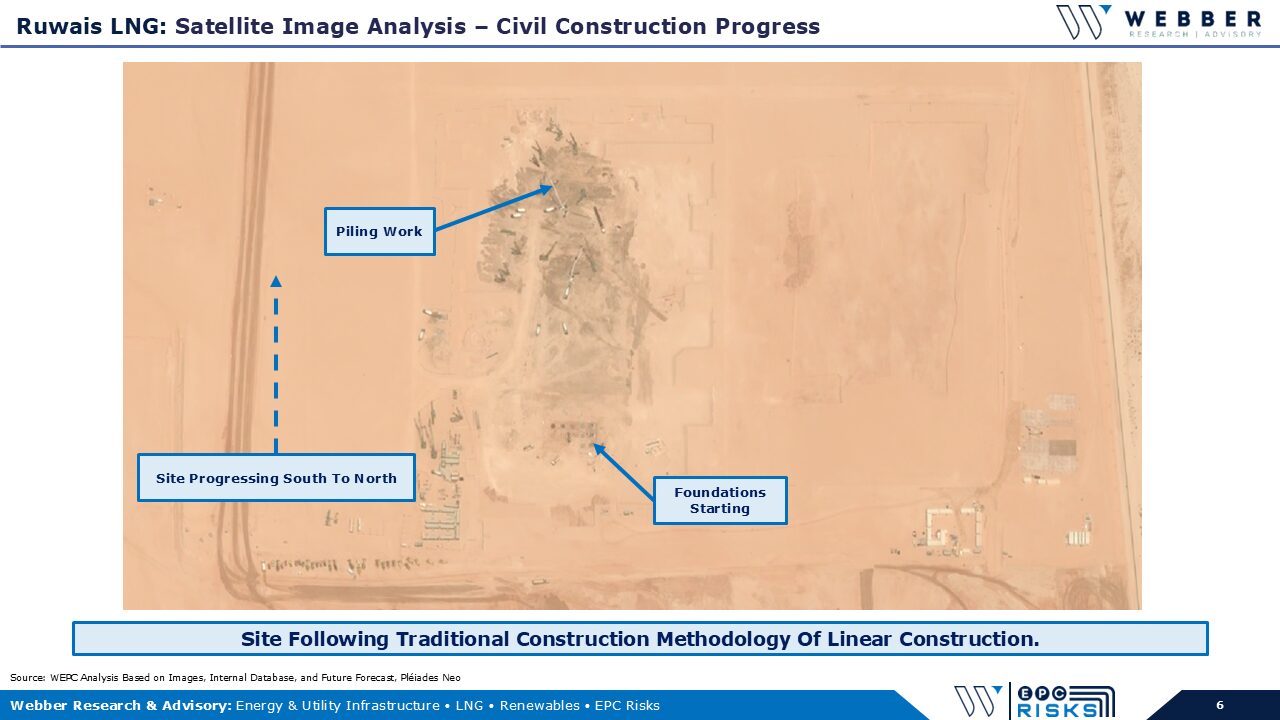

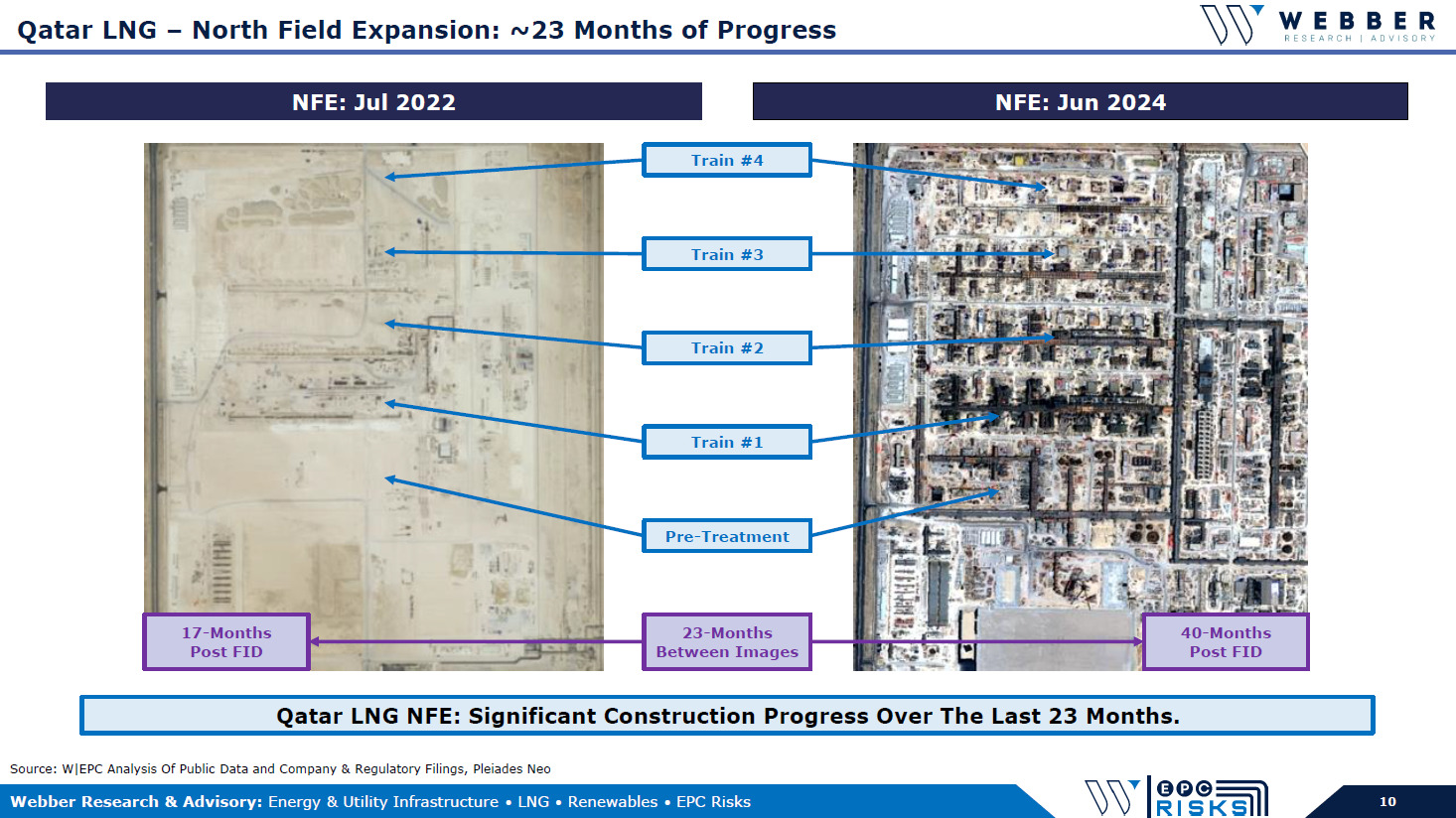

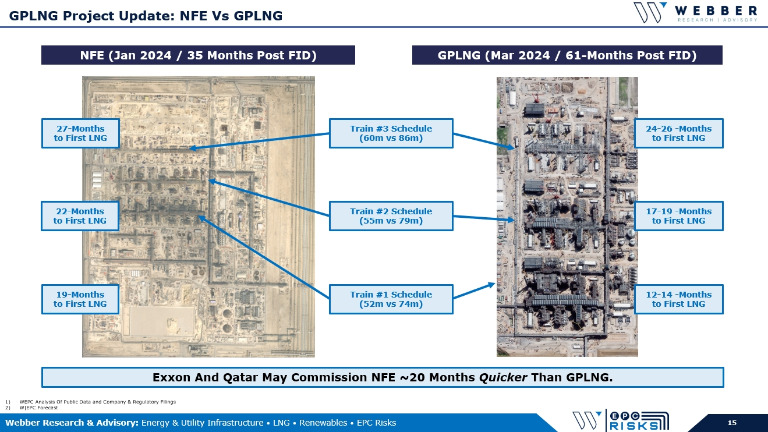

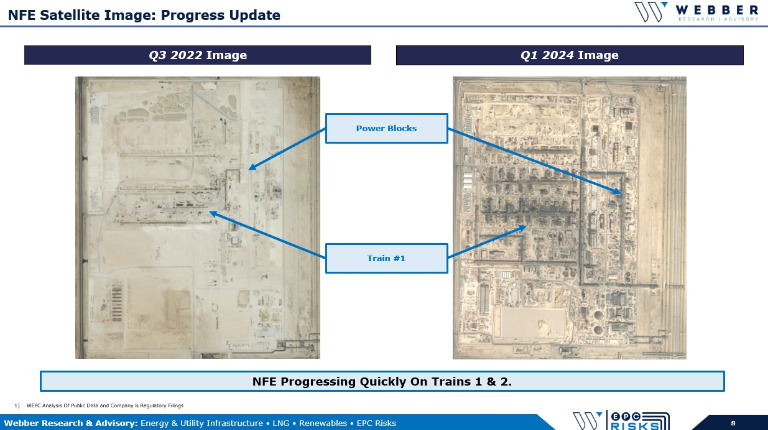

W|EPC: Qatar LNG North Field Expansion – Q324 Update & Project Estimates

For our full report, please visit our downloads page. If you’re already a Webber Research subscriber, you can access this report via our library. For access information, contact us at [email protected], or [email protected].

Read More

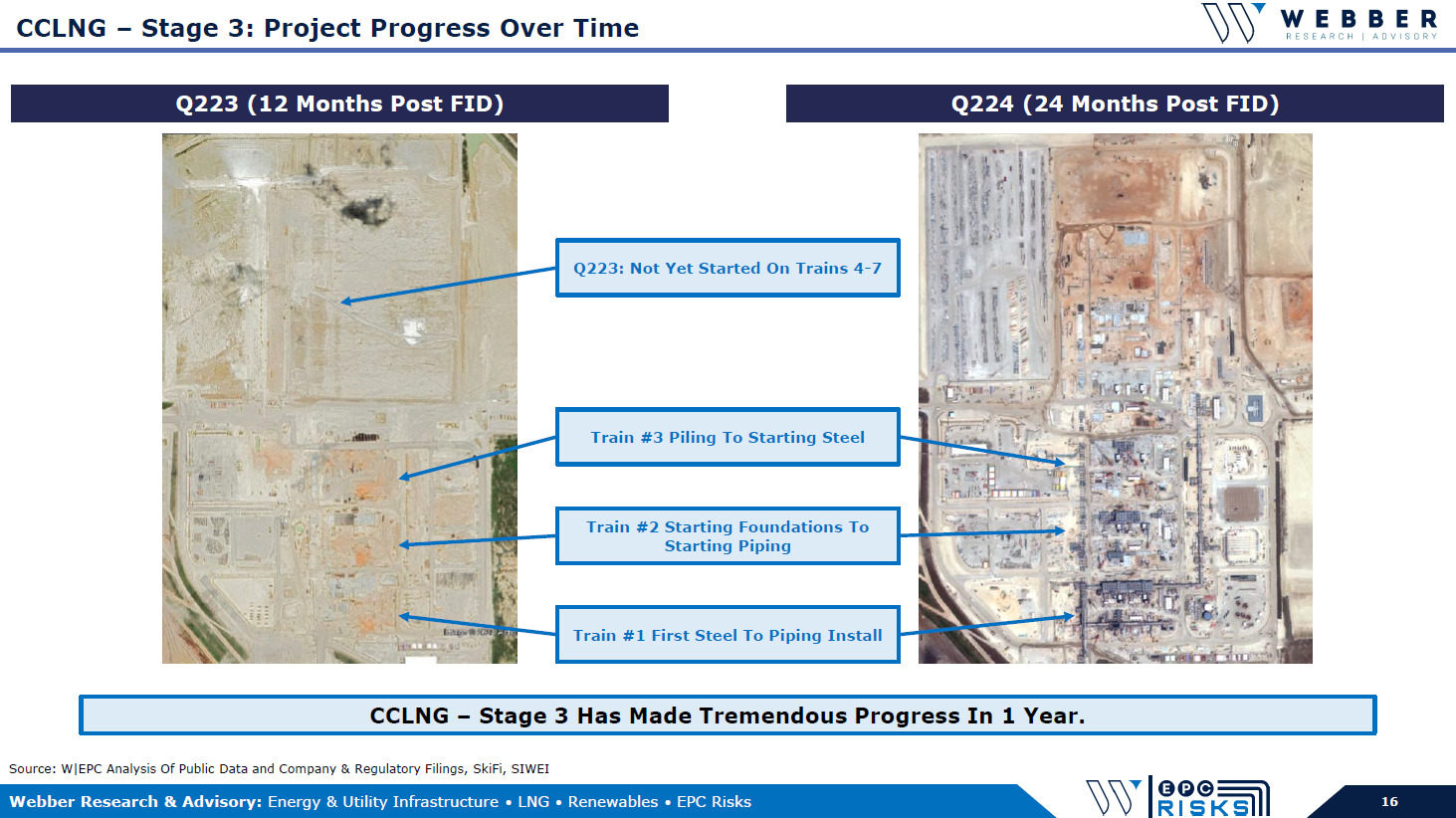

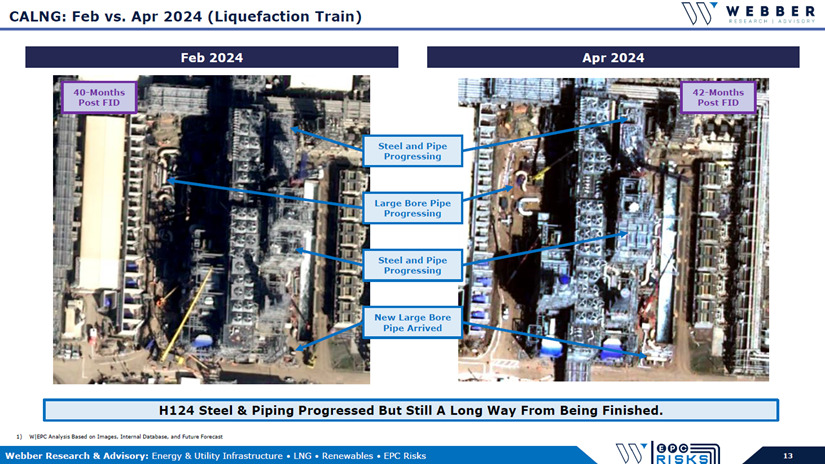

W|EPC: Cheniere’s Corpus Christi LNG – Q224 Project Update

To download this report, click here. If you’re already a Webber Research subscriber, you can access this report via our library. For access information, email us at [email protected] or [email protected].

