Webber Research: Fireside Chat Series – H2 Funding w/ Edward Rios – Commercialization Executive for the DOE Office of Energy Transitions

For access information, email us at [email protected], or at [email protected]

Read More

For access information, email us at [email protected], or at [email protected]

Read More

For access information, email us at [email protected], or at [email protected].If you’re already a Webber Research subscriber, click here.

Pages: 1-8

Read More

For access and subscription information, please email us at [email protected], or at [email protected]. To download this report, click here.

Read More

Preview Pages 1-18

Read More

https://www.ft.com/content/064437a4-2c60-4962-b722-d669d71e914a

Read More

Read More

Read More

Read More

https://www.twst.com/interview/despite-near-term-volatility-renewables-hold-long-term-promise

Read More

If you’re already a Webber Research subscriber, you can click here to access this presentation in our library. If you’re not yet a subscriber, please contact us at [email protected] for access information.

Read More

Please reach out to [email protected] for access information.

If you’re a current Webber Research subscriber, you can click here to access this presentation in our library. If you’re not yet a subscriber, please contact us at [email protected] for access information.

If you’re a current Webber Research subscriber you can click here to access this presentation in our library.

If you’re not yet a subscriber, please contact us at [email protected] for access information

https://www.e1marine.com/ardmore-turns-to-the-man-who-can-see-round-corners/

Read More

For access information, please email [email protected]

