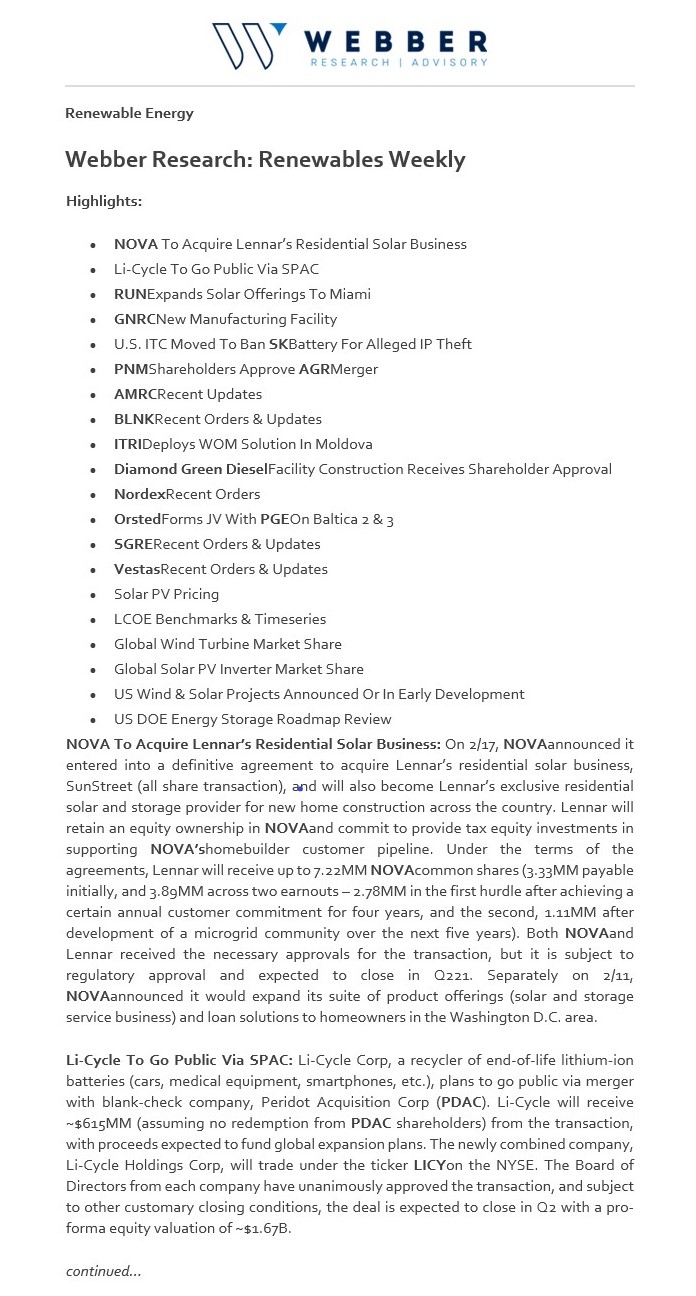

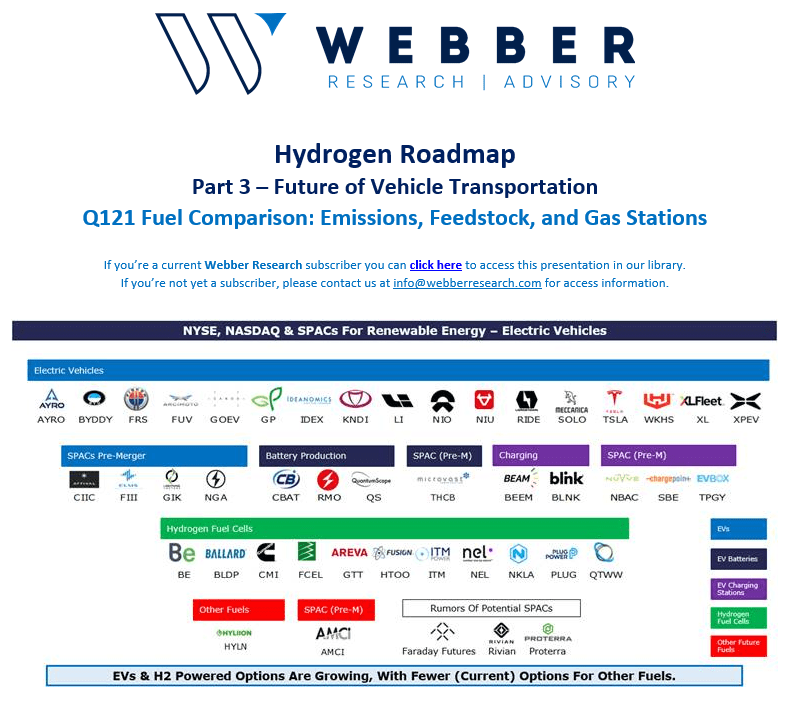

Hydrogen Roadmap – Fuel Comparisons: Emissions, Feedstock, & Gas Stations – Future Of Transportation (Part 3)

For access information, email us at [email protected], or at [email protected]

