Shell Archives - Webber Research

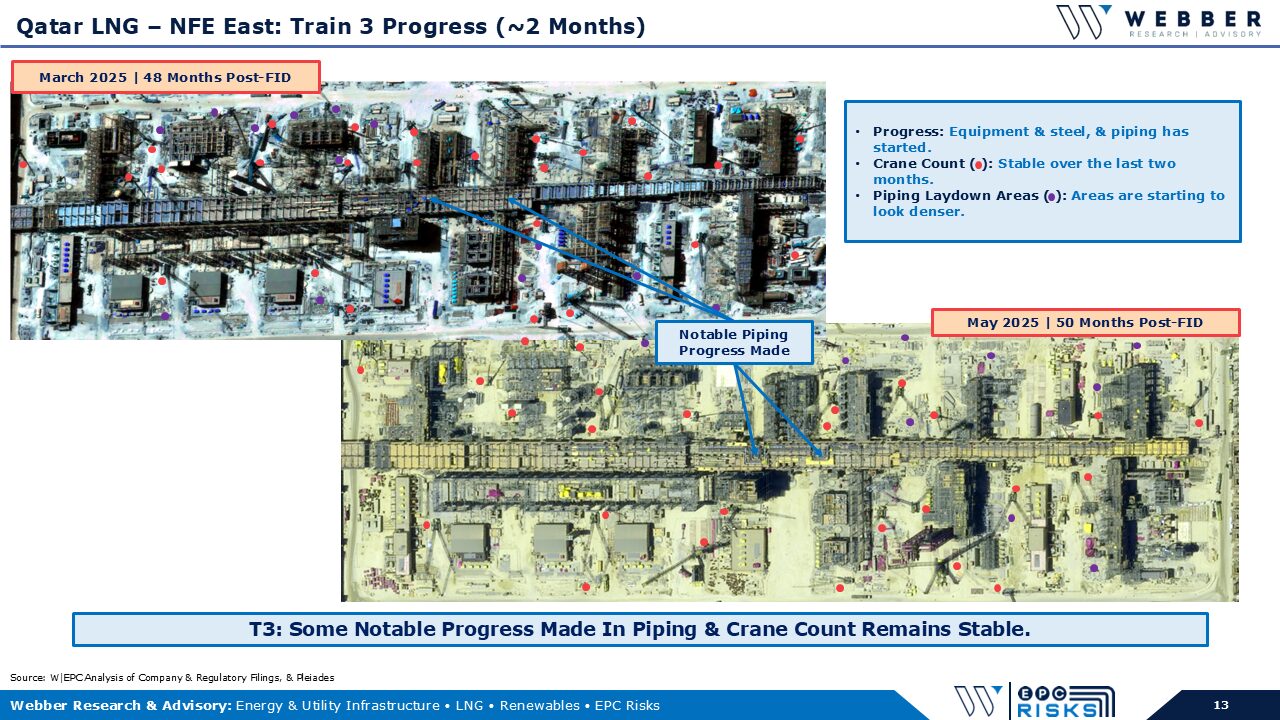

W|EPC: Qatar Energy’s NFE LNG Project Update – Q225

