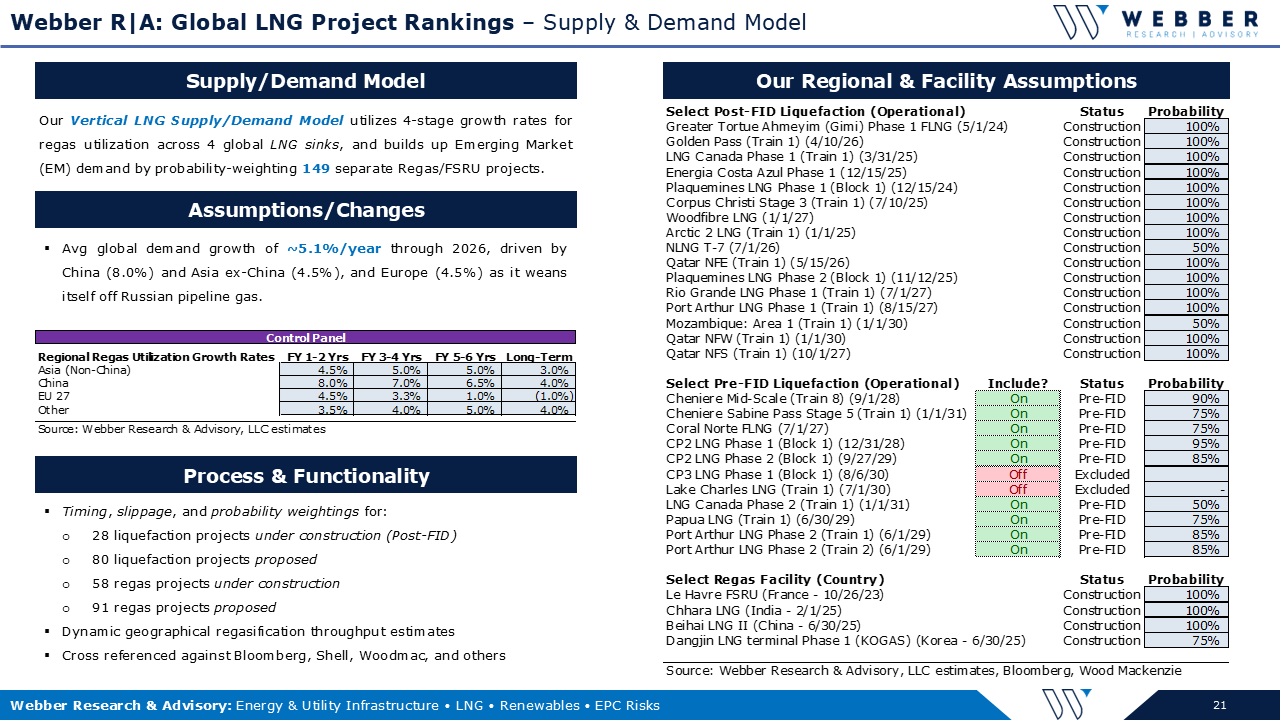

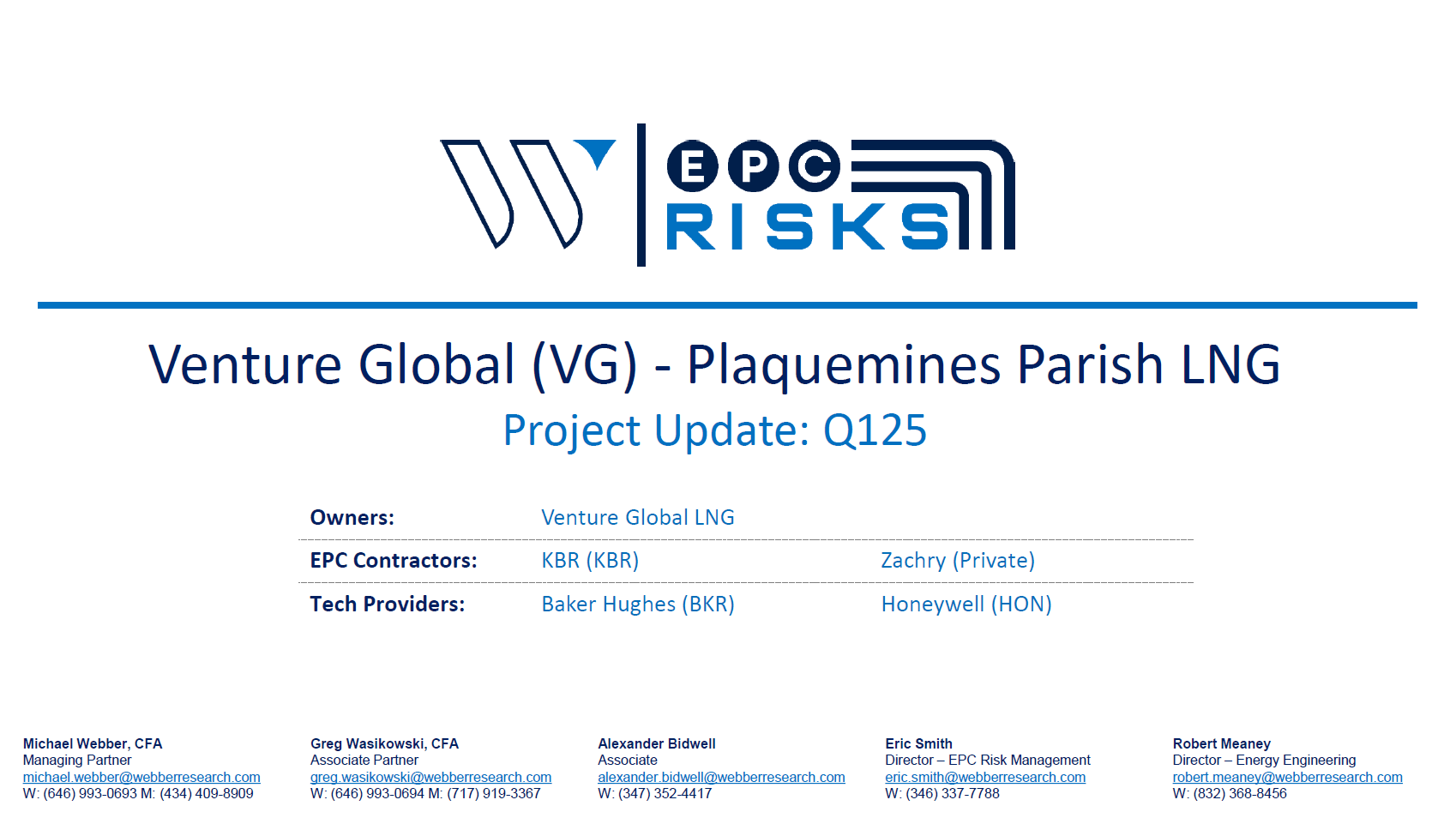

W|EPC: Plaquemines Parish LNG Interim Project Update: Q125

To access the full presentation, please visit our Research Library, or contact us at [email protected] or [email protected].

To access the full presentation, please visit our Research Library, or contact us at [email protected] or [email protected].

If you’re already a Webber Research client, you can access this via our Library. If you’re not yet a Webber Research client, you can access the full report on our Downloads page, or contact us for access information at [email protected] or [email protected].

Read More