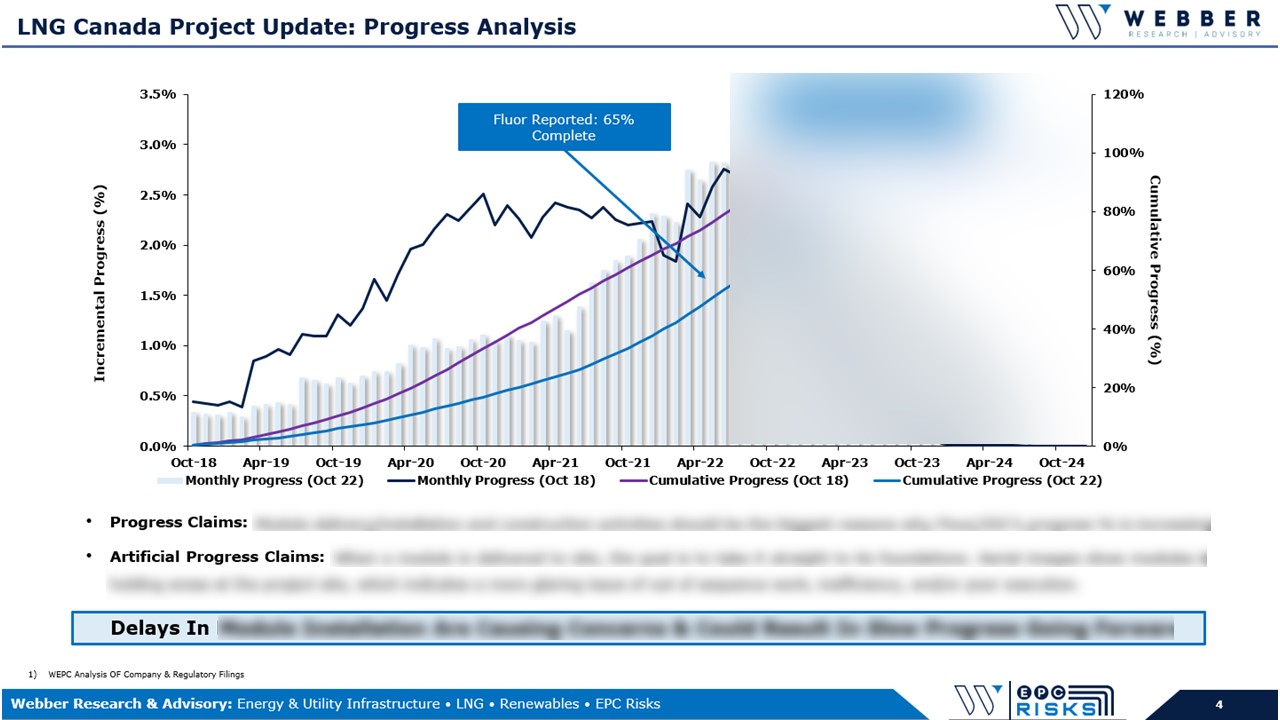

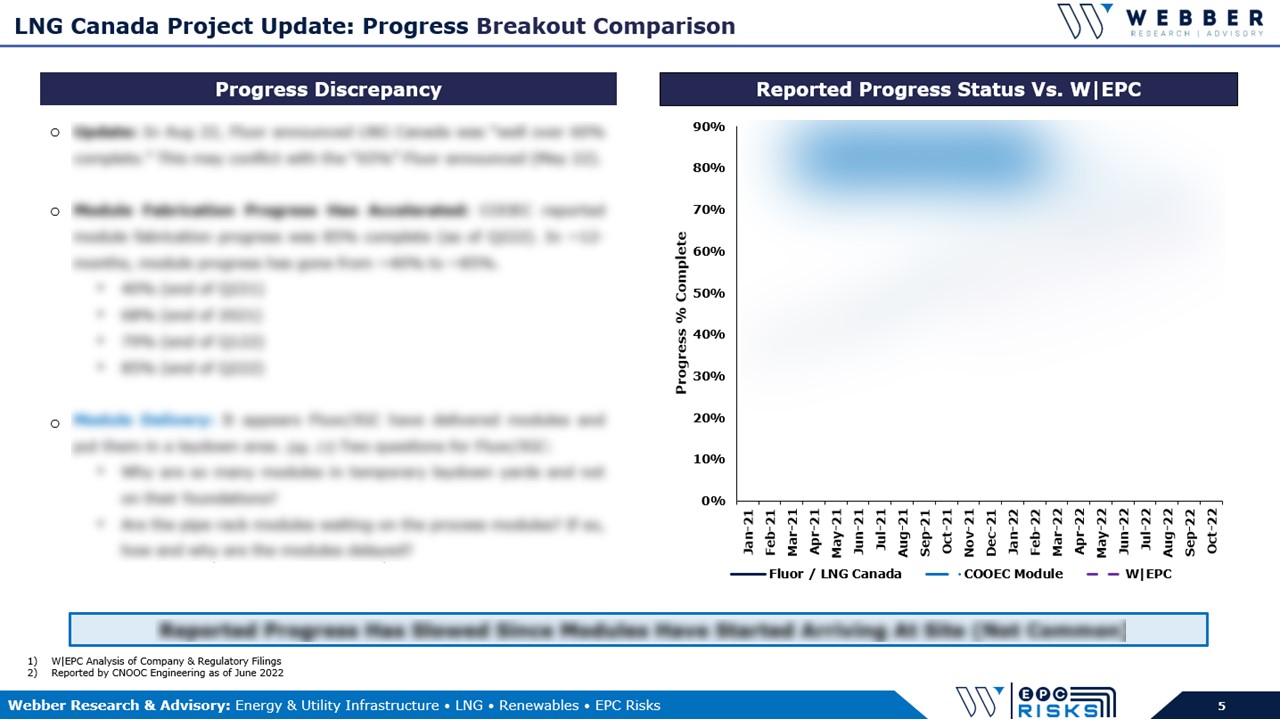

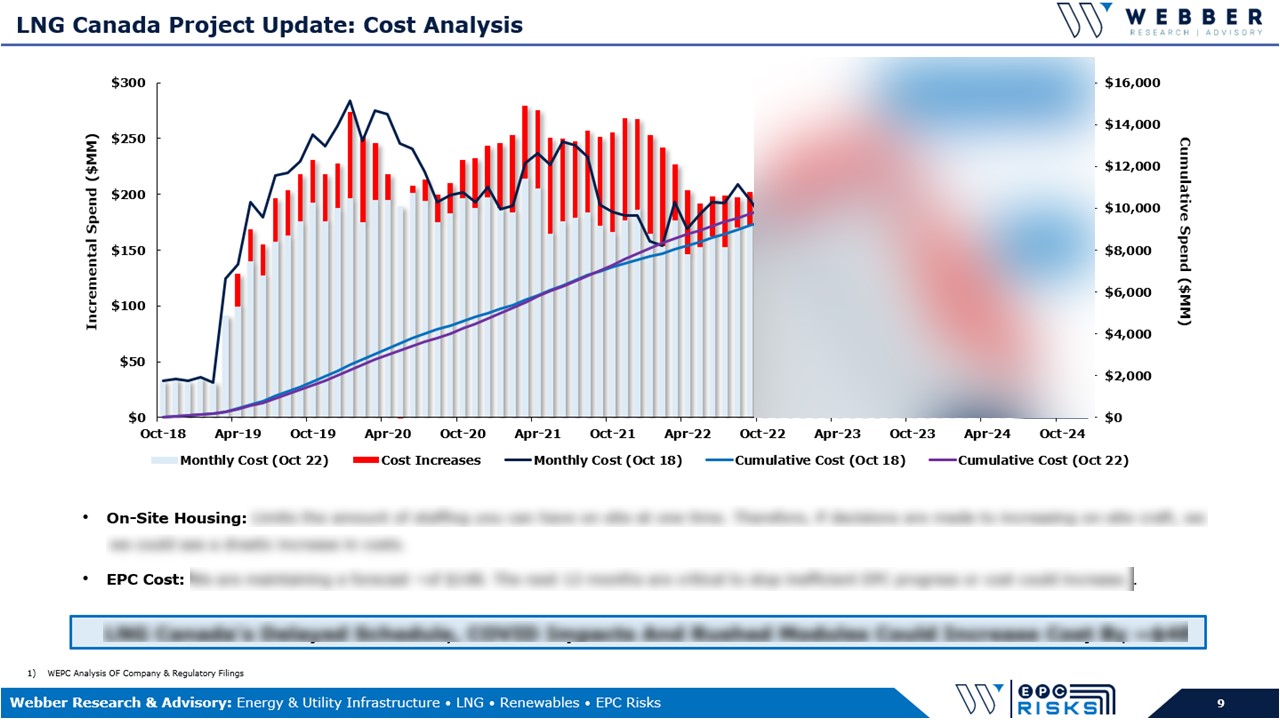

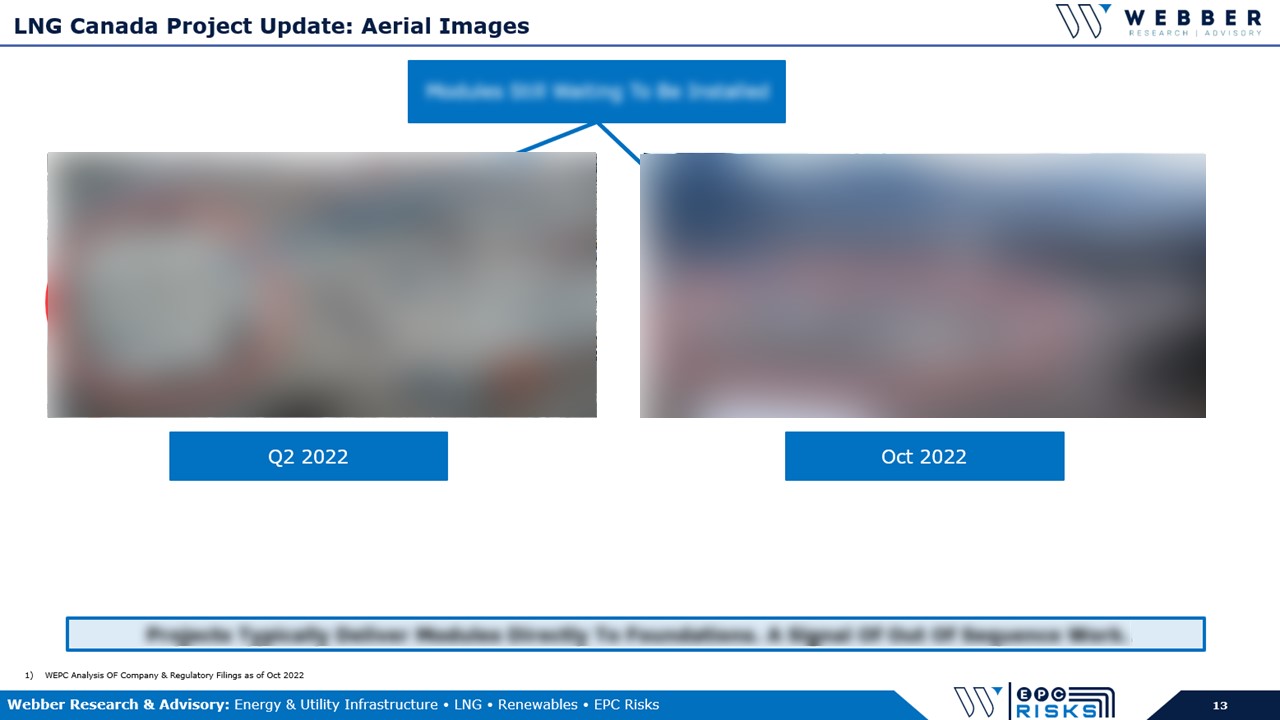

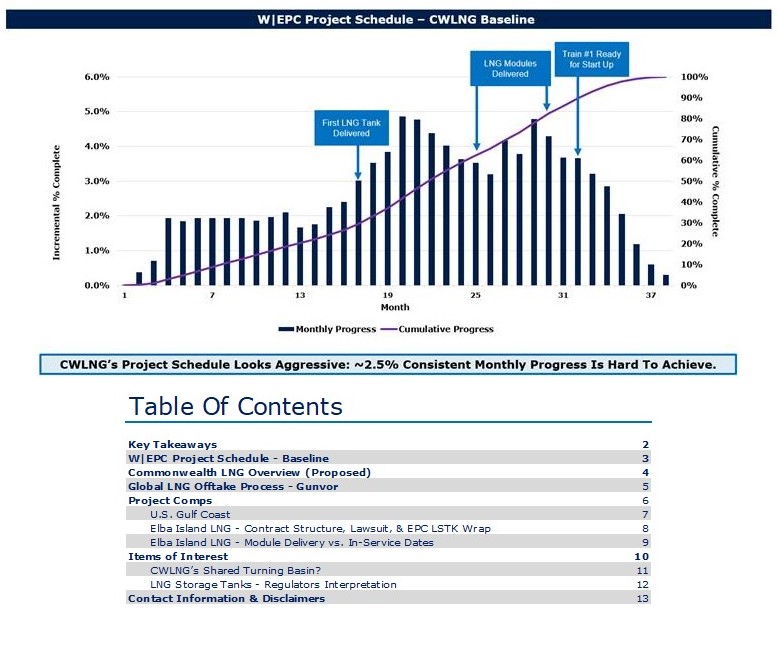

Read MoreW|EPC: LNG Canada – Q321 Timeline, Budget, & Progress Update

Please contact us for a full copy of the report at [email protected]

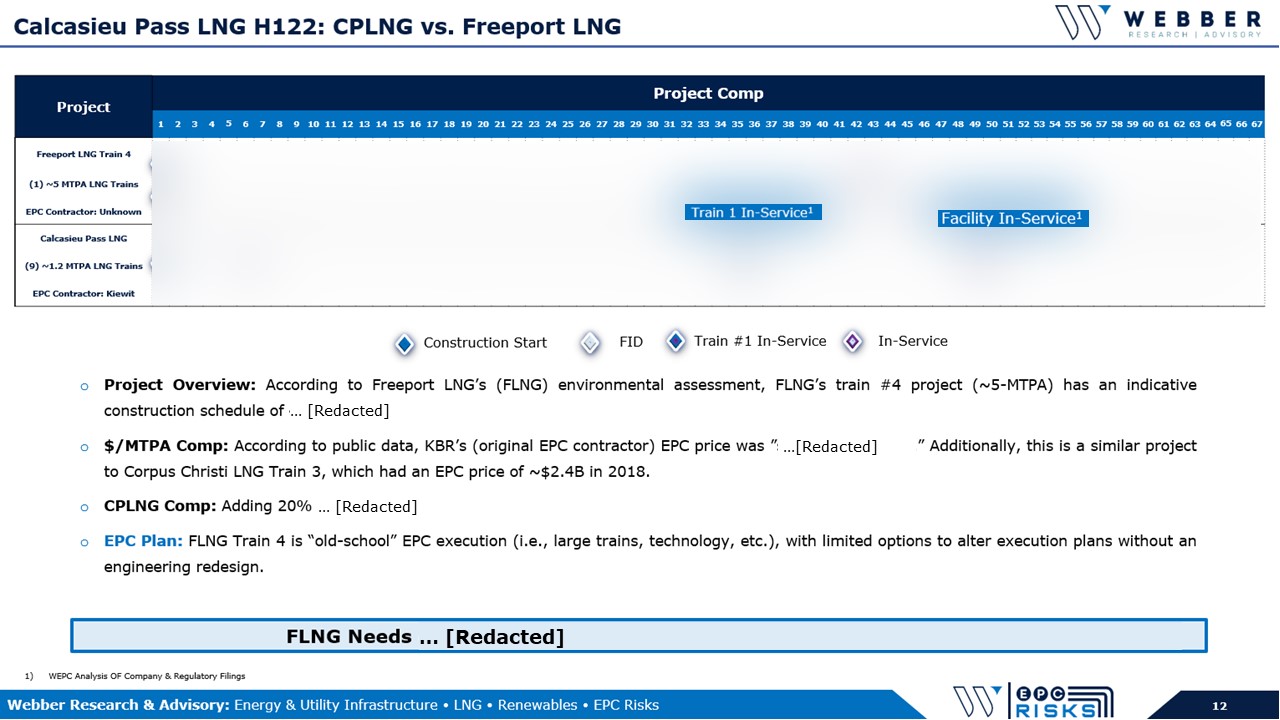

For access information, please email us at [email protected], or reach out to Webber Research Institutional Sales at [email protected]

For access information please email us at [email protected], or at [email protected].

Read More

For access information, please email at [email protected], or reach out to [email protected]

Read More

For access information, email us at [email protected], or at [email protected]

Read More

For access information, email us at [email protected]

View This Report In Our Webstore

For access information please email us at [email protected]

Read More

For access information, email us at [email protected], or at [email protected]

Read More

For access information please contact us at [email protected]

