Exxon, Qatar & Golden Pass: Something’s Gotta Give

Analyzing Project Costs & Logistics In The COVID Era

(Part 1 of 2 – Satellite Image Analysis Later This Week)

- Golden Pass: 4 Key Takeaways……………………………………Page 2

- EPC: Monthly Progress Evolution……………………………….. Page 3

- April 2020 Project Update…………………………………………Page 4

- IP & Construction Activity ……………………………………Page 5

- Labor Logistics In The COVID Era ………………………….Page 6

- Cost Analysis – Significant Overruns Already?……………Page 8

- COVID-19 Impact …………………………………………….Page 9

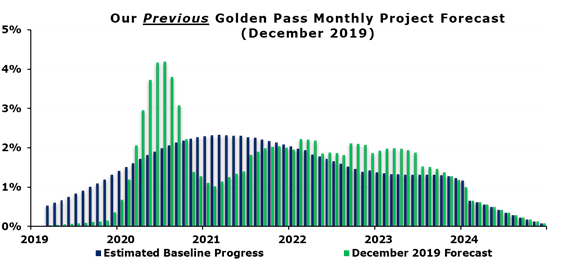

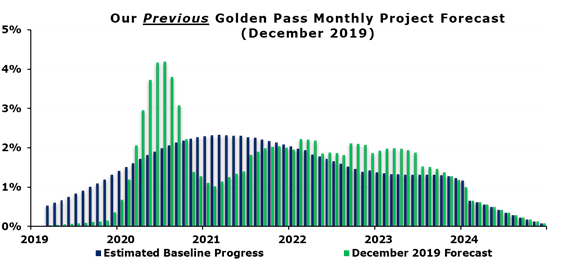

- December 2019 Baseline

- Partner Organization, Key Participants ……………………Page 10

- EPC Roles: MDR, Zachry, Chiyoda …………………………Page 12

- Variance Analysis …………………………………………….Page 14

For access information, please email us at [email protected]

Key Takeaways:

1) What’s Eating Golden Pass? QP & XOM Get Squirrelly In Press. On April 6th, the NYT ran an exclusive quoting Saad al-Kaabi (former QP CEO & current Qatar Energy Minister) as saying Golden Pass (GPX) was proceeding and on schedule. However, that was quickly followed by QP’s 30% partner Exxon (XOM) cutting $11B of 2020 CAPEX, delaying FID for Rovuma LNG (Mozambique), reiterating Coral LNG’s development, while ignoring GPX altogether. Since then, the NYT took down the article, energy markets are upside down, & questions mount. Based on actual EPC progress, we believe the reaffirmed GPX schedule falls somewhere between…..continued (Pages 2-3)

2) Is Golden Pass In Trouble? Monthly Progress Analysis. We believe GPX’s engineering has remained well behind schedule. Data suggests GPX has been attempting (unsuccessfully) to ramp labor earlier than planned…continued (Pages 9 & 13-14)

3) Labor Logistics In The COVID Era…On 4/17/20, GPX requested additional on-site parking amid challenges with safely busing craft workers to the site amid a global pandemic, however busing craft workers wasn’t supposed to begin for another year (2021). This minor, intuitive disclosure actually offers a few significant read-throughs for the project, as well as its path moving forward…continued (Pages 6-8)

4) Cost Overruns Poised To Accelerate From Here? Over the next 6 months we believe the project is already looking at construction cost overruns (relative to its baseline schedule) of at least…continued (Page 7)

client log-in

client log-in