Tankers: Floating Storage Scenario Analysis & Utilization Impact

Our 3-Stage Approach To Tankers For the Remainder Of 2020

- Our 3-Stage Approach To The Remainder Of 2020 Pages 1-2

- Floating Storage Scenario Analysis – Impact On Utilization Pages 2-3

- Storage Arbitrage, Inventories, & Rate Reactions Pages 4-7

- Multi-Factor Crude Tanker Utilization Model Pages 8-9

- Updated Tanker NAVs, Valuation Metrics, & Estimates Pages 9-10

For access information, please email us at [email protected]

Depth Of Floating Storage Build Key For Tanker Equities In Q220. Amid the double black swan start to the year (OPEC supply shock/pricing war coupled with demand destruction from the COVID-19 response), tanker equities have (generally) acted as a hedge against the rest of the energy tape, as the prospect of significant structural and arb-driven floating storage has supported tanker earnings well above seasonal trends (page 4). While increasing OPEC & Russian crude production battle to replace US exports (the degree to which remains in question) – the market mechanism for finding that new global production balance should ultimately result in saturated land based storage and a ramp in floating storage (already ~100mb), and narrower tanker capacity, providing a significant tailwind for tanker cash flows. From an equity perspective, we think about Tanker stocks (FRO, EURN, DHT, ASC, etc.) in 3 stages….(Pages 1-2)

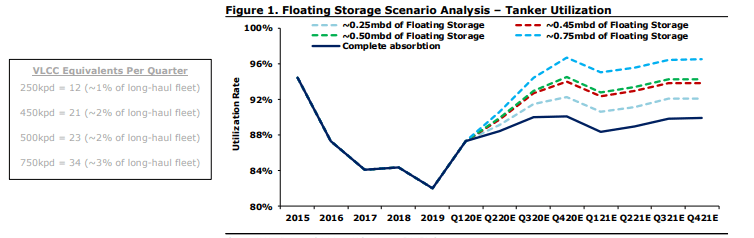

What Would Robust Floating Storage Mean For Tanker Rates & Utilization In Q2/Q3? We ran a multi-factor scenario analysis based on our updated crude tanker utilization model, flexed for different levels of incremental daily crude production moving into floating storage over the next 2-3 quarters. At the low end of the range…(Pages 2-8)

For access information, please email us at [email protected]

client log-in

client log-in