Total Pages: 20

Table Of Contents

- Update On Terrorist Attacks: Force Majeure (Page 2)

- Key Takeaways (Page 4)

- Project Comps: ~14 Months Post FID (Page 4)

- Project Risk Profile (Page 5)

- W|EPC Proprietary Risk Model (Page 5)

- Mozambique LNG Overview (Page 6)

- Schedule (Page 7)

- Construction Spend (Page 8)

- EPC Consortium (Page 9)

- Ownership (Page 10)

- Unique Project Risks (Page 11)

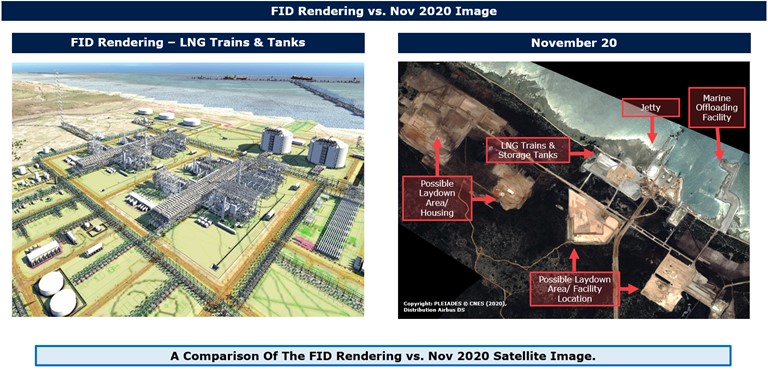

- Satellite Image Analysis (Page 14)

- Contact Information & Disclosures (Page 18)

Key Takeaways:

1) Mozambique LNG (MZLNG): After A Sluggish Start…The Next 6 Months Are Critical…

Q320 & Q420 satellite images indications… (pgs. 15-18)

17-months after FID, meaningful piling, concrete, &/or structural steel erection [redacted]…

Recent security issues (increasingly localized terrorism) could further hamper staffing levels & complicate the path forward (while also potentially creating the pretense for Force Majeure relief)

2) Schedule Analysis & Estimates:

Our proprietary risk model implies a probability of the project meeting its cost/schedule metrics is [redacted] (page 5)

EPC Contract Exposure: ~$8B LSTK contract, via a consortium comprised of Saipem (74.95%, SAPMF), McDermott (24.98), MDR) & Chiyoda (0.07%,)

A successful project would boost Saipem’s reputation, while also certainly meaningful for a restructured MDR ($560MM Raise on Jan 5, 2021).

3) Mozambique vs. LNG Canada

MZLNG & LNG Canada share similarities, including: a remote area, greenfield, man-camp, etc. (page 4)

Key differences: MZLNG’s has lower-cost construction wages, shorter project schedule, but 300% more peak labor (~11k craft workers).

Should MZLNG require even more labor given the circumstances described in pages that follow, it would likely require an even more significant pull from local labor (on-site housing can support ~9.5k workers).

MZLNG is located in one of the least developed areas of Mozambique, which creates unique risks around that heavy lean on local labor, even before considering the uptick in localized terrorism. (page 12)

4) Mozambique LNG: Baseline Report Q121

client log-in

client log-in