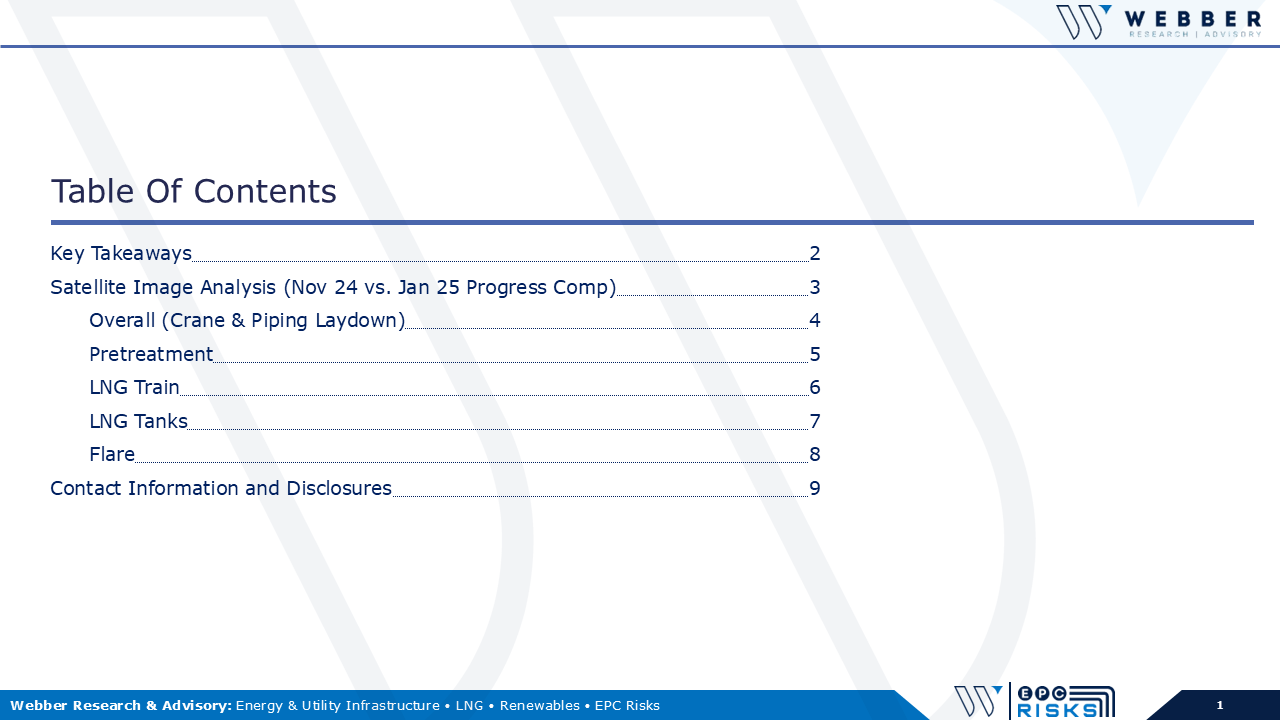

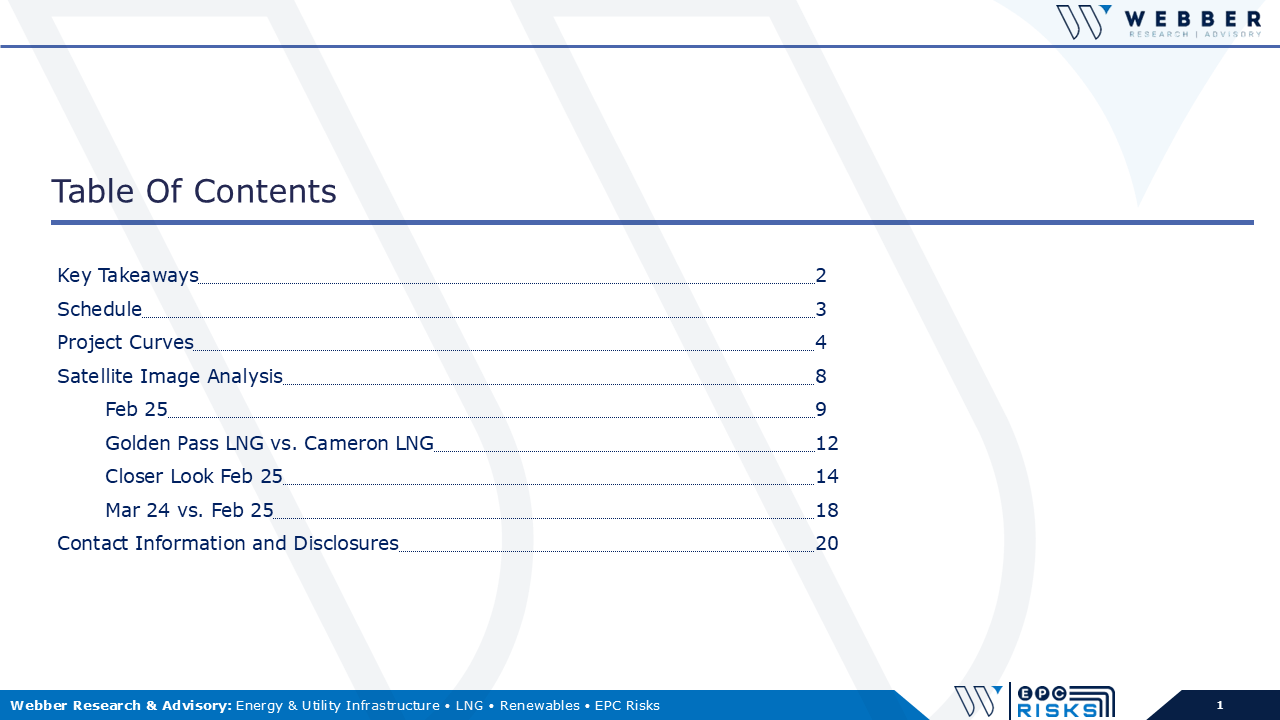

W|EPC: Golden Pass LNG Project Update – Q125

For the full deck, please visit our Downloads page. If you’re already a Webber Research subscriber, you can access this report via our Research Library. For access information please contact us at [email protected], or [email protected].