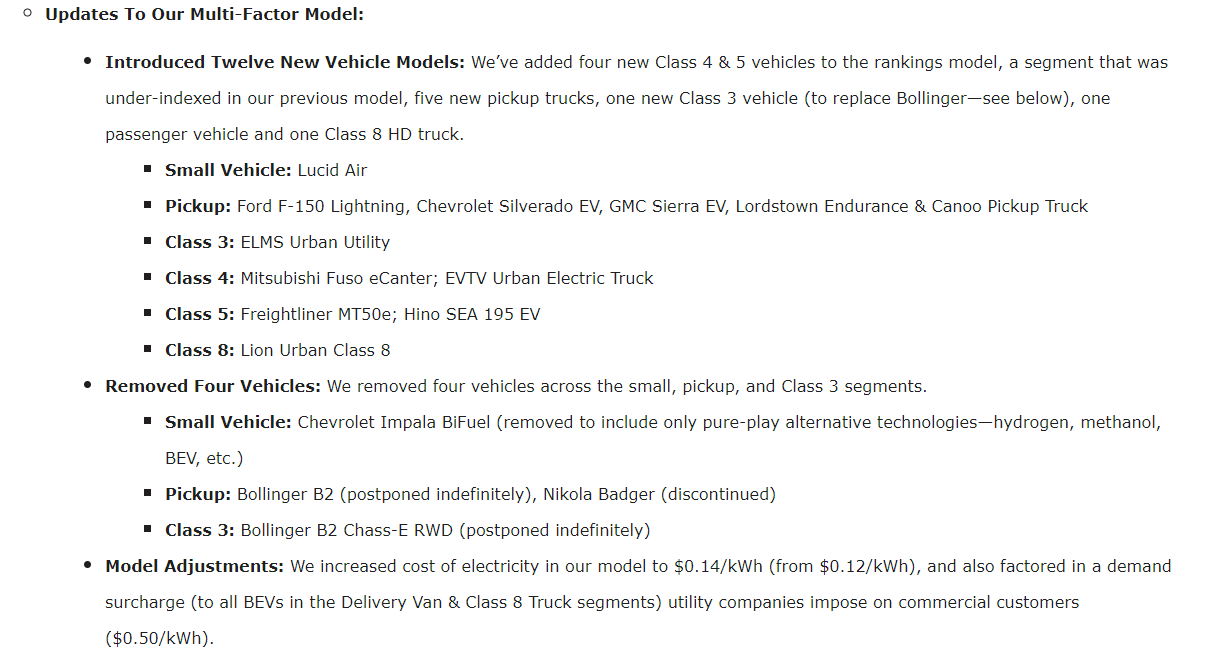

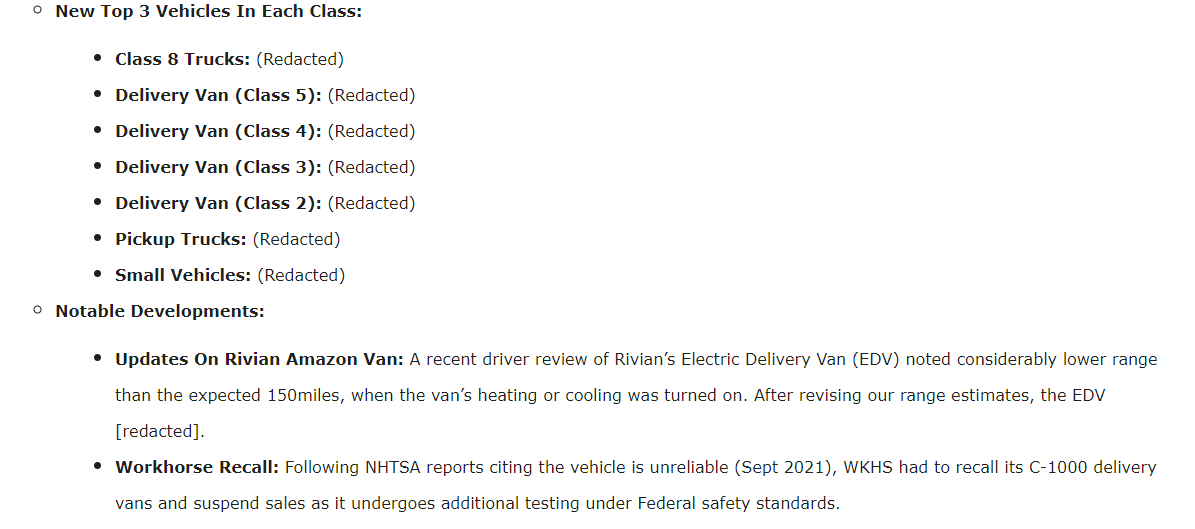

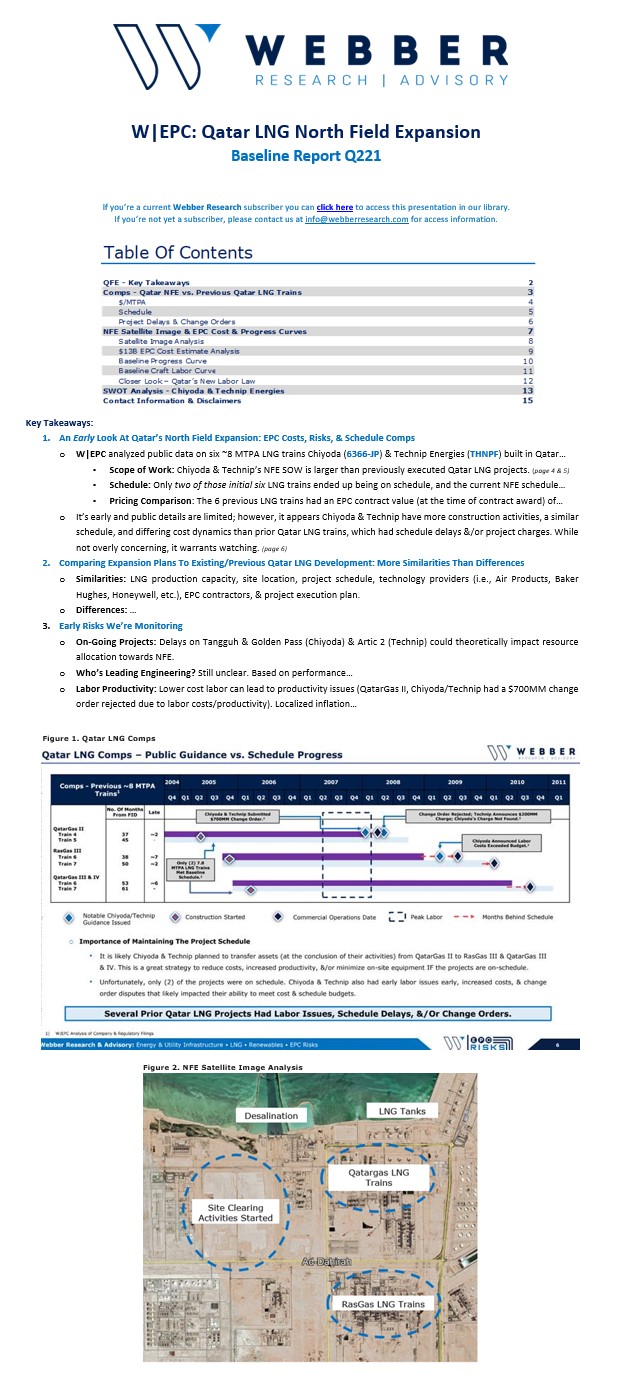

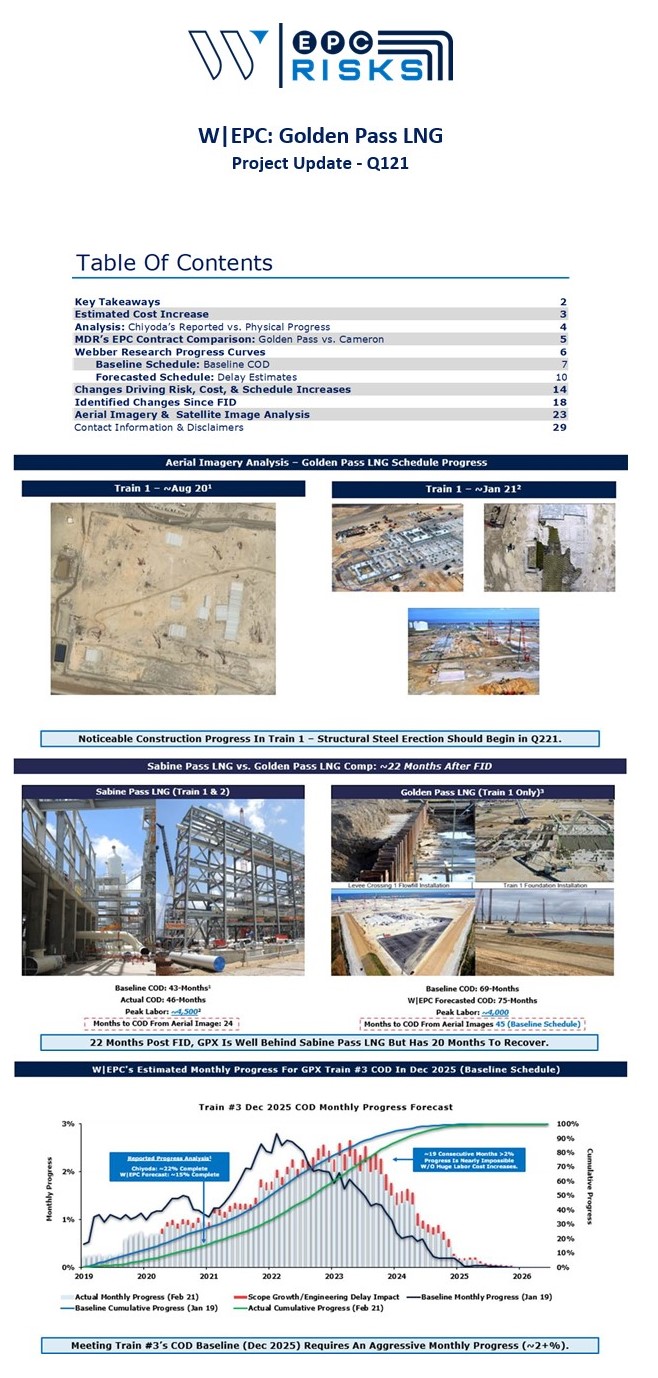

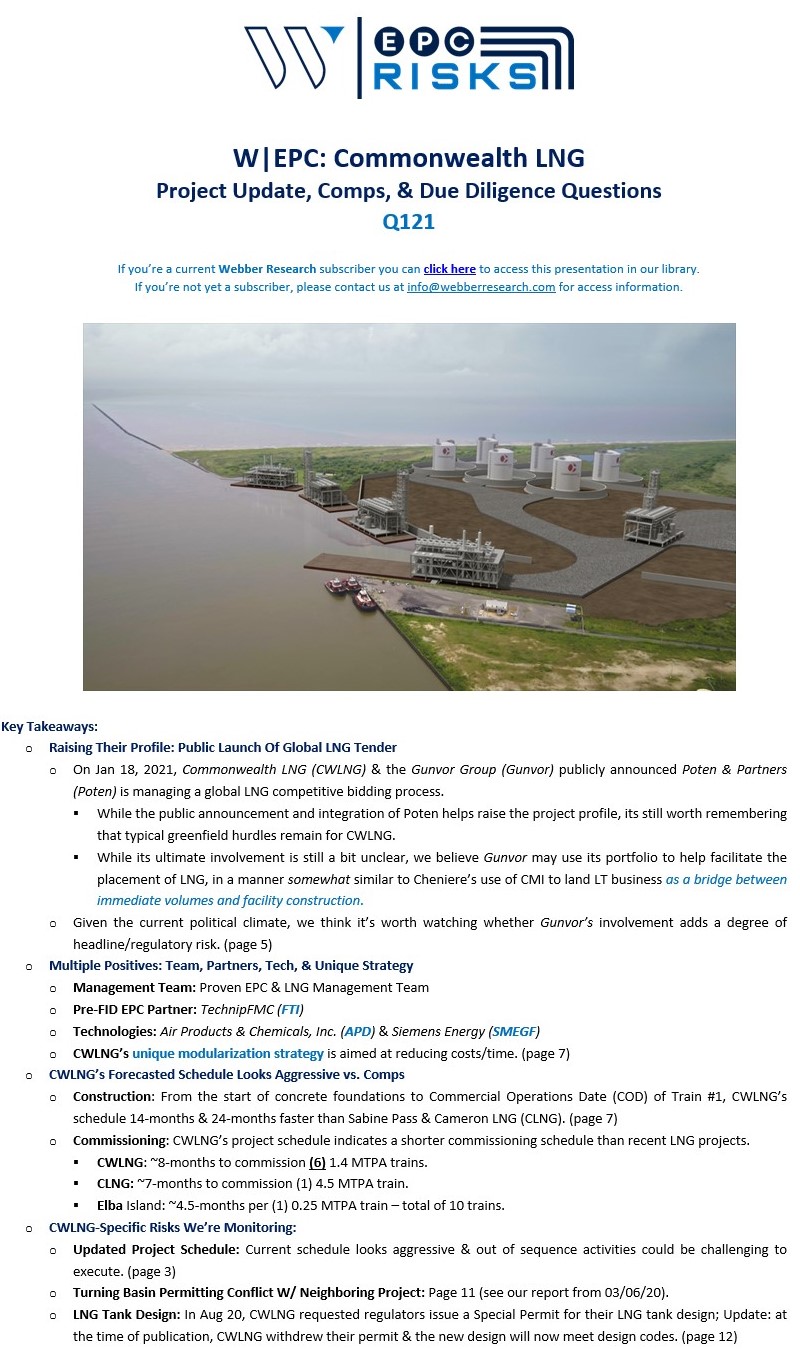

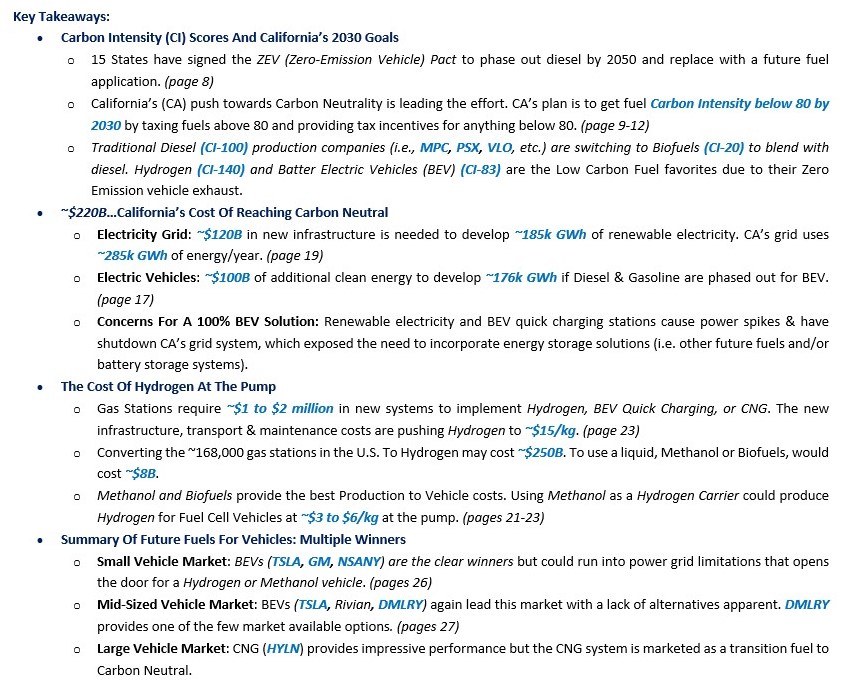

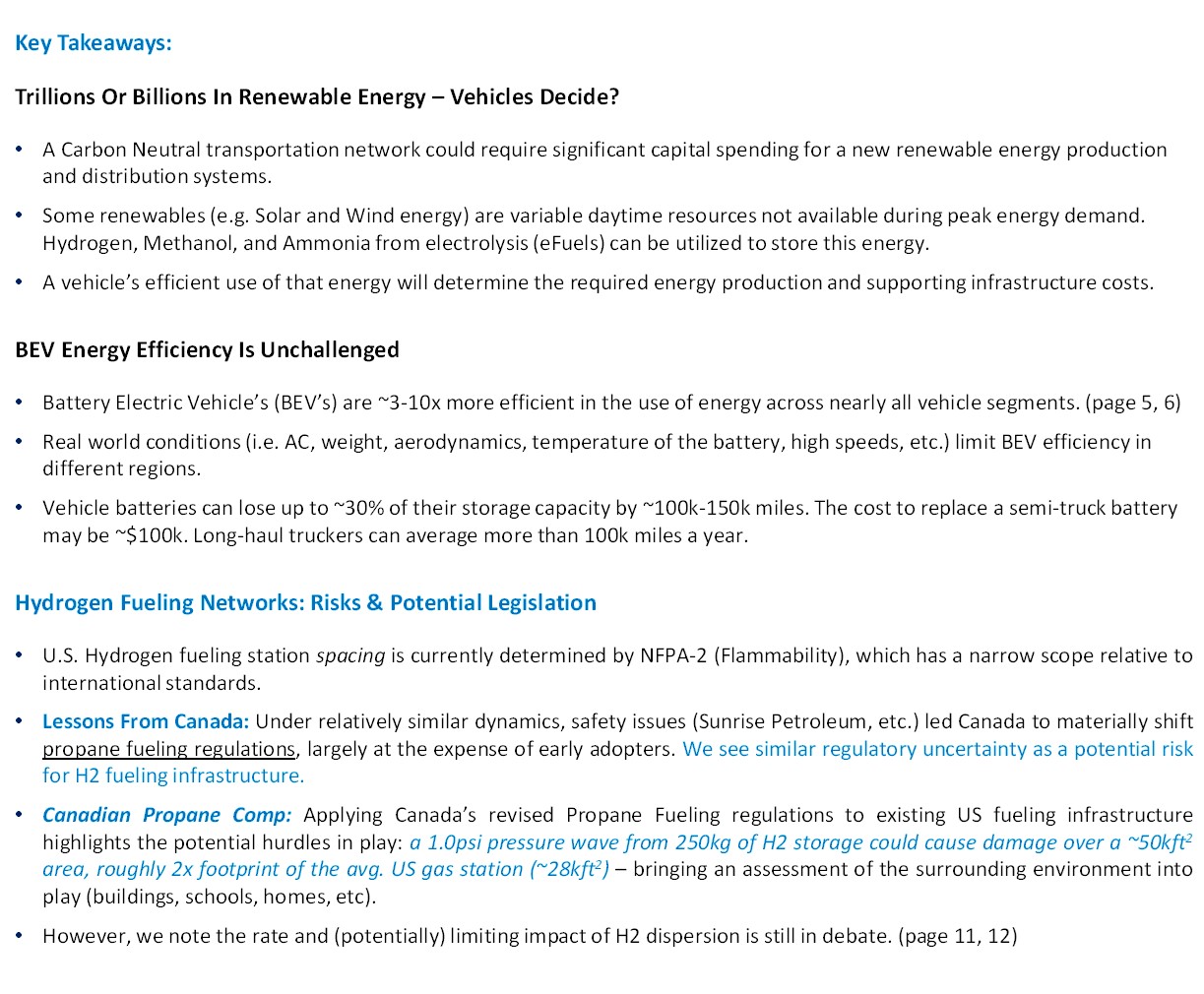

Key Takeaways:

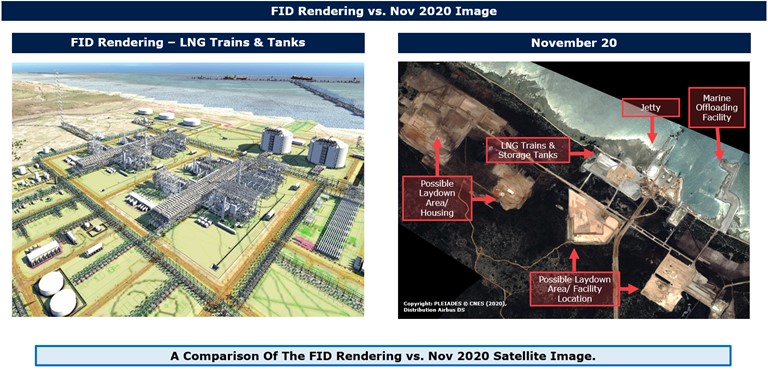

Mozambique LNG (MZLNG): After A Sluggish Start…The Next 6 Months Are Critical.

• Q320 & Q420 satellite images indications… (pgs. 15-18)

• 17-months after FID, meaningful piling, concrete, &/or structural steel erection [redacted]…

• Recent security issues (increasingly localized terrorism) could further hamper staffing levels and complicate the path forward (while also potentially creating the pretense for Force Majeure relief).

Schedule Analysis & Estimates: W|EPC Estimate MZLNG is…

• Our proprietary risk model implies a probability of the project meeting its original cost/schedule metrics is [redacted] (page 5)

• EPC Contract Exposure: ~$8B LSTK contract, via a consortium comprised of Saipem (74.95%, SAPMF), McDermott (24.98), MDR) & Chiyoda (0.07%,)

• Note: a successful project would boost Saipem’s reputation, while also certainly meaningful for a restructured MDR ($560MM Raise on Jan 5, 2021).

Mozambique vs. LNG Canada

• MZLNG & LNG Canada share similar characteristics, specifically: a remote area, greenfield, man-camp, etc. (page 4)

• Key differences: MZLNG’s has lower-cost construction wages, shorter project schedule, but 300% more peak labor (~11k craft workers).

• Should MZLNG require even more labor given the circumstances described in pages that follow, it would likely require an even more significant pull from local labor (on-site housing can support ~9.5k workers).

• MZLNG is located in one of the least developed areas of Mozambique, which creates unique risks around that heavy lean on local labor, even before considering the uptick in localized terrorism. (page 12)

Mozambique LNG: Baseline Report Q121

Mozambique LNG: Baseline Report Q121 (Page 15)

W|EPC: Mozambique LNG – Baseline Report & On-Site Satellite Image Analysis (Q121)

For access information, please email us at [email protected], or reach out to Webber Research Institutional Sales at [email protected]

Read More

For access information, please contact us at [email protected] or at [email protected]

Read More

If you’re a current Webber Research subscriber you access this presentation via our Client Login above. If you’re not yet a subscriber, please contact us at [email protected] for access information.

