Webber Research: Renewables Weekly

Webber Research: Renewables Weekly 11/05/2020

- Baker Hughes (BKR) Buys Carbon Capture Platform

- Dominion (D )Proposes 9 New Solar Facilities For ~500MW

- AMRC – 2 New Contracts In Oregon

- Neste Acquires Neighboring Refinery Plant

- ITRI Deploys AMI In Canada

- AGR Investor Day & PNM Merger

- Vestas Buys Out MHI Stake In MHI Vestas JV

- AEP PPAs In Ohio

- Diamond Green Diesel Receives Air Permit From TCEQ

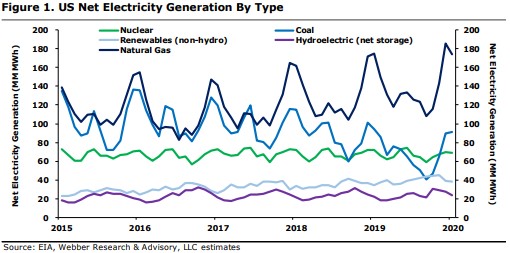

- US Net Electricity Generation

- Solar PV Pricing

- LCOE Benchmarks & Timeseries

- Global Wind Turbine Market Share

- Global Solar PV Inverter Market Share

- US Wind & Solar Projects Announced Or In Early Development

BKR Buys Carbon Capture Platform: On 11/3 BKR announced it acquired Compact Carbon Capture (3C) for an undisclosed amount. BKR plans to accelerate development and commercialization of 3C’s carbon capture solution, which adds to its existing portfolio of carbon capture technology including turbomachinery, solvent-based capture processes, well construction, CO2 storage management, and digital monitoring solutions…

Dominion Proposes 9 New Solar Facilities For ~500MW: On 11/2, Dominion Energy (D) proposed a slate of 9 new solar projects with output of 498MW. Six of the facilities (416MW) are through PPAs, helping to fulfill the Virginia Clean Economy Act (VCEA) requirement of having 1/3 of new solar and onshore wind be procured through PPAs through 2035….

AMRC 2 New Contracts In Oregon: On 10/26 and 10/27 AMRC…..

For access information, email us at [email protected], or go to webberresearch.com/downloads

Read More

client log-in

client log-in