W|EPC Utilities & Energy – Sempra Deep Dive – Oncor, March 2020

Sempra (SRE) Capital Project Analysis – Oncor March 2020.

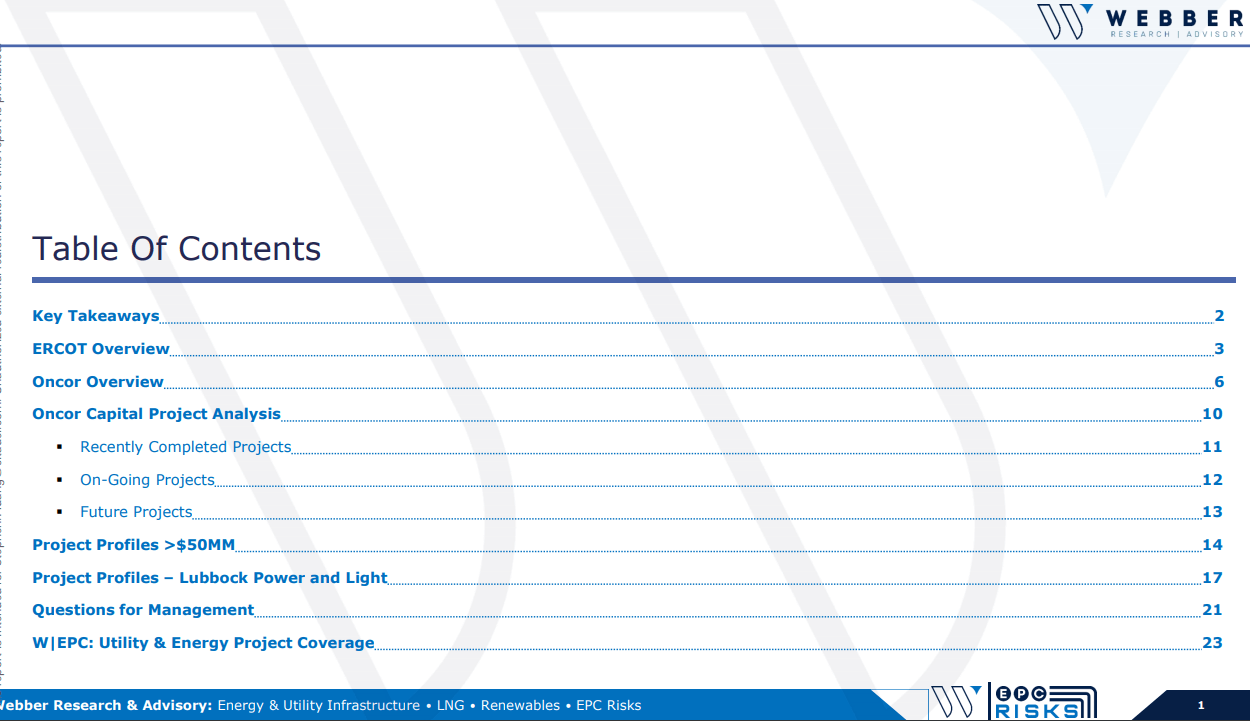

As part of our W|EPC Utility & Energy Project coverage, we’ve put together a deep dive into a number of large public utilities, including SRE, SO, D, AEP, CNP, ENB, EPD, ET, KMI, XOM, TOT, RDS:A, and others. We’ve included more information about our W|EPC Utility & Energy project coverage in the back of this presentation.

Given its size, and the sheer volume of projects and jurisdictions, we’re breaking our Sempra (SRE) coverage down into underlying components, with our Oncor deep dive below. Oncor Electric Delivery Company, LLC, is headquartered in Dallas, TX and is a regulated electrical distribution and transmission business. It is owned by two investors, SRE (80.25%) and Texas Transmission Investment LLC (19.75%).

Our Key Takeaways On Oncor:

- Out-sized Role In Critical TX Projects

- Oncor is involved with 5 out of the 10 most important projects to provide more efficient electricity dispatch, while supporting the increasing electrical demand in Texas. (Page 5)

- Oncor vs. Other Investor Owned Utilities

- Oncor has 156 more projects scheduled to be completed in 2020 than AEP, ET (50% AEP/50% Berkshire Hathaway) and CNP combined. (Page 8)

- Final Estimates vs. Final Actual Costs

- Over the last 15 months, Oncor’s reported final construction costs for 190 projects were 12% higher than their final estimated costs. (Pages 9-10)

- Lubbock Power and Light

- Oncor’s May 2019 acquisition of InfraREIT included a variety of electricity transmission and distribution projects & assets, which included ~$3600MM joint project with Lubbock Power and Light (LP&L). (Pages 13, 17-20)

- Future Project Opportunities

- The integration of LP&L to ERCOT should reduce congestion costs in the Panhandle of Texas and increase demand for new transmission projects in/and around Oncor’s coverage area. (Page 4)

client log-in

client log-in