W|EPC: Analyzing Energy Project Contract Terms – Risks, Strategies & Comps

Analyzing Energy Project Contract Terms – Part 1 – Risks, Strategies & Comps Across Stakeholder Groups – Q420

Analyzing EPC Risk Avoidance: Comps & Techniques For Investors, Owners, & Contractors

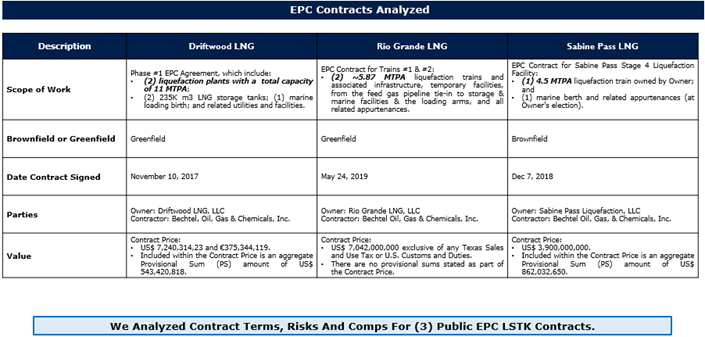

W|EPC analyzed ~$20B of publicly available EPC lump sum turn-key (LSTK) contracts, focusing on sensitive or contentious terms used to allocate risk, manage performance expectations, & establish a framework for third-party indemnification and liquidated damages, etc. (Pages 3, 5-7, & 9-17). Specific points of emphasis:

- Investors: Leveraging a project’s future expansion plans to protect ROE and/ maximize options (ROFR) options. (Pages 5, 9-11)

- Owners: Finding & justifying onerous contract terms as market or on-the-run.

- Contractors: Avoiding those onerous contract terms.

Analyzing Notable Risks

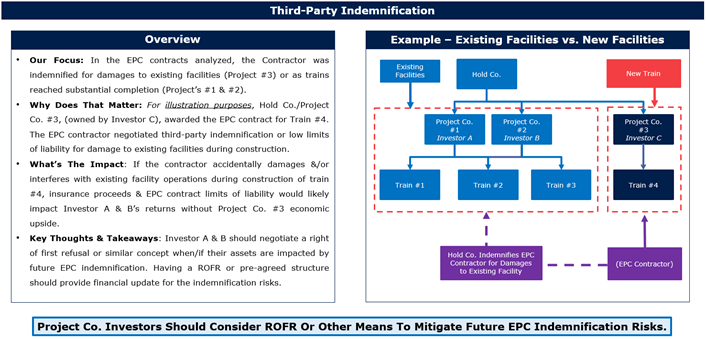

- Liability & Indemnity: Existing Facilities can be problematic for Contractors & expose stakeholders. (Pages 5, 9-11)

- Performance Guarantees & Damages: Numerous performance guarantees were publicly disclosed (likely inadvertently) that illustrates risks & production, emissions, and/or power consumption liabilities. (Pages 6, 12-14)

- Technical Risk Allocation: One project’s subsurface provisions are tighter and limit change orders provisions for differences in soils data. (Pages 7, 15-17)

Distributing Project Risk Amid A Ramp In Renewables

- The steep ramp in renewables demand & project development could create an opportunity/leverage for participating EPC providers to ultimately own less project risk.

- Certain renewable projects could struggle getting an EPC LSTK contract (typically advantageous for the project owner, at the expense of the EPC provider). Dominion Energy (D), for instance, was unsuccessful in finding an EPC provider to provide a LSTK contract for their Coastal Virginia Offshore Wind (CVOW) project.

- EPC providers may have some leverage here, at least for now. W|EPC believes integrating EPC contract strategies/terms earlier than traditional projects (i.e. hydrocarbons) will improve risk/reward.

W|EPC: Analyzing Energy Project Contract Terms – Risks, Strategies & Comps

Table Of Contents:

- Key Takeaways – Page 2

- EPC Contracts Analyzed – Page 3

- Overview – Notable Risks for Any Projects – Page 4

- Third-Party Indemnification – Page 5

- Performance Guarantees – Page 6

- Rely-Upon Information – Page 7

- Contract Analysis, Significance, Negotiation Strategies, & Comps – Page 8

- Third-Party Indemnification – Page 9

- Performance Guarantees – Page 12

- Technical Risk Allocation – Page 15

For full access information, email us at [email protected], or at [email protected]

client log-in

client log-in