Read More

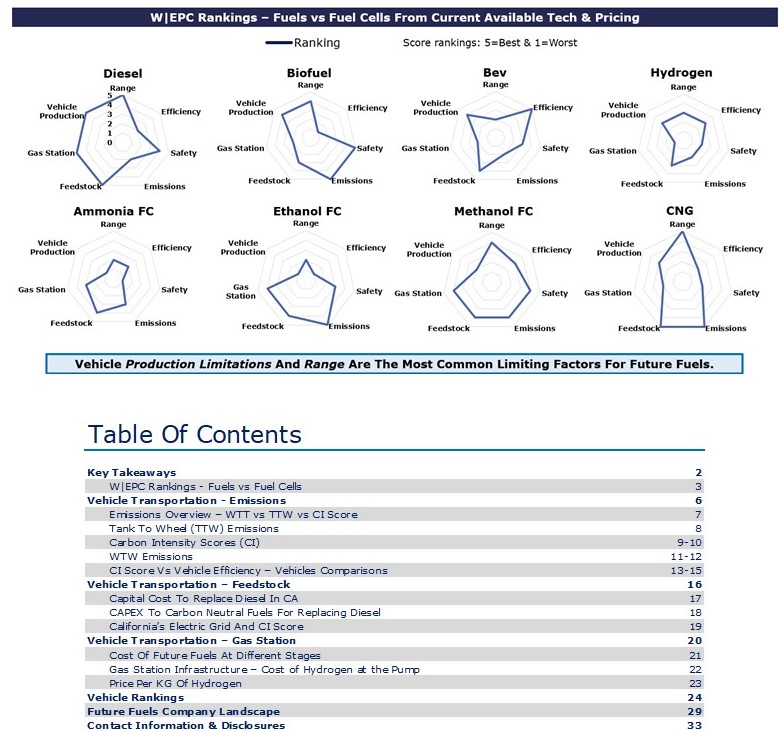

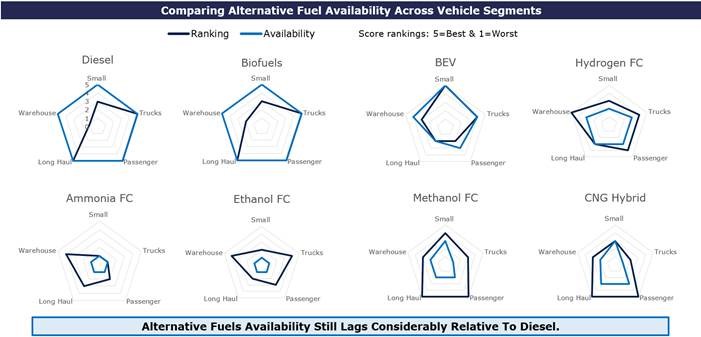

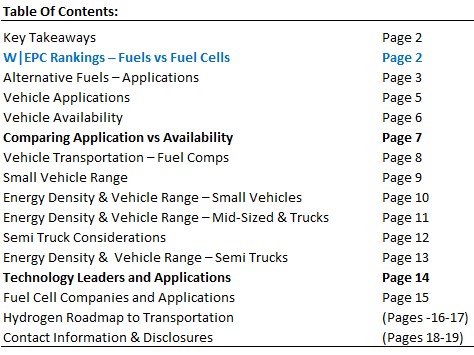

Client Conference Call: Ranking & Evaluating Alternative Fuels – The Future Of Vehicle Transportation H2 • BEV • Methanol • CNG Hybrid • Ethanol • Ammonia • Biofuels • Diesel

W|EPC: Future Of Transportation – Ranking & Evaluating Alternative Fuels – H2 ∙ BEV ∙ Methanol ∙ CNG Hybrid ∙ Ethanol ∙ Ammonia ∙ Diesel ∙ Biofuels

If you’re a current Webber Research subscriber you access this presentation via our Client Login above. If you’re not yet a subscriber, please contact us at [email protected] for access information.

Alternative Fuel Analysis…Will History Repeat Itself?

In 1992 & 2005, the Department of Energy (DOE) created & amended the Energy Policy Act (EPA) that addressed fuel research and tax benefits for vehicle manufacturing.

Battery Electric Vehicles (BEV), Hydrogen (H2), Hybrids, Biofuels, Ethanol and Methanol were analyzed in 2005, but vehicle manufacturers supported gasoline hybrid vehicles due to technology and production constraints.

Since then, fuel cell technology and global, federal, & state emission guidelines have accelerated innovation and the market is now actively deciding transportation alternatives.

