W|EPC: Qatar LNG North Field Expansion – Baseline Report Q221

For access information, please email at [email protected], or reach out to [email protected]

Read More

For access information, please email at [email protected], or reach out to [email protected]

Read More

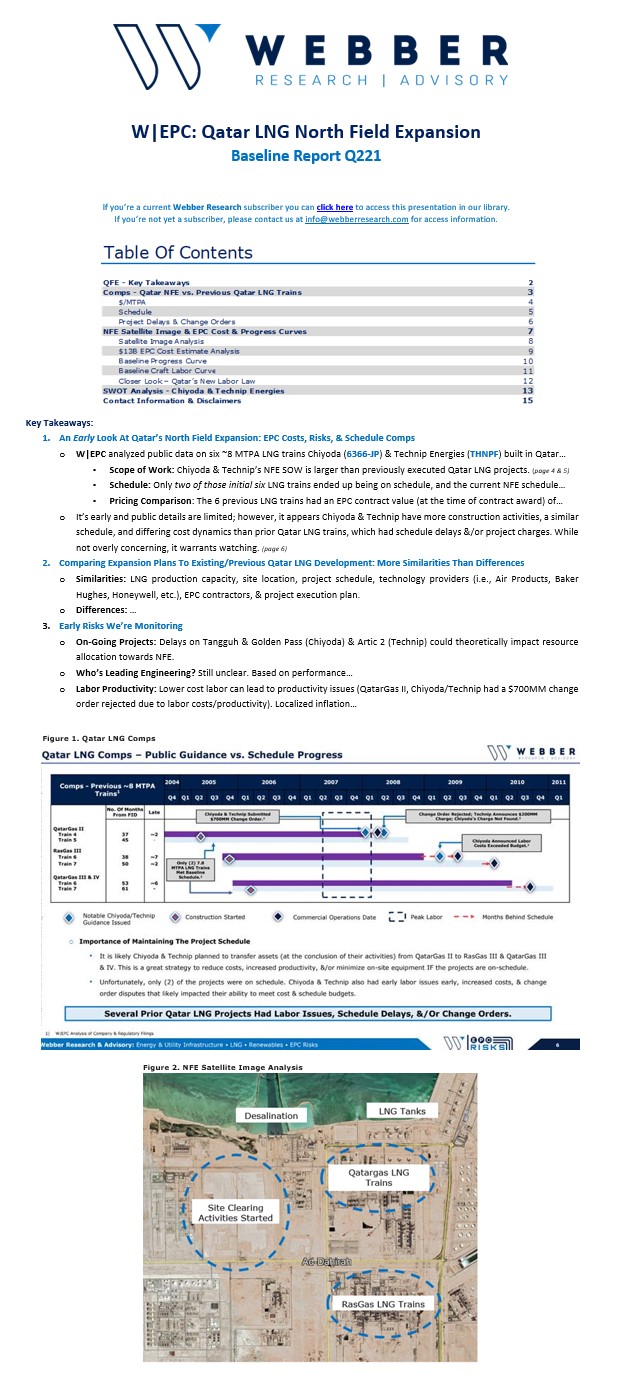

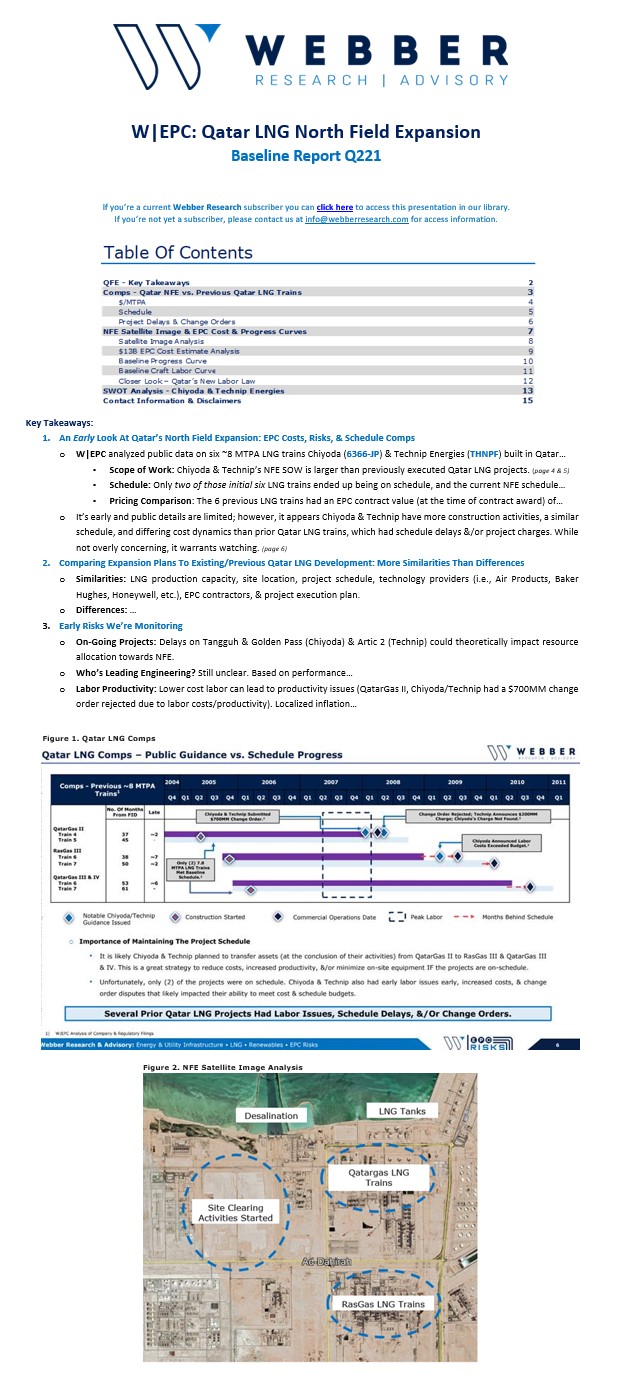

Key Takeaways:

• Chiyoda’s Engineering Delays Continue. We believe engineering delays have eroded a significant portion of the EPC risk, contingency, and profit, with the likelihood of ramping balance sheet exposure. (Pages 4 & 11)

• Our updated project timeline (delay) and contingency fund estimates are now material, sitting at….(continued)

• Our estimates point to Golden Pass project progress sitting closer to ~10% vs Chyioda’s report figure of 16% (Q2) based on both our satellite image review and….(continued)

• Sabine Pass Comparison. 18-Months after FID Sabine Pass LNG Trains 1 & 2 were 57.1% complete, vs our estimated range for Golden Pass LNG (~10-16%). (Page 8)

Table Of Contents

Golden Pass LNG Satellite Image Overview (page 13)

For access information please email us at [email protected]

W|EPC: Golden Pass LNG – Delay & Contingency Fund Estimates Continue To Ramp – Updated Project & Satellite Image ReviewRead More

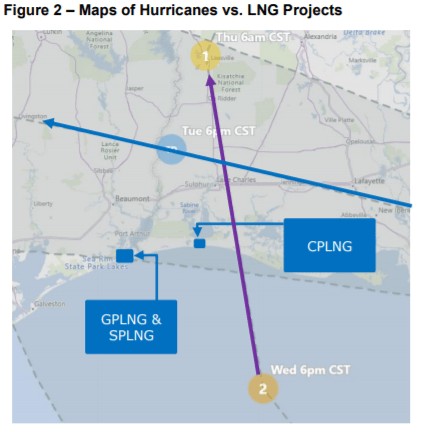

Marco & Laura Impact Could Last 7 to 14 Days…Depending on Damage & Craft Labor Retention

EPC contractors receive schedule relief for Force Majeure (FM) events (i.e. named storms such as Marco & Laura) in industry standard EPC contracts, which typically provides EPC contractors schedule relief but not cost relief.

