W|EPC: NextDecade (NEXT) – Rio Grande LNG Q225 Project Update & Client Call, Tues 04/22 @11AM EST

Webber Research: Global LNG Project Tiers, Rankings Outlook, & Balance Model + Trump & LNG: Leveraging The Pizzazz

LNG Update: USG Pricing Color & Mubadala Builds Its NEXT Stake

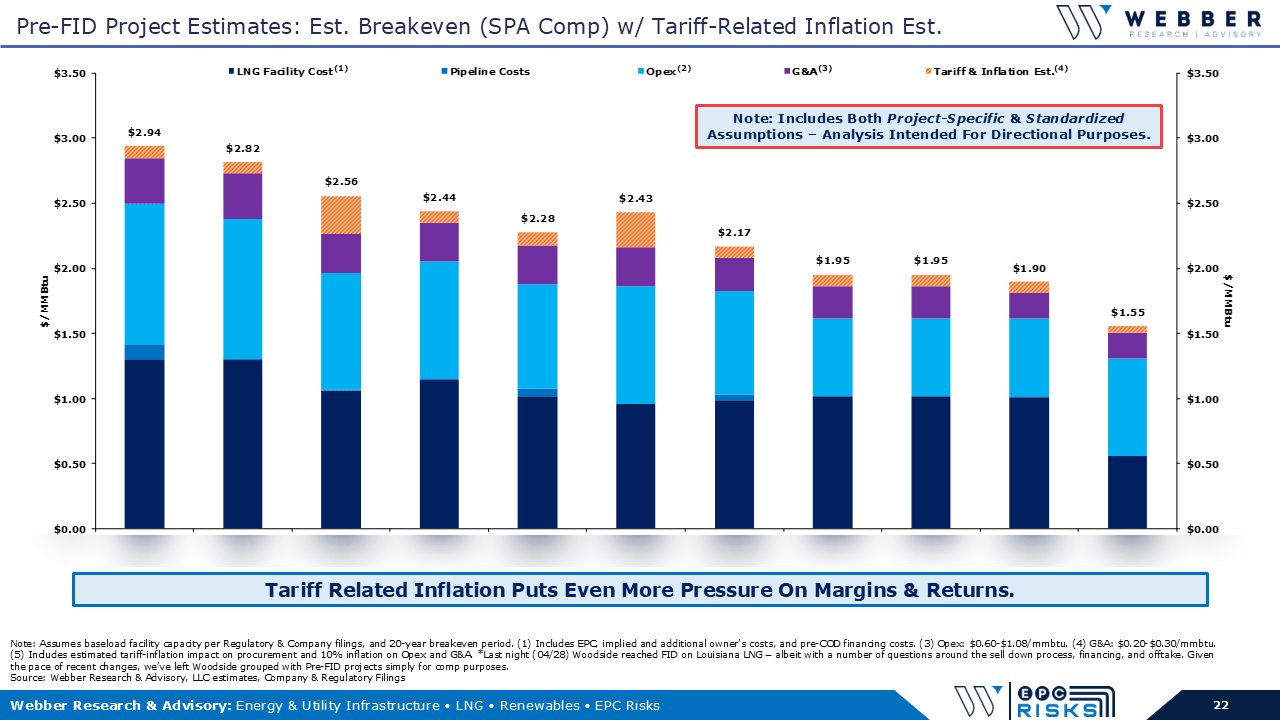

Updated Pricing Color For U.S. Developers: Cheniere, Shell, Venture Global, Next Decade, Freeport, Annova, Commonwealth, Delfin & More. Over the past week we’ve had several conversations with LNG buyers, project developers, and downstream operators, with the more pertinent color below:

LNG Pricing Currently Being Offered In The USG:

• Consensus Range: $2.25–2.40/mmbtu – Individual Developer Pricing Details On Page 2

• Outlier: $2.10-2.20/mmbtu – Individual Developer Pricing Details On Page 2

• Outlier: Offering ~$1.75/mmbtu – Individual Developer Pricing Details On Page 2

Favored Projects: Buyer With Some Effective Baseload Exposure – In the U.S. only really considering a handful of projects (page 2), however, Qatar is the most likely – and buyer has option to pull from Ras Laffan or Golden Pass. Webber Note: the optionality here provides another window into how Qatar is marketing their entire ~100mtpa portfolio.