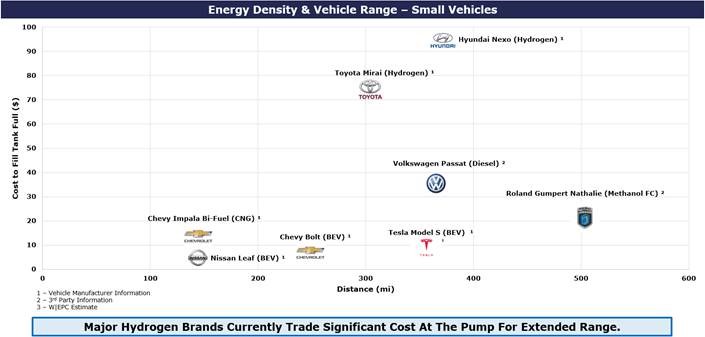

Small Vehicle Applications

BEV have taken a leading role in the small vehicle category with minimal competition from Hydrogen.

Hydrogen’s price, lack of infrastructure, and safety concerns highlight the risk associated with new fuel applications; however, Methanol may have an opportunity to fill this role.

The Roland Gumpert Nathalie markets an impressive range and methanol costs are comparative to BEV, but the $450k price tag limits it’s applications until manufacturing scales up to reduce cost.

Mid-Sized Vehicles and Truck Applications

Mid-Sized Vehicles and Truck Applications

Fuel energy density becomes a larger role as the size of a vehicle increases.

Fuel storage capacity, energy density, and vehicle efficiency play a large role in the range and cost for a vehicle.

Semi-Truck Range Is A Gating Issue For Future Fuels

New Semi-Truck concepts are ranging from shorter applications (<300 miles) to the long-haul market (>600 mile/day).

Daimler eCascadia seems to make sense for shorter applications and Hyliion’s Compressed Natural Gas (CNG) hybrid semi will likely apply well to long haul trades, if the marketing is as good as advertised.