EPC contractor FM claims on Calcasieu Pass, Golden Pass, and Sabine Pass LNG likely started yesterday August 24th, 2020 (due to mandatory evacuations & closures).

Something to watch…construction workers tend to scatter and chase higher paying (wages & per-diem) jobs post hurricanes/natural disasters, which creates headaches for on-going/planned projects and complicates FM claims.

Based on current Marco & Laura forecasts and expected rain/storm surge, we are forecasting a 7 to 14-day construction schedule delay on Calcasieu Pass LNG (CPLNG), Golden Pass LNG, & Sabine Pass LNG Train #6 (SPLNG6).

Impact & Timeline Implications

Often, impacts due to hurricanes occur well beyond the actual storm itself due to lost productivity and challenges restarting/staffing the project.

Flooding – enough drainage pumps installed and site drainage working sufficient to mitigate additional rain fall.

Storm Surge – levees/walls high enough to protect rising levels and all equipment moved to the highest elevation on the site (if practical).

Wind – cranes must be placed horizontally and structures secured to reduce/prevent damage.

Temporary Construction Facilities – if levees and/or drainage are not in place at temporary construction facilities, equipment and material stored in laydown yards/facilities could be damaged by water and cause unplanned long-term issues.

EPC contractors have a reputation for trying to use FM impacts to absorb existing self-inflicted schedule delays. Based on the current/expected forecast, we believe the following FM timeline is realistic.