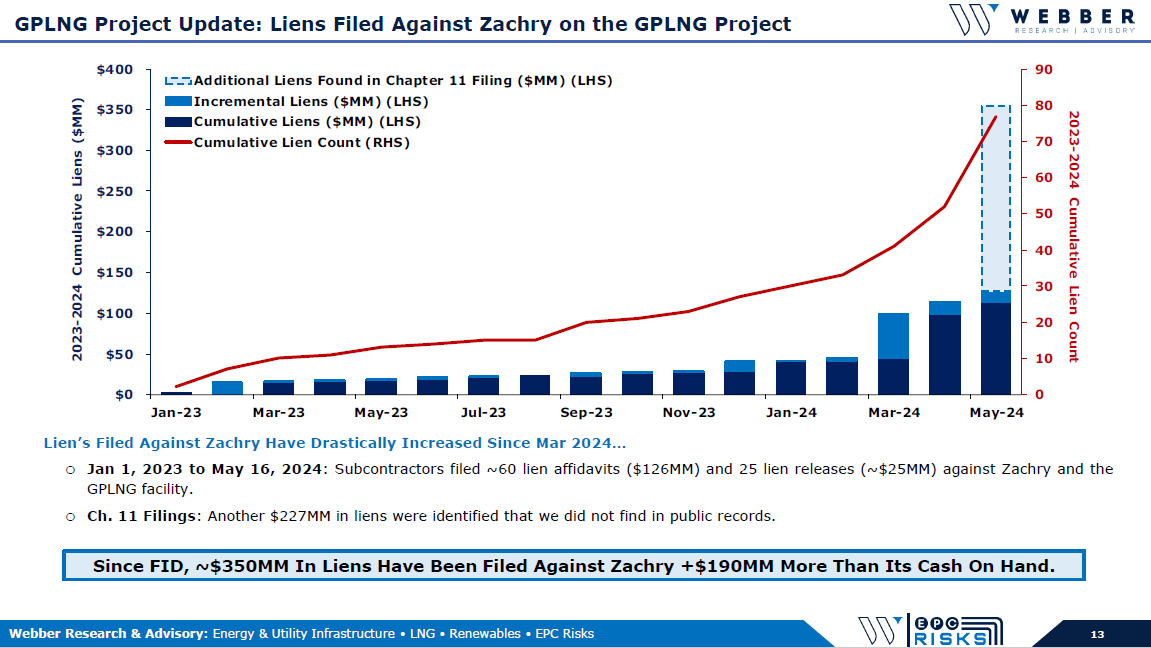

W|EPC: Client Call – Golden Pass LNG & Zachry Bankruptcy Impact – Weds 06/05 @11am

To download this report, click here. If you’re already a Webber Research subscriber, you can access this report via our library. For access information, contact us at [email protected], or at [email protected].

W|EPC: Sempra’s Costa Azul (ECA) LNG Project Update – Q224

To access the full report, please visit our Downloads Page. If you’re already a Webber Research Subscriber, you can access this report via our library. For access or subscription information, contact [email protected] or at i[email protected]

Webber Research & Advisory Expands LNG & Energy Infrastructure Platform With Addition Of LNG Industry Veteran Alexander Bidwell

Read More

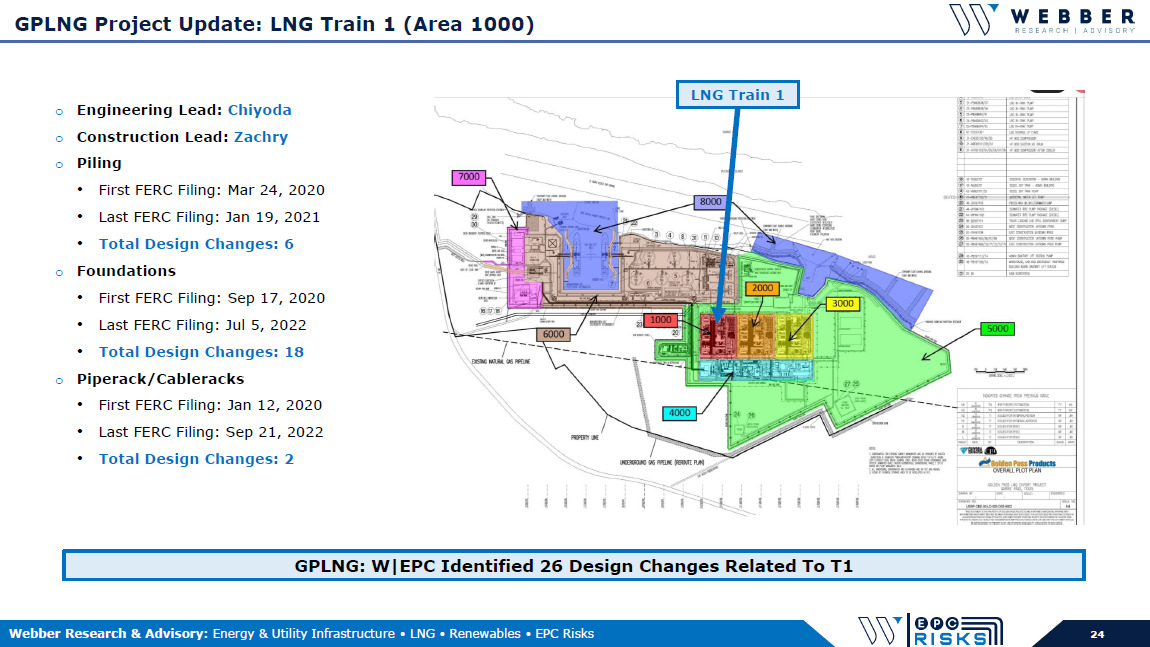

W|EPC: Golden Pass LNG Project Update – Q224

To download this report, click here. If you’re already a Webber Research subscriber, you can access this report via our library. For access information, contact us at [email protected], or at [email protected]

W|EPC: Venture Global’s Plaquemines LNG Project Update – Q224

To Download this report, click here. If you’re already a Webber Research subscriber, you access this report via our library. For access information, email us at [email protected] or at [email protected].

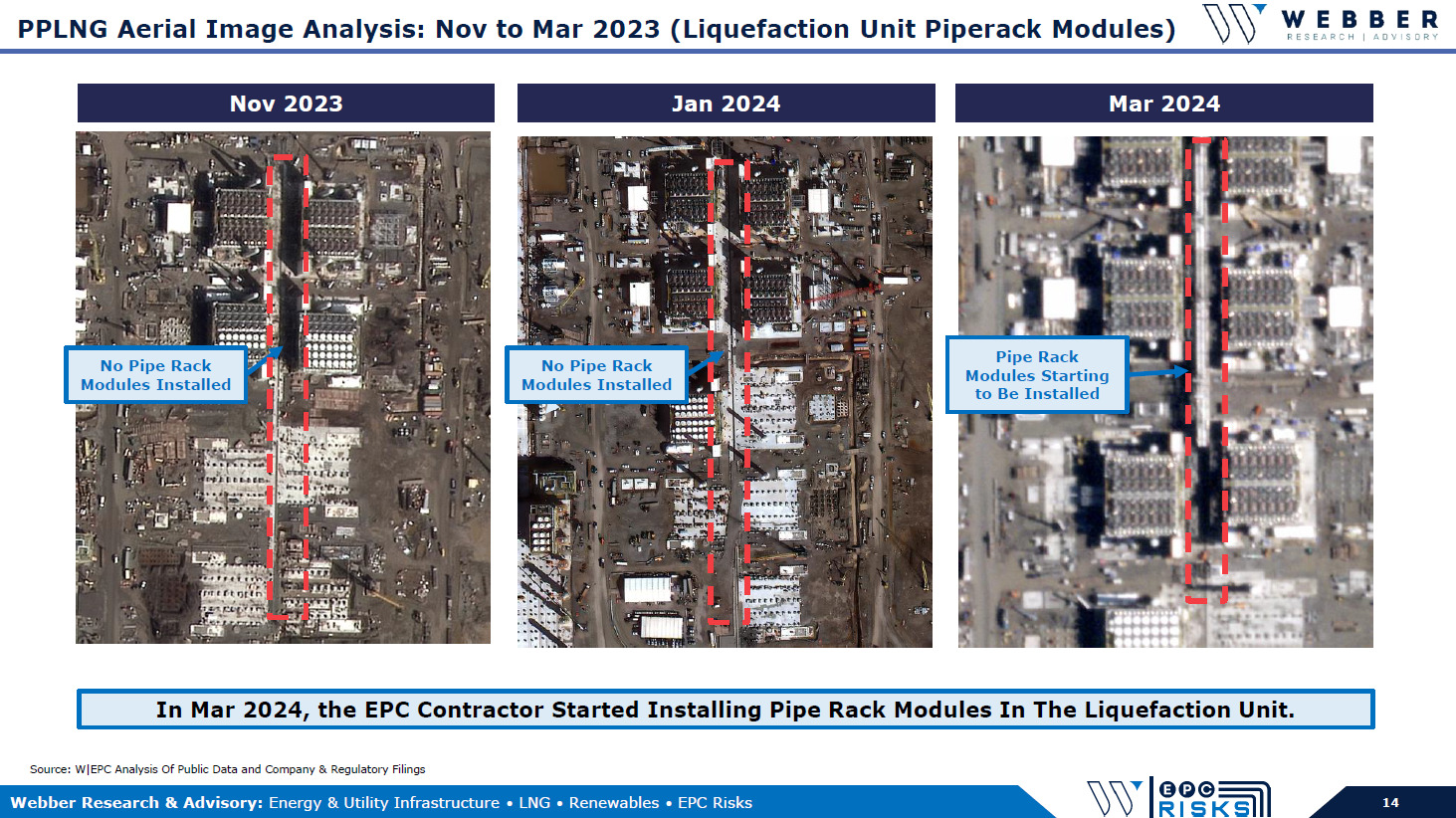

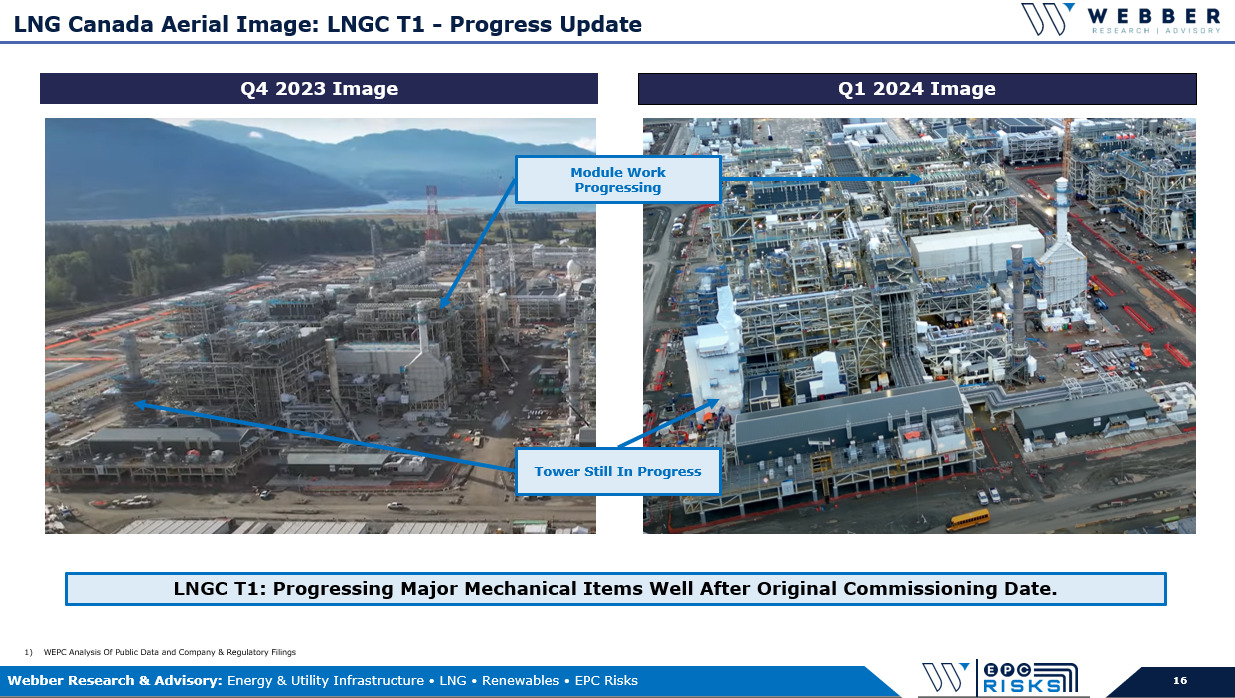

W|EPC: LNG Canada Project Update – Q124

To download this report, click here. If you’re already a Webber Research subscriber, click here. For access information, please contact us at [email protected], or [email protected].