Read More

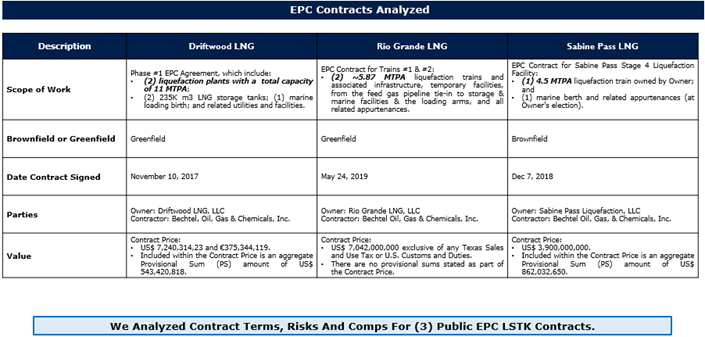

W|EPC: Analyzing Energy Project Contract Terms – Risks, Strategies & Comps

Analyzing Energy Project Contract Terms – Part 1 – Risks, Strategies & Comps Across Stakeholder Groups – Q420

Analyzing EPC Risk Avoidance: Comps & Techniques For Investors, Owners, & Contractors

W|EPC analyzed ~$20B of publicly available EPC lump sum turn-key (LSTK) contracts, focusing on sensitive or contentious terms used to allocate risk, manage performance expectations, & establish a framework for third-party indemnification and liquidated damages, etc. (Pages 3, 5-7, & 9-17). Specific points of emphasis:

- Investors: Leveraging a project’s future expansion plans to protect ROE and/ maximize options (ROFR) options. (Pages 5, 9-11)

- Owners: Finding & justifying onerous contract terms as market or on-the-run.

- Contractors: Avoiding those onerous contract terms.

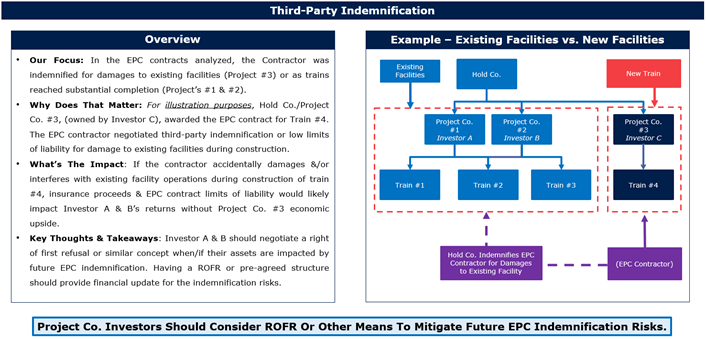

Analyzing Notable Risks

- Liability & Indemnity: Existing Facilities can be problematic for Contractors & expose stakeholders. (Pages 5, 9-11)

- Performance Guarantees & Damages: Numerous performance guarantees were publicly disclosed (likely inadvertently) that illustrates risks & production, emissions, and/or power consumption liabilities. (Pages 6, 12-14)

- Technical Risk Allocation: One project’s subsurface provisions are tighter and limit change orders provisions for differences in soils data. (Pages 7, 15-17)

Distributing Project Risk Amid A Ramp In Renewables

- The steep ramp in renewables demand & project development could create an opportunity/leverage for participating EPC providers to ultimately own less project risk.

- Certain renewable projects could struggle getting an EPC LSTK contract (typically advantageous for the project owner, at the expense of the EPC provider). Dominion Energy (D), for instance, was unsuccessful in finding an EPC provider to provide a LSTK contract for their Coastal Virginia Offshore Wind (CVOW) project.

- EPC providers may have some leverage here, at least for now. W|EPC believes integrating EPC contract strategies/terms earlier than traditional projects (i.e. hydrocarbons) will improve risk/reward.

W|EPC: Analyzing Energy Project Contract Terms – Risks, Strategies & Comps

Table Of Contents:

- Key Takeaways – Page 2

- EPC Contracts Analyzed – Page 3

- Overview – Notable Risks for Any Projects – Page 4

- Third-Party Indemnification – Page 5

- Performance Guarantees – Page 6

- Rely-Upon Information – Page 7

- Contract Analysis, Significance, Negotiation Strategies, & Comps – Page 8

- Third-Party Indemnification – Page 9

- Performance Guarantees – Page 12

- Technical Risk Allocation – Page 15

For full access information, email us at [email protected], or at [email protected]

Read More

Webber Research: Reviewing California’s Rollout Plans For A Hydrogen Fueling Network

Webber Research: Reviewing California’s Rollout Plans For A Hydrogen Fueling Network Evaluating Safety, Cost, & Implementation Data

For full access information, email us at [email protected], or at [email protected]

In mid-November the California Air Resources Board (CARB) published initial plans detailing the development and implementation of a light-duty hydrogen fueling station networks, including a focus on financial self-sufficiency.

