Total Pages: 17

Table Of Contents

- Vogtle Summary

- Key Takeaways

- GP Potential Cost Exposure

- Cost & Schedule Analysis

- EPC Contractor History

- Concluding Thoughts

- Disclosures

Regulatory Background: Vogtle is regulated by the Georgia Public Service Commission (GPSC). GPSC’s primary role is to protect rate payers & determine if project costs can be justifiably passed-through via utility rates. In the quarters that follow we’ll venture to aggregate, analyze, and interpret cost overruns through the lens of GPSC, to put together a thoughtful estimate of what cost overruns will eventually land with SO shareholders.

- Quarterly Deep Dive Into Southern Company’s (SO) $27B Vogtle Nuclear Expansion. Southern Company (SO), is the largest owner of the Vogtle Nuclear Facility, via the 46% held by its wholly-owned subsidiary Georgia Power.

- Vogtle has two active units (Units 1-2), which have been in-service since 1987-89. A two unit expansion (Units 3-4) was approved in 2009

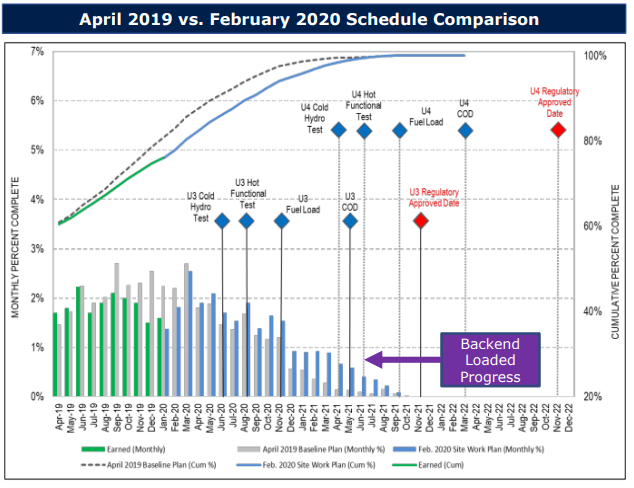

- Units 3 & 4 were originally expected to be in-service in 2016-17 and cost a combined ~$14B, the expansion project is now 6-7 years behind schedule, with costs rising to ~$27B….and potentially higher (slides 3-6).

- Hence, the premise of adding a W|EPC Quarterly Vogtle Project Monitor to our Utility & Energy research platform: Digging into those cost overruns – particularly the bulging EPC costs, to get a more accurate and detailed view of the potential headwind for project stakeholders and SO shareholders.

client log-in

client log-in