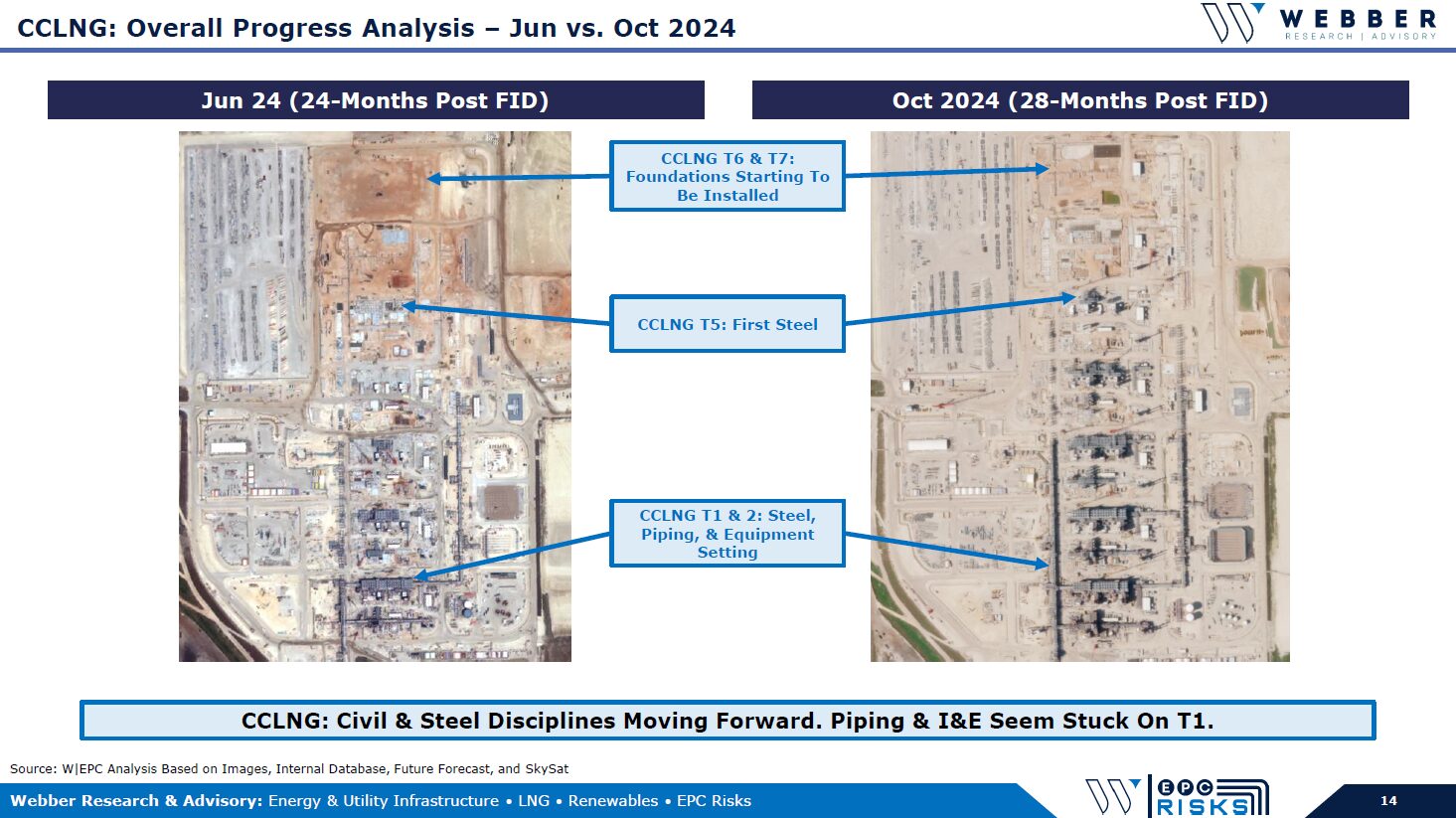

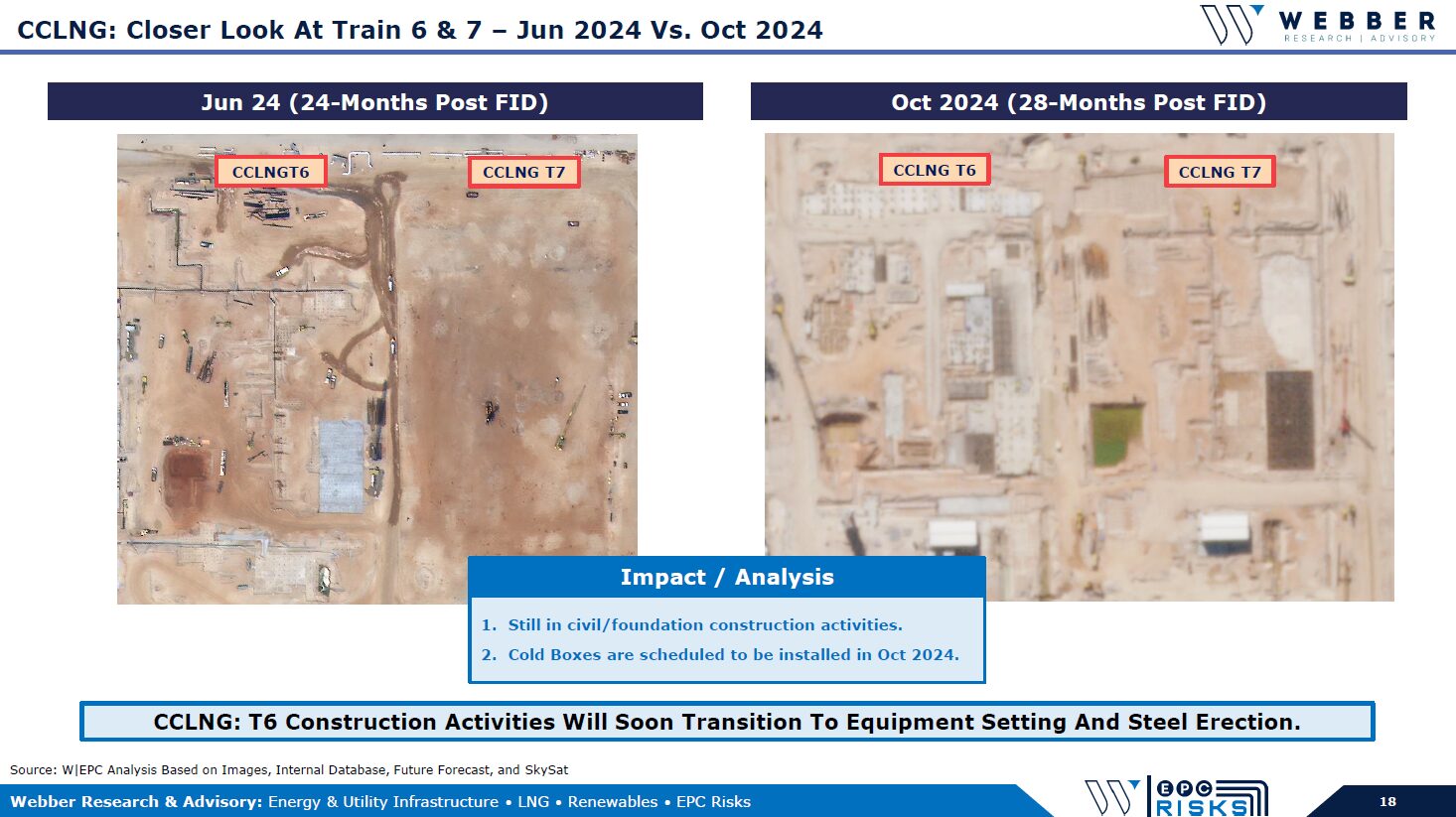

W|EPC: Corpus Christi LNG Project Update – Q424

If you’re already a Webber Research subscriber, you can access this report via our Research Library. To access the full report, please visit our Downloads page, or contact us at [email protected] or [email protected].