Read More

W|EPC: LNG Canada Q225 Project Update – Client Call, Weds 06/11 @11AM EST

Read More

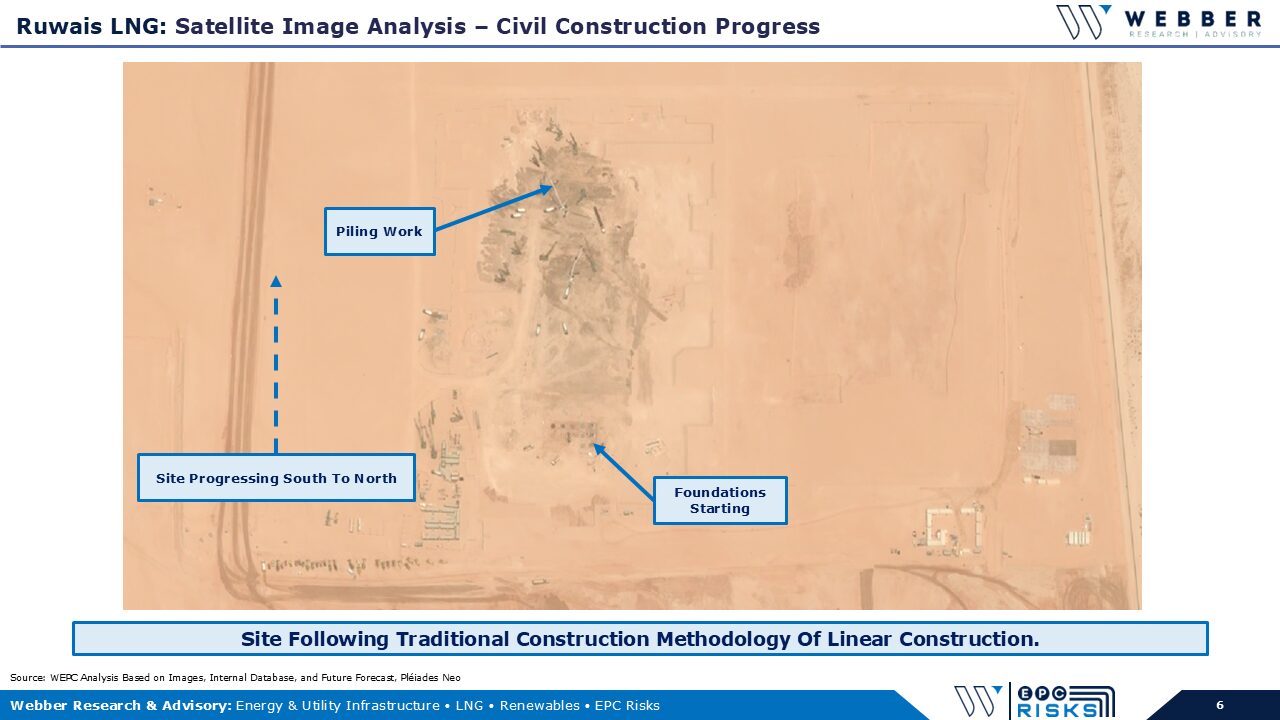

W|EPC: Ruwais LNG Project Update – Q225

Read More

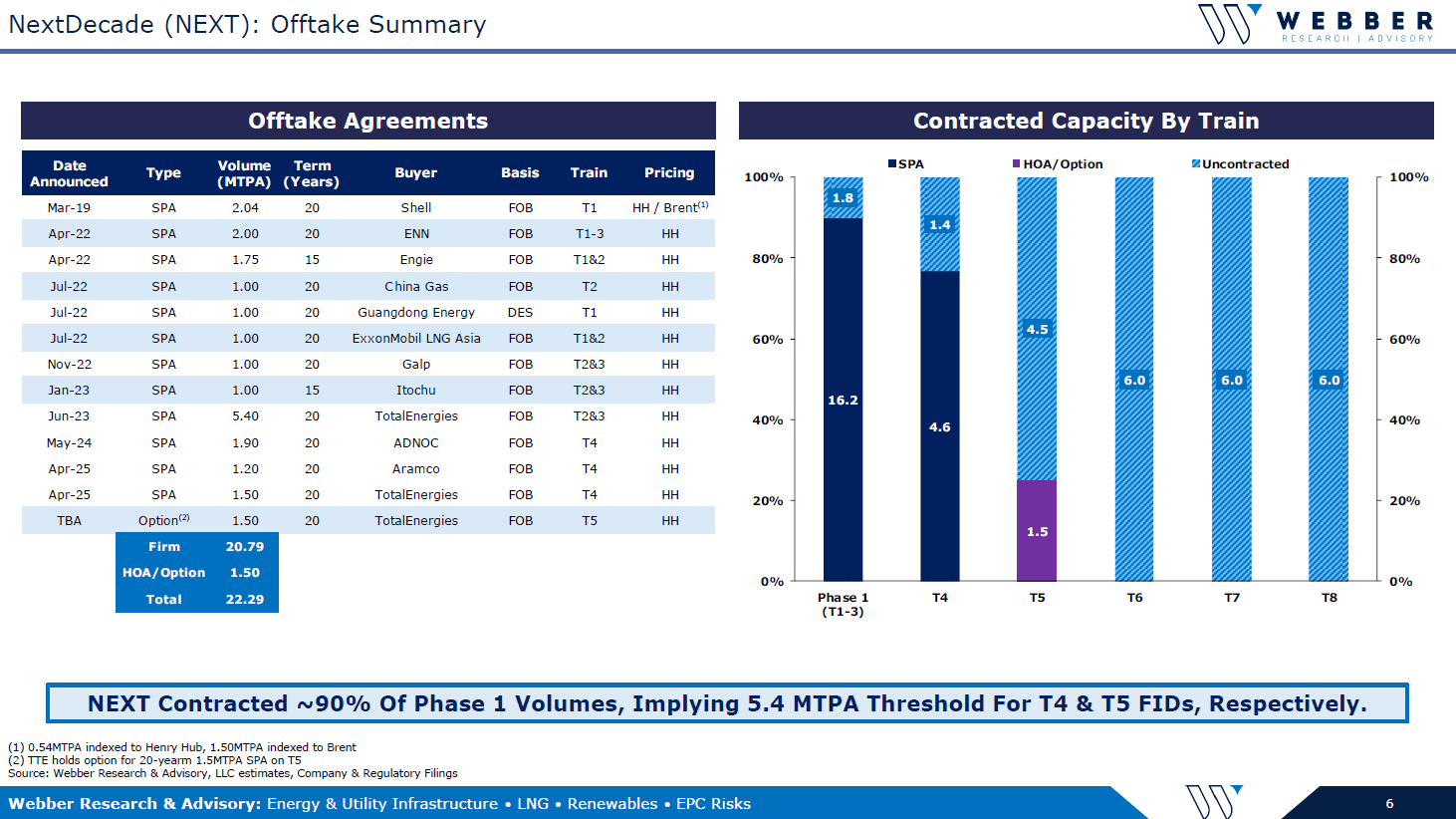