W|EPC: Qatar LNG – North Field Expansion – Q124 Project Update

To download this report, click here. If you’re already a Webber Research subscriber, you can access this report via our research library. If you’re not a a subscriber, contact us at [email protected] or [email protected].

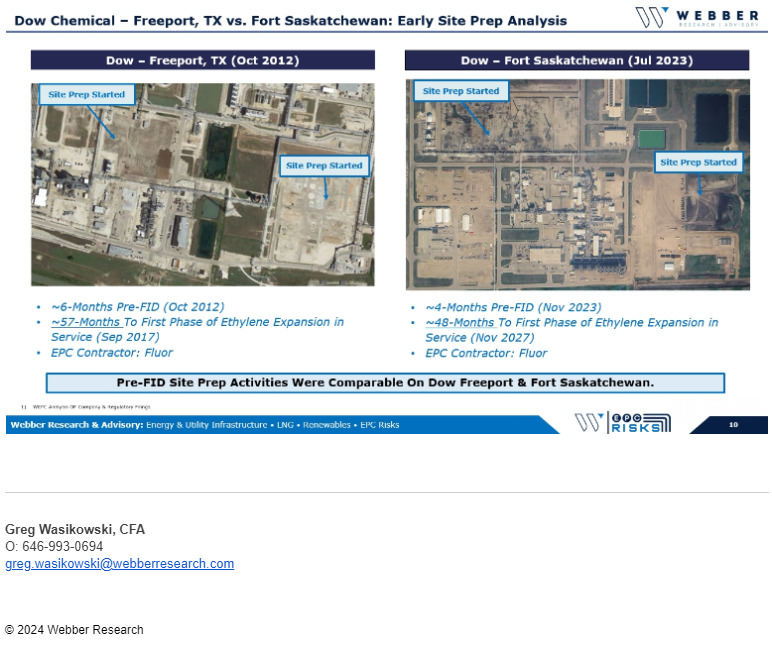

W|EPC: Dow Chemical’s $7B Net Zero Ethylene Cracker, Early Analysis – Q124

To download this report, click here. If you’re already a Webber Research subscriber, you can access this report via our Library. For access information, please contact Walter Lobo, or reach out to us at [email protected].

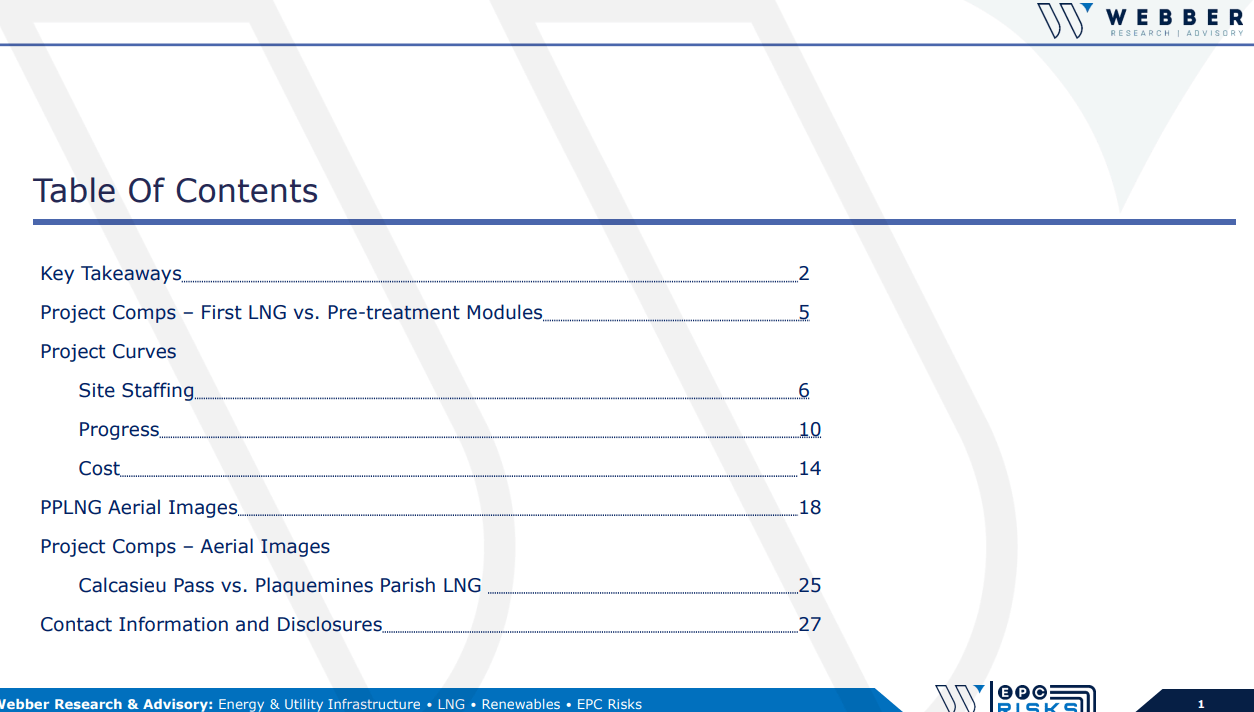

W|EPC: Plaquemines Parish LNG – Q124 Update

To download this report, click here. For access information, please contact us at [email protected], or at [email protected]

Webber Research Expands Platform with Addition of LNG Industry Veteran Kamran Javed

Read More

Financial Times: LNG pioneer Charif Souki leaves Tellurian with $8mn after ousting

https://www.ft.com/content/1b2e7fed-28c8-4c01-9302-63007d8276bd

Read More

Webber Research & Advisory Co-Founder Highlighted Among The 30 Leaders Driving Energy Transition In Shipping