Venture Global: At least 2 buyers in Calcasieu potentially going back for more LNG in Plaquemines, site visits are still ongoing (page 3).

Project Roll Ups: One buyer speculated we’ll see some of the 3rd and 4th tier Greenfield projects get rolled up in 2020, as existing players look for cheaper growth optionality and early stage projects solve for funding issues. Webber Note: we agree, and think it could start in the next quarter or two, with a Brownfield or well-funded player consolidating some pre-FEED or pre-FERC powerpoint projects.

Mubadala Builds NEXT Equity Position: On 12/12, NEXT filed a shelf registration for 10.1MM shares, controlled by Mubadala Investment Company (Mubadala) – 8.0MM of which were issued to Mubadala on 10/24 (at $6.27/share) and 2.1MM of which Mubadala acquired from another shareholder (we believe BKR). While the stock traded off 4% as the registration headlines spooked the market a bit (unfortunately, a relatively predictable outcome, even for a maintenance filing), the stock regained the lost ground relatively quickly. We view the BKR sale (via BHGE) as mostly a post-spin cleanup effort, with at least read through here that Mubadala likely wanted more equity than NEXT was willing to issue on a primary basis.

For access information, please email us at: [email protected]

Read More

Webber R|A: Vertical LNG Weekly

FERC Approves 4 Texas LNG Projects: On 11/21 The Federal Energy Regulatory Commission (FERC) voted in favor (2-1) of all three Brownsville LNG export terminals (below), along with Cheniere’s CC Stage – 3 expansion – granting all 4 projects final approval. Among those approved:

• NextDecade’s (NEXT) Rio Grande LNG (~27 mtpa)

• Annova LNG Brownsville (~7 mtpa)

• Texas LNG Brownsville (~4 mtpa)

• Cheniere’s (LNG) CC Stage – 3 expansion (~9.5 mtpa)

The approvals made meaningful progress for the projects, and come amid an uptick in local environmental pushback in Brownsville. While FERC approval is certainly helpful, all 4 projects still require meaningful commercialization targets to reach positive FID. We remain buyers of LNG and NEXT, as we view the Texas coast as the path of least resistance for associated Permian gas to reach the international markets.

Creating A Residual Value Floor: It’s also worth noting that we think the combination of an advantaged location and FERC approval effect helps create a meaningful asset and (to some degree) a valuation floor for the respective development companies. While we think the idea FERC/Site asset would have most of its practical relevance in a distressed scenario, we think its meaningful none-the-less, and not something we feel would be equal among projects (due to proximity advantages to the Permian).

European Investment Bank (EIB) Announces Phase Out Of Fossil Fuel Lending: Roughly two weeks before the 25th session of the Conference of the Parties (COP 25), the European Investment Bank (EIB), EU’s nonprofit long-term lending institution, announced it would (effectively) stop lending to fossil fuel projects, via particularly tight environmental guidelines. While the move is another meaningful step towards the de-carbonization of Europe, the immediate impact on LNG infrastructure is highly muted. For scale, the EIB lent out ~€11.8BN between 2013 and 2017, compared to JPM financing ~$62.7BN in 2018 alone. It’s also worth noting that the EIB can choose how they define alignment to the Paris Agreement, while others (World Bank, EBRD, Asian Development Bank, etc.) can choose different interpretations, and these institutions will still be able to finance midstream/downstream gas and gas-fired projects. On a more granular basis, most demand (and incremental lending) for natural gas projects now comes from non-European markets. Which typically has access to wider pockets of capital. For example, Mitsui recently invested in a major gas-fired power plant in Thailand, with financing provided by the Japan Bank for International Cooperation. Hence, we think the EIB move is material in the sense of sector leadership, but we aren’t expecting a dramatic market impact, at least at this point. Other notable takeaways from the EIB announcement: …….

Emails us at [email protected] for access details

Read More client log-in

client log-in