W|EPC: Plaquemines Parish LNG Interim Project Update: Q125

To access the full presentation, please visit our Research Library, or contact us at [email protected] or [email protected].

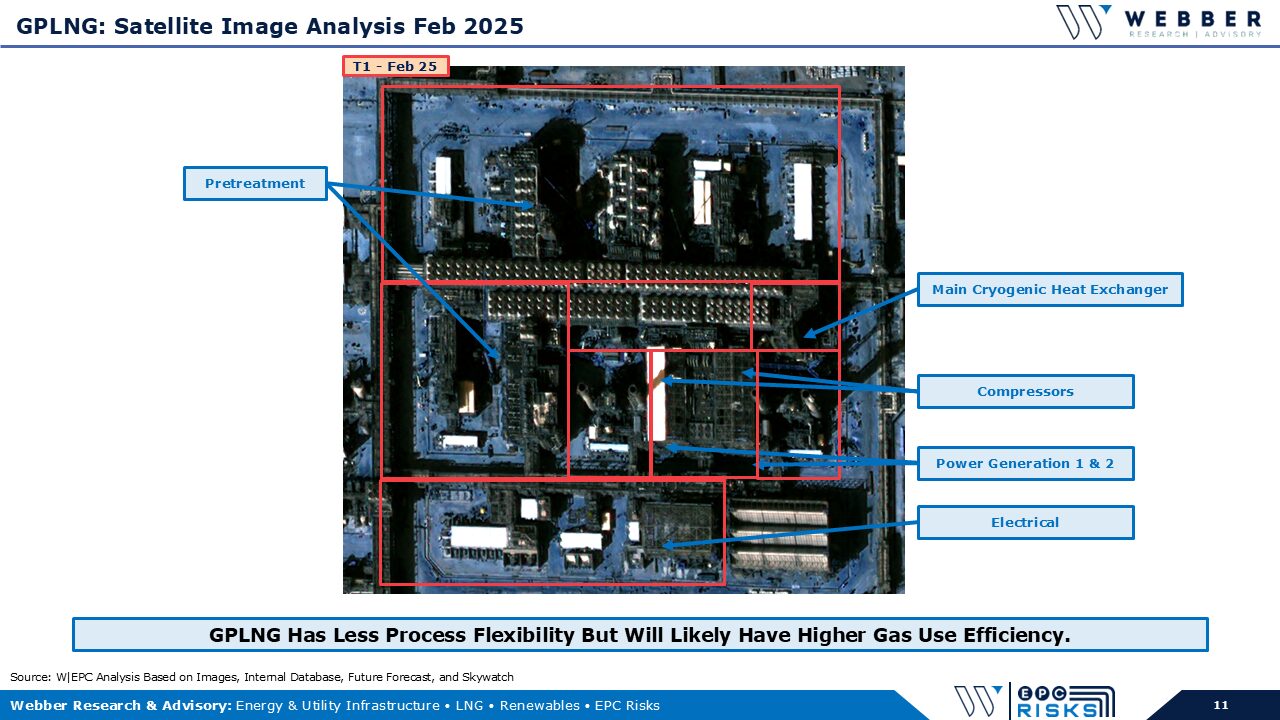

W|EPC: Golden Pass LNG Project Update – Q125

For the full deck, please visit our Downloads page. If you’re already a Webber Research subscriber, you can access this report via our Research Library. For access information please contact us at [email protected], or [email protected].

Read More

W|EPC: Client Call – Cheniere’s (LNG) Corpus Christi LNG Q125 Update – Thurs 02/27 @11AM EST

client log-in

client log-in