Read More

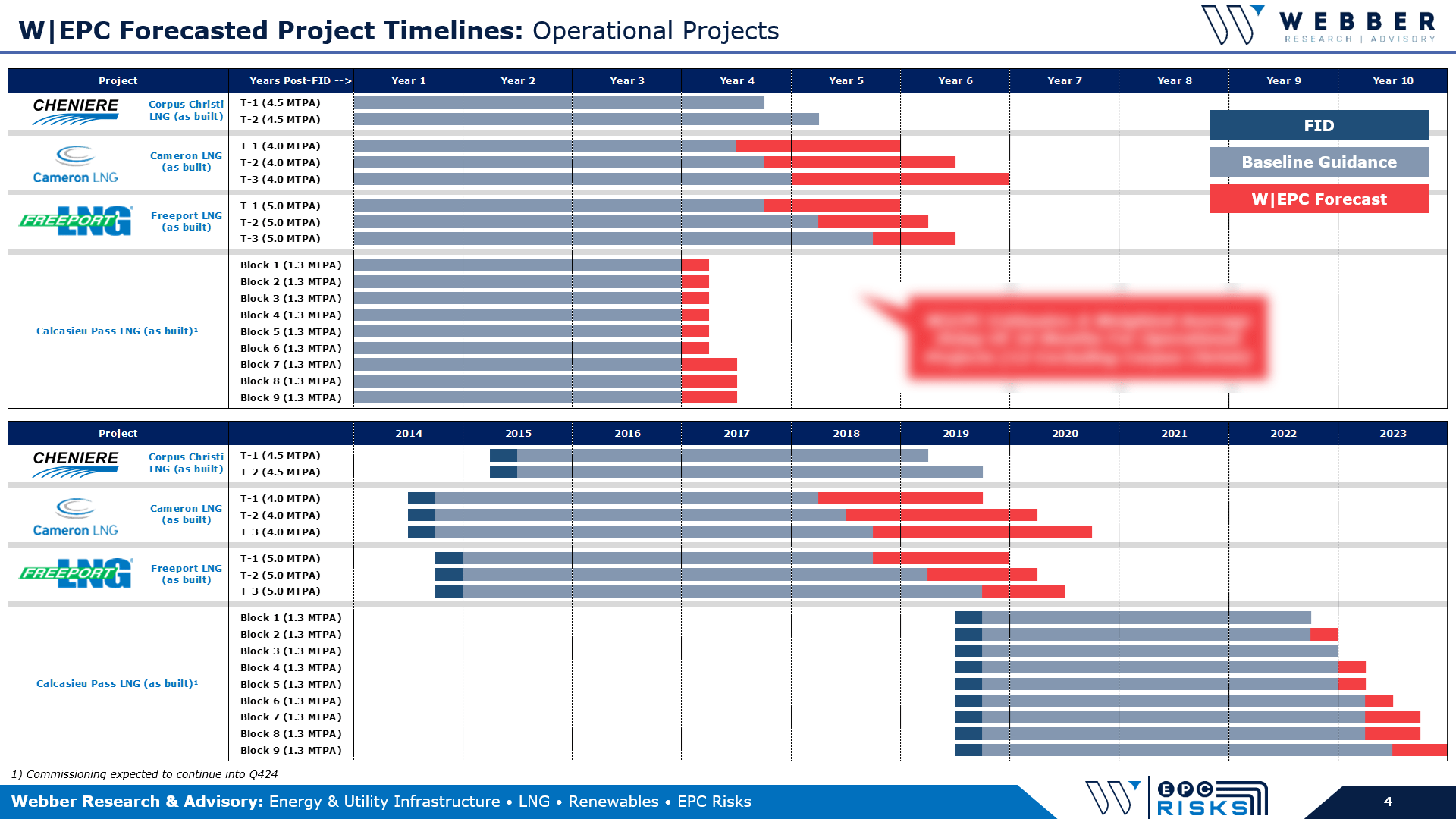

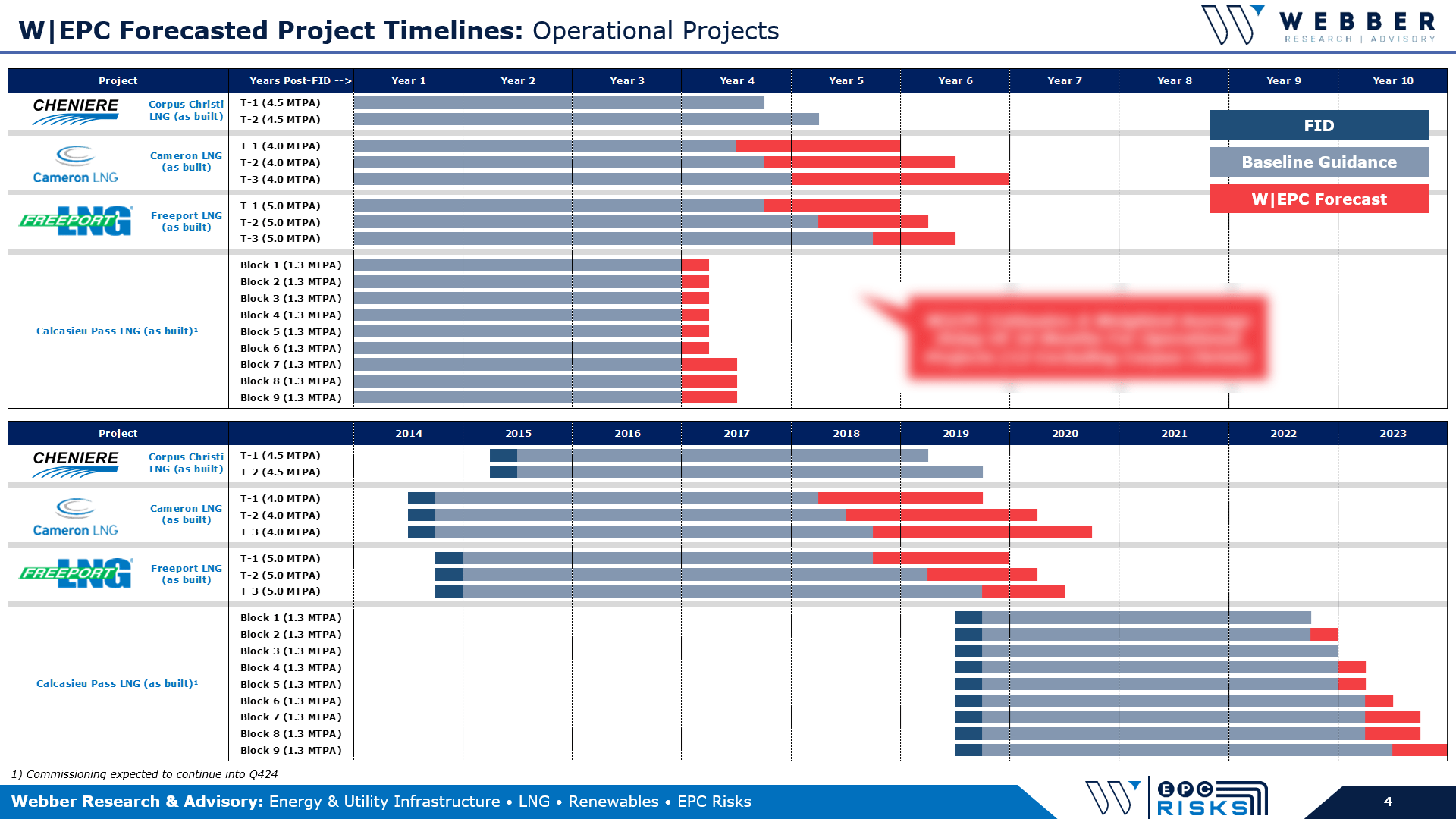

W|EPC: Forecasted LNG Project Timelines – Q423 Update

If you’re a current Webber Research subscriber, you can click here to access this presentation in our library. If you’re not yet a subscriber, please contact us at Walter Lobo for access information. To download this presentation, click here.