Read More

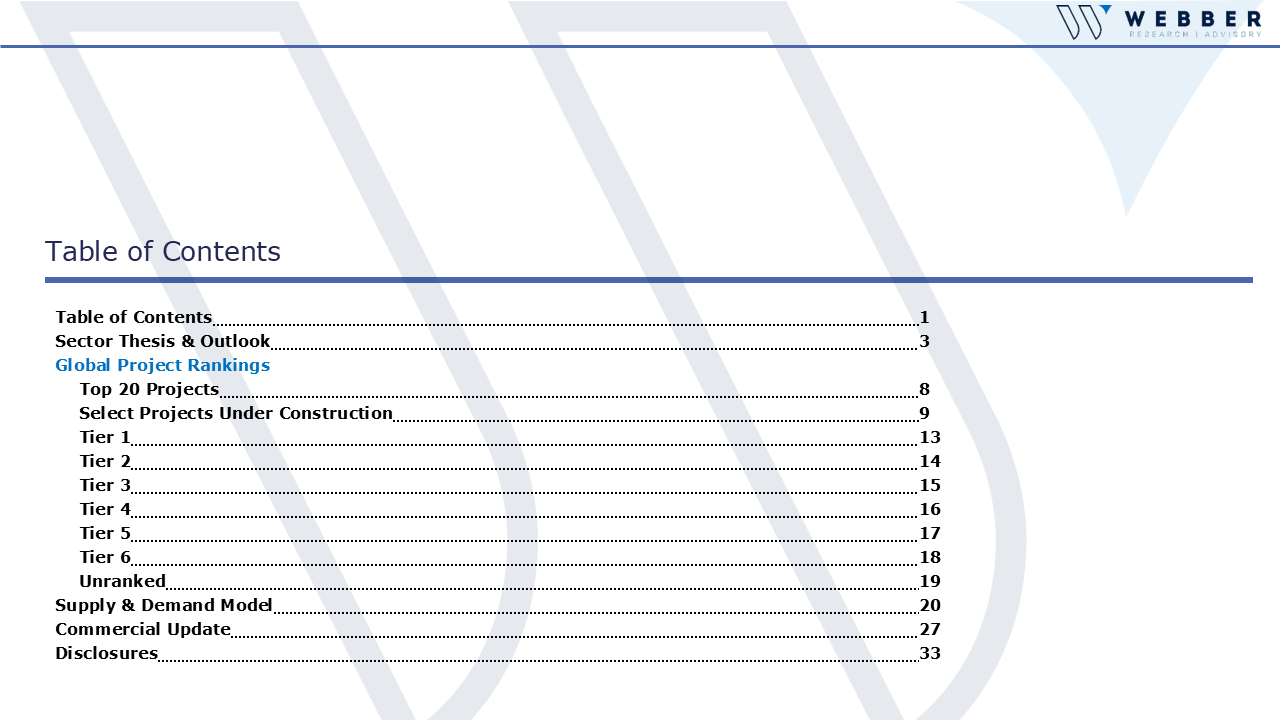

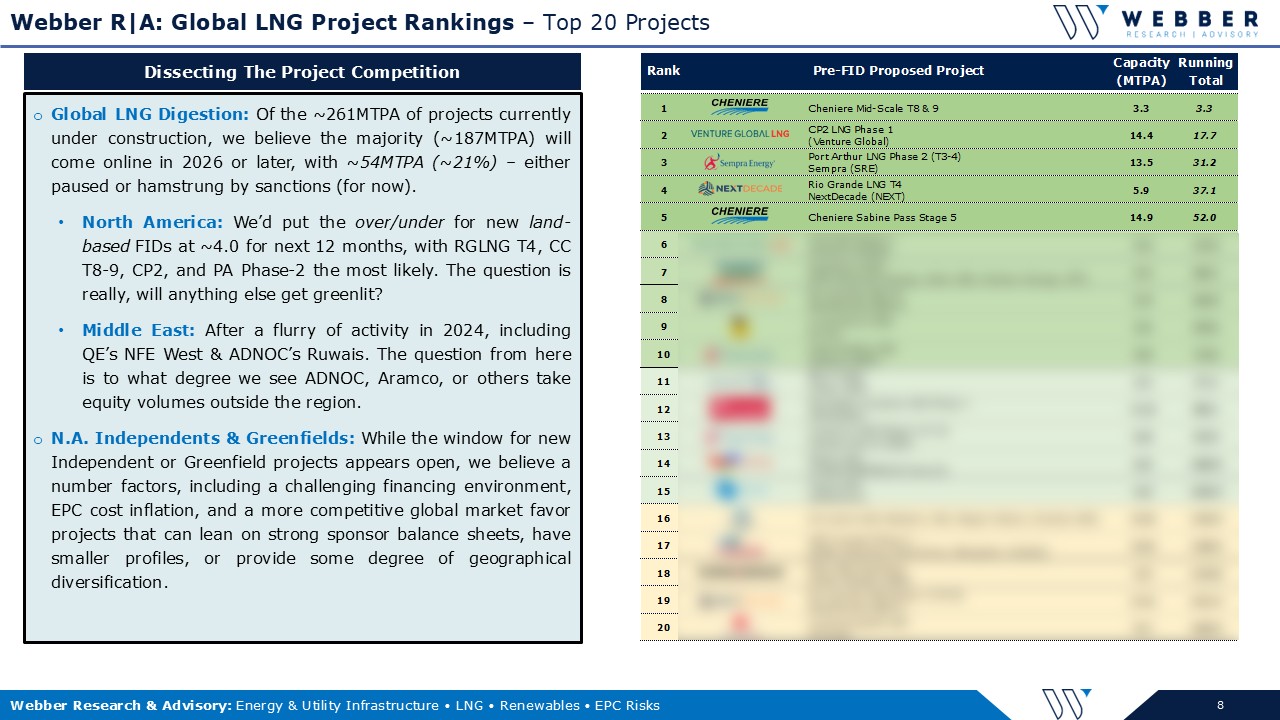

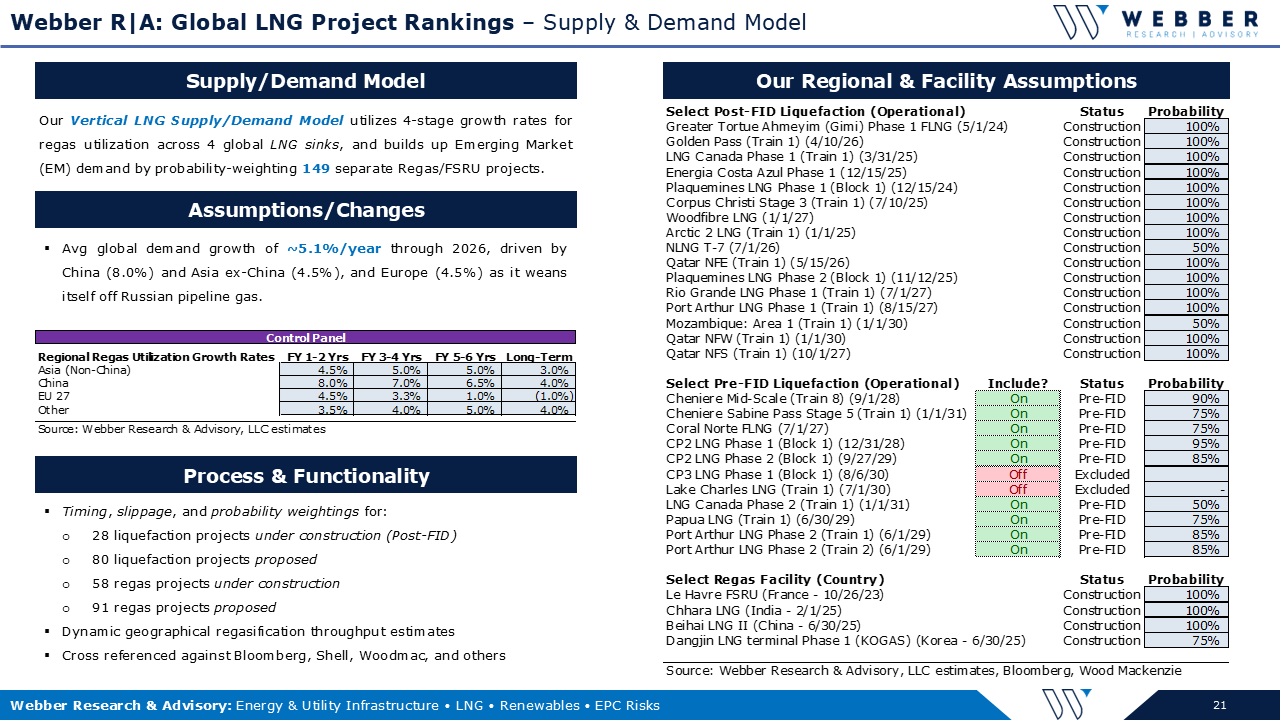

Webber Research: Global LNG Project Tiers, Rankings Outlook, & Balance Model + Trump & LNG: Leveraging The Pizzazz

W|EPC: Client Call 01/15 @11AM – Venture Global’s Plaquemines Parish – Q125 Project Review

