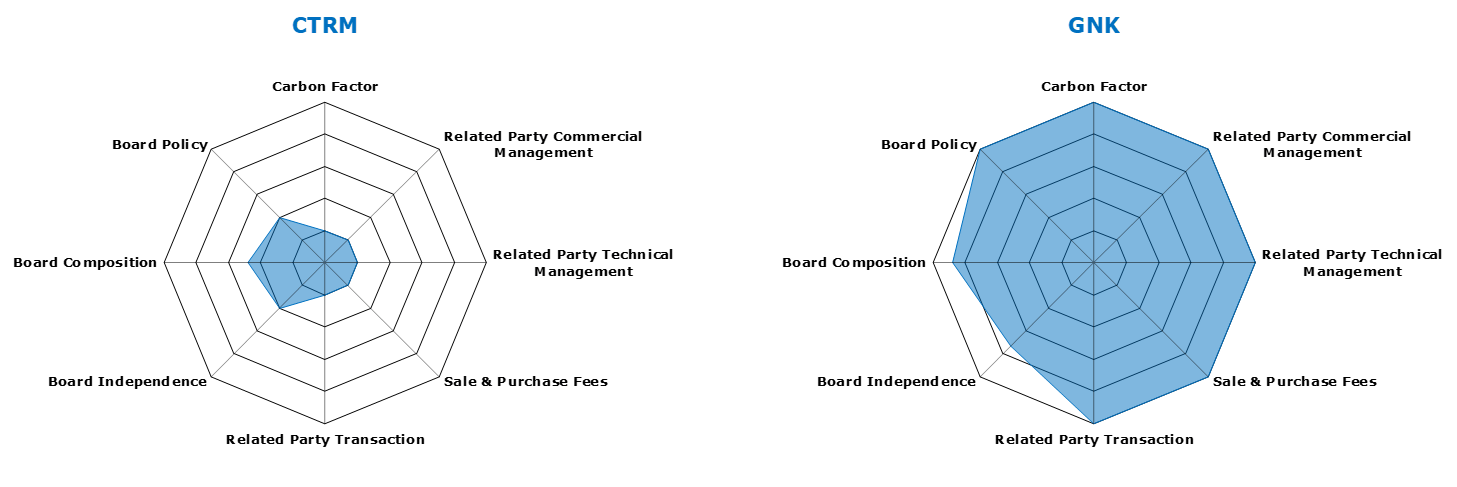

FreightWaves: Corporate governance in shipping

https://www.freightwaves.com/news/shipping-corporate-governance-whos-been-naughty-or-nice

Read More

https://www.freightwaves.com/news/shipping-corporate-governance-whos-been-naughty-or-nice

Read More

If you’re a current Webber Research subscriber, you can click here to access this presentation in our library.

If you’re not yet a subscriber, please click here to download the full report, or email us at [email protected] for access information.

Please contact us for a full copy of the report at [email protected]

https://www.seatrade-maritime.com/opinions-analysis/esg-moving-more-transparent-future

Read More