Total Pages: 19

Table Of Contents

- AEP Company Overview

- Key Takeaways

- ERCOT Overview

- Actual Project Cost Analysis

- Capital Project Analysis

- ETT CREZ Warranty Status

- Key Project Profile

- Additional IR Questions

American Electric Power (AEP) April 2020 Capital Project Analysis

American Electric Power (AEP, Market Cap ~$42B) has been in business for 114 years, with 5.5 MM customers across 11 states, including Texas. General Project EPC Background (AEP Subsidiaries):

American Electric Power Texas (AEPT) is a subsidiary of AEP, and provides transmission and distribution of electric power to ~1MM customers through Retail Electric Provider’s (REPs) in west, central, and south Texas, with an ROE sitting at at ~9.4%.

Southwestern Electric Power Company’s (SWEPCO), also an AEP sub, has 4K miles of transmission lines and 5K MW’s of generation capacity, supporting 536K customers primarily in Western Louisiana, North East Texas, the Panhandle of Texas, and Western Arkansas. SWEPCO’s ROE sit at ~9.6%.

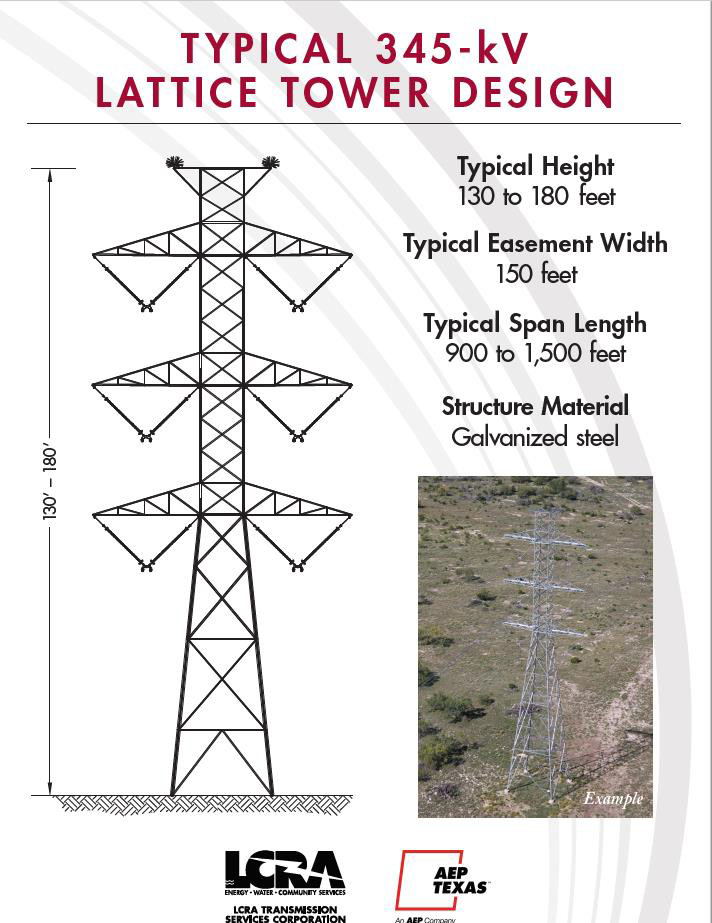

Electric Transmission Texas, LLC, (ETT) is 50/50 JV between AEP and Berkshire Hathaway Energy Company, and owns/operates transmission facilities within Electric Reliability Council of Texas (ERCOT), primarily around the AEPT service territory. ETT’s ROE sits at ~9.6%, and it’s capital budget is not broken out within AEP’s forecasted numbers. AEPT and SEPC 2020-2024 capital forecast (~$8.4B) comprises ~25% of AEP’s total expected spend (~$33B) over that period.

Key Takeaways:

• Why Utility Project Tracking Is Increasingly Important In This Environment…

• Estimated vs. Actual Project Costs – Who comes in well under budget…and who doesn’t? (Pages 9-11)

• AEPT & SWEPCO Capex Trending Materially Below Forecast (Pages 5-8)

• The Jury Is Still Out On $1.6B Of Project Costs (Pages 12-15)

• ETT – Ongoing Problems With CREZ Projects, But No Warranty Cost Recovery Claims? (Pages 16-17)

client log-in

client log-in