OPEC+ Fallout: Contagion Everywhere From Looming Price War…

***From Sunday 3/8***

For access information please email us at [email protected]

Tankers Among Few Eventual Beneficiaries

- Impact On Tankers: Page 1, 3-5

- The 2015 Tanker Comp, Similarities, Implied Upside Pages 3-4

- Impact On LNG Developers (LNG, TELL, NEXT, GLNG, NFE) Pages 2-3

- Historical & Implied Equity Correlations To Crude Vol Page 3

- NAVs: Current, Mid-Cycle to Trough Range Page 3

- OPEC+ Background Page 3, 6

This Is Going To Hurt: On Friday (3/6) talks between OPEC and its OPEC+ allies (Russia) over a corona-related production cut collapsed, sending oil prices down with it (Brent and WTI down 9% and 10%, respectively on Friday). While the lack of OPEC+ support for crude prices was enough to rattle markets, what’s transpired since – the relationship between the Saudis and the Russians rapidly devolving into what looks like an all-out pricing war – has the potential to reshape energy markets for years to come, and will likely take the mantle as the most value-destructive policy shift in decades.

Exogenous Demand Shock, Meet Exogenous Supply Shock. As noted below, Aramco has already come out with discounted crude prices (OSPs) on the back of the meeting, and is reportedly speaking to a potential production ramp from its current 9.7mbd, to well above 10mbd, and could even reach a record of 12mbd. Again – that would be additional supply into a market that’s already oversupplied amid global efforts to contain the Coronavirus (nCoV) weighing on demand. While the Russians have less available swing production, what they do have will be moving in the wrong direction as well, as they look to grab share from U.S. Shale producers.

How Does This Impact Our Universe:

Tankers: We’ll Call It Mixed… (And That’s One Of The Few Bright Spots). Once the dust settles the tanker group, including FRO, DHT, EURN, ASC, etc, should be one of the few actual overproduction beneficiaries as: 1) tanker activity and rates are generally positively levered to production volumes (including overproduction), and 2) we expect to see floating storage, both economic (as the front end of the crude forward curve collapses (already in progress) and…….continued on Pages 3-5

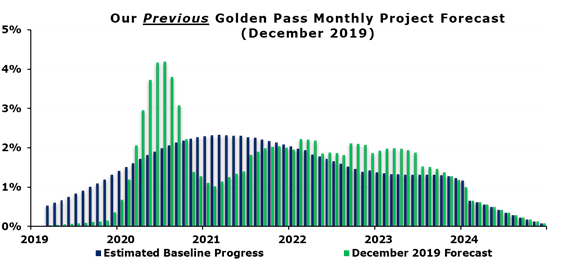

Most Relevant Tanker Comp: 2015, after OPEC failed to respond to falling crude prices. While overcapacity and falling crude prices ravaged the rest of the energy markets, Crude Tanker rates (VLCCs) averaged $65K/day (Figure 4) – a level not reached since 2008, up 116% y/y and the firmest level in nearly a decade. What would 2015 day rates mean for current tanker stocks? If we replaced our current 2020 rate decks with the 2015 average rates….continued on page Pages 2-3

Everything Stops. If nCoV brought the near-term prospects of new LNG business to a particularly slow crawl, we believe the OPEC+ blow up will bring it to a full stop, at least until the dust settles. For companies in the process of restructuring (like TELL).….continued on Pages 2-3

For access please email us at [email protected]

Read More

client log-in

client log-in