W|EPC: Sempra’s Costa Azul (ECA) Phase 1 Project Update – Q423

If you’re already a Webber Research subscriber, this report is available via our research library. For access information, email us at [email protected]. To download this report, click here.

W|EPC: Sempra’s Costa Azul – Is ECA Different? A Deep Dive Into SRE’s Mighty Mouse

Sempra LNG’s Costa Azul – Analysis & Risks As Larger Projects Falter

- Overview Pages 1-3

- ECA Phase 1 & 2 Structures Pages 3-4

- Supply Dynamics & Feedstock Analysis Pages 6-7

- Sempra LNG Commercial Arrangements Pages 8-9

- EPC Analysis

- Project History & Dynamics Pages 9-10

- TechnipFMC – Historical Execution Details Pages 10-12

- Site Issues With Modularization Pages 12-13

- Independent Site & Schedule Analysis Pages 13-17

- Project Cost Analysis & Major Risks Pages 18-26

- Shipping, Midstream Pages 27-28

- Management Questions Pages 29-30

- Conclusions Pages 30-31

Mighty Mouse? Sempra’s (SRE) Costa Azul LNG (ECA, 2.4mtpa Phase-1) might be the only North American LNG project with a realistic chance at FID in 2020. As we saw last cycle, being small (and cheap) can be an advantage in difficult markets. As we note below, we’ve included our key takeaways around 1) Project viability in the current environment, 2) Site & Permitting Issues, 3) our independent project timeline & cost estimates, and 4) our Independent assessment of ECA’s project economics.

Background: Energía Costa Azul (ECA) is a 1 BCF/d LNG import terminal located north of Ensenada, Baja California, Mexico, ~31 miles south of the U.S./Mexican border (San Diego-Tijuana). It’s owned by Infrastructura Energetic Nova (IEnova), one of the largest natural gas infrastructure developers in Mexico, and is listed on the Mexican Stock Exchange (BMV: IENOVA). Sempra Energy owns 66.43% of IEnova.

Existing Infrastructure: The current ECA import terminal (Figure 1) includes the following infrastructure: (1) a marine berth and breakwater; (2) two 160,000 m3 LNG tanks; and (3) LNG vaporizers, nitrogen injection systems, and pipeline interconnections. Similar to some existing U.S. exporters and brownfield projects, ECA will be turning their facilities around to export LNG.

Permitting: ECA has received most of the major Mexico and U.S. permits needed to begin construction, but still lacks a key Mexican land-use permit. ECA LNG is not subject to FERC review under the National Gas Act (NGA) or National Environmental Policy Agency (NEPA). However, ECA is subject to various Mexican state and federal regulatory agencies, such as the Secretaris de Medio Ambiente y Recursos Naturales/ Ministry of Environmental and Natural Resources (SEMARNAT) and the Agencia Nacional de Seguridad Industrial y de Proteccion al Medio Ambiente del Sector Hidrocarburos/ National Agency for Industrial Security and Environmental Protection for the Hydrocarbon Industry (ASEA), as well as the U.S. Department of Energy (DOE).…continued

