Webber Research: Q219 ESG Scorecard

Webber Research Q219 ESG Scorecard

Webber Research Q219 ESG Scorecard

New Logo, Same Idea. Along with our launch, we also included our Webber Research ESG Scorecard, as we’ll be incorporating additional factors that broadens our models score to include carbon disclosures (below). The scorecard that follows is effectively identical to the scorecard we released in Q2 – the model, data, and scores are inline with Q219 results. Redistributing our ESG Scorecard allows it to serve as a baseline for our model at our new Webber Research & Advisory platform, while also reiterating our commitment to further integrate ESG dynamics into our process. To that point, we intend to imbed each company’s ESG Scorecard quartile prominently within our company notes, to put it on par with other data often highlighted in equity research.

New Carbon Factor. In Q2 2020 we intend to incorporate the disclosure of Carbon data within public company filings as a new factor within our proprietary multi-factor ESG model. Our new Carbon Factor is aimed at aligning certain aspects of our corporate governance framework with the primary metrics found within the Poseidon Principles, and intended to help facilitate the disclosure of carbon data to investors.

The Idea: The premise that underpins our ESG framework is simple – we believe there is no longer a place in the public shipping markets for companies that do not prioritize strong corporate governance and capital stewardship. We believe that risk premiums associated with poor governance and capital discipline should continue to widen, eventually pricing-out conflicted players and antiquated structures from the public markets.

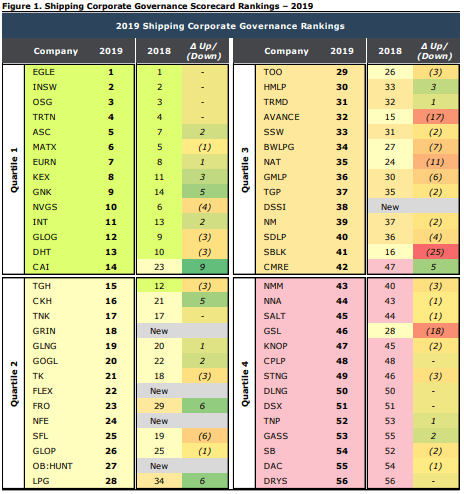

What Is The Webber Research ESG Scorecard? Our scorecard ranks our public universe on a number of corporate governance metrics, with the goal of identifying both high quality platforms and points of conflict based on those underlying factors. Our scorecard crystallizes a framework that’s been core to our investment strategy and coverage, while also aimed at keeping conflicted entities from relying on anonymity or indifference to perpetuate what’s become a consistent headwind for the sector.

client log-in

client log-in