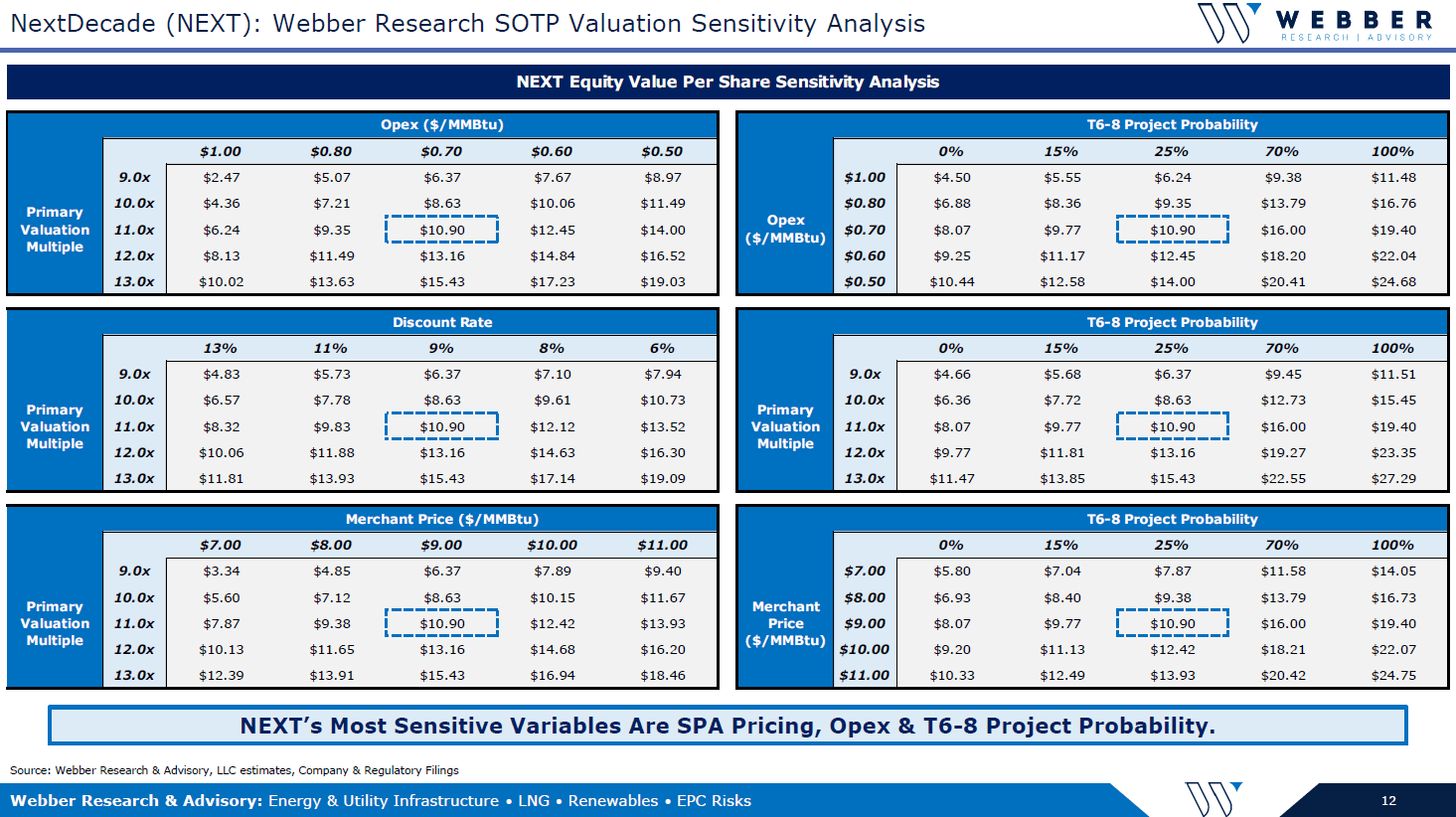

NextDecade Corp. (NEXT): Model Refresh & Overview

Read More