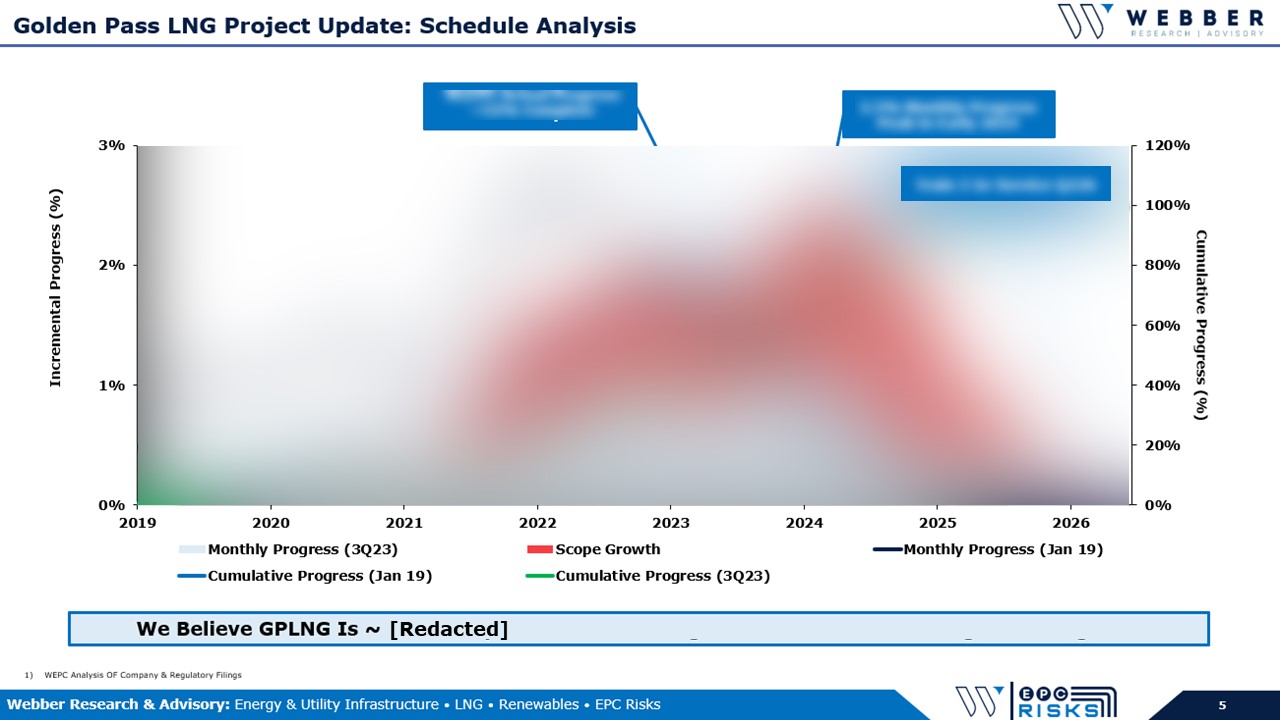

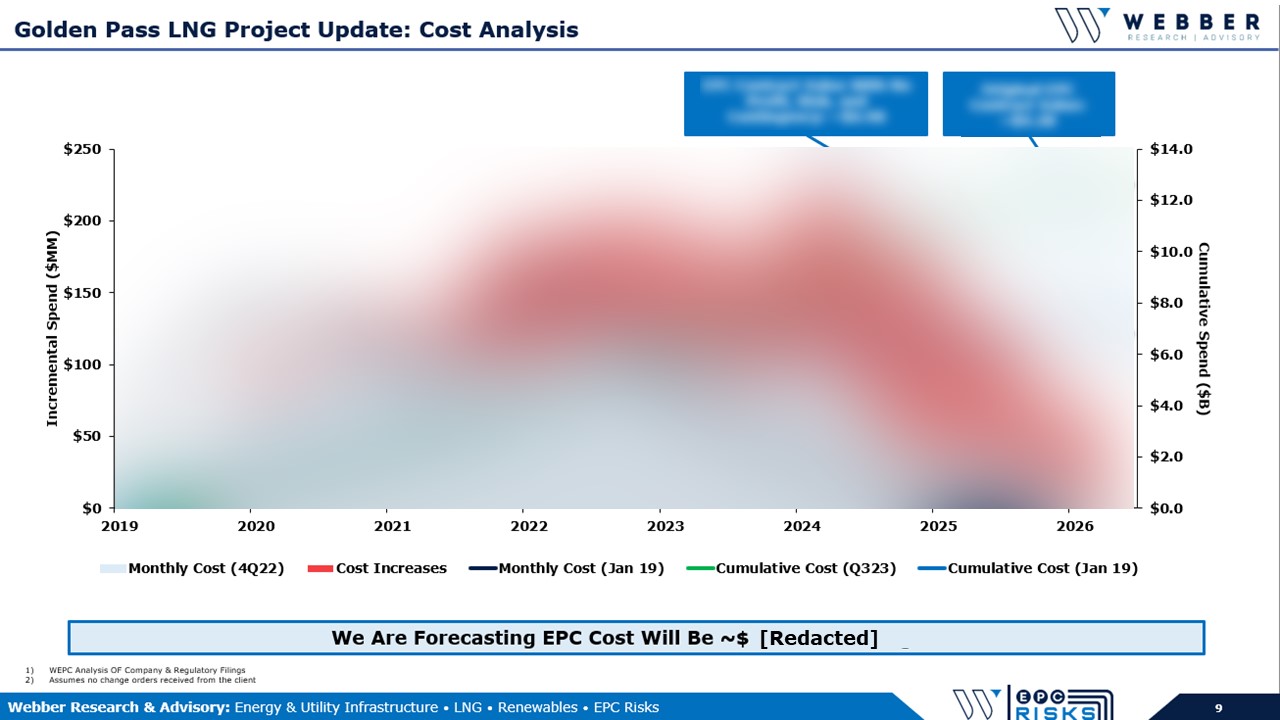

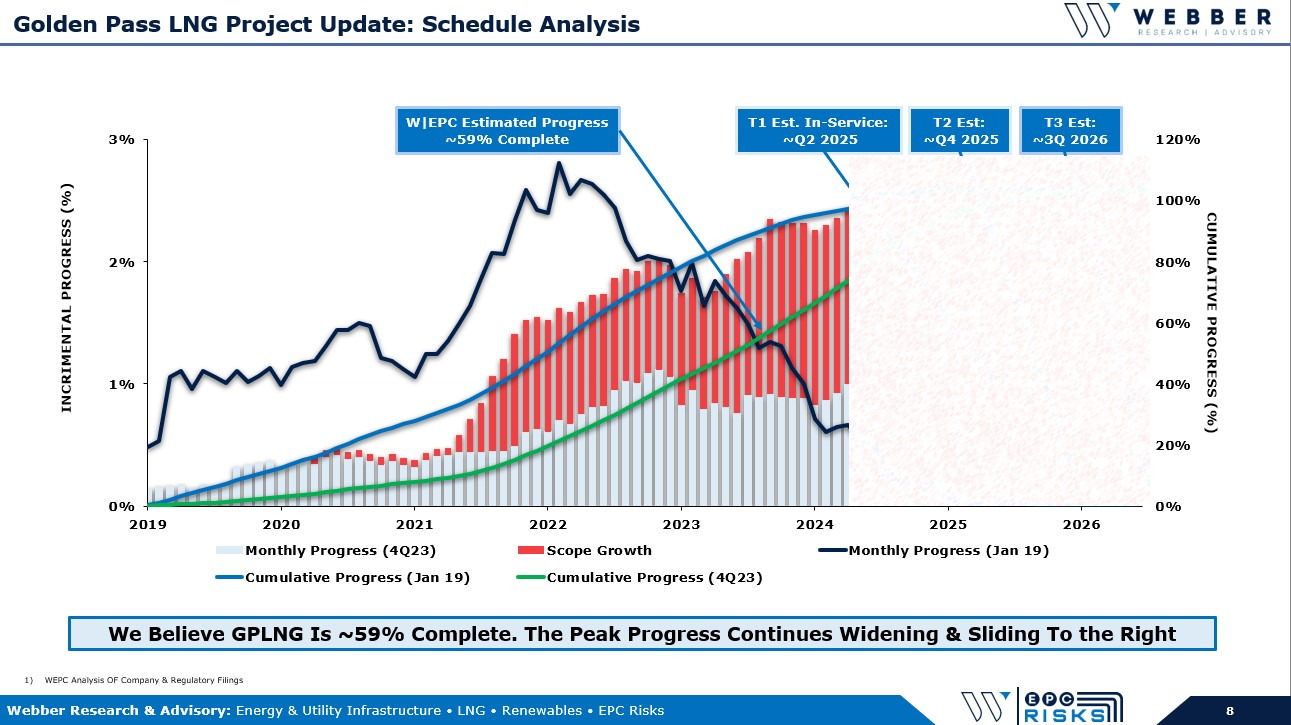

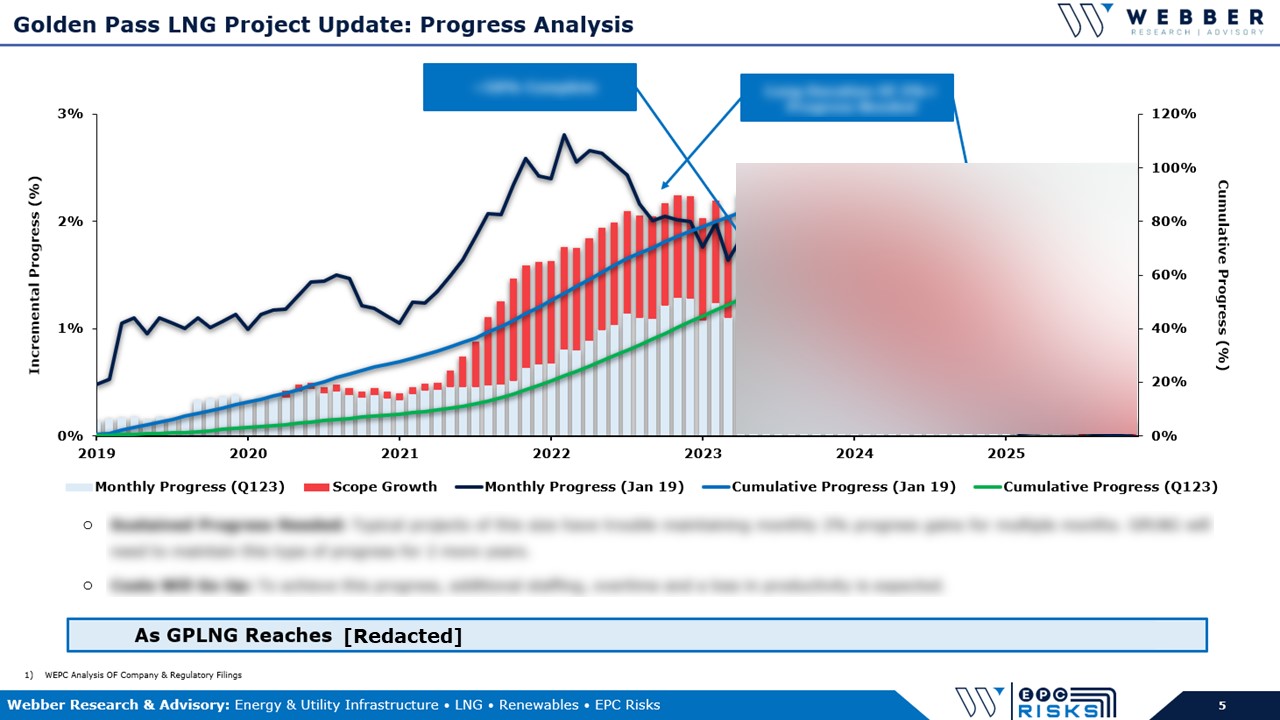

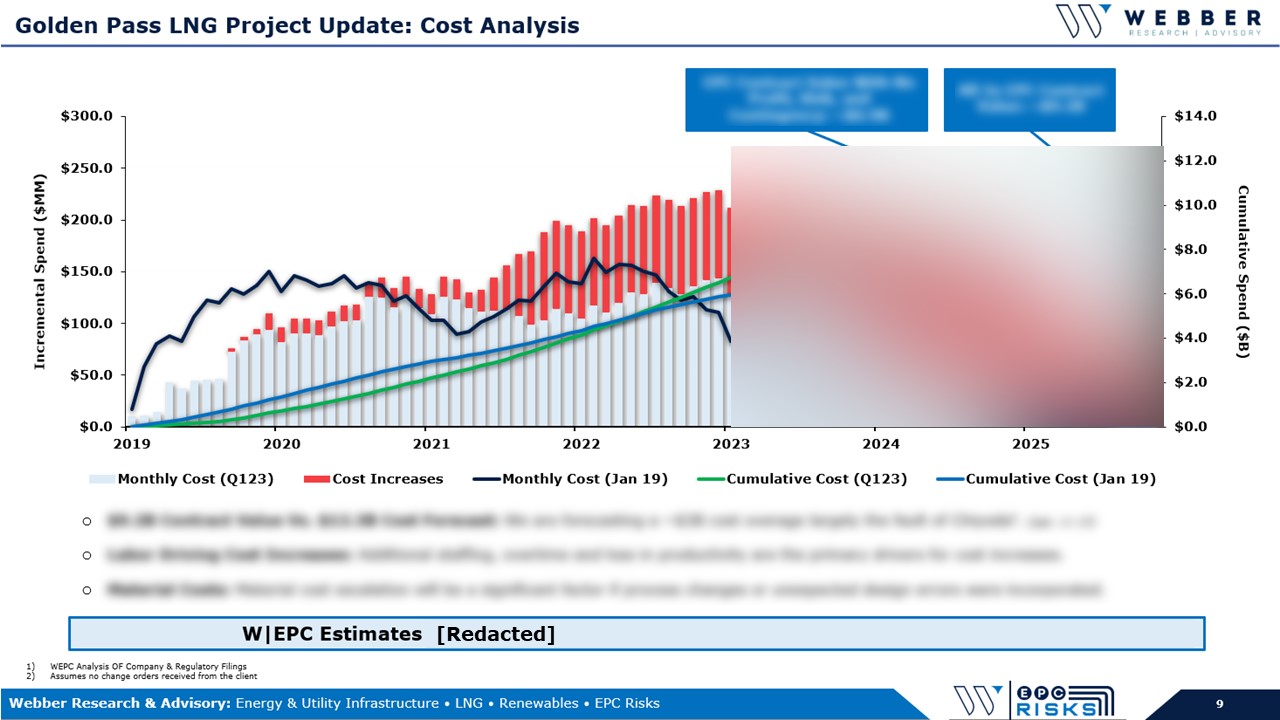

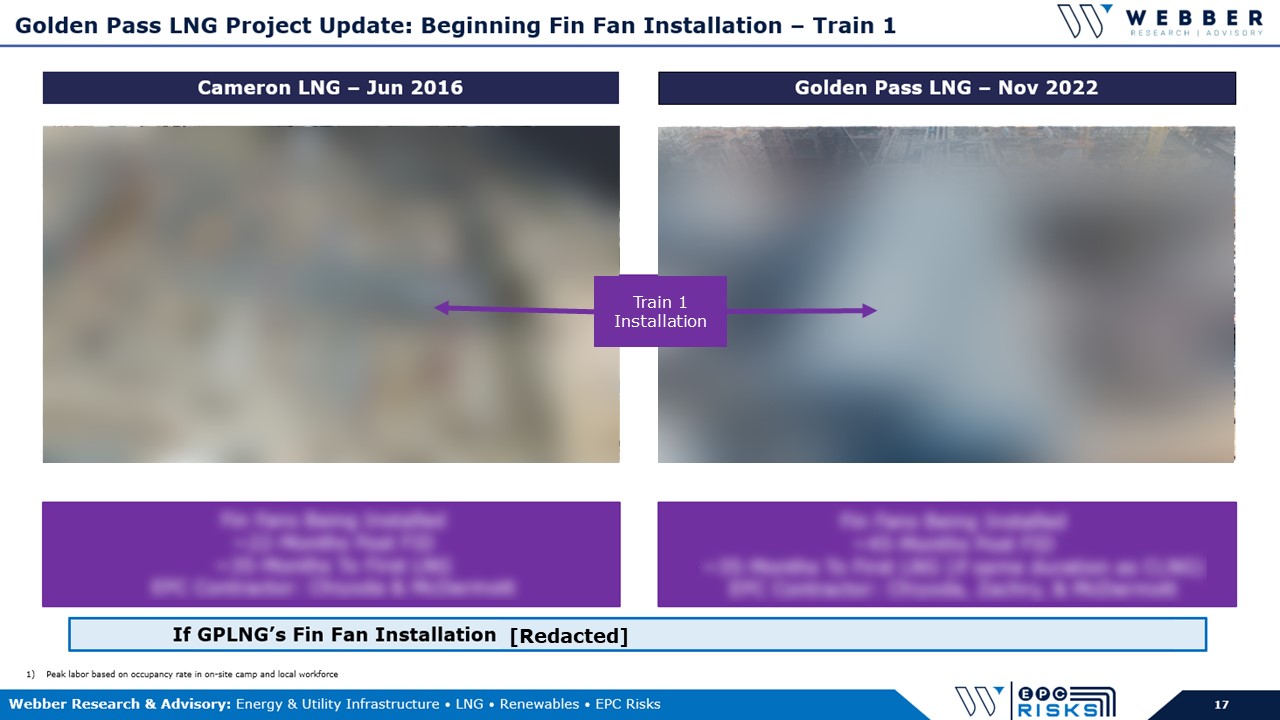

W|EPC: Golden Pass LNG Project Update – Q423

If you’re already a Webber Research subscriber, this report is available via our research library. For access information, email us at [email protected]. To download this report, click here.

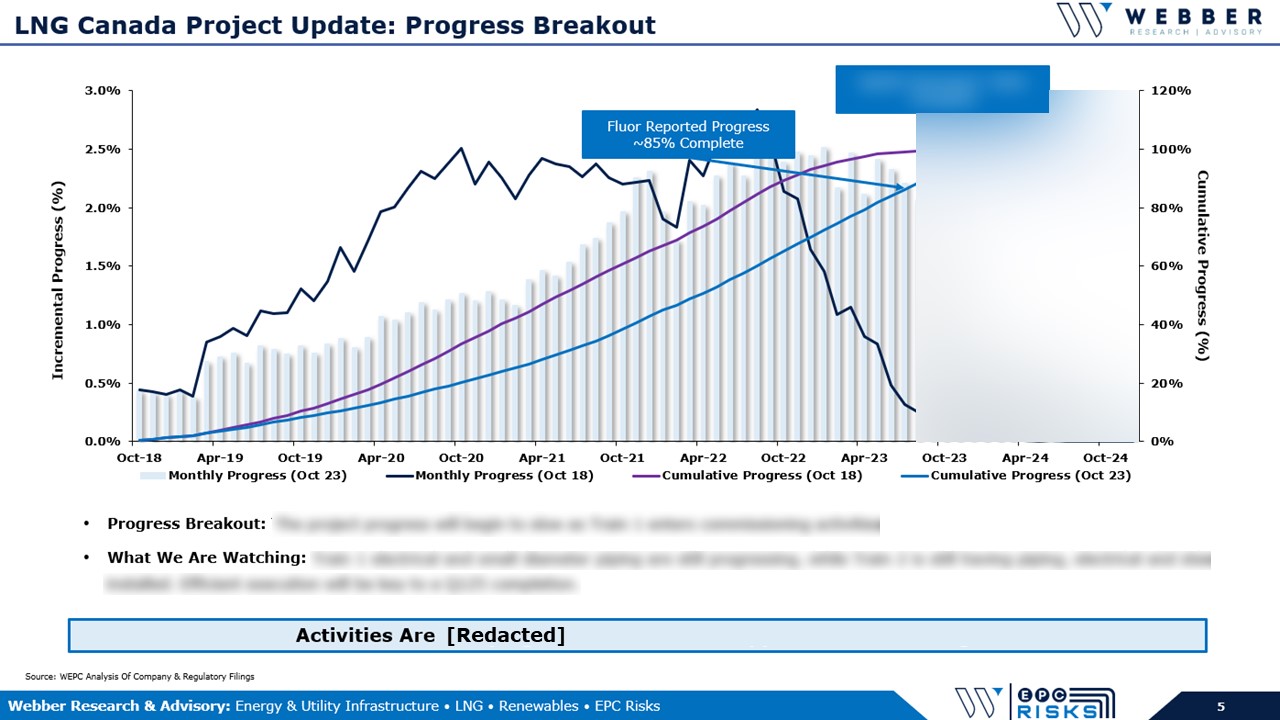

W|EPC: LNG Canada Project Update – Q423

If you’re already a Webber Research subscriber, this report is available via our research library. For access information, email us at [email protected]. To download this report, click here.

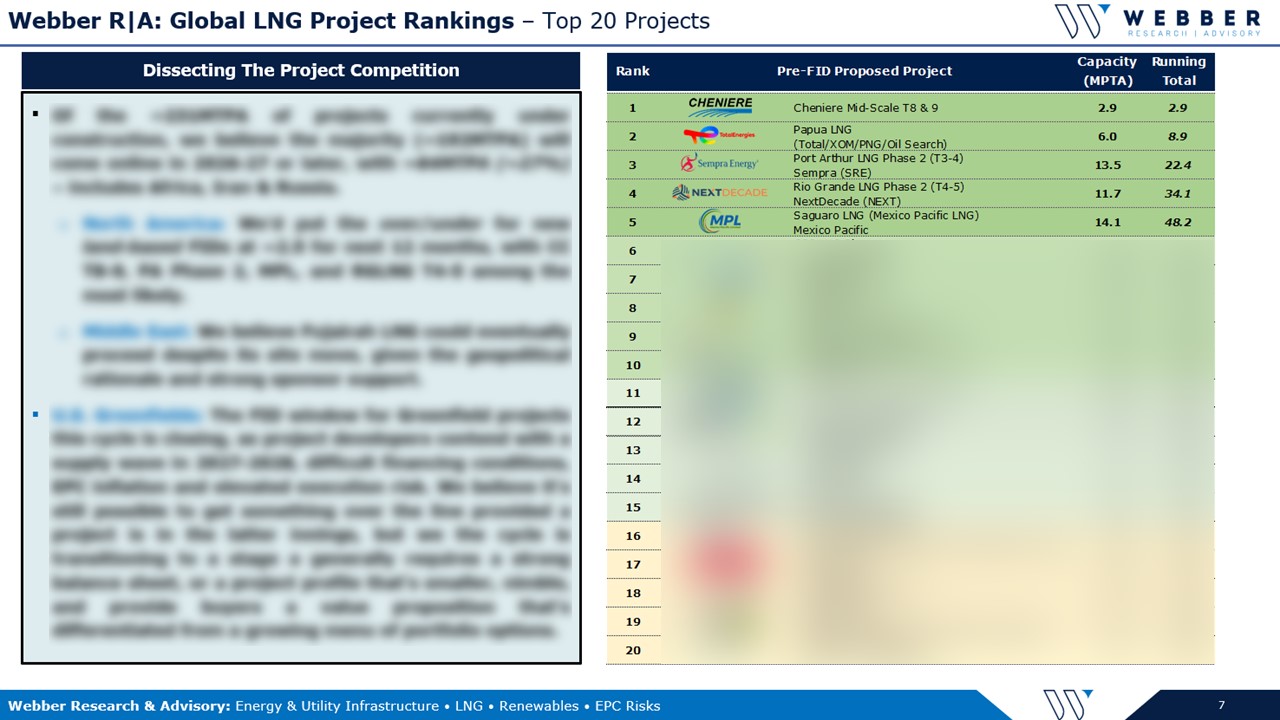

Webber Research: Global LNG Project Rankings & S/D Model Refresh – Q423

If you’re already a Webber Research subscriber, this report is available via our research library. For access information, email us at [email protected]. To download this report, click here.