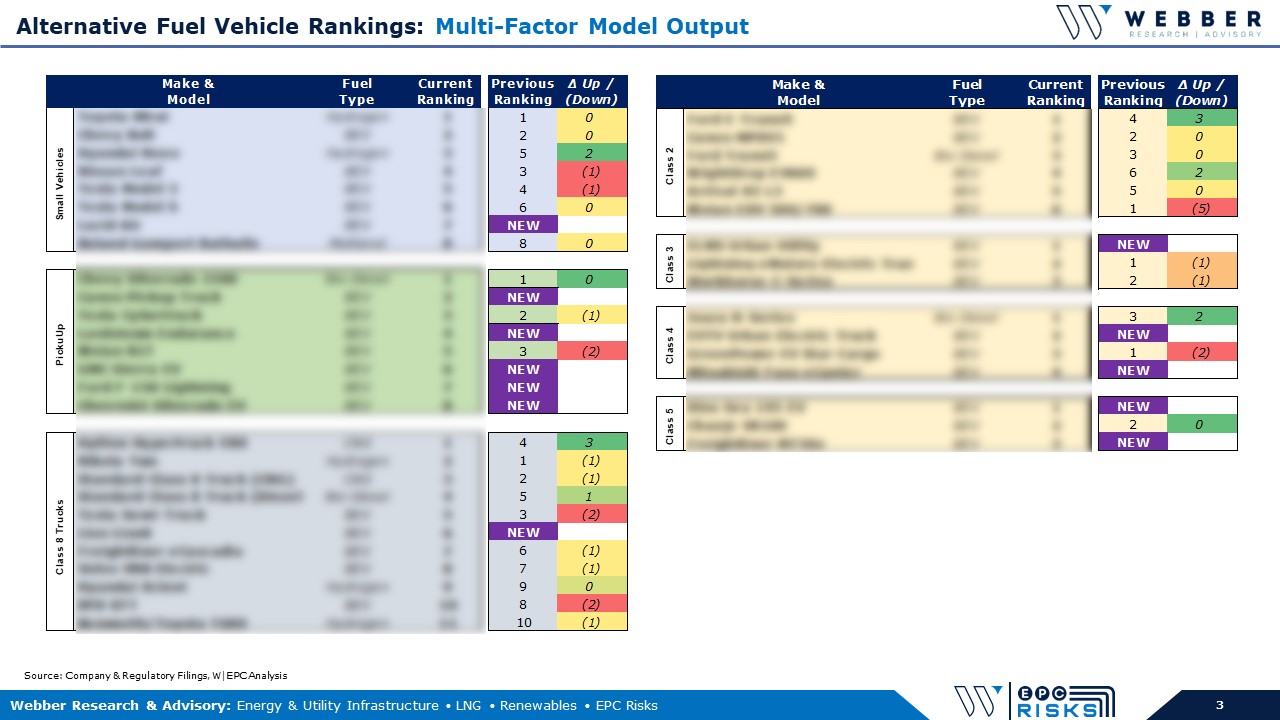

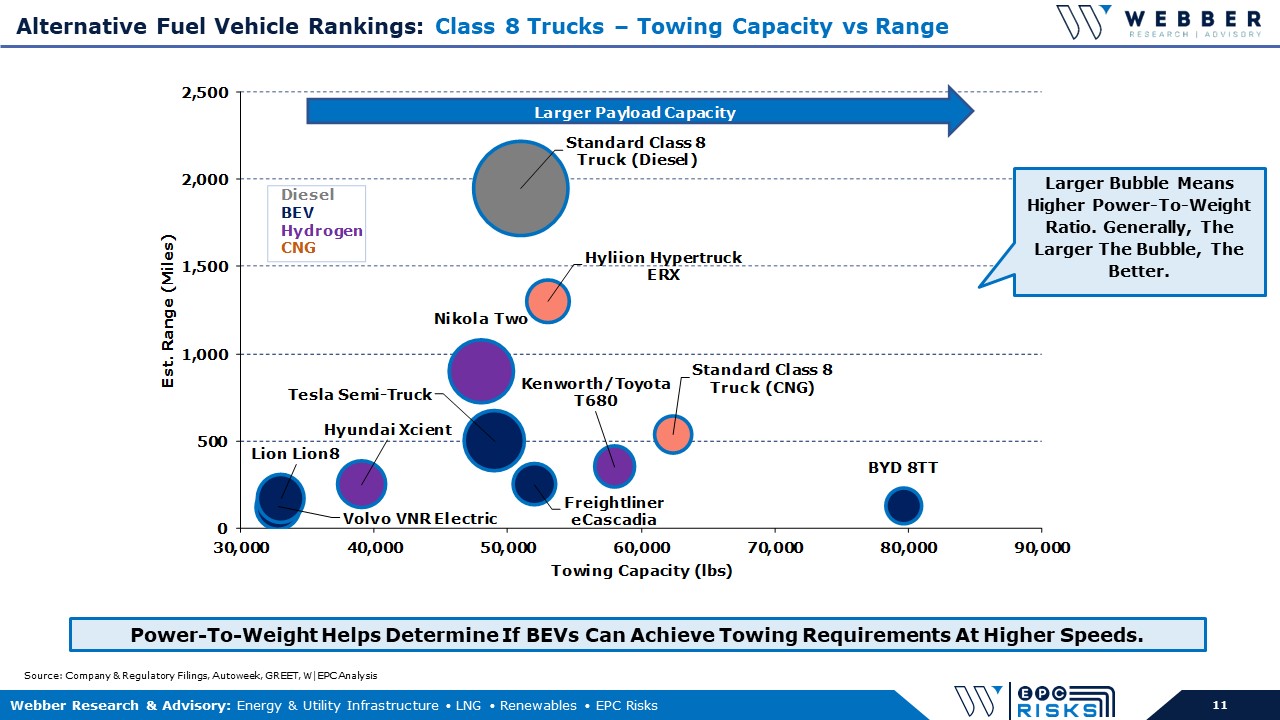

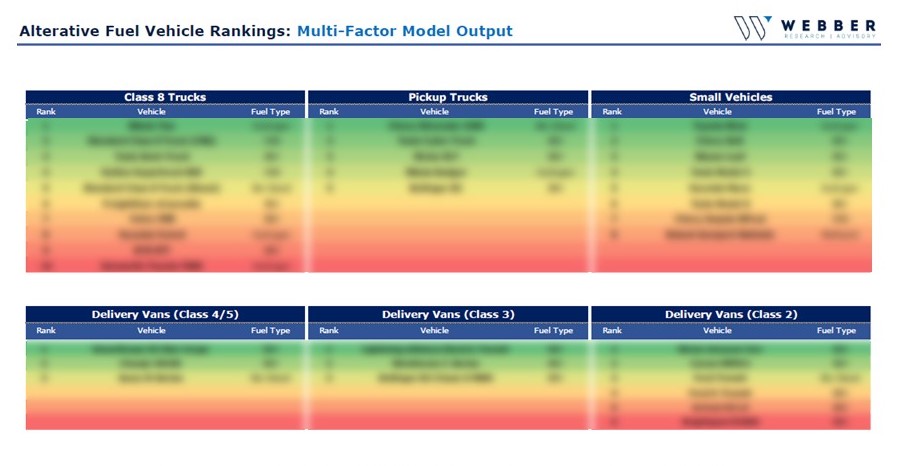

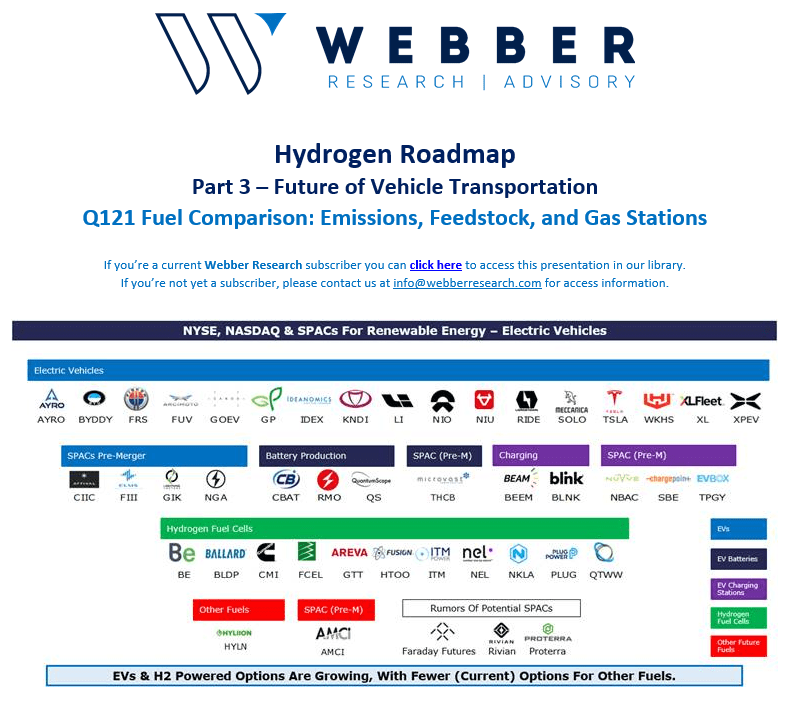

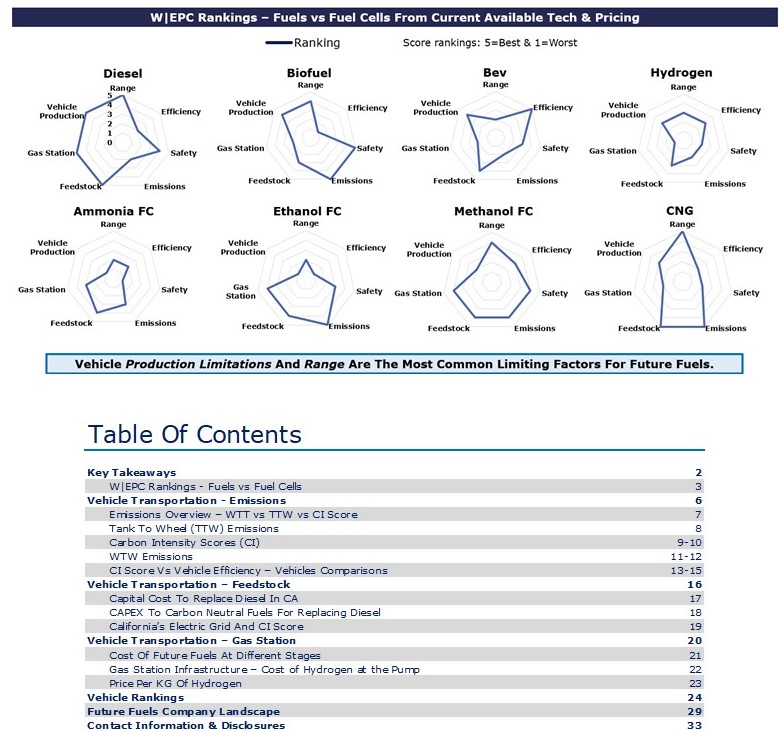

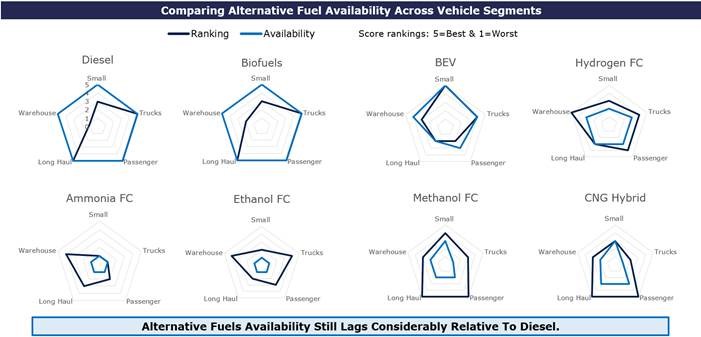

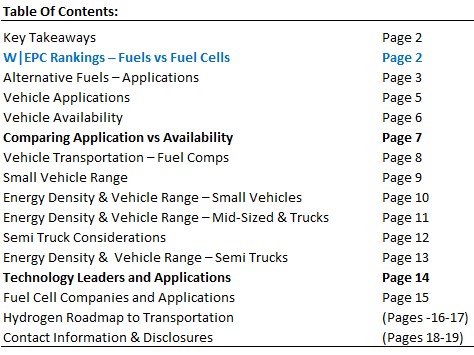

Alternative Fuel Analysis…Will History Repeat Itself?

In 1992 & 2005, the Department of Energy (DOE) created & amended the Energy Policy Act (EPA) that addressed fuel research and tax benefits for vehicle manufacturing.

Battery Electric Vehicles (BEV), Hydrogen (H2), Hybrids, Biofuels, Ethanol and Methanol were analyzed in 2005, but vehicle manufacturers supported gasoline hybrid vehicles due to technology and production constraints.

Since then, fuel cell technology and global, federal, & state emission guidelines have accelerated innovation and the market is now actively deciding transportation alternatives.

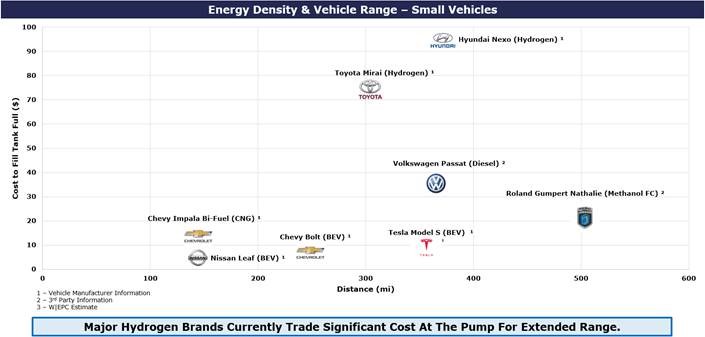

Small Vehicle Applications

BEV have taken a leading role in the small vehicle category with minimal competition from Hydrogen.