Prep time for storms – 1 to 3 days

Marco & Laura storm duration – 2 to 4 days

Restart & productivity losses – 4 to 7 days

Our specific estimates and thoughts on individual projects in the pages that follow:

For subscription information, email us at [email protected]. For more information on this note, please visit our online store at webberresearch.com/downloads

Read More

For access information, please email us at [email protected]

Key Takeaways:

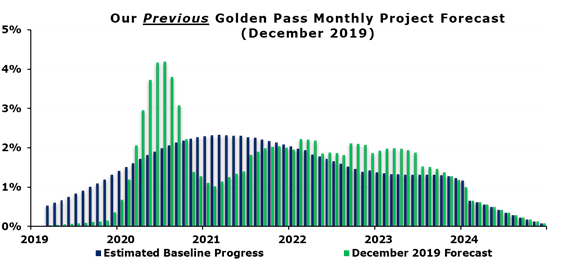

1) What’s Eating Golden Pass? QP & XOM Get Squirrelly In Press. On April 6th, the NYT ran an exclusive quoting Saad al-Kaabi (former QP CEO & current Qatar Energy Minister) as saying Golden Pass (GPX) was proceeding and on schedule. However, that was quickly followed by QP’s 30% partner Exxon (XOM) cutting $11B of 2020 CAPEX, delaying FID for Rovuma LNG (Mozambique), reiterating Coral LNG’s development, while ignoring GPX altogether. Since then, the NYT took down the article, energy markets are upside down, & questions mount. Based on actual EPC progress, we believe the reaffirmed GPX schedule falls somewhere between…..continued (Pages 2-3)

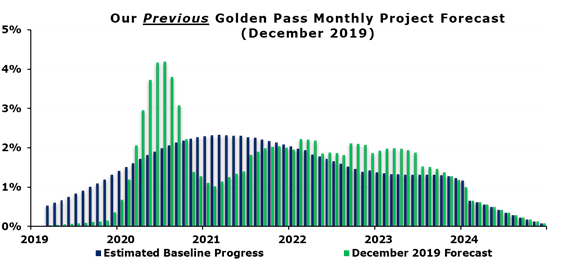

2) Is Golden Pass In Trouble? Monthly Progress Analysis. We believe GPX’s engineering has remained well behind schedule. Data suggests GPX has been attempting (unsuccessfully) to ramp labor earlier than planned…continued (Pages 9 & 13-14)

3) Labor Logistics In The COVID Era…On 4/17/20, GPX requested additional on-site parking amid challenges with safely busing craft workers to the site amid a global pandemic, however busing craft workers wasn’t supposed to begin for another year (2021). This minor, intuitive disclosure actually offers a few significant read-throughs for the project, as well as its path moving forward…continued (Pages 6-8)

4) Cost Overruns Poised To Accelerate From Here? Over the next 6 months we believe the project is already looking at construction cost overruns (relative to its baseline schedule) of at least…continued (Page 7)

Updated Pricing Color For U.S. Developers: Cheniere, Shell, Venture Global, Next Decade, Freeport, Annova, Commonwealth, Delfin & More. Over the past week we’ve had several conversations with LNG buyers, project developers, and downstream operators, with the more pertinent color below:

LNG Pricing Currently Being Offered In The USG:

• Consensus Range: $2.25–2.40/mmbtu – Individual Developer Pricing Details On Page 2

• Outlier: $2.10-2.20/mmbtu – Individual Developer Pricing Details On Page 2

• Outlier: Offering ~$1.75/mmbtu – Individual Developer Pricing Details On Page 2

Favored Projects: Buyer With Some Effective Baseload Exposure – In the U.S. only really considering a handful of projects (page 2), however, Qatar is the most likely – and buyer has option to pull from Ras Laffan or Golden Pass. Webber Note: the optionality here provides another window into how Qatar is marketing their entire ~100mtpa portfolio.

Venture Global: At least 2 buyers in Calcasieu potentially going back for more LNG in Plaquemines, site visits are still ongoing (page 3).

Project Roll Ups: One buyer speculated we’ll see some of the 3rd and 4th tier Greenfield projects get rolled up in 2020, as existing players look for cheaper growth optionality and early stage projects solve for funding issues. Webber Note: we agree, and think it could start in the next quarter or two, with a Brownfield or well-funded player consolidating some pre-FEED or pre-FERC powerpoint projects.

Mubadala Builds NEXT Equity Position: On 12/12, NEXT filed a shelf registration for 10.1MM shares, controlled by Mubadala Investment Company (Mubadala) – 8.0MM of which were issued to Mubadala on 10/24 (at $6.27/share) and 2.1MM of which Mubadala acquired from another shareholder (we believe BKR). While the stock traded off 4% as the registration headlines spooked the market a bit (unfortunately, a relatively predictable outcome, even for a maintenance filing), the stock regained the lost ground relatively quickly. We view the BKR sale (via BHGE) as mostly a post-spin cleanup effort, with at least read through here that Mubadala likely wanted more equity than NEXT was willing to issue on a primary basis.

For access information, please email us at: [email protected]

Read More