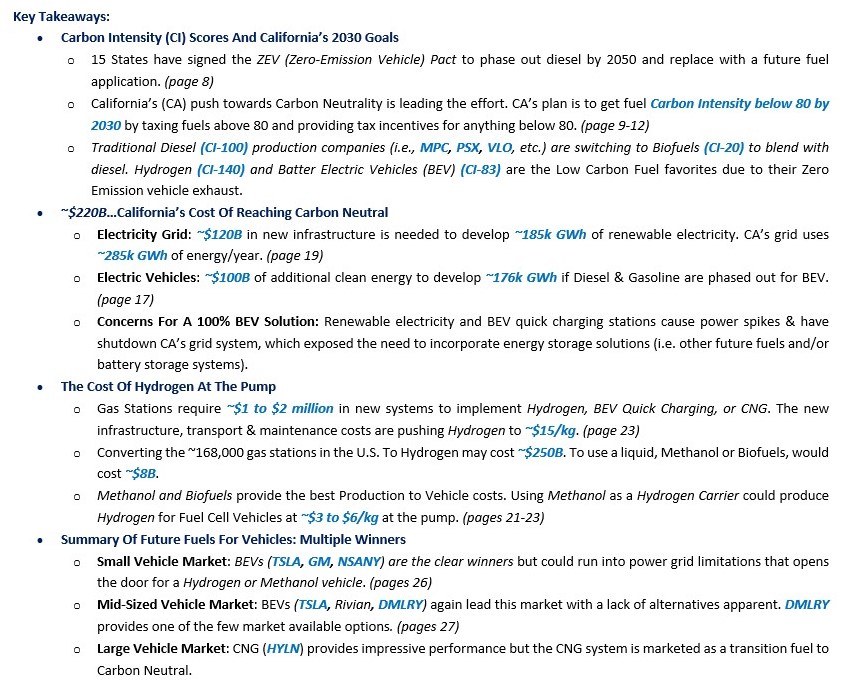

Specifically, CARB’s initial draft highlights:

1. Estimates around required state-support and eventual self-sufficiency

2. A comparison of existing market solutions, ongoing government research, and the latest awards in the Energy Commission’s Grant Funding program.

3. The economic sensitivity around FCEV deployment and the pace of network development.

4. Opportunities for cost reductions

5. Potential price reductions at the pump

6. Regional economic differences

Within the context of CARB’s report, we evaluated the economics and risks for deployment of Hydrogen fueling station options based on the following:

• Public Safety

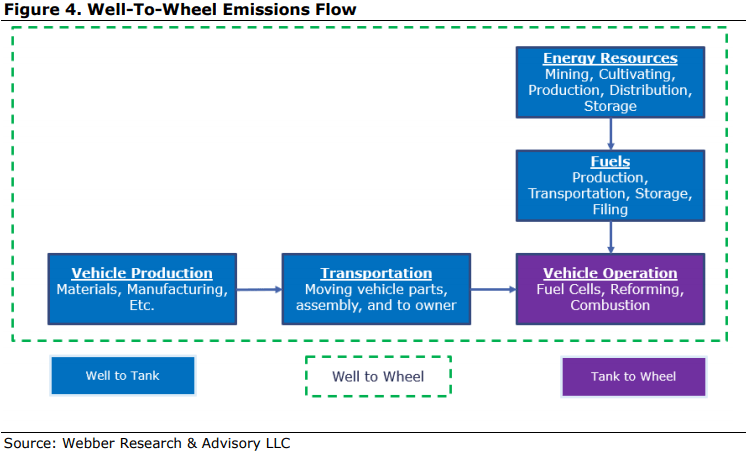

• Climate Change and Air Quality – Tank to Wheel (TTW) – Well to Wheel (WTW)