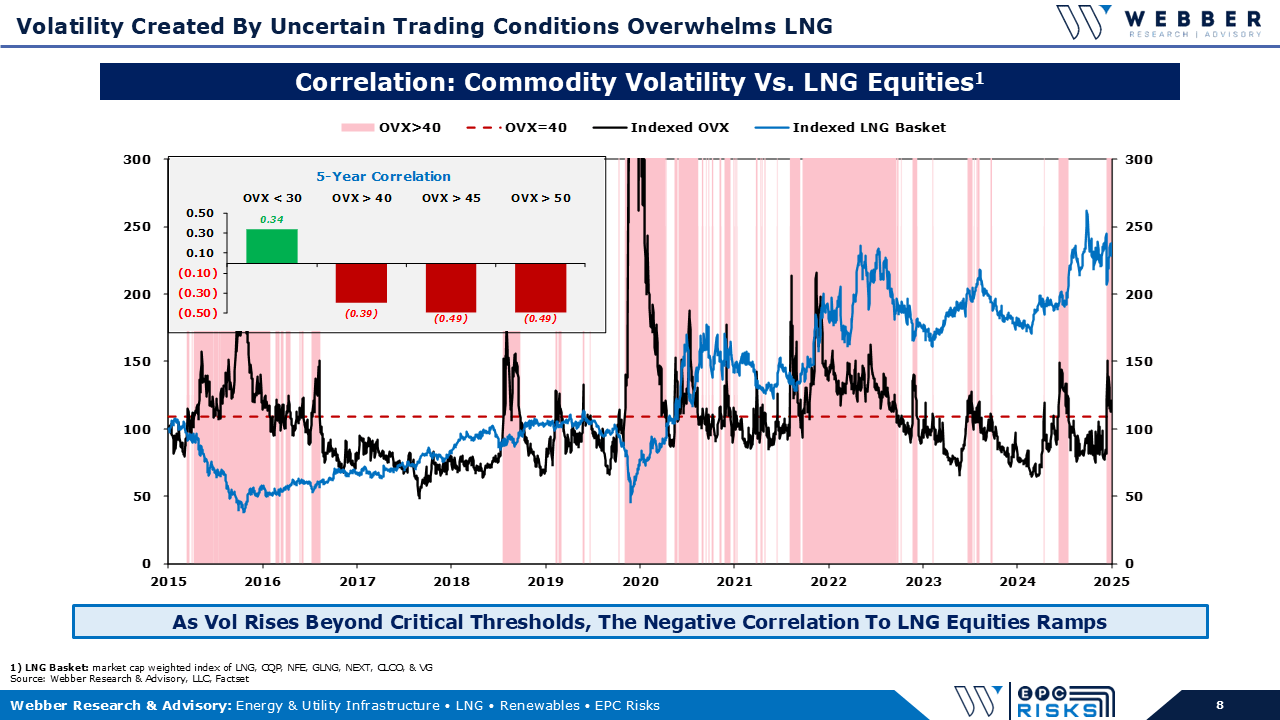

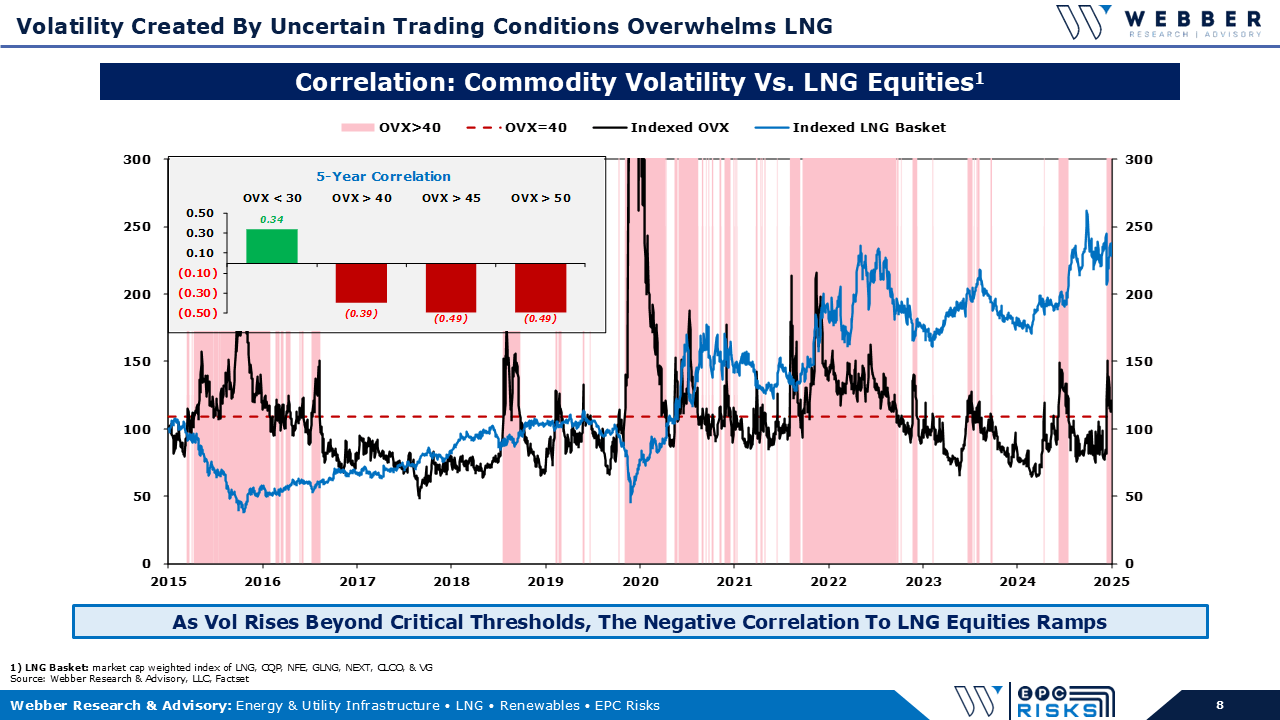

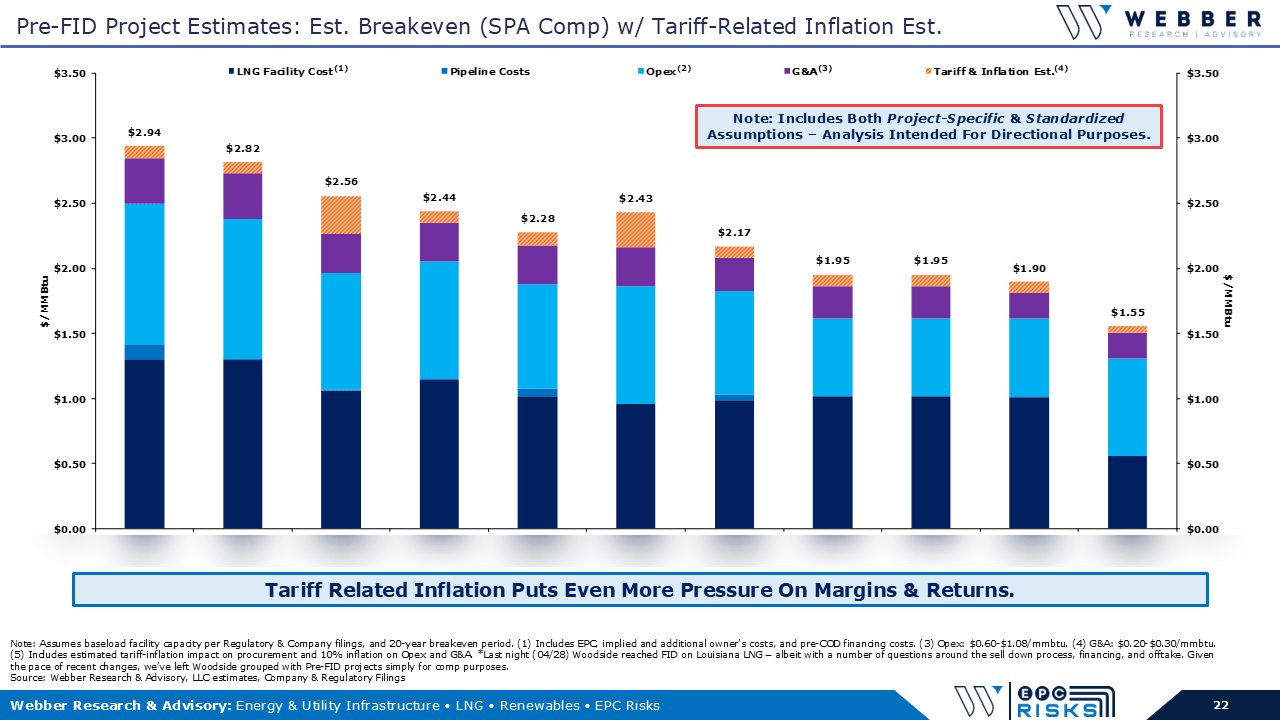