Hydrogen’s price, lack of infrastructure, and safety concerns highlight the risk associated with new fuel applications; however, Methanol may have an opportunity to fill this role.

The Roland Gumpert Nathalie markets an impressive range and methanol costs are comparative to BEV, but the $450k price tag limits it’s applications until manufacturing scales up to reduce cost.

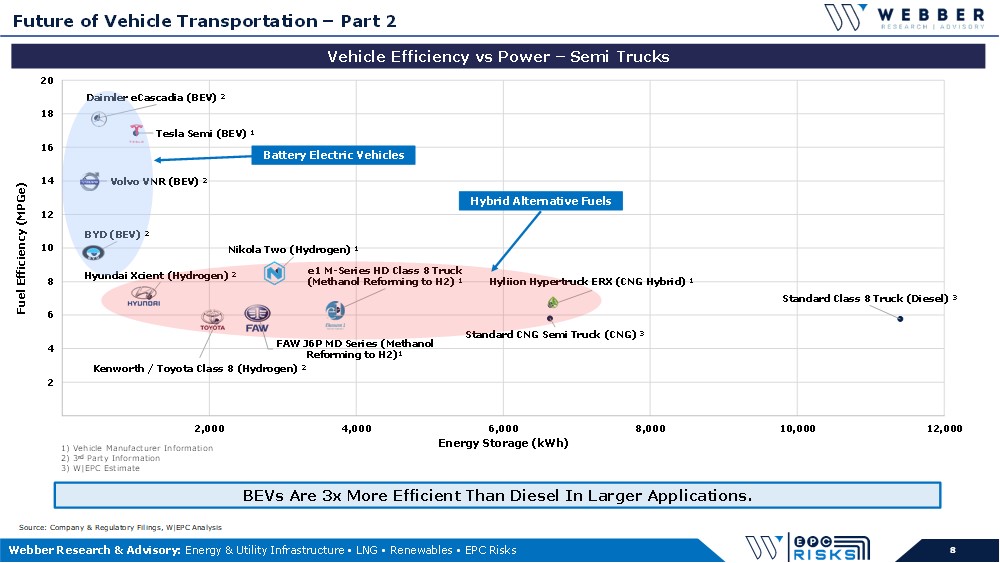

Mid-Sized Vehicles and Truck Applications

Mid-Sized Vehicles and Truck Applications

Fuel energy density becomes a larger role as the size of a vehicle increases.

Fuel storage capacity, energy density, and vehicle efficiency play a large role in the range and cost for a vehicle.

Semi-Truck Range Is A Gating Issue For Future Fuels

New Semi-Truck concepts are ranging from shorter applications (<300 miles) to the long-haul market (>600 mile/day).

Daimler eCascadia seems to make sense for shorter applications and Hyliion’s Compressed Natural Gas (CNG) hybrid semi will likely apply well to long haul trades, if the marketing is as good as advertised.

https://webberresearch.com/downloads/wepc-future-of-transportation-ranking-evaluating-alternative-fuels-h2-%e2%88%99-bev-%e2%88%99-methanol-%e2%88%99-cng-hybrid-%e2%88%99-ethanol-%e2%88%99-ammonia-%e2%88%99-diesel-%e2%88%99-biofu/

Check this: Sex Drive Boosters for Men: Energy, Enthusiasm, and Expertise

Read More

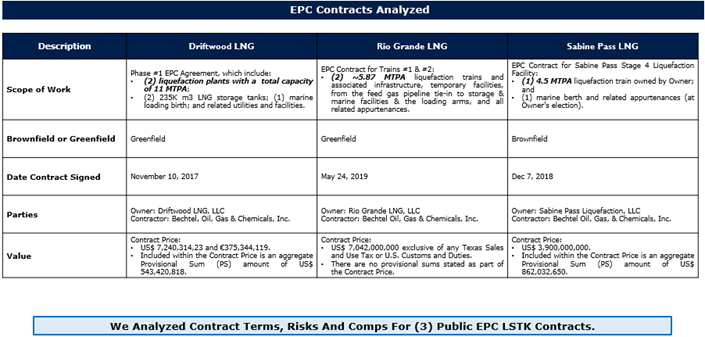

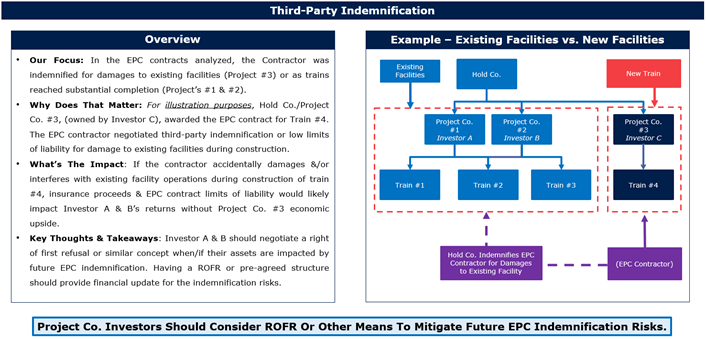

Analyzing EPC Risk Avoidance: Comps & Techniques For Investors, Owners, & Contractors

W|EPC analyzed ~$20B of publicly available EPC lump sum turn-key (LSTK) contracts, focusing on sensitive or contentious terms used to allocate risk, manage performance expectations, & establish a framework for third-party indemnification and liquidated damages, etc. (Pages 3, 5-7, & 9-17). Specific points of emphasis:

Analyzing Notable Risks

Distributing Project Risk Amid A Ramp In Renewables

W|EPC: Analyzing Energy Project Contract Terms – Risks, Strategies & Comps

Table Of Contents:

For full access information, email us at [email protected], or at [email protected]

Read More

For full access information, email us at [email protected], or at [email protected]

In mid-November the California Air Resources Board (CARB) published initial plans detailing the development and implementation of a light-duty hydrogen fueling station networks, including a focus on financial self-sufficiency.

Specifically, CARB’s initial draft highlights:

1. Estimates around required state-support and eventual self-sufficiency

2. A comparison of existing market solutions, ongoing government research, and the latest awards in the Energy Commission’s Grant Funding program.

3. The economic sensitivity around FCEV deployment and the pace of network development.

4. Opportunities for cost reductions

5. Potential price reductions at the pump

6. Regional economic differences

Within the context of CARB’s report, we evaluated the economics and risks for deployment of Hydrogen fueling station options based on the following:

• Public Safety

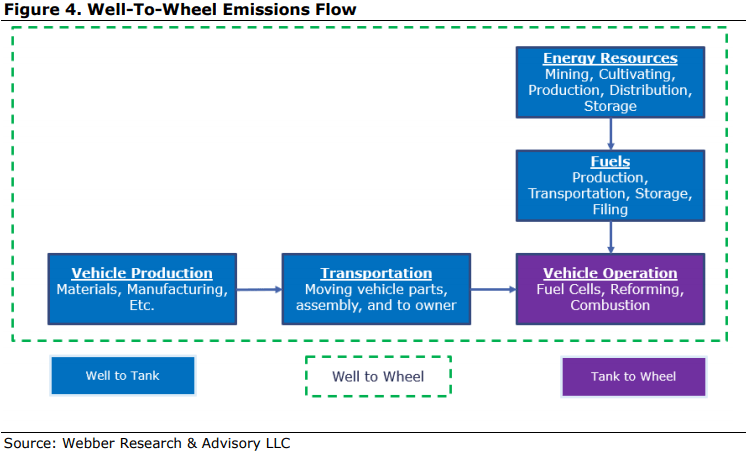

• Climate Change and Air Quality – Tank to Wheel (TTW) – Well to Wheel (WTW)

• Gas Station Infrastructure Costs

• Hydrogen Costs at Pump for Consumer

W|EPC Takeaway: As highlighted below, if the primary goal of CARB is to reduce tailpipe emissions, we believe electric vehicles and hydrogen vehicles are the most viable options today. However, if the goal is to reduce total emissions and to implement hydrogen fueling as quickly, safely, and cost-effectively as possible, it opens the door for a mix of other fuel considerations – including biofuels, e-fuels, and other energy mediums to expedite the Hydrogen Economy. We believe how California ultimately balances those priorities will determine what it’s future fueling network looks like.

Climate Change & Air Quality

Air quality and the need for sustainable future fuels to reduce GHG emissions is driving alternative fuel technology development. CARB’s Low Carbon Fuel Credits (LCFC) are based on Well to Wheel Carbon Intensity Scores (CI) that identify upstream pollution caused by fuels.

Gas Station Infrastructure Costs

Future fuels (i.e. H2, Ammonia, Methanol) will require new infrastructure in almost all cases to meet federal and state emission guidelines. The Implementation cost of these can vary from storage retrofitting, to +$1 million infrastructure upgrades. The costs could further increase based on the engineering design and blast radius study results.

Hydrogen gas station equipment could include:

• Compressors – 350 bar pressure

• Above Ground Storage

250 bar pressure

250 kg storage

• H2 Dispenser Larger corporate gas stations may have the financial means to implement the costly infrastructure upgrades especially if supported by fuel tax credits. However, smaller gas stations may face challenges investing in the capital costs & the ~$2K/month electricity bill to own & operate the equipment.

Cost comparisons vs the low-cost alternative for Methanol:

• Hydrogen – See Figure 6. Multiple scenarios based on CARB capital cost estimates

• Methanol to Hydrogen in Vehicle – ~$50,000 per gas station to upgrade storage

• Methanol to Hydrogen at Pump – ~$1 million per gas station (250kg H2 storage)

Hydrogen Costs at Pump for Consumer: ~$16/kg and by 2030 as Low as $8/kg?

At the pump, the H2 price begins to stack up due to CAPEX, maintenance, safety, and production costs. We have provided a few options that have been considered for comparisons sake below that could further drive down the cost of hydrogen.

• Centralized Electrolysis: ~$8/kg

• Centralized Reformer (No Carbon Capture): ~$2.50/kg

• Methanol Reforming at Pump: ~$5/kg

Includes 250kg hydrogen storage and compression

• Methanol Reforming in Vehicle: ~$3.50/kg

Gas Station infrastructure cost are relatively minimal

For a methanol reforming at pump scenario, storage-related infrastructure costs could be lighter as Methanol is a potential mid-stream solution for hydrogen, and is generally easier to store in large quantities – potentially pushing the hydrogen cost at the pump level below $10/kg in a shorter timeframe.

For full access information, email us at [email protected], or at [email protected]

Read More

EPD PDH 2 – Project Delay Analysis. In Q220, EPD announced a 3-month schedule slip (from Q123 to Q223), potentially limiting future change orders (i.e. cost escalation) related to COVID impact (based on typical EPC contract FM concepts).To reduce the COVID delay to only 3 months, we believe EPD implemented a schedule recovery plan that accelerated/compressed back-end construction activities to meet a Q423 COD forecast. (pgs. 10 – 13). We’ve independently estimated PDH 2’s slippage based on Q420 aerial project site images, with details found within our note… (pages 4 – 7).