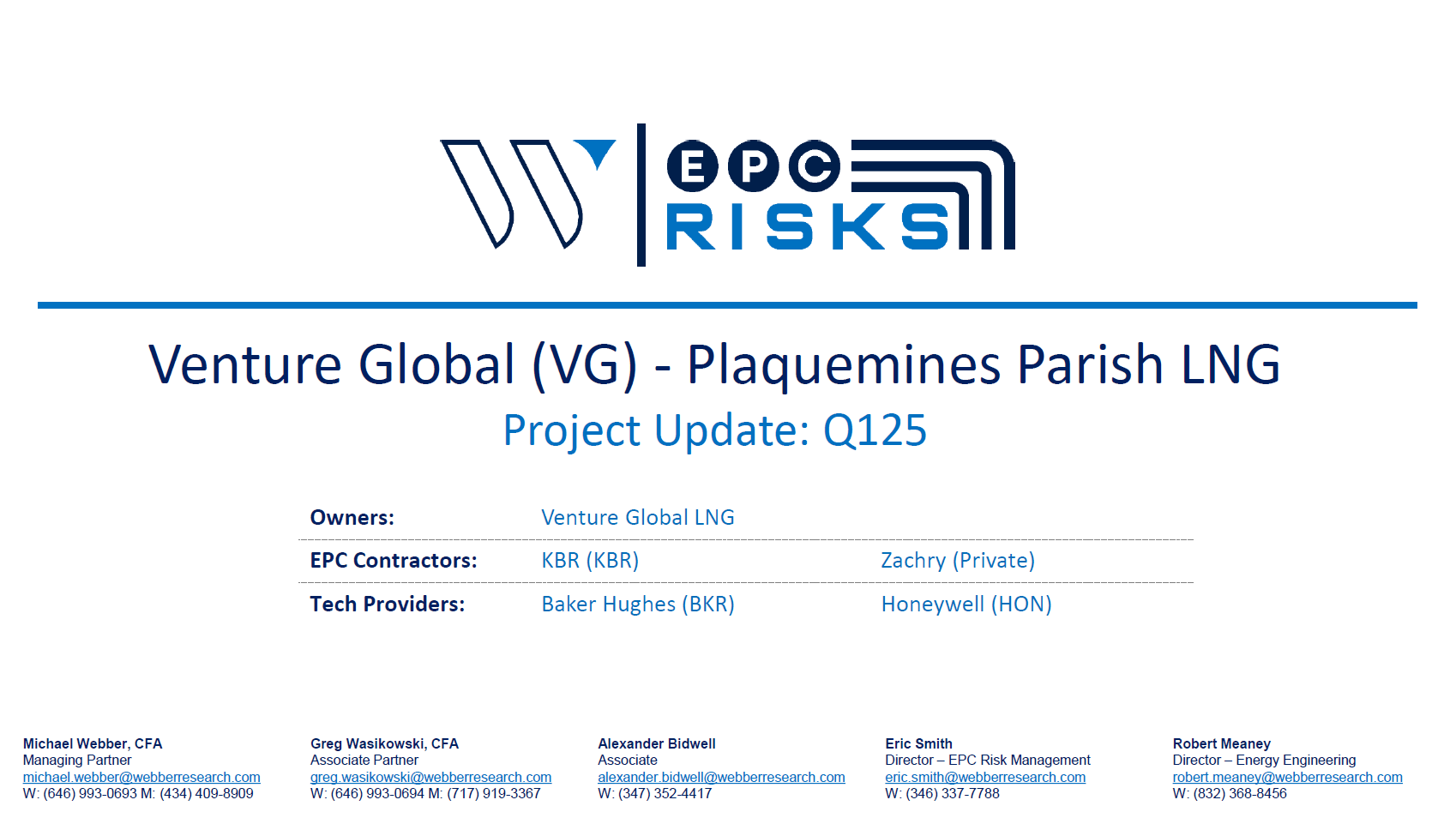

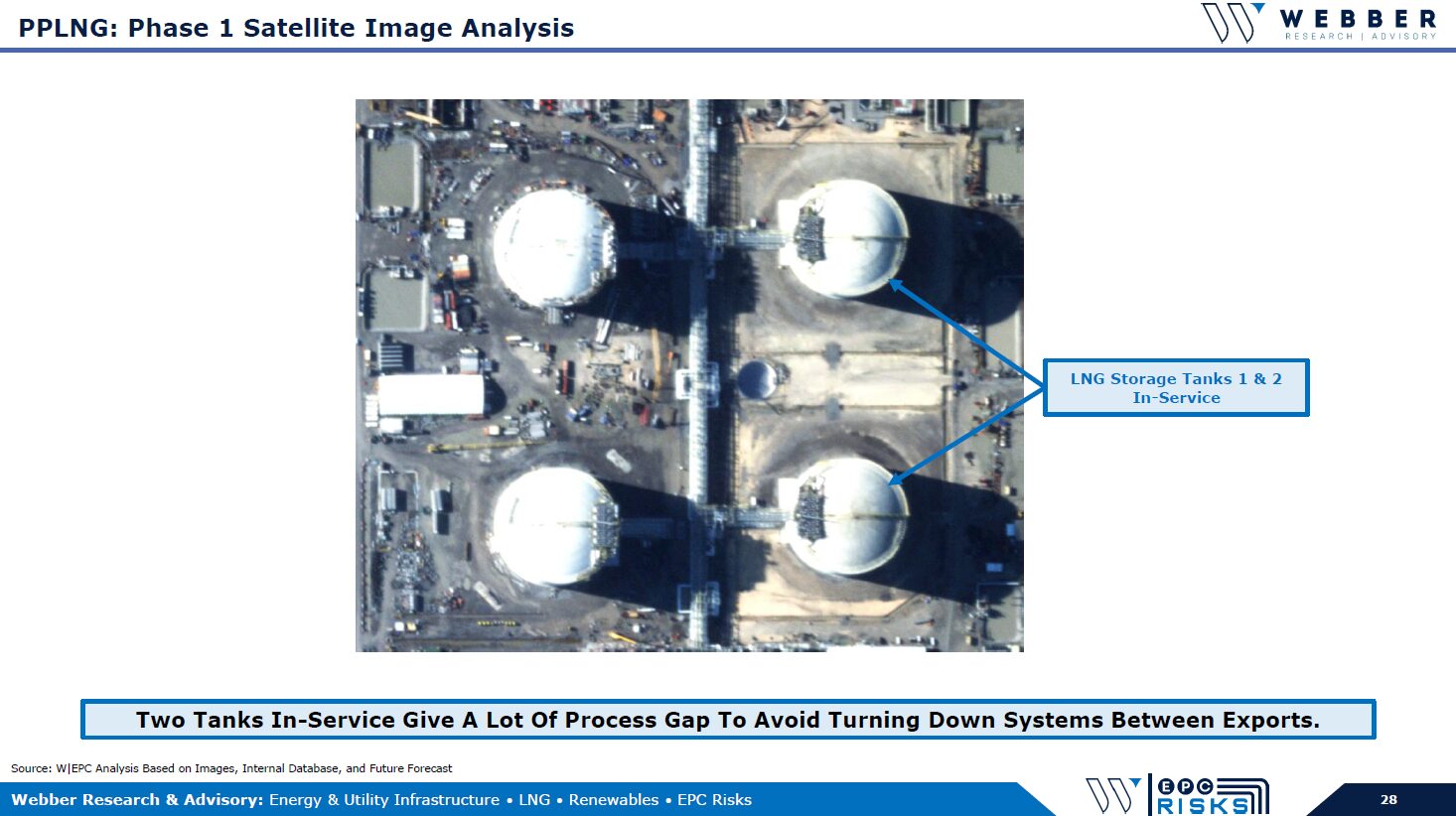

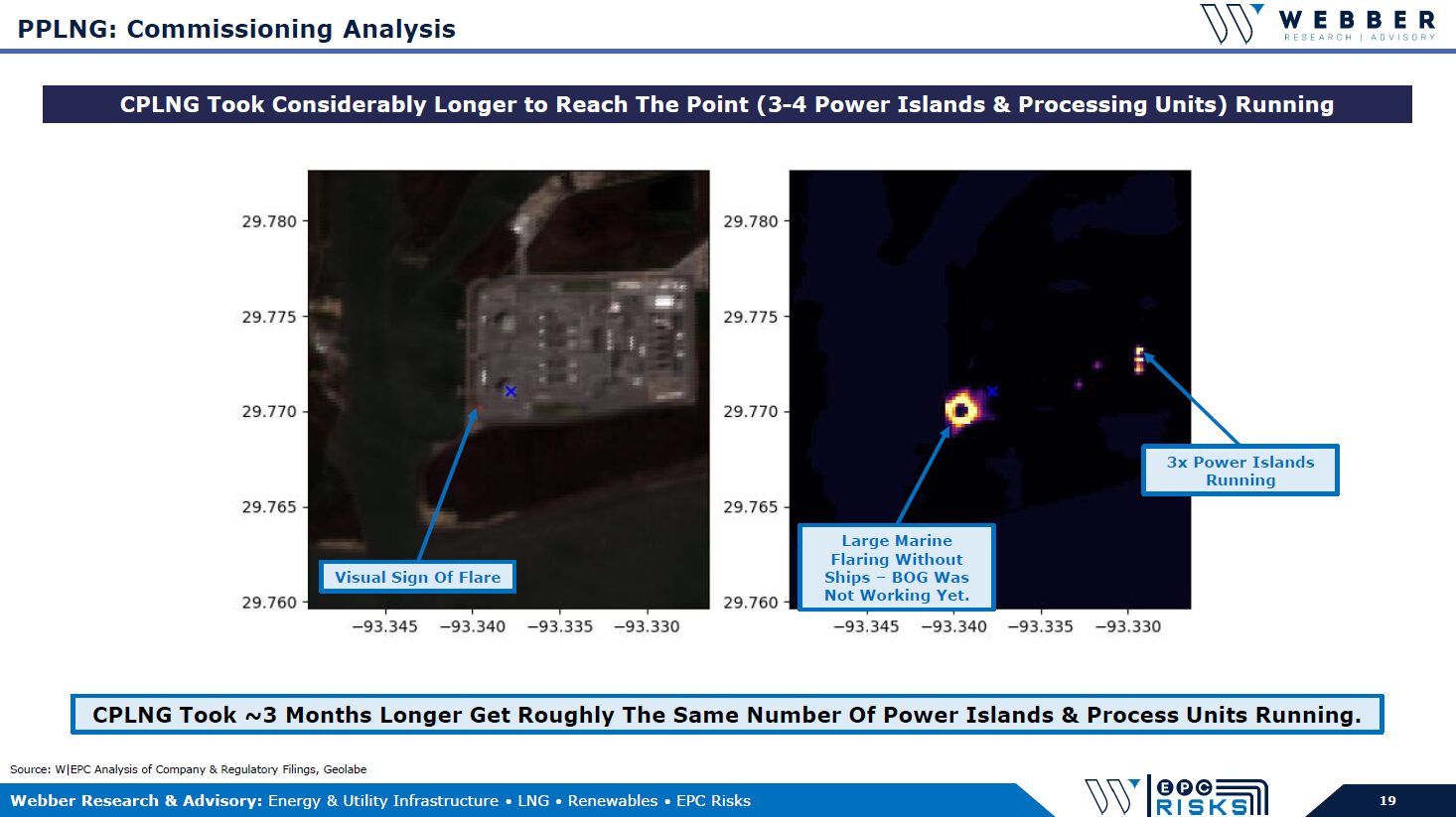

W|EPC: Venture Global’s Plaquemines Parish LNG – Q125 Project Review

If you’re already a Webber Research client, you can access this via our Library. If you’re not yet a Webber Research client, you can access the full report on our Downloads page, or contact us for access information at [email protected] or [email protected].

Read More

client log-in

client log-in