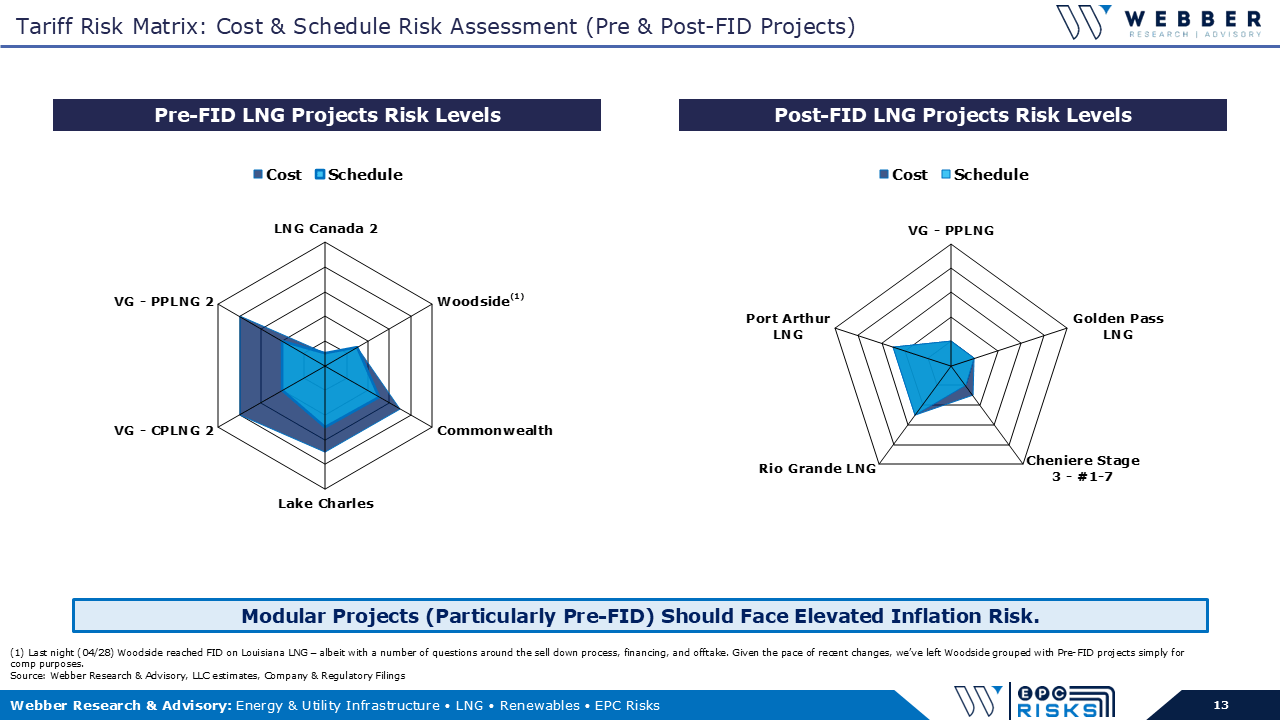

Client Call: Chill, Baby, Chill. – LNG Tariff & Inflation Impacts – Weds 04/30 @11am EST

