W|EPC: Hydrogen Roadmap – Future of Vehicle Transportation (Part 2) – Alternative Fuels – Efficiency & Safety

Total Pages: 20

Table Of Contents

Key Takeaways

- W|EPC Rankings: Fuels vs Fuel Cells – Page 3

Vehicle Transportation – Efficiency

- Production Efficiency: Grid To Tank – Page 5

- Vehicle Efficiency vs Energy Storage: Small Vehicles Page 6

- Vehicle Efficiency vs Energy Storage: Mid-Size & Trucks Page 7

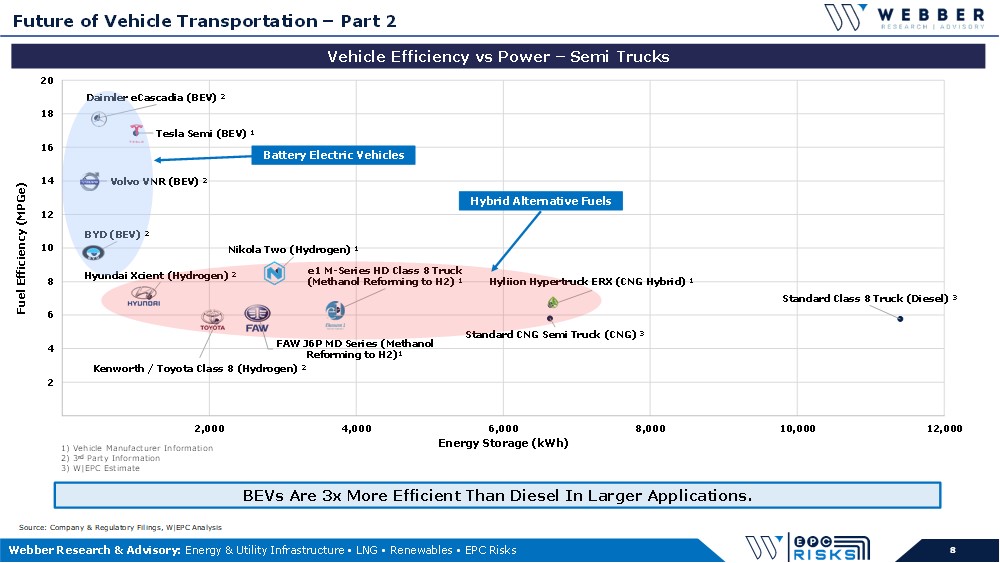

- Vehicle Efficiency vs Energy Storage: Semi-Trucks Page 8

Vehicle Transportation – Safety

- OSHA Ratings – Page 10

- Fuel Analysis From Baker Risk – Page 11

- NFPA Spacing Considerations – Page 12

- Ignition Contours From Baker Risk – Page 13

- Relevant Comp: Canada’s Sunrise Propone Issue – Page 14

Technology Leaders & Applications

- Fuel Cell Companies & Applications – Page 16

Hydrogen Roadmap to Transportation

- Layout & Overview – Page 17-18

- Contact Information & Disclosures – Page 19-20

Key Takeaways:

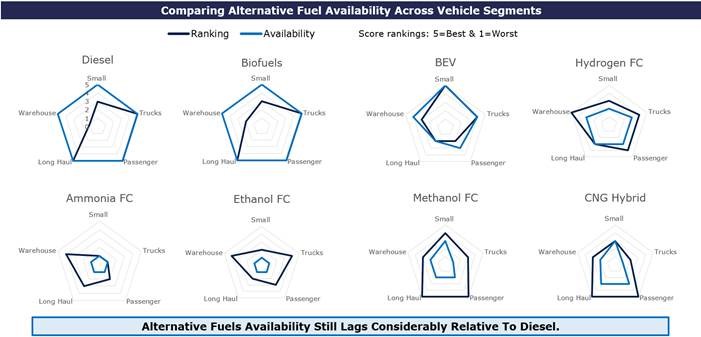

1) Trillions Or Billions In Renewable Energy – Vehicles Decide?

