W|EPC: Renewable Methanol & Hydrogen – Analyzing Methanex’s (MEOH) Geismar Facilities

Renewable Methanol & Hydrogen – Analyzing Methanex’s (MEOH) Geismar Facilities – September 2020

- Methanex & Renewable Methanol – Key Takeaways (page 2)

- Renewable Methanol (page 3)

- Methanol Feedstock & Applications (page 4)

- Hydrogen is Getting Cheaper (page 5)

- Renewable Methanol Facilities (page 6)

- Geismar Methanol Facilities (page 7)

- Methanex Overview (page 8)

- History – Geismar Units 1 & 2 (page 9)

- Geismar Unit 3 Comps (page 10)

- GU3 Cost Overview (page 11)

- Schedule – Key Milestones & Impact (page 12)

- Monthly Progress Curves (page 13)

- EPC Dynamics – So Long KBR, Next Up?(page 14)

- Disclosures (page 15)

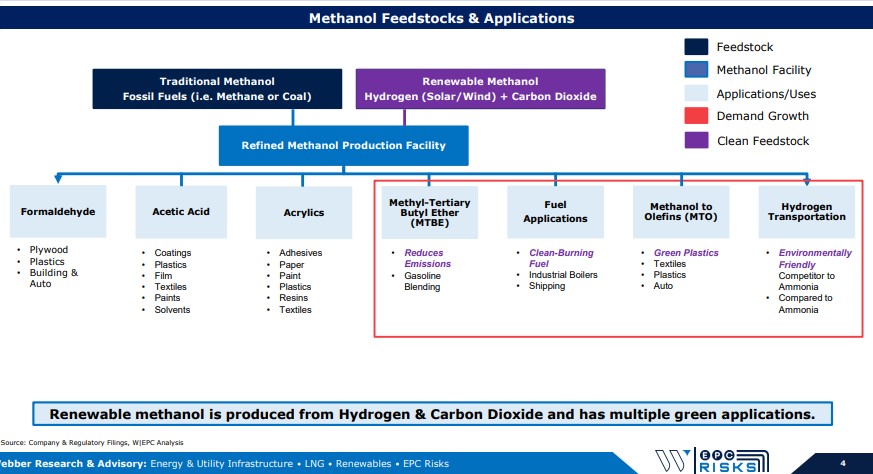

Lower-Cost Hydrogen Will Produce Cost Competitive Renewable Methanol: Pipe Dream or Reality? Global methanol demand sits near ~75 MTPA; with demand expected to ramp amid new EU and U.S. environmental mandates. Renewable Methanol (RM) is produced using Hydrogen (H2) from solar/wind and carbon dioxide (CO2) as compared to traditional methanol produced from fossil fuels (i.e. coal & natural gas). (Page 4)

Cost-competitive RM would open the door to green plastics and support various marine, fuel, & vehicle clean energy mandates but, costs are not competitive based on current technology. (Pages 4 – 5) Limited project economics hasn’t stopped ~10 commercial scale renewable methanol facilities in various stages of development around the world. As these projects develop, lower costs and improved technology would be a game changer for the methanol industry while providing H2 more downstream applications. (Page 6)

Tracking the 800 lbs. Methanol Gorilla…Methanex (MEOH). (Pages 8 – 9)

Geismar Unit 3 – Positioning vs. Competition. (Pages 10 – 13)

For access information, please email us at [email protected] or visit us at webberresearch.com

client log-in

client log-in