Read More

W|EPC: Sempra’s Costa Azul (ECA) Phase 1 Project Update – Q423

If you’re already a Webber Research subscriber, this report is available via our research library. For access information, email us at [email protected]. To download this report, click here.

Webber Research: Fireside Chat Series – CoolCo LNG CEO Richard Tyrell, Thurs 9/28 @ 11am EST

Webber Research: Fireside Chat Series – NextDecade (NEXT) CEO Matt Schatzman, Tues. 08/08 @11AM EST

FreightWaves: Corporate governance in shipping

https://www.freightwaves.com/news/shipping-corporate-governance-whos-been-naughty-or-nice

Read More

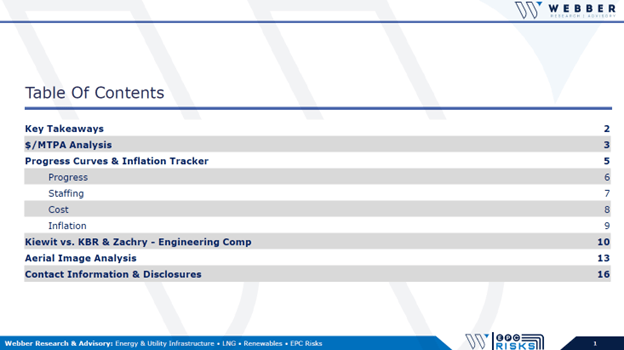

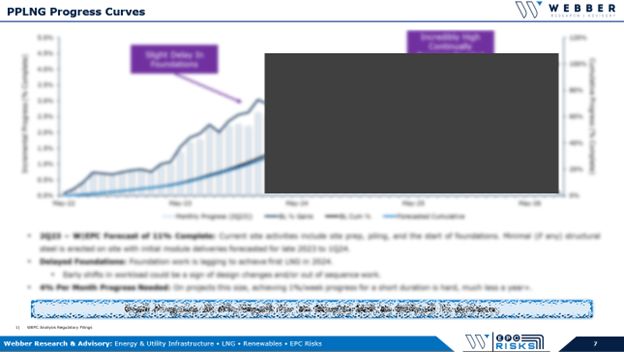

W|EPC: Venture Global’s Plaquemines Parish LNG – Q323 Project Update

If you’re already a Webber Research subscriber, you can access this report via our W|EPC Research Library. If you’re not yet a subscriber and would like to download this report, click here. For access or subscription information, email us at [email protected].

