The Wall Street Transcript: Despite Near-Term Volatility, Renewables Hold Long-Term Promise

https://www.twst.com/interview/despite-near-term-volatility-renewables-hold-long-term-promise

Read More

https://www.twst.com/interview/despite-near-term-volatility-renewables-hold-long-term-promise

Read More

https://www.e1marine.com/ardmore-turns-to-the-man-who-can-see-round-corners/

Read More

For access information, email us at [email protected]

Highlights:

• Recent News (page 1)

• LH2 Carrier Progress (page 3)

• M&A Tracker (page 4)

• Valuation Summaries (page 5)

• Hydrogen Production Costs (page 7)

• Industry Dynamics (page 9)

For access information, please email us at [email protected]

Depth Of Floating Storage Build Key For Tanker Equities In Q220. Amid the double black swan start to the year (OPEC supply shock/pricing war coupled with demand destruction from the COVID-19 response), tanker equities have (generally) acted as a hedge against the rest of the energy tape, as the prospect of significant structural and arb-driven floating storage has supported tanker earnings well above seasonal trends (page 4). While increasing OPEC & Russian crude production battle to replace US exports (the degree to which remains in question) – the market mechanism for finding that new global production balance should ultimately result in saturated land based storage and a ramp in floating storage (already ~100mb), and narrower tanker capacity, providing a significant tailwind for tanker cash flows. From an equity perspective, we think about Tanker stocks (FRO, EURN, DHT, ASC, etc.) in 3 stages….(Pages 1-2)

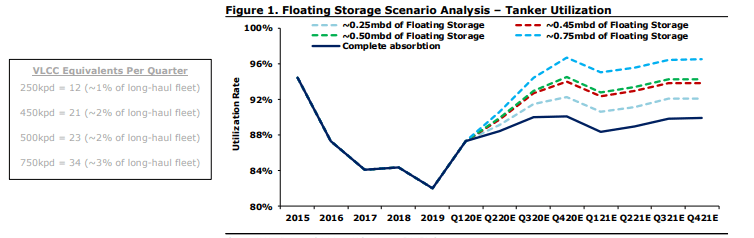

What Would Robust Floating Storage Mean For Tanker Rates & Utilization In Q2/Q3? We ran a multi-factor scenario analysis based on our updated crude tanker utilization model, flexed for different levels of incremental daily crude production moving into floating storage over the next 2-3 quarters. At the low end of the range…(Pages 2-8)

For access information, please email us at [email protected]

Read More