• Gas Station Infrastructure Costs

• Hydrogen Costs at Pump for Consumer

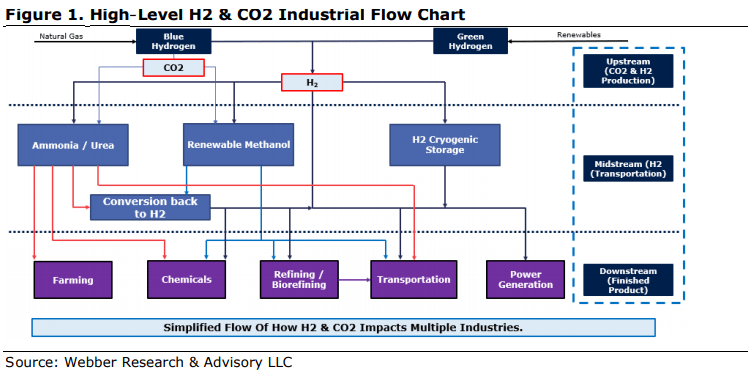

W|EPC Takeaway: As highlighted below, if the primary goal of CARB is to reduce tailpipe emissions, we believe electric vehicles and hydrogen vehicles are the most viable options today. However, if the goal is to reduce total emissions and to implement hydrogen fueling as quickly, safely, and cost-effectively as possible, it opens the door for a mix of other fuel considerations – including biofuels, e-fuels, and other energy mediums to expedite the Hydrogen Economy. We believe how California ultimately balances those priorities will determine what it’s future fueling network looks like.

Climate Change & Air Quality

Air quality and the need for sustainable future fuels to reduce GHG emissions is driving alternative fuel technology development. CARB’s Low Carbon Fuel Credits (LCFC) are based on Well to Wheel Carbon Intensity Scores (CI) that identify upstream pollution caused by fuels.

Gas Station Infrastructure Costs

Future fuels (i.e. H2, Ammonia, Methanol) will require new infrastructure in almost all cases to meet federal and state emission guidelines. The Implementation cost of these can vary from storage retrofitting, to +$1 million infrastructure upgrades. The costs could further increase based on the engineering design and blast radius study results.

Hydrogen gas station equipment could include:

• Compressors – 350 bar pressure

• Above Ground Storage

250 bar pressure

250 kg storage

• H2 Dispenser Larger corporate gas stations may have the financial means to implement the costly infrastructure upgrades especially if supported by fuel tax credits. However, smaller gas stations may face challenges investing in the capital costs & the ~$2K/month electricity bill to own & operate the equipment.

Cost comparisons vs the low-cost alternative for Methanol:

• Hydrogen – See Figure 6. Multiple scenarios based on CARB capital cost estimates

• Methanol to Hydrogen in Vehicle – ~$50,000 per gas station to upgrade storage

• Methanol to Hydrogen at Pump – ~$1 million per gas station (250kg H2 storage)

Hydrogen Costs at Pump for Consumer: ~$16/kg and by 2030 as Low as $8/kg?

At the pump, the H2 price begins to stack up due to CAPEX, maintenance, safety, and production costs. We have provided a few options that have been considered for comparisons sake below that could further drive down the cost of hydrogen.

• Centralized Electrolysis: ~$8/kg

• Centralized Reformer (No Carbon Capture): ~$2.50/kg

• Methanol Reforming at Pump: ~$5/kg

Includes 250kg hydrogen storage and compression

• Methanol Reforming in Vehicle: ~$3.50/kg

Gas Station infrastructure cost are relatively minimal

For a methanol reforming at pump scenario, storage-related infrastructure costs could be lighter as Methanol is a potential mid-stream solution for hydrogen, and is generally easier to store in large quantities – potentially pushing the hydrogen cost at the pump level below $10/kg in a shorter timeframe.

For full access information, email us at [email protected], or at [email protected]

Read More

client log-in

client log-in