Read More

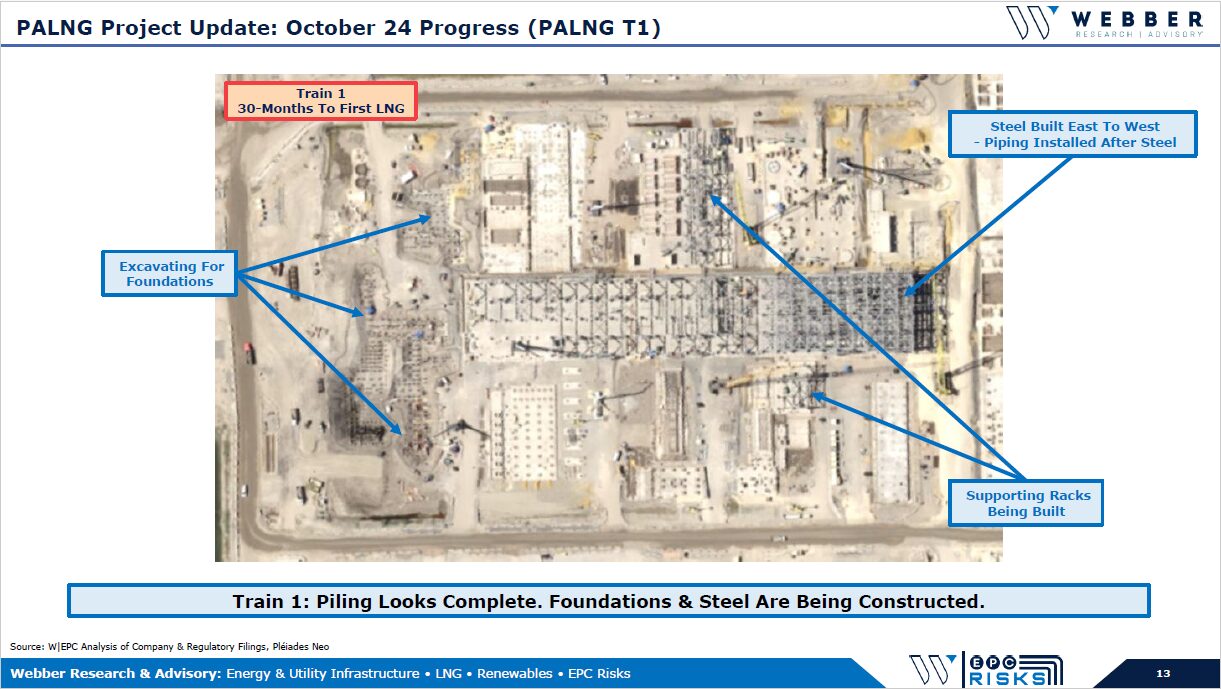

W|EPC: Port Arthur LNG Quarterly Project Update – Q4234

For access information, please contact us at [email protected] or [email protected]

LNG Canada Update: Shell, Fluor, JGC, & Force Majeure

- **March 18 Update………………………………….Page 2

- Executive Summary…………………………………Page 3

- COVID-19 Impact……………………………………Page 4

- EPC Schedule Analysis……………………………..Page 5

- Site Labor Analysis 6………………………………..Page 6

- Site Labor EPC Cost Impact……………………….Page 7

- Conclusions…………………………………………..Page 8

Update: In light of yesterday’s announcement that the Shell-led LNG Canada project was cutting its staffing levels in half over the coming days, we felt it worthwhile to pass along our LNG Canada Update from late February, along with a slide on our updated thoughts. (Page 2)

COVID-19 Impact Updates

1. The World Health Organization (WHO) officially declared COVID-19 a pandemic on 11-Mar-20.

a. JFJV may have a stronger FM claim now that WHO has declared the COVID-19 a pandemic, to the extent that JFJV specifically has “pandemic” or “epidemic” listed as an FM event in their contract.

b. FM Impact of Chinese module fabrication yards…….Page 4

2. On 17-Mar, LNG Canada and JFJV both announced that JFJV’s on-site workforce in Kitimat would be halved in order to increase social distancing and help prevent the spread of COVID-19. Given that the announcement was made jointly between JFJV and LNG Canada – impact on FM/schedule relief.…..Page 5

3.While JFJV did not announce when the site at Kitimat would resume a full workforce, it took “several” weeks for workers to return to JFJV’s Chinese fabrication yards…..Page 5

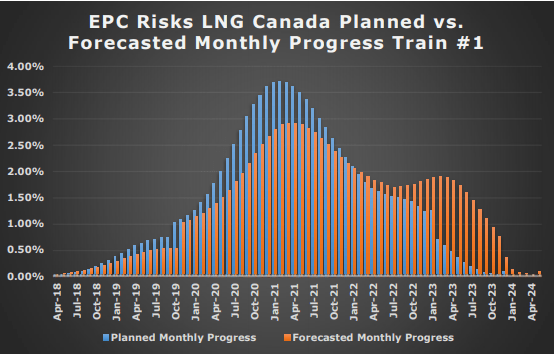

LNG Canada Planned Vs Foretasted Progress – Where Were We In February, and Where Are We Heading Now?…..Pages 5-8

Read More

client log-in

client log-in