Enterprise’s First ESG Guidance… : On October 28, 2020, EPD released their approach to ESG. In the report, EPD touts they are the largest Midstream producer of Hydrogen. With the addition of PDH2, Enterprise would increase their Hydrogen production by 140k tons/year, and we estimate ~150MW of electricity by incorporating fuel cells in their Mont Belvieu, TX facility.

Companies like SK are working with fuel cell manufacturers to integrate high temperature Solid Oxide Fuel Cells (SOFC) into PDH units to use the hydrogen produced to reduce operating costs….this could help EPD’s ESG potential.

Project Timeline Catch Up – Risks & Benefits: A schedule recovery plan can be costly and is not guaranteed to succeed. PDH 2 schedule recovery risks/benefits include: Risks – An EPC lump sum contractor (S&B) compresses the schedule & may cause inefficient construction & cost escalation. Benefits – The COVID delay started before site prep and avoided a de-staffing of the project. Based on limited on-site progress, S&B likely hasn’t spent much of their field budget & may have available contingency to support acceleration costs/inefficiencies.

W|EPC’s estimated timeline shows site labor and progress can support pulling activities back to Q223 with a probability of success of…. (pgs. 10-13)

W|EPC: Enterprise (EPD) PDH-2 Q420 Project Monitor & Satellite Image Review

For access information, please email us at [email protected], or our institutional sales at [email protected]

Related post: Sex Drive Boosters for Men: Energy, Enthusiasm, and Expertise

Read More

For access information, email us at [email protected], or go to webberresearch.com/downloads

Read More

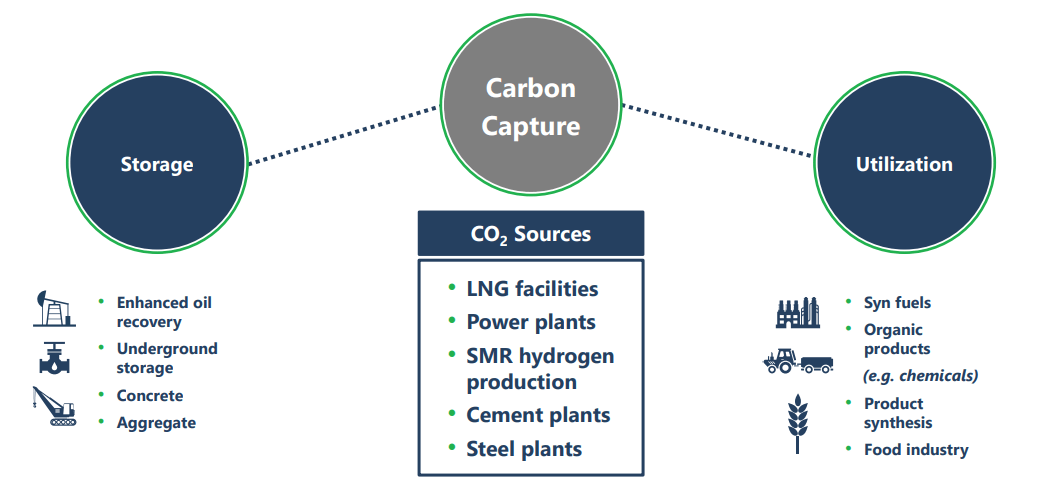

BKR Buys Carbon Capture Platform: On 11/3 BKR announced it acquired Compact Carbon Capture (3C) for an undisclosed amount. BKR plans to accelerate development and commercialization of 3C’s carbon capture solution, which adds to its existing portfolio of carbon capture technology including turbomachinery, solvent-based capture processes, well construction, CO2 storage management, and digital monitoring solutions…

Dominion Proposes 9 New Solar Facilities For ~500MW: On 11/2, Dominion Energy (D) proposed a slate of 9 new solar projects with output of 498MW. Six of the facilities (416MW) are through PPAs, helping to fulfill the Virginia Clean Economy Act (VCEA) requirement of having 1/3 of new solar and onshore wind be procured through PPAs through 2035….

AMRC 2 New Contracts In Oregon: On 10/26 and 10/27 AMRC…..

For access information, email us at [email protected], or go to webberresearch.com/downloads

Read More

Please join us for the latest Webber Research Client Call on Monday, 10/26 at 12PM, when we’ll discuss our latest deep dive into Southern Company’s Vogtle Nuclear expansion.

For access information, please contact us at [email protected], or our Institutional Sales Desk at [email protected]

W|EPC: Southern Company (SO) – Q420 Vogtle Project Monitor – Key Decisions That Could Haunt Cost PrudencyRead More

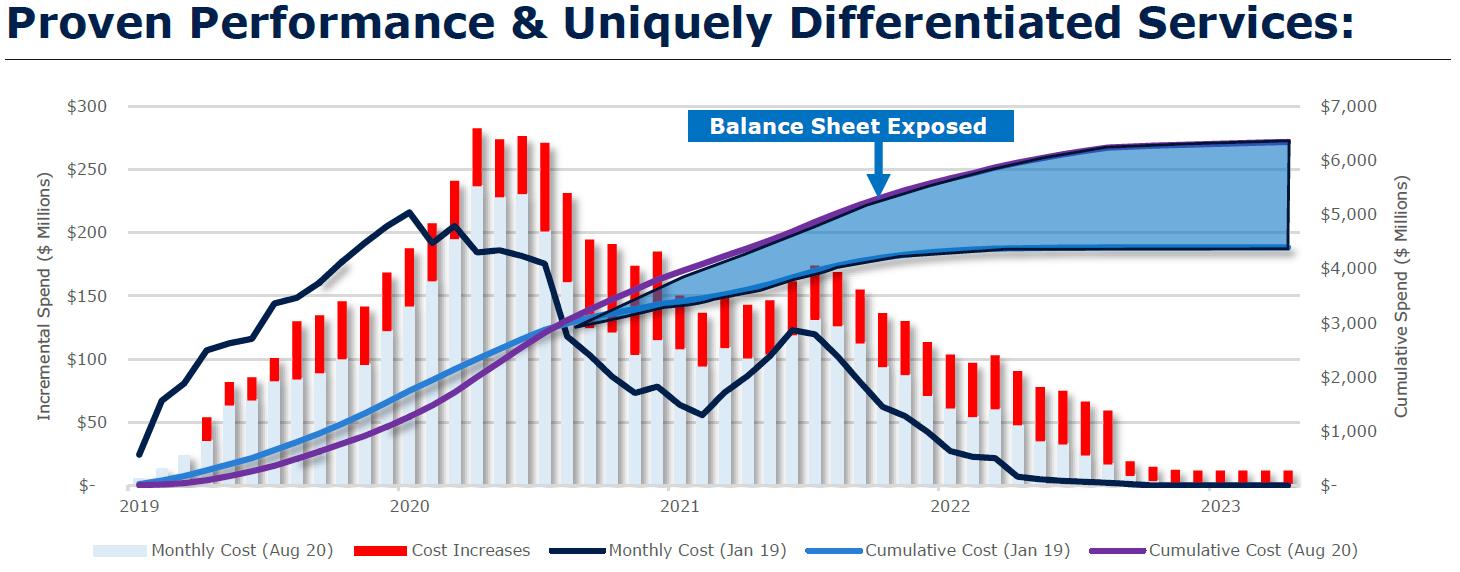

Who Will Be Getting Stuck With +$2.1B In Cost Overruns? Once Vogtle Unit 4 reaches “fuel load”, Georgia Power/Southern Company (GP/SO) can request a cost prudency determination to push their portion of cost overruns (~$2.1B) into recoverable utility rates. (Page 4)

Regulators will determine cost prudency based on project data, testimony, and a simple question: What should a reasonable manager have done at the time of the decision? (Page 5)

We expect that process to be heavily scrutinized considering the scale of the overruns, and, in our opinion, some questionable GP/SO decisions. (Pages 4-5)

Decisions That Could Haunt GP/SO’s Prudency. We believe there’s a case to be made that multiple GP/SO management decisions ran contrary to industry standards, potentially contributing to ($) billions in cost overruns, including

Analyzing 12-Years Of GP & SO Testimony… (Pages 20 & 23)

Please join us for our next Client Call at 12pm EST on Monday 10/26, to review our Vogtle Project Monitor. Please reach out to us for access details.

Table Of Contents:

For access information, please email us at [email protected], or our institutional sales at [email protected]

Read More

Highlights:

• CEC Releases Clean Transportation Plan (page 1)

• New York Set 70% Renewable Energy Mandate By 2030 (page 1)

• ENPH Partners With Natura Living In Thailand (page 1)

• ENS Partners With alpha-Encorp (page 2)

• Bifacial Tariff Exemptions Blocked (page 2)

• JKS Signs Module Supply Agreement (page 2)

• CSIQ Adding Storage To GS Solar Farm (page 2)

• Enel Begins Construction Of Azure Sky Solar Project (page 2)

• Siemens Sub Acquires AMS (page 2)

• Proterra Raises $200MM (page 2)

• GE Wins 327MW Wind Order In India (page 2)

• SGRE Edges Out Vestas In Q2 (page 3)

• NOVA Expands Solar + Storage Offering (page 3)

• Arrival Raises $118MM From BlackRock Investment (page 3)

• PNM Plans To Replace Coal Plant With 1GW Solar + Storage (page 3)

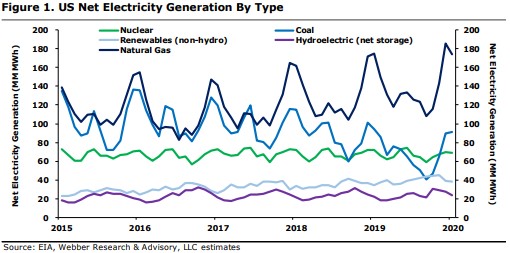

• US Net Electricity Generation (pages 4-5)

• Solar PV Pricing (page 5)

• LCOE Benchmarks & Timeseries (page 6)

• Global Wind Turbine Market Share (Page 7)

• Global Solar PV Inverter Market Share (page 7)

• US Wind & Solar Projects Announced Or In Early Development (page 8)

CEC Releases Clean Transportation Plan: Last week, the California Energy Commission (CEC) released its clean transportation plan with ~$384MM of investments scheduled over the next 3 years for electric vehicle (EV) and zero-emission vehicle (ZEV) infrastructure. The spending includes ~$133MM for light-duty EV charging systems, ~$130MM for medium- and heavy-duty ZEV infrastructure, and ~$70MM for hydrogen refueling infrastructure. California currently has ~26MM automobiles and ~6MM trucks registered in the state – ~726k of which are ZEVs (vs its goal of 1.5MM by 2025 and 3MM by 2030). It also currently has 57k Level 2 chargers and 4.9k DC fast chargers vs its 2025 goal of 240k Level 2 and 10k fast chargers.

New York Set 70% Renewable Energy Mandate By 2030: On 10/15 New York’s Public Service Commission (PSC) announced it would formally adopt a 70% renewable energy initiative by 2030 as part of its Clean Energy Standard. The announcement includes a directive for NYSERDA to enter into annual contracts for 4,500MWh for upstate renewables and 700-1,000MW of offshore wind.