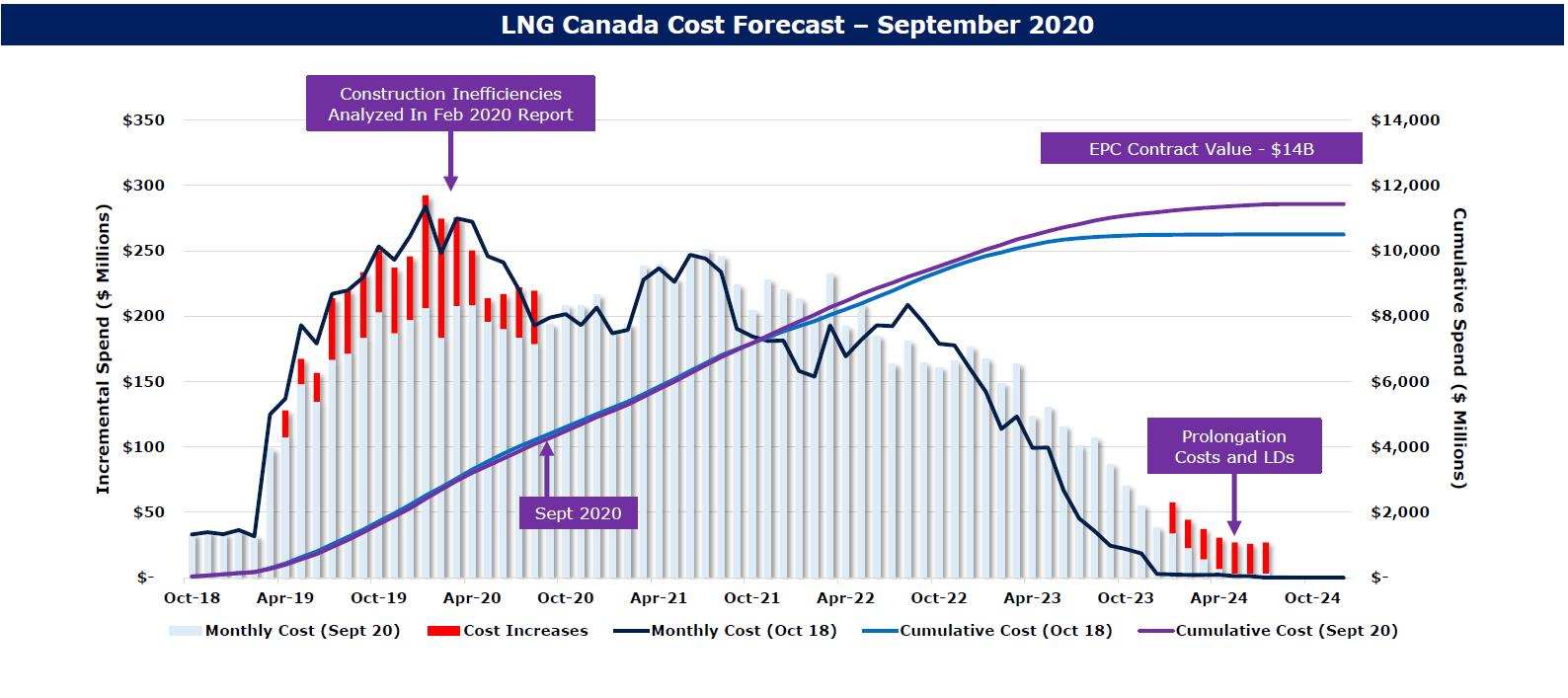

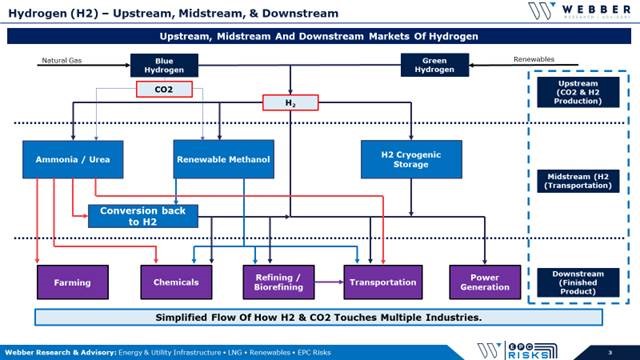

A Carbon Neutral transportation network could require significant capital spending for a new renewable energy production and distribution systems.

Some renewables (e.g. Solar and Wind energy) are variable daytime resources not available during peak energy demand. Hydrogen, Methanol, and Ammonia from electrolysis (eFuels) can be utilized to store this energy.

A vehicle’s efficient use of that energy will determine the required energy production and supporting infrastructure costs.

2) BEV Energy Efficiency Is Unchallenged

Battery Electric Vehicle’s (BEV’s) are ~3-10x more efficient in the use of energy across nearly all vehicle segments.

Real world conditions (i.e. AC, weight, aerodynamics, temperature of the battery, high speeds, etc.) limit BEV efficiency in different regions.

Vehicle batteries can lose up to ~30% of their storage capacity by ~100k-150k miles. The cost to replace a semi-truck battery may be ~$100k. Long-haul truckers can average more than 100k miles a year.

3) Hydrogen Fueling Networks: Risks & Potential Legislation

U.S. Hydrogen fueling station spacing is currently determined by NFPA-2 (Flammability), which has a narrow scope relative to international standards.

Lessons From Canada: Under relatively similar dynamics, safety issues (Sunrise Petroleum, etc.) led Canada to materially shift propane fueling regulations, largely at the expense of early adopters. We see similar regulatory uncertainty as a potential risk for H2 fueling infrastructure.

4) Canadian Propane Comp: Applying Canada’s revised Propane Fueling Regulations to existing US fueling infrastructure highlights the potential hurdles in play: a 1.0psi pressure wave from 250kg of H2 storage could cause damage over…..

client log-in

client log-in