Click here to buy this report

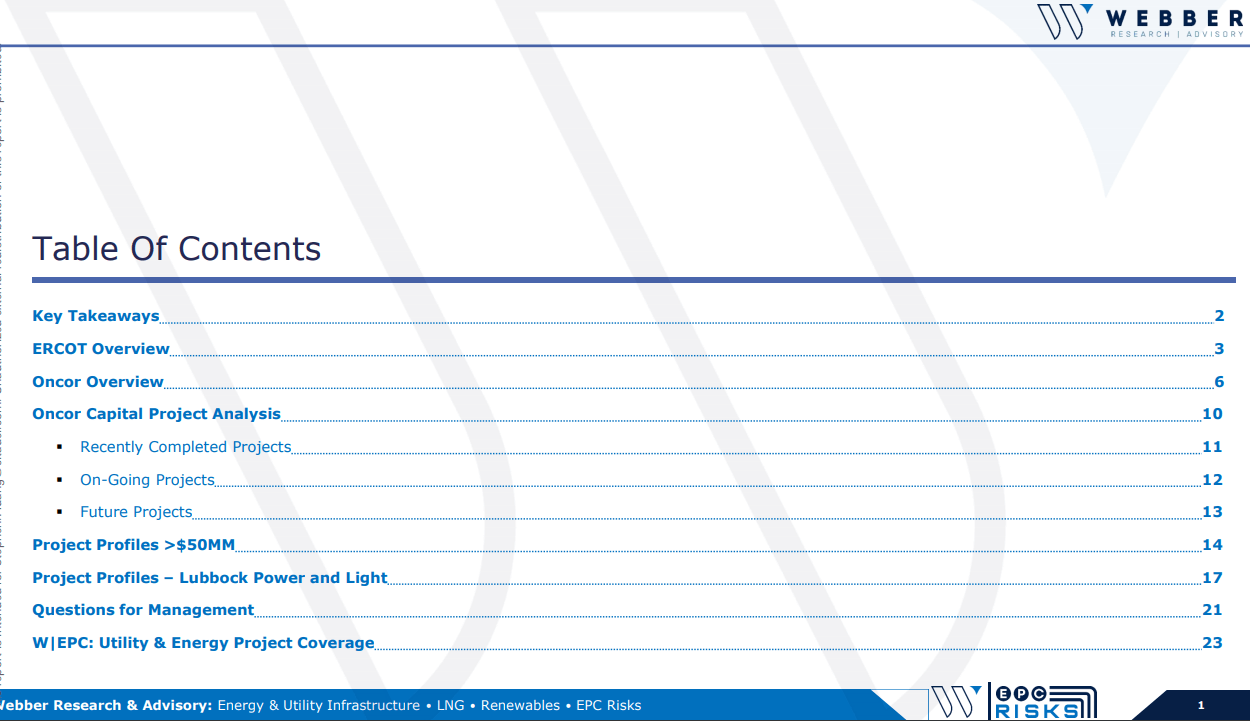

W|EPC Utilities & Energy – Sempra Deep Dive – Oncor, March 2020

Sempra (SRE) Capital Project Analysis – Oncor March 2020.

As part of our W|EPC Utility & Energy Project coverage, we’ve put together a deep dive into a number of large public utilities, including SRE, SO, D, AEP, CNP, ENB, EPD, ET, KMI, XOM, TOT, RDS:A, and others. We’ve included more information about our W|EPC Utility & Energy project coverage in the back of this presentation.

Given its size, and the sheer volume of projects and jurisdictions, we’re breaking our Sempra (SRE) coverage down into underlying components, with our Oncor deep dive below. Oncor Electric Delivery Company, LLC, is headquartered in Dallas, TX and is a regulated electrical distribution and transmission business. It is owned by two investors, SRE (80.25%) and Texas Transmission Investment LLC (19.75%).

Our Key Takeaways On Oncor:

- Out-sized Role In Critical TX Projects

- Oncor is involved with 5 out of the 10 most important projects to provide more efficient electricity dispatch, while supporting the increasing electrical demand in Texas. (Page 5)

- Oncor vs. Other Investor Owned Utilities

- Oncor has 156 more projects scheduled to be completed in 2020 than AEP, ET (50% AEP/50% Berkshire Hathaway) and CNP combined. (Page 8)

- Final Estimates vs. Final Actual Costs

- Over the last 15 months, Oncor’s reported final construction costs for 190 projects were 12% higher than their final estimated costs. (Pages 9-10)

- Lubbock Power and Light

- Oncor’s May 2019 acquisition of InfraREIT included a variety of electricity transmission and distribution projects & assets, which included ~$3600MM joint project with Lubbock Power and Light (LP&L). (Pages 13, 17-20)

- Future Project Opportunities

- The integration of LP&L to ERCOT should reduce congestion costs in the Panhandle of Texas and increase demand for new transmission projects in/and around Oncor’s coverage area. (Page 4)

client log-in

client log-in