Read More

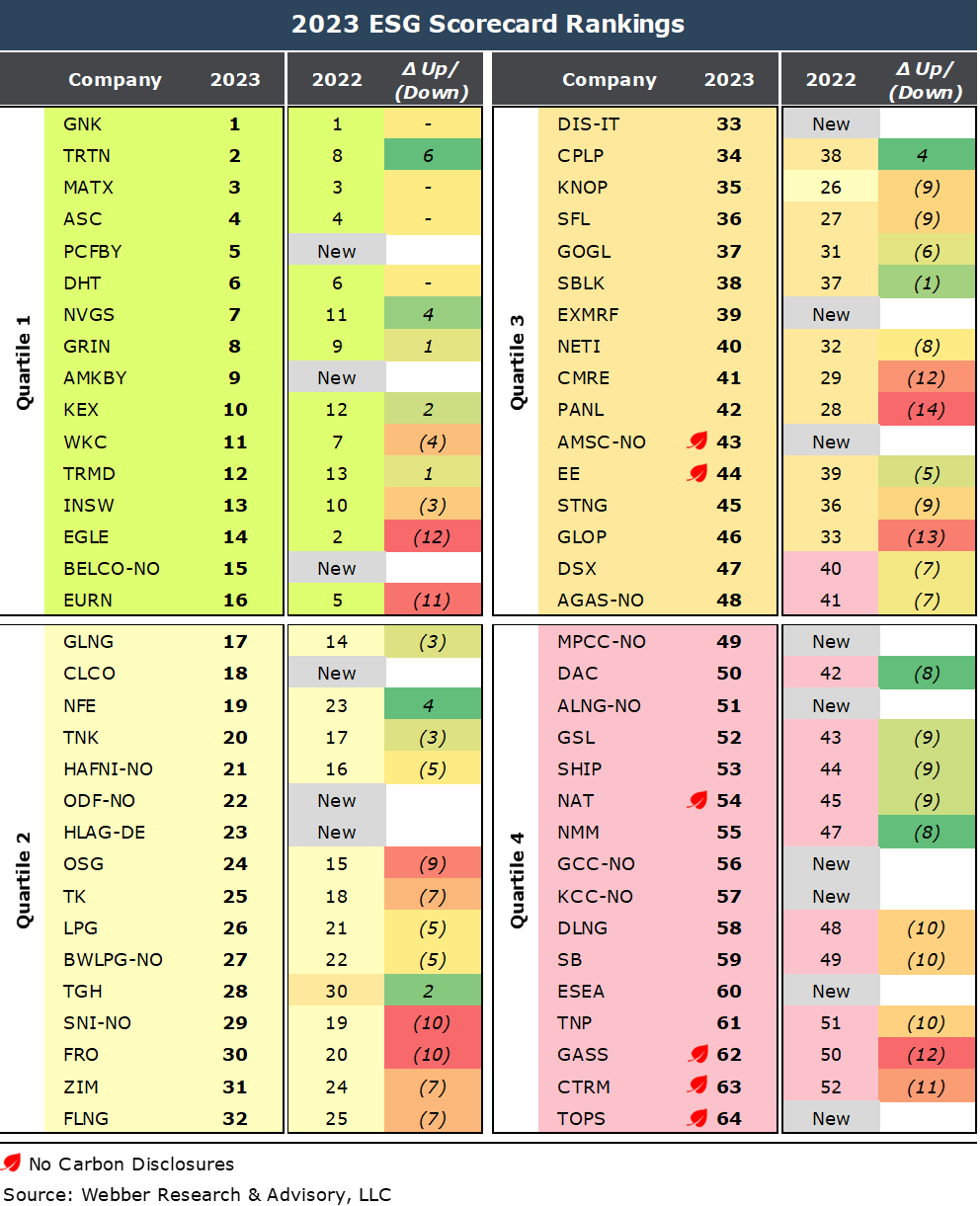

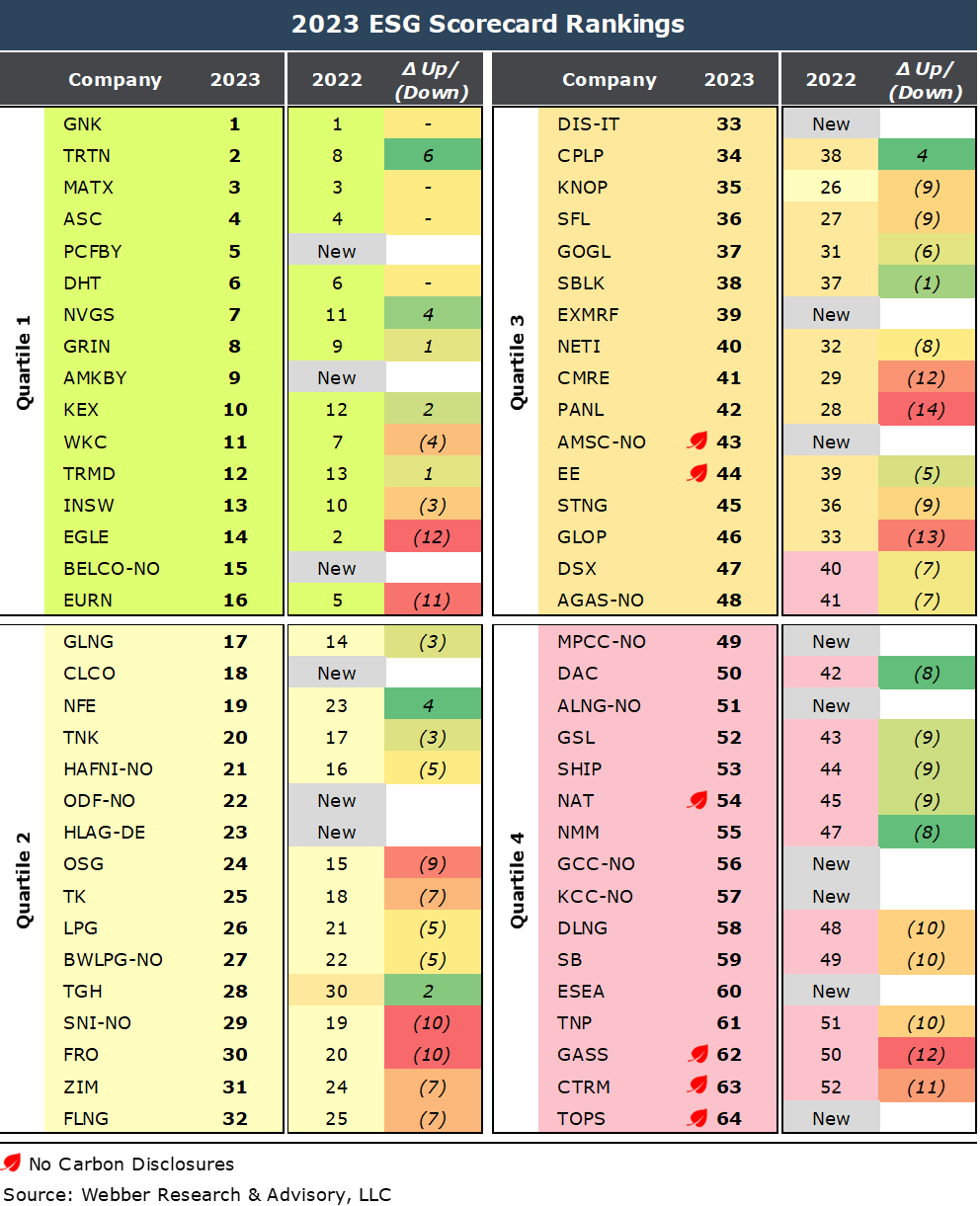

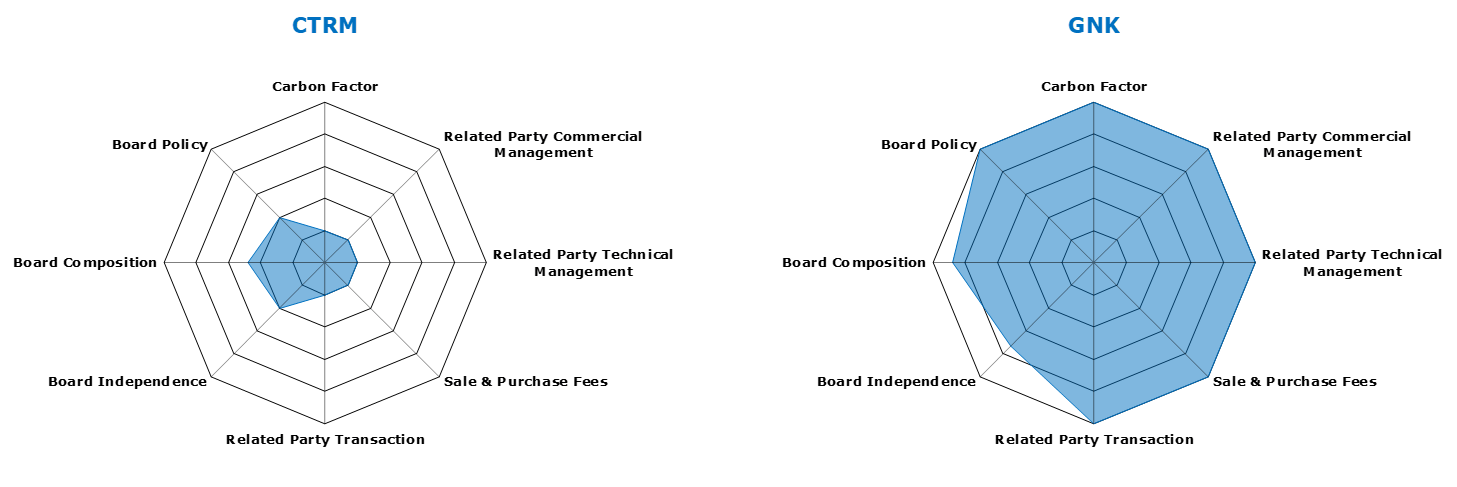

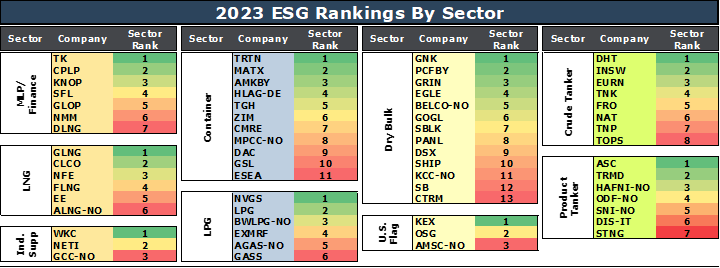

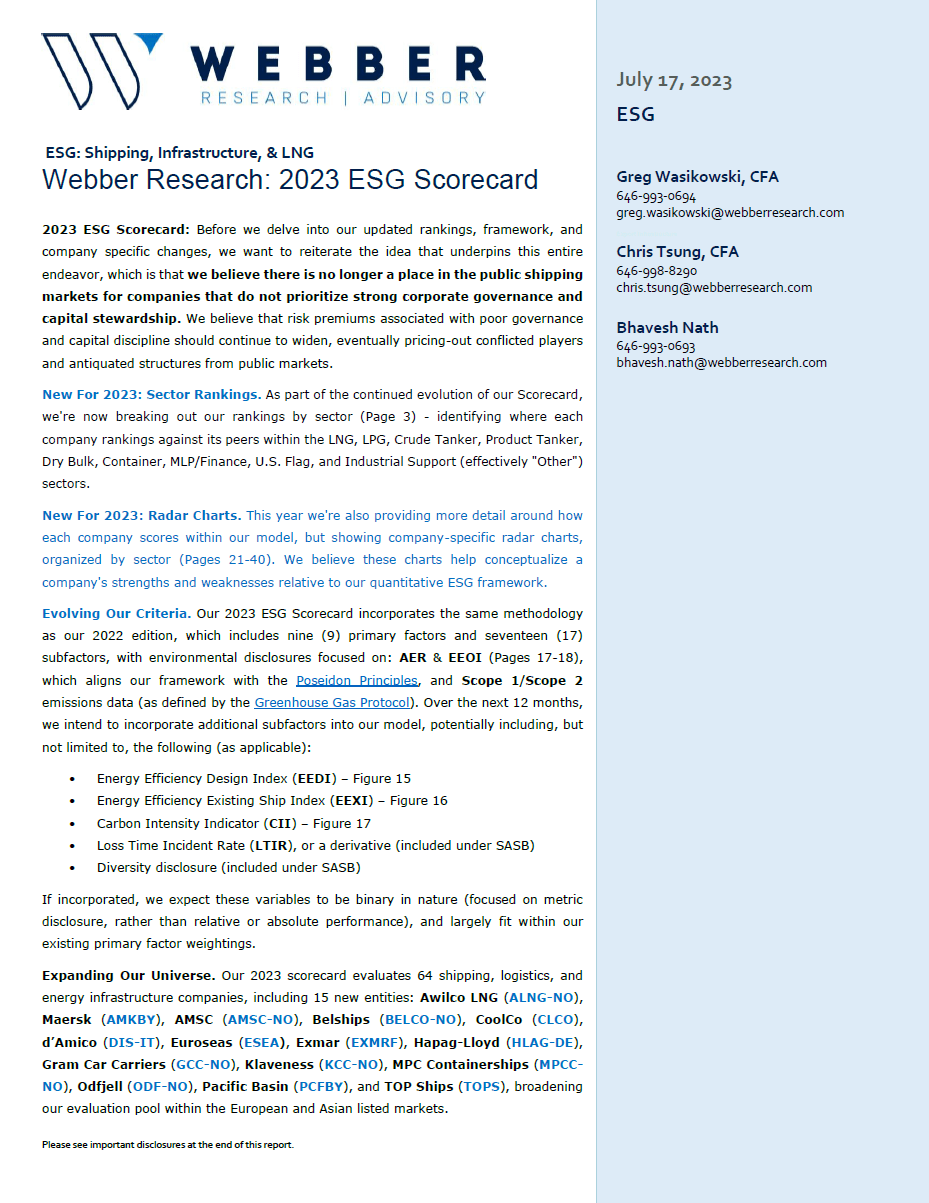

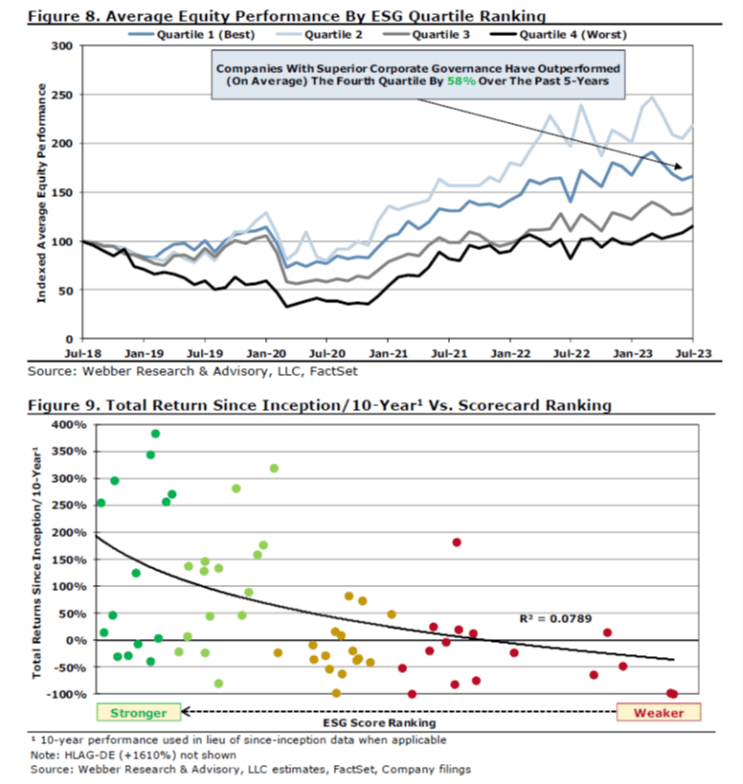

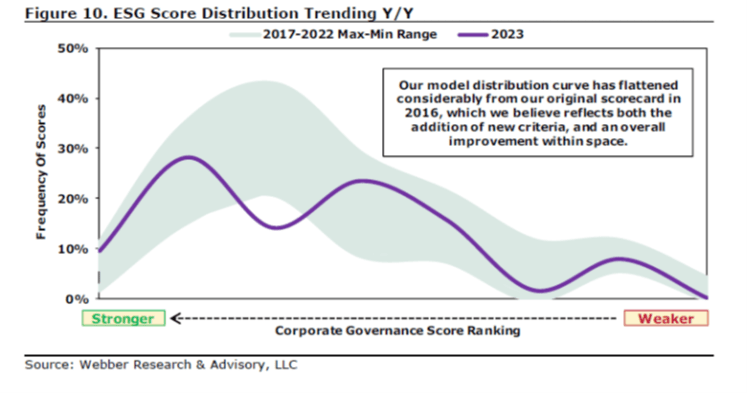

Webber Research: 2023 ESG Scorecard

If you’re a current Webber Research subscriber, you can click here to access this presentation in our library.

If you’re not yet a subscriber, please click here to download the full report, or email us at [email protected] for access information.

New for 2023: Company Specific Model Displays

New for 2023: Sector Specific ESG Rankings

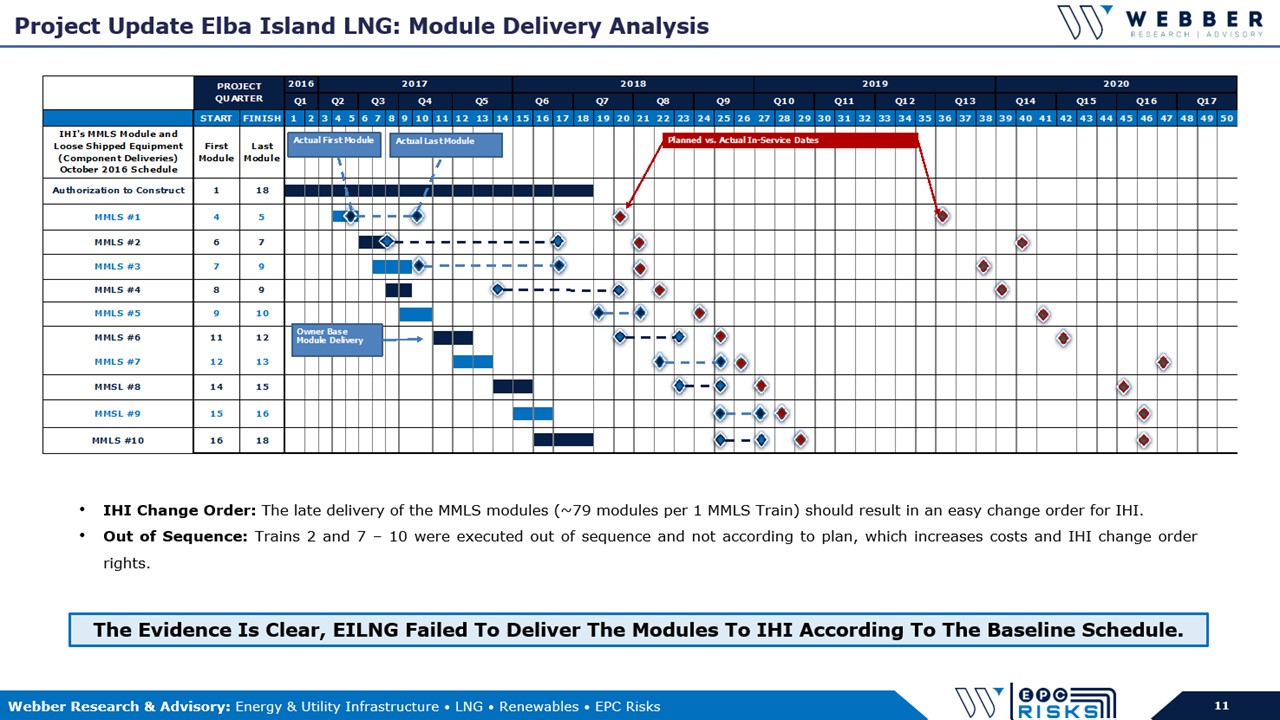

W|EPC: Kinder Morgan’s Elba Island – Analyzing ~$350MM In Project Claims vs. EPC LSTK Wraps (May 2023)***

For access information, contact us at [email protected] or at [email protected]. To download this report, please click here.

Webber Research Fireside Chat Series: Kirby Corp (KEX) CEO David Grzebinski – Weds, May 10th @10am EST

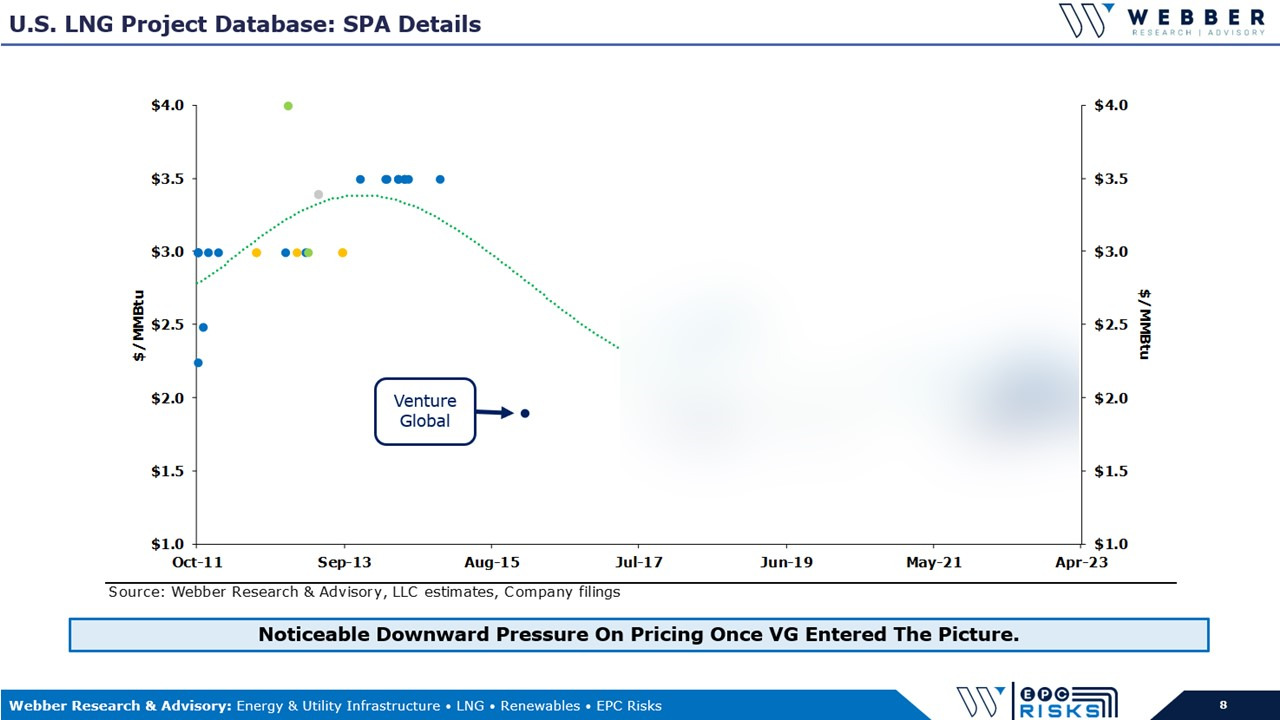

Conference Call Replay: Changes To DOE’s Non-FTA Process: Impact on Global LNG

For replay information, please reach out to [email protected]

W|EPC: DOE Non-FTA Reg Changes & LNG Project Database Update Summary

For access information, contact us at [email protected] or [email protected]. To download this report, please click here.