Read More

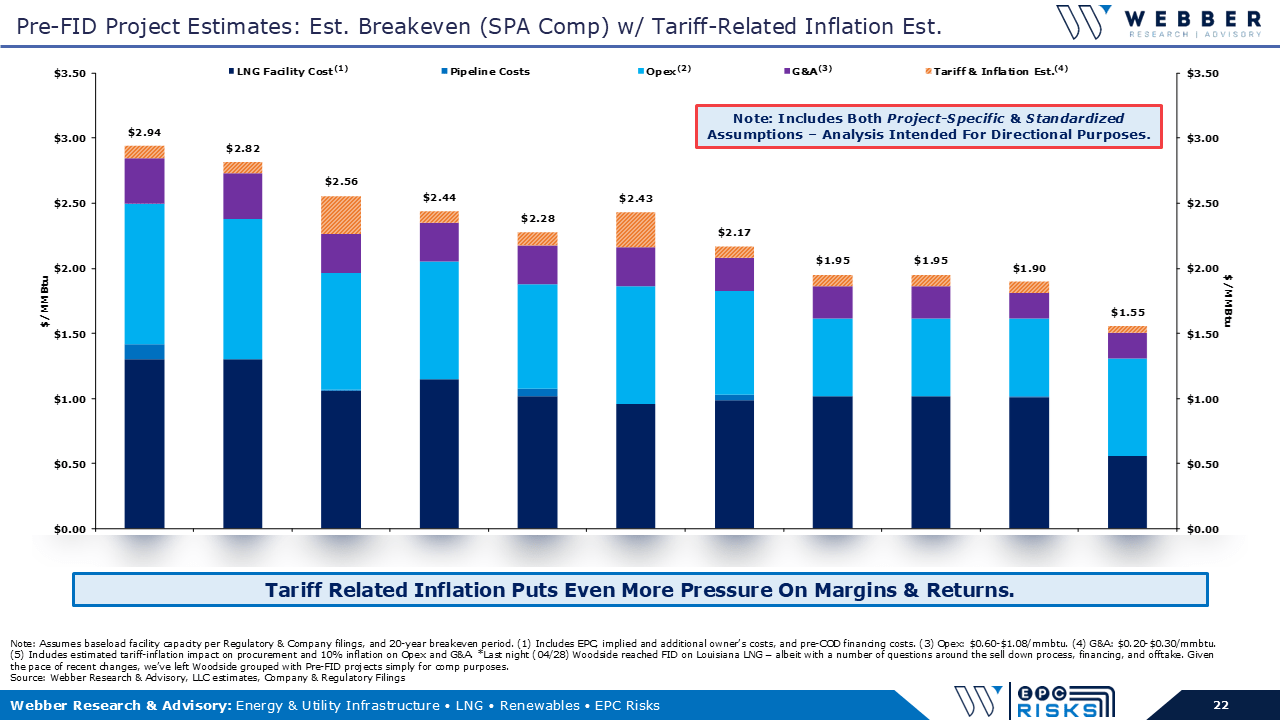

W|PEC: Chill, Baby, Chill – Tariff & Inflation Impact on LNG

Read More