ENPH Partners With Natura Living In Thailand: On 10/12 ENPH announced it partnered with Natura Living to develop commercial solar projects in Thailand for PepsiCo (PEP). Natura installed a 60kW solar array on PEP’s snack division building using ENPH’s IQ 7+ microinverters and is currently installing another 60kW array on PEP’s agronomy division building (expected completion in Q420).

For access information, email us at [email protected], or go to webberresearch.com/downloads

Read More

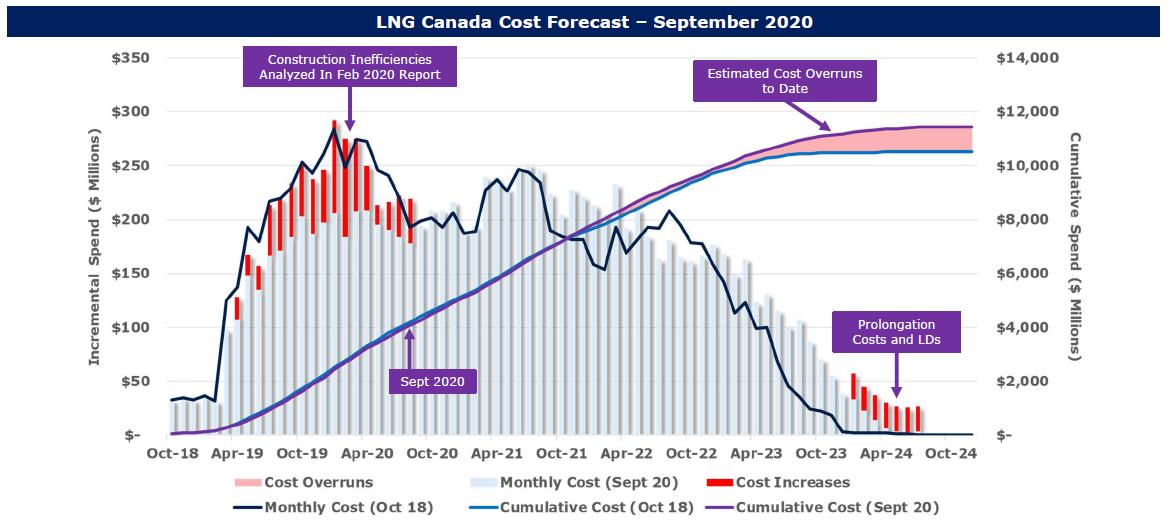

Please join us for the latest Webber Research Client Call on Wednesday, 10/21 at 12PM, when we’ll discuss our latest thoughts on LNG Canada.

For access information, please contact us at [email protected], or our Institutional Sales Desk at [email protected]

W|EPC: LNG Canada – Updated Satellite Image Analysis & Construction Progress – Q420 Project MonitorRead More

https://www.tradewindsnews.com/twplus/meet-30-people-who-will-shape-shippings-future/2-1-879760

Read More

Table Of Contents:

Key Takeaways:

W|EPC: LNG Canada – Updated Satellite Image Analysis & Construction Progress – Q420 Project Monitor

For access information, please email us at [email protected], or our institutional sales at [email protected]

Read More

Table Of Contents:

Key Takeaways:

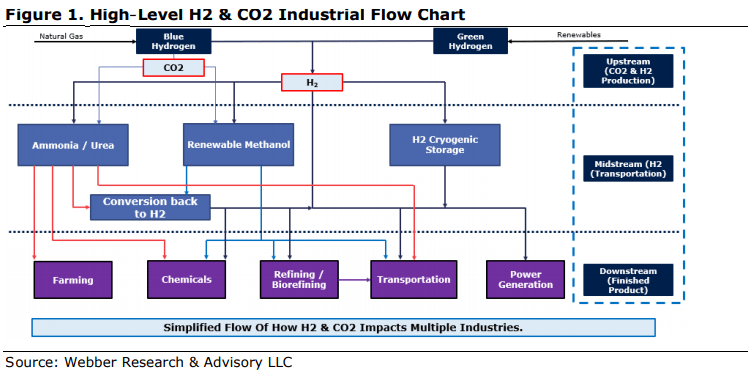

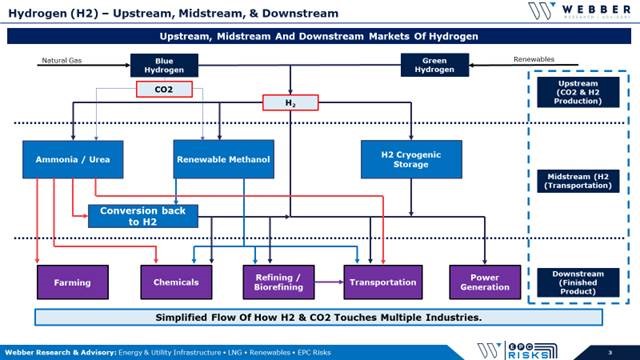

Upstream Sources Of Hydrogen – Blue & Green (Pages 4 – 9)

>95% of Hydrogen (H2) is produced using Steam Methane Reformer (SMR) technology that produces 7 units of CO2/unit of H2 (on average)

SMR w/ a carbon capture system (Blue H2) is the preferred option to environmentally manage excess CO2. (page 7)

Green H2 provides minimal CO2 but current technology limits Green H2’s cost competitiveness. (Page 6)

H2’s Sprint To Market Share… Current Leaders (Pages 17 – 21, 27 – 30)

We analyzed 13 Technology Companies spanning 12 Process industries, including ThyssenKrupp, Air Products, Air Liquide, & KBR/Johnson Matthey…the clear technology leaders include…

Frozen Industries – Marine, Automotive, & H2 Transport (Pages 22 – 26)

Outside factors (i.e. carbon neutral fuels, fuel cells, regulations, safety, & other downstream applications) will play a large role in selecting the midstream transportation choice for H2.

International Maritime Organization’s (IMO) mandates for reduced emissions has many ship builders looking at LNG, Ammonia, and/or Methanol; without a clear long-term winner (yet), many shipbuilders are frozen.

Fuel pumps (gas stations) must receive H2 from high-pressure storage vehicles, pipelines, or by converting Methanol or Ammonia to H2 at the fuel pump, with a number of implications.…(page 20)

Midstream For Hydrogen – H2 Transportation Options (Pages 10 – 16)

Ammonia, Methanol, and Cryogenic H2 are used to transport H2 long-distances.

Ammonia is the clear favorite to…

Methanol is the best option for…

Cryogenic H2 technology/costs…

For access information, please email us at [email protected], or our institutional sales at [email protected]

Read More

Plug Power (PLUG)

Company Overview – Page 5

Plug Symposium (Raw Notes) – Page 10

Investment Rationale / Key Points – Page 12

Primary Risks – Page 14

Valuation – Page 15

Ballard Power Systems (BLDP)

Company Overview – Page 22

Analyst Day (Raw Notes) – Page 28

Investment Rationale / Key Points – Page 35

Primary Risks – Page 36

Valuation – Page 37

SolarEdge Technologies (SEDG)

Company Overview – Page 45

Investment Rationale / Key Points – Page 48

Primary Risks – Page 49

Valuation – Page 50

Industry Overviews

Hydrogen & Fuel Cells – Page 55

Solar / Inverters – Page 67

Expanding Our Hydrogen & Inverter Coverage. We are initiating coverage of PLUG (Outperform, PT: $19), BLDP (Outperform, PT: $26), and SEDG (Market Perform, PT: $200). Since launching our first wave of coverage in April (REGI – OP, ENPH – MP, TPIC – MP, and ENS – MP) renewables have continued to aggressively take both mind-share and market-share – positioning the sector for unprecedented investment as governments, counterparties, and end-users move toward carbon neutrality over the next 15-40 years. Benchmark renewable levelized cost of energy (LCOE) figures have declined nearly 75% over the past-10 years, increasing the viability of alternative energy sources. We believe the extension of that process toward low- and zero-carbon hydrogen could create a generational growth engine across Energy, Industrials, and Technology over the next several decades.

The Push For Hydrogen: Major markets worldwide continue to adopt integrated hydrogen strategies and roadmaps, with Europe and China at the forefront. The EU is expected to invest €183-€490B by 2050 to effectively develop a continental hydrogen economy, with green hydrogen (i.e. hydrogen created using renewable sources) at its center. China recently announced its National Hydrogen Fuel Cell Strategy and pledged to reach carbon neutrality by 2060 despite currently deriving two-thirds of its power from coal. We think the increasingly widespread support for carbon-reducing policy creates a deliberate and sturdy foundation for renewables, and particularly hydrogen.

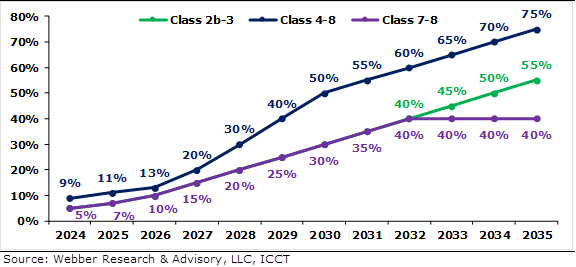

Figure 58. California Advanced Clean Truck Regulations

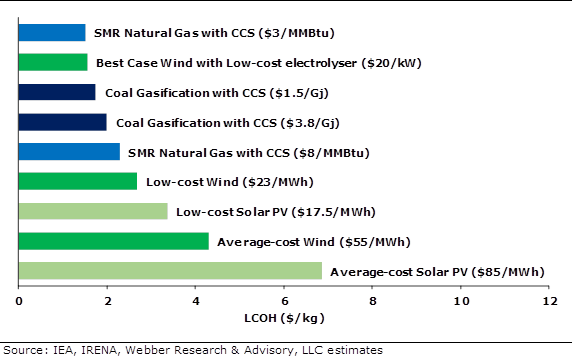

Figure 50. Hydrogen Production Costs From Renewables & Fossil Fuels

For access information, please email us at [email protected]

Read More

We’re very pleased to share our most recent Webber Research Technical & Commercial Project Consulting Overview – detailing our expertise across a wide variety capabilities, services and experience. If you’re a project stakeholder, developer, creditor, or operator, we’re here to add value and minimize risk for your process.

Webber Research: Technical & Commercial Project Consulting Overview

Our Focus: LNG, Biofuels, Renewables, Petrochemicals, and broader Energy Infrastructure

Key Experience, Capabilities & Services:

• Proprietary Project Database: Includes schedules, satellite & drone images, & benchmarks

• Lenders/Stakeholder’s Independent Engineer: $50B+ of global project’s executed

• Commercial & Contracts Negotiations: Negotiated ~$30B in EPC proposals/contracts

• Government/Regulatory Liaison: FERC, U.S. Army Corps of Engineers, etc.

• Project Due Diligence: ~$1.5B investment that grew to ~$7B in ~8 years

• Validate Schedule/Progress Reporting: Helping independent stakeholders can avoid surprises

• Litigation Consulting/Claims: Supporting more than $1B in litigation, depositions, and expert witness

Unmatched Process. Industry Changing Results.

Read More