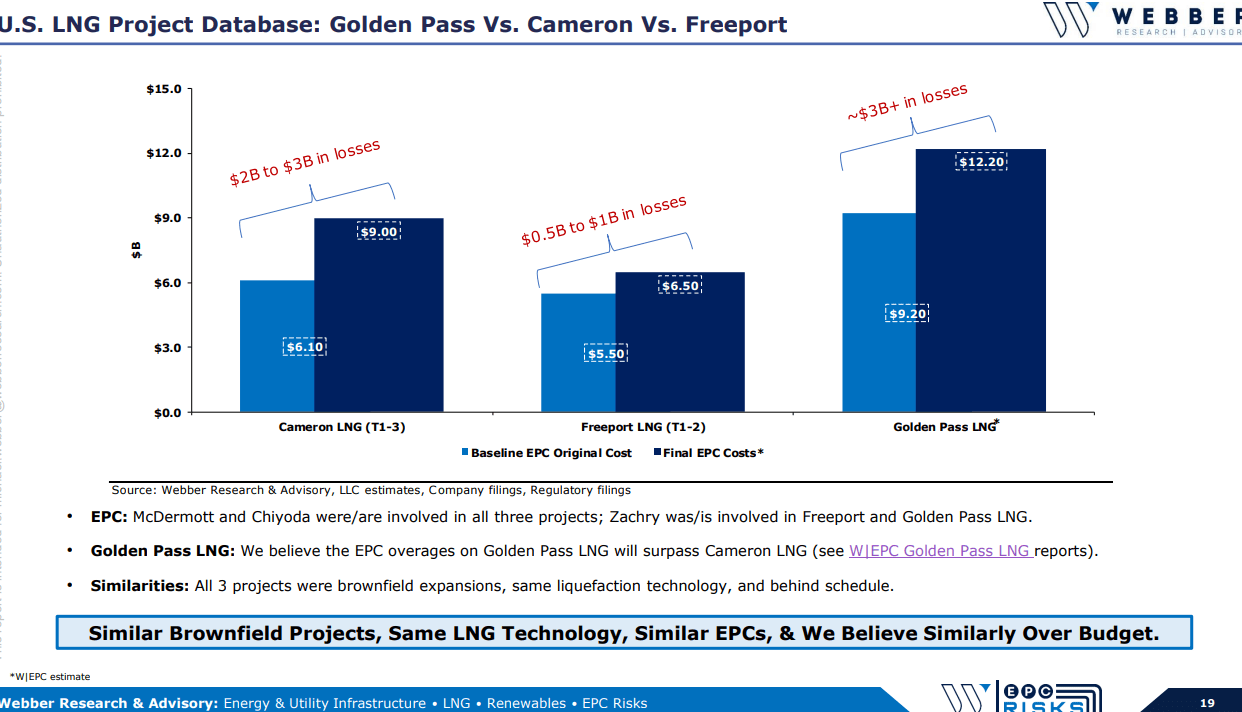

W|EPC: Golden Pass LNG – Project Timeline & Cost Estimates, Satellite Image Review – Q223

For access information, contact us at [email protected] or at [email protected]. To download this report, please click here.

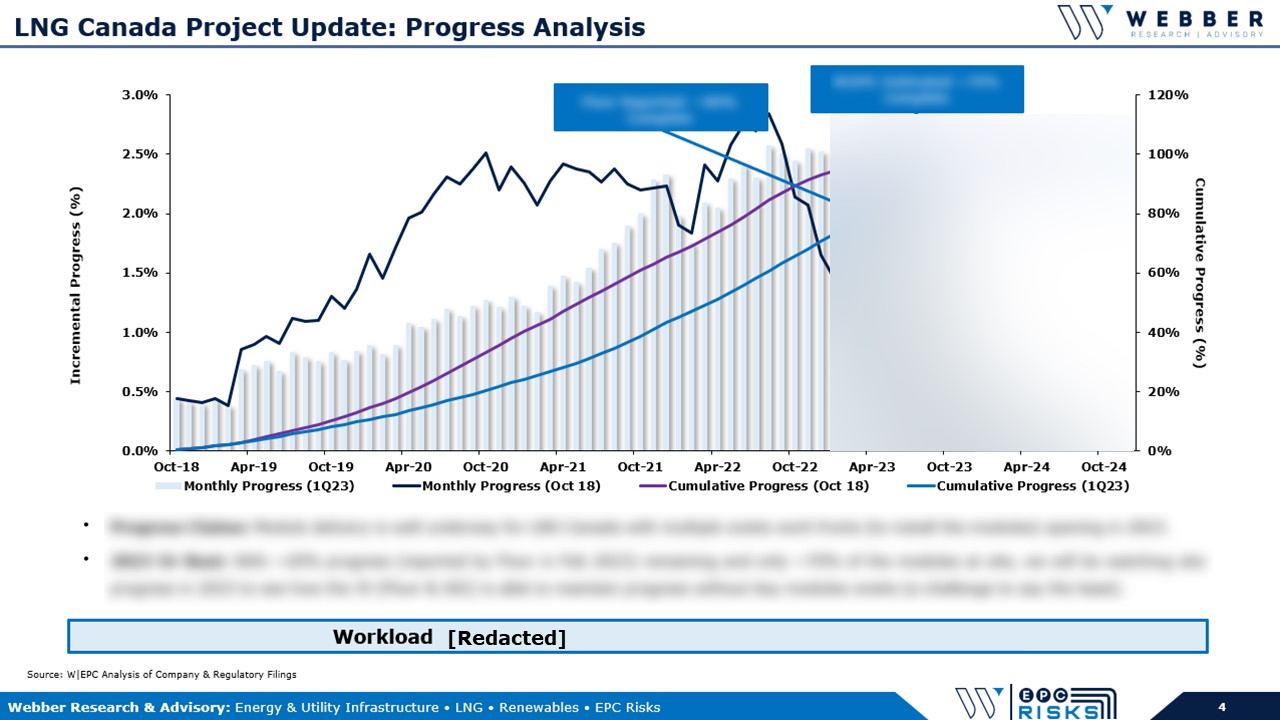

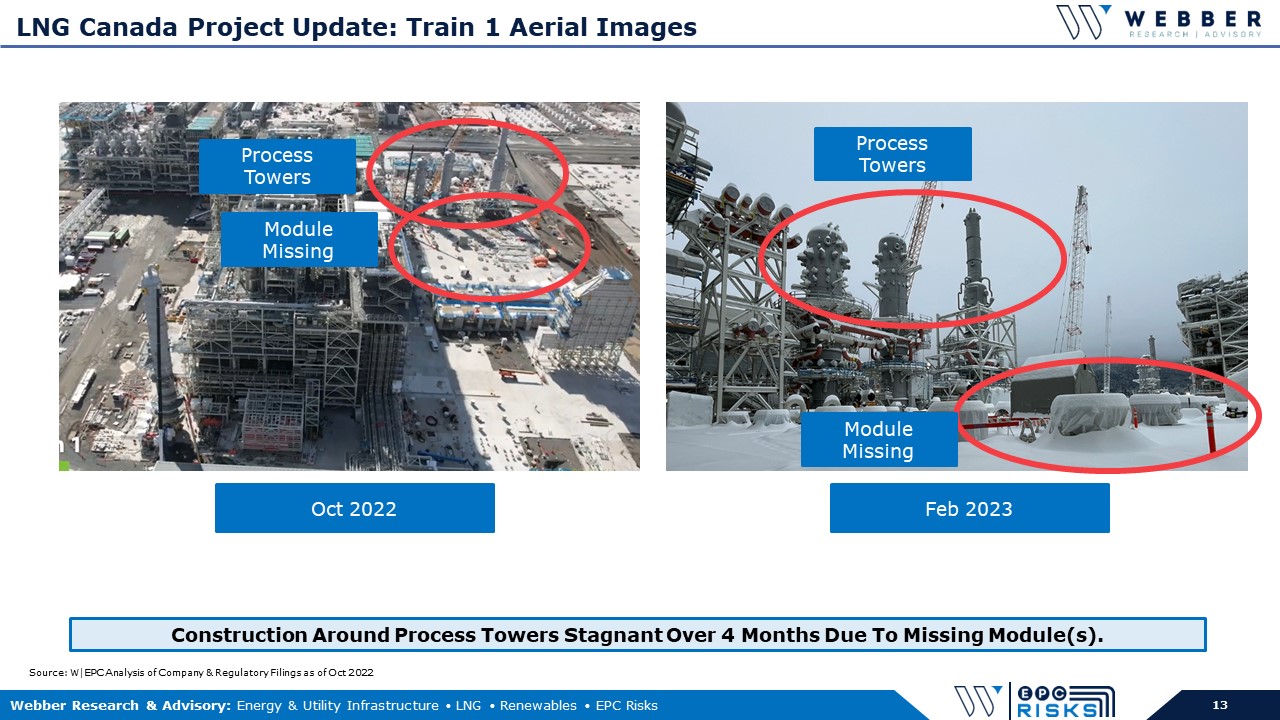

W|EPC: LNG Canada Project Update Q123 – Data & Satellite Image Review

For access information, contact us at [email protected] or at [email protected]. To download this report, please click here.

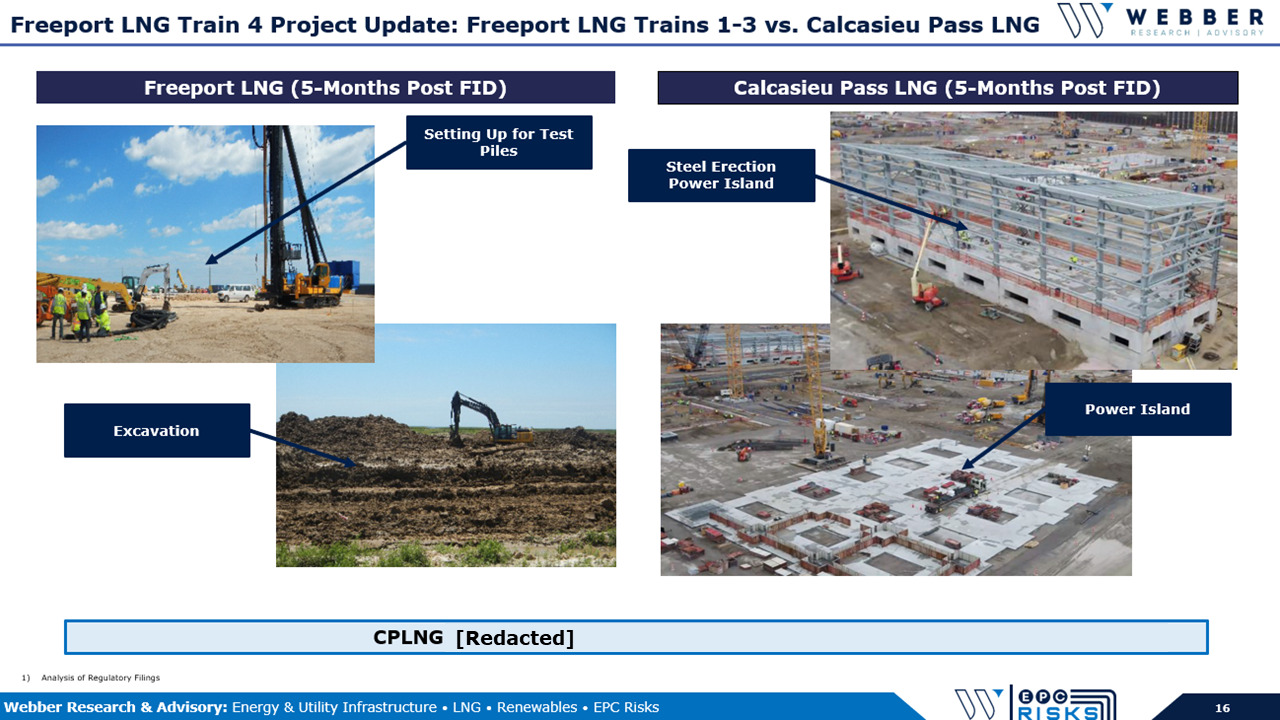

W|EPC: Freeport LNG Train 4 – Project Update Q123

For access and subscription information, please email us at [email protected], or at [email protected]. To download this report, click here.

Webber Research Recognized by Institutional Investor As Leading Boutique Research Firm – 2022 All America Research Team

Read More

client log-in

client log-in